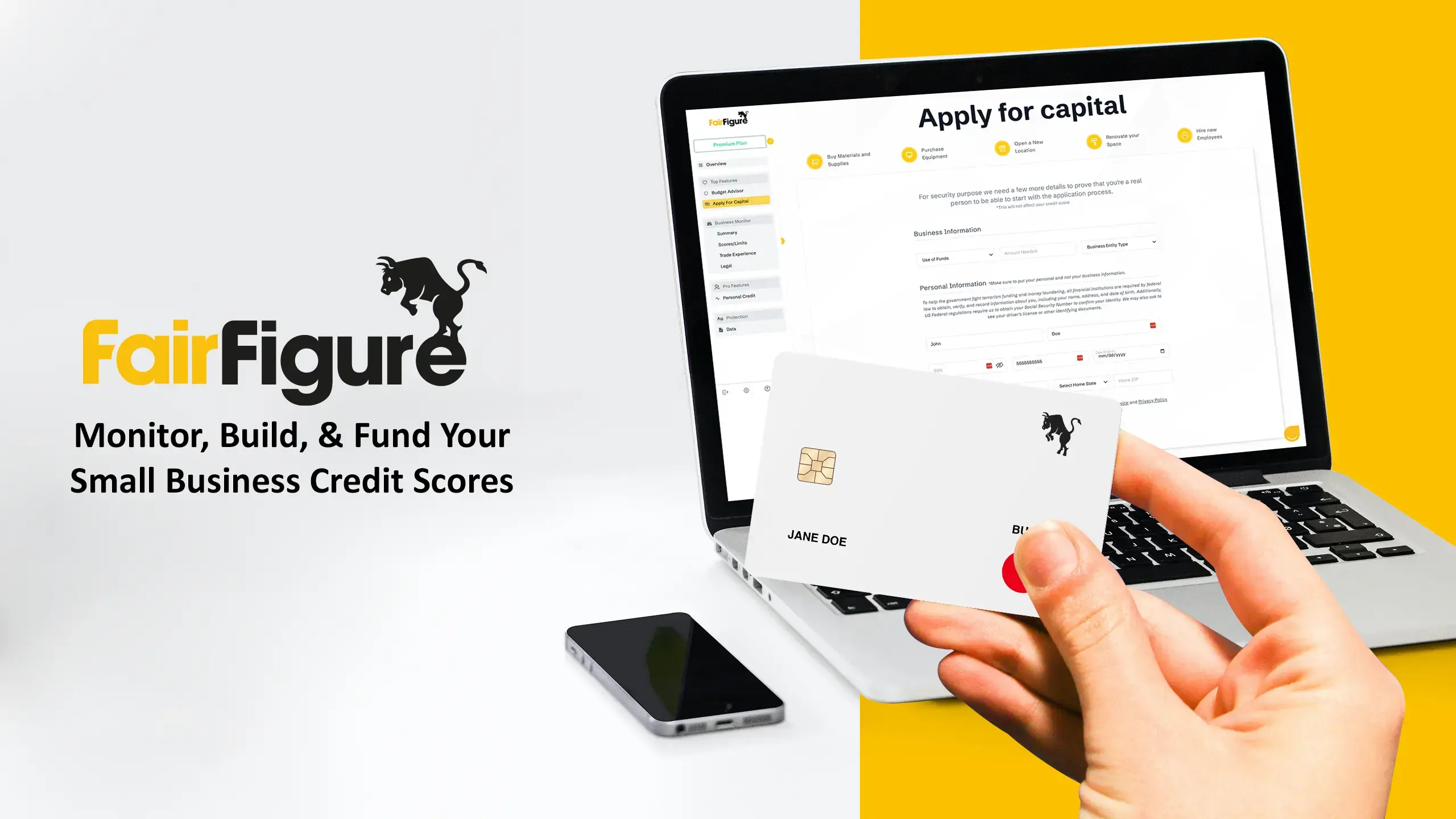

Fairfigure Credit Card Solutions: Unlock Financial Freedom Today

Credit cards can be tricky to navigate. FairFigure Credit Card Solutions aims to simplify this for you.

FairFigure offers a range of credit card solutions tailored for both personal and business use. Whether you need a card with low-interest rates, cash-back rewards, or travel benefits, FairFigure has options to meet your needs. Understanding credit card options can save you money and improve your financial health. This blog post will explore how FairFigure Credit Card Solutions can help you make informed choices. With the right card, you can manage your finances better and enjoy added perks. Ready to find the perfect credit card for your needs? Let’s dive in and see what FairFigure has to offer: FairFigure Credit Card Solutions.

Introduction To Fairfigure Credit Card Solutions

Fairfigure Credit Card Solutions offers tailored financial products. These solutions cater to both individuals and businesses. Understanding Fairfigure can help you make informed financial decisions.

What Is Fairfigure?

Fairfigure is a credit card service provider. It offers a range of credit products to suit various needs. From personal credit cards to business credit solutions, Fairfigure has it all.

The company’s platform is user-friendly. You can easily manage your accounts online. This makes it convenient for busy individuals and businesses.

Purpose And Mission

Fairfigure’s mission is to provide accessible credit solutions. They aim to simplify the credit process for everyone. Their purpose is to offer transparent and fair financial products.

They believe in empowering users through financial education. This helps customers make better financial choices. Their services are designed to be straightforward and easy to understand.

