Apply For Credit Cards: Unlock Exclusive Rewards Today

Credit cards offer a convenient way to manage finances and make purchases. Applying for a credit card can seem daunting, but it doesn’t have to be.

Understanding the process to apply for a credit card is the first step to financial flexibility. With a plethora of options available, it’s important to know what features and benefits align with your personal financial goals. Whether you need a card for everyday expenses, building credit, or earning rewards, there’s a card out there for you. In this guide, we’ll walk you through the essentials of applying for a credit card, ensuring you make an informed choice. Ready to find the perfect credit card? Let’s get started by exploring the key factors to consider. For more information, check out Upgrade.

Introduction To Credit Cards And Their Purpose

Credit cards are essential financial tools for many people. They offer convenience, security, and rewards. Understanding how they work can help you use them wisely. This guide will give you an overview of credit cards and their benefits.

Understanding Credit Cards

A credit card allows you to borrow money up to a certain limit. You can use it to make purchases, pay bills, or withdraw cash. Each month, you receive a statement showing your balance and the minimum payment due. Paying off your balance in full each month avoids interest charges.

Credit cards come with interest rates, fees, and rewards programs. Interest rates apply if you carry a balance. Fees may include annual fees, late payment fees, and foreign transaction fees. Rewards programs offer points, cash back, or travel miles for spending.

The Benefits Of Having A Credit Card

Credit cards offer several advantages:

- Convenience: Credit cards are widely accepted and easy to use.

- Security: They provide fraud protection and dispute resolution.

- Rewards: Earn points, cash back, or travel miles for purchases.

- Building Credit: Regular use and timely payments improve credit scores.

Credit cards also offer additional perks like extended warranties, purchase protection, and travel insurance. These benefits can provide peace of mind and save you money.

| Benefit | Description |

|---|---|

| Convenience | Easy to use and widely accepted |

| Security | Fraud protection and dispute resolution |

| Rewards | Points, cash back, or travel miles |

| Building Credit | Improves credit scores with regular use |

Understanding credit cards and their benefits can help you make better financial decisions. Use credit cards responsibly to enjoy their advantages without falling into debt.

Credit: www.cnbc.com

Key Features Of Credit Cards

Credit cards offer various features that can make managing finances easier. Understanding these features helps you choose the right card for your needs.

Rewards Programs

Many credit cards come with rewards programs that offer points, cash back, or miles for every purchase. These rewards can be redeemed for travel, gift cards, or statement credits. Some cards offer higher rewards for specific categories like dining, groceries, or gas.

- Points for purchases

- Cash back options

- Miles for travel

Interest Rates And Fees

Understanding the interest rates and fees associated with credit cards is crucial. The Annual Percentage Rate (APR) varies by card and can be affected by your credit score. Be aware of additional fees such as late payment fees, balance transfer fees, and foreign transaction fees.

| Type of Fee | Details |

|---|---|

| APR | Varies based on credit score |

| Late Payment Fee | Charged if a payment is late |

| Balance Transfer Fee | Fee for transferring balances |

| Foreign Transaction Fee | Applies to purchases made abroad |

Credit Limits

Credit cards come with a credit limit, the maximum amount you can borrow. This limit is determined by your creditworthiness. Managing your credit limit wisely is important to avoid over-limit fees and to maintain a good credit score.

- Initial credit limit based on credit score

- Possibility to request an increase

- Keep utilization low to maintain credit score

Security Features

Modern credit cards include security features to protect against fraud. These may include EMV chips, contactless payments, and fraud monitoring services. Additionally, many cards offer zero liability for unauthorized transactions.

- EMV chip technology

- Contactless payment options

- Fraud monitoring services

- Zero liability for unauthorized charges

Online Account Management

Most credit cards offer online account management tools. These tools allow you to view statements, make payments, and track spending. They also provide alerts for due dates and suspicious activity.

