Credit Card Upgrade: Unlock Exclusive Benefits Today

Upgrading your credit card can offer better rewards, perks, and financial flexibility. It’s a smart move for those looking to maximize their financial benefits and improve their credit score.

If you’re considering a credit card upgrade, it’s essential to understand the potential advantages and how they align with your financial goals. An upgrade can mean higher cash back on purchases, no annual fees, and even early direct deposit benefits. By choosing the right card, you can enhance your spending power and manage your finances more efficiently. For example, the Upgrade Card offers up to 3% cash back on purchases and no annual fees, making it a compelling option for those seeking better rewards and lower costs. Explore Upgrade Card options and make a choice that suits your financial needs.

Credit: www.upgrade.com

Introduction To Credit Card Upgrades

Credit card upgrades can provide enhanced benefits and features that match your evolving financial needs. Whether you seek better rewards, lower interest rates, or additional perks, upgrading your credit card can be a smart move. Let’s dive into the essentials of credit card upgrades.

What Is A Credit Card Upgrade?

A credit card upgrade involves replacing your current credit card with a new card that offers better terms, rewards, and features. This may include higher credit limits, lower interest rates, or more attractive rewards programs. Upgrading can help you optimize your financial strategy and enhance your spending power.

Why Consider Upgrading Your Credit Card?

There are several reasons to consider upgrading your credit card:

- Better Rewards: Many upgraded cards offer higher cash back percentages or more valuable points on everyday purchases.

- Enhanced Spending Power: Some cards, like the Upgrade Cards, provide extra spending power when linked to a Rewards Checking account.

- Lower Fees: Upgraded cards often come with no annual fees, saving you money in the long run.

- Additional Perks: Features like early direct deposit and flexible payment options can make managing finances easier.

| Feature | Description |

|---|---|

| Higher Rewards | Earn up to 3% cash back on purchases. |

| No Annual Fees | Keep more of your money with cards that have no annual fees. |

| Enhanced Spending Power | Boost your spending limit by linking to a Rewards Checking account. |

| Early Direct Deposit | Receive your paycheck up to two days early. |

Upgrading your credit card can provide several benefits, aligning with your financial goals and lifestyle. If you find that your current card no longer meets your needs, exploring an upgrade could be a wise decision.

Key Features Of Upgraded Credit Cards

Upgraded credit cards offer numerous benefits that enhance your financial experience. These features include higher credit limits, better rewards programs, exclusive access to events and services, and enhanced security features.

Higher Credit Limits

One of the most significant benefits of upgraded credit cards is higher credit limits. This allows for more purchasing power and financial flexibility. Higher limits can also improve your credit score by lowering your credit utilization ratio.

| Benefit | Details |

|---|---|

| More Purchasing Power | Allows for larger purchases without maxing out your card. |

| Improved Credit Score | Lowers credit utilization ratio, positively affecting credit score. |

Better Rewards Programs

Upgraded credit cards often come with better rewards programs. These include higher cash back percentages, more travel points, and greater dining rewards.

- Cash Back: Earn up to 3% on everyday purchases.

- Travel Points: Accumulate points for flights and hotels faster.

- Dining Rewards: Enjoy higher rewards at restaurants.

Exclusive Access To Events And Services

Many upgraded credit cards provide exclusive access to events and services. This can include VIP tickets, special travel offers, and concierge services.

- VIP Tickets: Priority access to concerts and sports events.

- Travel Offers: Special deals on flights and hotel stays.

- Concierge Services: Personalized assistance for travel and dining reservations.

Enhanced Security Features

Upgraded credit cards feature enhanced security measures to protect your finances. These include fraud detection, virtual card numbers, and biometric authentication.

- Fraud Detection: Advanced algorithms to detect suspicious activity.

- Virtual Card Numbers: Use temporary numbers for online purchases.

- Biometric Authentication: Use fingerprints or facial recognition for secure access.

Pricing And Affordability

Understanding the pricing and affordability of credit card upgrades is crucial for making informed decisions. This section will explore the annual fees, interest rates, and hidden costs associated with credit card upgrades.

Annual Fees: What To Expect

Most Upgrade cards come with no annual fees. This makes them an attractive option for those seeking cost-effective financial tools. For example, the Upgrade OneCard and other Upgrade Cards offer significant benefits without an annual fee.

Here is a comparison table of annual fees for different Upgrade products:

| Product | Annual Fee |

|---|---|

| Upgrade OneCard | $0 |

| Upgrade Cards | $0 |

Interest Rates Comparison

Interest rates can vary based on your credit score and other factors. Understanding these rates helps you manage your finances better. Below is a comparison of interest rates for different Upgrade products:

- Personal Loans: APRs from 9.99%-35.99%

- Flex Pay: APRs range from 0% to 36%

- Premier Savings: APY of 4.14% with $1,000 monthly direct deposit

Upgrade Cards also offer competitive rates, making them a favorable choice for many users.

Hidden Costs To Be Aware Of

While Upgrade products are transparent with their fees, it’s important to be aware of potential hidden costs:

- Origination Fees: For personal loans, these fees range from 1.85% to 9.99%.

- Late Payment Fees: Ensure timely payments to avoid additional charges.

- Flex Pay Terms: The APR can vary significantly based on your credit score.

Being aware of these potential costs can help you plan and manage your finances more effectively.