- View statements online

- Make payments through the website

- Track spending and set budgets

- Receive alerts for due dates and unusual activity

Exclusive Rewards: What You Can Earn

Applying for a credit card offers more than just a convenient payment method. Credit cards come with a variety of exclusive rewards. These rewards can help you save money, travel better, and enjoy unique perks. Let’s explore some of these exclusive rewards you can earn.

Cash Back Rewards

Cash back rewards are one of the most popular benefits of credit cards. With cash back, you earn a percentage of your spending back as cash. For example:

- 1% cash back on all purchases

- 3% cash back at supermarkets

- 5% cash back on quarterly rotating categories

These rewards can be redeemed as statement credits, direct deposits, or gift cards. They are an easy way to get a bit of your money back.

Travel Points And Miles

If you love to travel, credit cards that offer travel points and miles are a great choice. These cards let you earn points or miles for every dollar spent. Here’s how you can benefit:

- Earn miles on airline purchases

- Collect points for hotel stays

- Redeem miles for free flights and upgrades

Travel rewards can make your trips more affordable and enjoyable.

Sign-up Bonuses

Many credit cards offer generous sign-up bonuses for new cardholders. You can earn these bonuses by spending a certain amount within the first few months. Examples include:

- Earn 50,000 bonus points after spending $3,000 in 3 months

- Get $200 cash back after spending $1,000 in 3 months

These bonuses can give your rewards balance a significant boost quickly.

Loyalty Program Perks

Credit cards often come with loyalty program perks for frequent customers. These perks can include:

- Priority boarding on flights

- Free checked bags

- Exclusive access to airport lounges

These benefits can enhance your travel experience and make it more comfortable.

Retail Discounts

Some credit cards offer special retail discounts at popular stores. These discounts can help you save money on everyday purchases. Examples include:

- 10% off at select clothing stores

- 5% off on groceries

- Special deals on electronics

With these discounts, you can enjoy lower prices on the things you love to buy.

For more information on credit cards and their rewards, visit Upgrade.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of credit cards is essential. This section covers key elements such as annual fees, interest rates, balance transfer options, foreign transaction fees, and late payment penalties. Let’s dive into each component to help you make an informed decision.

Annual Fees

Annual fees can vary widely among credit cards. Some cards offer no annual fees, making them more attractive for budget-conscious users. Others may charge fees ranging from $25 to $500, often justified by additional benefits and rewards. Always weigh the cost against the value offered.

Interest Rates

Interest rates, or Annual Percentage Rates (APRs), are critical in determining the cost of borrowing. They typically range from 9.99% to 35.99%. A lower APR means lower interest costs over time. Consider your spending habits and ability to pay off balances when evaluating interest rates.

Balance Transfer Options

Many credit cards offer balance transfer options to help manage existing debt. These options often come with introductory 0% APR for a specified period, usually 6 to 18 months. However, be mindful of balance transfer fees, which can be around 3% to 5% of the transferred amount.

Foreign Transaction Fees

For frequent travelers, foreign transaction fees are important. Some cards charge a fee of 2% to 3% on every purchase made abroad. Opt for cards with no foreign transaction fees if you frequently travel internationally to save on additional costs.

Late Payment Penalties

Late payment penalties can add up quickly. These fees typically range from $25 to $40 per missed payment. In addition to the fee, a late payment can negatively impact your credit score. Set up reminders or automatic payments to avoid these charges.

For more information on credit cards and personal finance, visit Upgrade.

Pros And Cons Of Using Credit Cards

Credit cards can be a valuable financial tool when used responsibly. They offer numerous benefits and some potential pitfalls. Understanding both sides can help you make informed decisions about your credit use.

Advantages Of Credit Cards

Credit cards come with several benefits that can enhance your financial flexibility and security.

- Convenience: Easily make purchases without carrying cash.

- Rewards Programs: Earn points, cashback, or travel miles on spending.

- Building Credit: Regular use and timely payments improve your credit score.

- Fraud Protection: Liability for fraudulent charges is often limited.

- Emergency Funds: Access to funds during financial emergencies.

Potential Drawbacks To Consider

While credit cards offer many perks, they also have potential downsides you should be aware of.

- High-Interest Rates: Carrying a balance can lead to significant interest charges.

- Debt Accumulation: Easy access to credit can lead to overspending and debt.

- Fees: Annual fees, late payment fees, and foreign transaction fees can add up.

- Impact on Credit Score: Missed payments or high balances can negatively affect your credit score.

- Complex Terms: Understanding the fine print and terms can be challenging.

Credit: www.fssbonline.com

Specific Recommendations For Ideal Users

Choosing the right credit card can significantly impact your financial health. Different user profiles have unique needs. Here, we provide specific recommendations for various user types.

Students And Young Professionals

Students and young professionals often benefit from cards that offer rewards for everyday expenses. Look for cards with:

- No annual fees

- Rewards on groceries, dining, and streaming services

- Low interest rates

These features help build credit without incurring high costs. Many student cards also offer educational resources to help you manage your finances.

Frequent Travelers

Frequent travelers should focus on cards that offer travel rewards. Key features include:

- Airline miles or hotel points

- No foreign transaction fees

- Travel insurance and purchase protection

Look for cards with partnerships with airlines and hotels. These partnerships can maximize your rewards and offer exclusive travel perks.

Big Spenders And High Earners

Big spenders and high earners should seek cards with high reward rates and premium benefits. Key features include:

- High cashback percentages

- Exclusive access to events and services

- Low interest rates and high credit limits

These cards often come with higher annual fees but offer significant rewards and benefits in return.

Budget-conscious Individuals

Budget-conscious individuals should look for cards with:

- No annual fees

- Low interest rates

- Reward programs for everyday purchases

Consider cards that offer cashback on groceries, gas, and utilities. This can help you save money on essential expenses.

Online Shoppers

Online shoppers can benefit from cards offering high cashback on online purchases. Important features include:

- High rewards on e-commerce transactions

- Purchase protection and extended warranties

- Low interest rates

Many cards also offer exclusive deals with major online retailers, providing additional savings.

Conclusion: Unlocking The Potential Of Credit Cards

Understanding credit cards can open doors to financial opportunities. They offer convenience, rewards, and a way to build credit. When used wisely, credit cards can be a powerful tool in your personal finance toolkit.

Making The Most Of Your Credit Card

To maximize the benefits of your credit card, consider the following tips:

- Pay your balance in full: Avoid interest charges by paying off your balance each month.

- Monitor your spending: Keep track of your expenses to stay within your budget.

- Utilize rewards: Take advantage of cashback, points, or travel rewards offered by your card.

- Stay within your credit limit: High utilization can negatively impact your credit score.

Final Thoughts On Choosing The Right Credit Card

Selecting the best credit card depends on your financial needs and habits. Consider the following aspects:

- Interest rates: Look for cards with low APRs if you carry a balance.

- Fees: Be aware of annual fees, foreign transaction fees, and other charges.

- Rewards: Choose a card that offers rewards matching your spending patterns.

- Credit requirements: Ensure you meet the credit score criteria for the card.

By evaluating these factors, you can find a credit card that aligns with your financial goals.