Pros And Cons Of Upgrading Your Credit Card

Upgrading your credit card can offer numerous benefits, but it also has some potential downsides. This section will explore both the advantages and drawbacks, helping you make an informed decision.

Advantages Of An Upgraded Credit Card

- Higher Credit Limits: Upgraded cards often come with higher credit limits, providing more spending power.

- Better Rewards: Cards like the Upgrade Card offer up to 3% cash back on purchases.

- No Annual Fees: Many upgraded cards, such as the Upgrade OneCard, do not charge an annual fee.

- Enhanced Features: Enjoy extra features like early direct deposit with Rewards Checking Plus and high APY with Premier Savings.

- Flexible Payment Options: Upgrade OneCard offers Pay Now with no interest or Pay Later options.

Potential Drawbacks To Consider

- Higher Interest Rates: Some upgraded cards may come with higher APRs, ranging from 9.99% to 35.99% for personal loans.

- Origination Fees: Personal loans through Upgrade may include origination fees from 1.85% to 9.99%.

- Monthly Deposit Requirements: Premier Savings requires a $1,000 monthly direct deposit to qualify for the highest APY of 4.14%.

- Credit Score Impact: Applying for an upgraded card can temporarily affect your credit score.

- Complex Terms: Flex Pay APRs range from 0% to 36%, and terms vary based on credit score and other factors.

Who Should Consider Upgrading Their Credit Card?

Credit card upgrades can provide better rewards, higher limits, and more benefits. But not everyone needs to upgrade. So, who should consider upgrading their credit card? Let’s explore.

Ideal User Profiles

Some users benefit more from credit card upgrades than others. Here are the ideal user profiles:

- Frequent Travelers: They can benefit from travel rewards and perks.

- High Spenders: Those who spend a lot can earn significant cash back.

- Credit Builders: Users with good credit can receive better terms and higher limits.

- Rewards Seekers: Those wanting to maximize their rewards points.

These user profiles can make the most of upgraded credit card features.

Specific Scenarios Where An Upgrade Makes Sense

Upgrading your credit card is not always necessary. But there are specific scenarios where it makes sense:

| Scenario | Why Upgrade? |

|---|---|

| High Spending on Everyday Purchases | Earn up to 3% cash back with Upgrade Cards. |

| Frequent Travel | Access travel rewards and perks with certain cards. |

| Need for Financial Flexibility | Products like Upgrade OneCard offer flexible payment options. |

| Desire for Better Savings | Use Premier Savings to earn 4.14% APY. |

Consider these scenarios to determine if a credit card upgrade is right for you.

Credit: www.idfcfirstbank.com

How To Upgrade Your Credit Card

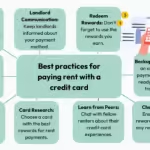

Upgrading your credit card can offer many benefits like higher credit limits and better rewards. It’s important to know how to navigate the process effectively to make the most out of your credit card.

Steps To Request An Upgrade

- Review Your Current Card: Look at the features and benefits of your current card. Decide if an upgrade aligns with your financial goals.

- Check Eligibility: Ensure you meet the requirements for an upgrade. This may include having a good credit score and a history of on-time payments.

- Compare Available Options: Research different credit cards offered by your issuer. Consider factors like rewards, interest rates, and fees.

- Contact Your Issuer: Call the customer service number on the back of your card. Ask about the upgrade process and available options.

- Submit Your Request: Follow the instructions given by the customer service representative. You may need to fill out a form or provide additional information.

- Wait for Approval: The issuer will review your request. This may take a few days to a few weeks. Be patient and check your email or account for updates.

- Activate Your New Card: Once approved, you will receive your new card. Activate it and start enjoying your new benefits.

What To Do If Your Upgrade Request Is Denied

If your upgrade request is denied, don’t worry. There are several steps you can take to improve your chances in the future:

- Understand the Reason: Ask your issuer why your request was denied. This information can help you address any issues.

- Improve Your Credit Score: Pay your bills on time, reduce your debt, and avoid opening new credit accounts.

- Increase Your Income: A higher income can improve your creditworthiness. Consider taking on a side job or negotiating a raise.

- Reevaluate Your Spending: Ensure your spending habits align with your financial goals. Track your expenses and create a budget.

- Wait and Reapply: If you’ve addressed the issues mentioned by your issuer, wait a few months before reapplying. This gives you time to improve your credit profile.

Credit: www.getonecard.app

Frequently Asked Questions

What Is A Credit Card Upgrade?

A credit card upgrade is switching to a better card. It offers more benefits and rewards. It usually requires a good credit history.

How Can I Upgrade My Credit Card?

Contact your credit card issuer for an upgrade. They will review your account and credit history. You may need to provide additional information.

What Benefits Come With A Credit Card Upgrade?

Upgraded credit cards offer better rewards. They may include higher cashback, travel perks, and lower interest rates. Additional benefits may vary by card issuer.

Is A Credit Card Upgrade Worth It?

Yes, if you use your card frequently. Upgraded cards offer better rewards and benefits. Ensure the perks outweigh any potential fees.

Conclusion

Upgrading your credit card can offer many benefits. Better rewards, no fees, and flexible payment options are just a few. Upgrade provides a range of financial products designed for your needs. With personal loans, checking, and savings accounts, managing money becomes easier. Interested in exploring your options? Learn more at Upgrade. Make your financial journey smoother and more rewarding today!