Credit: www.chime.com

Frequently Asked Questions

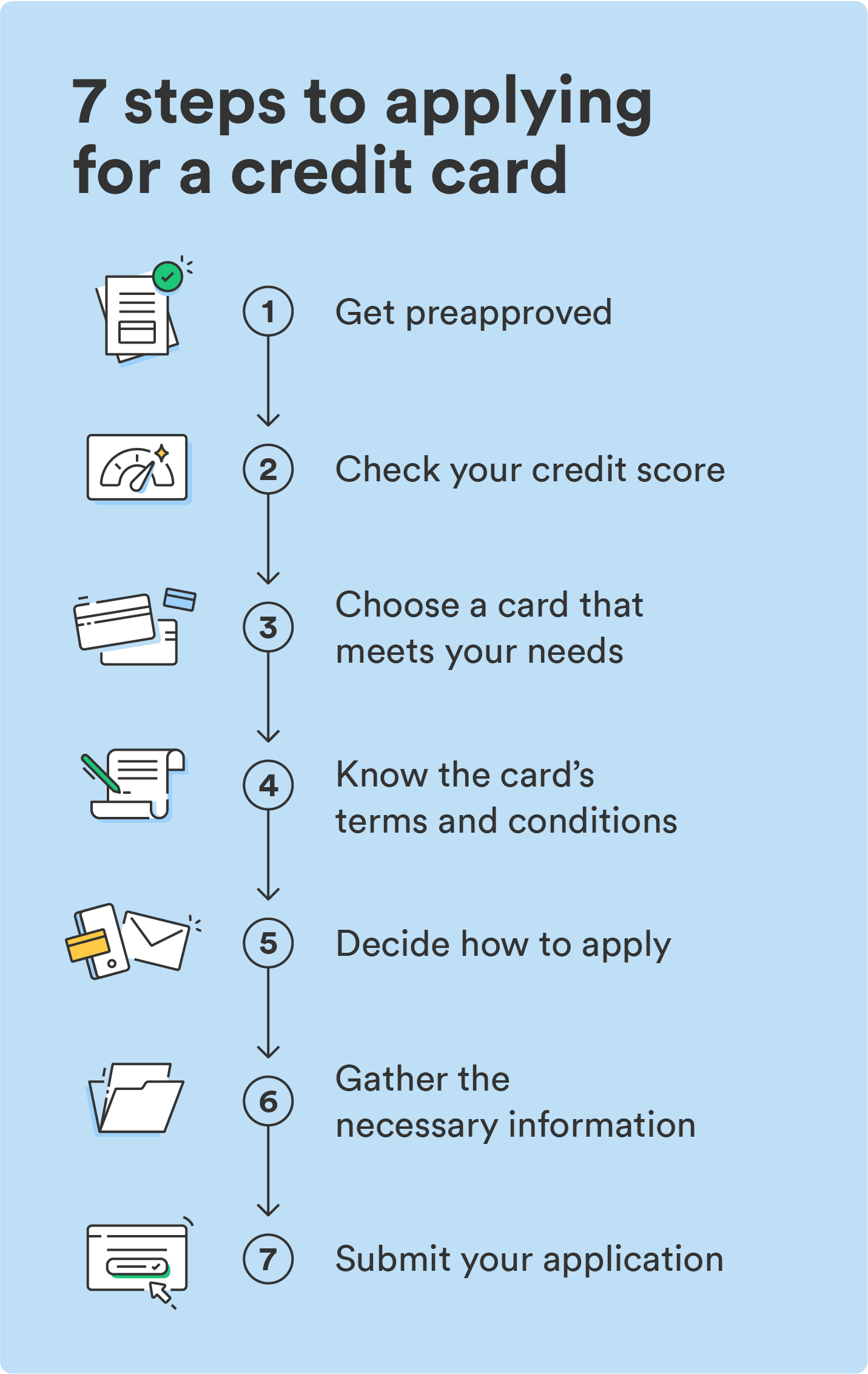

How To Apply For A Credit Card?

Applying for a credit card is simple. Visit the issuer’s website, fill out the application form, and submit required documents.

What Are The Eligibility Criteria?

Eligibility criteria vary by issuer. Generally, you need to be at least 18 years old, have a stable income, and a good credit score.

Can I Apply For A Credit Card Online?

Yes, applying for a credit card online is convenient. Visit the issuer’s website, complete the application, and submit it electronically.

How Long Does Approval Take?

Approval time varies. Some issuers provide instant decisions, while others may take a few days to review your application.

Conclusion

Applying for credit cards can be a smart financial move. Consider your needs and options carefully. Research different offers to find the best fit. Upgrade offers personal loans with flexible terms. Their loans can help with debt consolidation or large purchases. Fast approval and no prepayment fees are big benefits. Learn more about Upgrade’s personal loans here. Making informed choices can lead to better financial health. Take the time to understand the terms and benefits. This will ensure you make the best decision for your financial future.