Fairfigure focuses on customer satisfaction. They offer reliable customer support. This ensures that users can get help when they need it.

Key Features Of Fairfigure Credit Card Solutions

Fairfigure Credit Card Solutions offers numerous benefits for individuals and businesses. Let’s explore the key features that make Fairfigure a standout choice for credit card users.

Low-interest Rates

Fairfigure provides some of the most competitive low-interest rates in the market. This helps users save money on interest payments, making it easier to manage their finances.

Rewards And Cashback Programs

Fairfigure offers generous rewards and cashback programs. Users can earn points on every purchase and redeem them for cash, travel, or merchandise.

- Earn points on every purchase

- Redeem points for cash, travel, or merchandise

Flexible Credit Limits

Fairfigure provides flexible credit limits tailored to your financial needs. Whether you need a higher limit for business expenses or a lower limit for personal use, Fairfigure has you covered.

Enhanced Security Measures

Fairfigure places a strong emphasis on enhanced security measures. With advanced encryption technology, your transactions are secure. You can shop online or in-store with confidence.

| Security Feature | Description |

|---|---|

| Advanced Encryption | Protects your transaction data |

| Fraud Alerts | Notifies you of suspicious activity |

User-friendly Mobile App

The Fairfigure mobile app offers a user-friendly experience. Easily track your spending, make payments, and view your rewards. Manage your account anytime, anywhere.

- Track spending

- Make payments

- View rewards

These features make Fairfigure Credit Card Solutions a reliable and convenient choice for managing your finances.

Pricing And Affordability Breakdown

FairFigure Credit Card Solutions offers a transparent approach to pricing. Understanding the costs involved is crucial. This section provides a detailed breakdown of the annual fees, interest rates, and any hidden charges associated with FairFigure cards.

Annual Fees

FairFigure offers competitive annual fees across its credit card range. Here’s a quick overview of the annual fees for some of the popular cards:

| Card Type | Annual Fee |

|---|---|

| FairFigure Basic Card | $0 |

| FairFigure Premium Card | $95 |

| FairFigure Business Card | $150 |

Interest Rates Comparison

Interest rates are a critical factor in choosing a credit card. FairFigure offers competitive interest rates designed to suit various financial needs:

- FairFigure Basic Card: 15.99% APR

- FairFigure Premium Card: 18.99% APR

- FairFigure Business Card: 20.99% APR

These rates are competitive when compared to industry averages, providing value for both personal and business users.

Hidden Charges And Fees

Transparency is key. FairFigure ensures you are aware of all potential charges:

- Late Payment Fee: Up to $39

- Foreign Transaction Fee: 3% of the transaction amount

- Balance Transfer Fee: 5% of the amount transferred

By understanding these fees, users can manage their expenses better and avoid unexpected charges.

Pros And Cons Of Fairfigure Credit Card Solutions

Fairfigure Credit Card Solutions offers a range of features and benefits for businesses. Understanding the pros and cons helps in making an informed decision. Below, we explore the advantages and potential drawbacks of using Fairfigure.

Advantages Of Using Fairfigure

- Flexible Payment Options: Fairfigure offers multiple payment methods to suit different business needs.

- Competitive Interest Rates: Enjoy lower interest rates compared to other credit card solutions.

- Enhanced Security: State-of-the-art security features protect against fraud and unauthorized transactions.

- Rewards Program: Earn points on every purchase, redeemable for various rewards.

- 24/7 Customer Support: Access to round-the-clock customer service for any issues or queries.

- Customizable Limits: Set spending limits for employees to manage expenses effectively.

Potential Drawbacks

- Annual Fees: Fairfigure charges annual fees that may be higher than some competitors.

- Eligibility Criteria: Strict eligibility requirements might exclude some businesses from qualifying.

- Limited Acceptance: Not all merchants accept Fairfigure, potentially limiting its use.

- Complex Application Process: The application process can be lengthy and complex.

- Foreign Transaction Fees: Charges apply for international transactions, which can add up.

By weighing these pros and cons, businesses can decide if Fairfigure aligns with their financial needs and goals.

Ideal Users And Scenarios For Fairfigure Credit Card Solutions

Fairfigure Credit Card Solutions offer a range of benefits tailored to various needs. Understanding who benefits most from these cards can help potential users make an informed decision. Let’s explore some of the ideal users and scenarios.

Best For Frequent Travelers

Frequent travelers will find Fairfigure Credit Card Solutions particularly beneficial. These cards offer:

- Travel rewards such as miles and points

- Airport lounge access for comfort

- Travel insurance for peace of mind

Imagine enjoying a long layover in a quiet lounge. Fairfigure makes this possible. Plus, the travel points can help you save on your next trip. It’s a win-win for those always on the go.

Ideal For Online Shoppers

Online shoppers can maximize their savings with Fairfigure Credit Card Solutions. Benefits include:

- Cashback rewards on online purchases

- Purchase protection for safer shopping

- Exclusive discounts from partner retailers

Picture earning cashback on every online order. This means more money in your pocket. Moreover, the purchase protection ensures your transactions are secure. Shop with confidence and save more.

Suitable For Budget-conscious Users

Those mindful of their budget will appreciate Fairfigure’s offerings. These cards feature:

- Low interest rates to save on fees

- No annual fees to keep costs down

- Flexible payment options for better control

Think about managing your finances without high costs. Fairfigure’s low interest rates and no annual fees make this possible. Flexible payment options ensure you stay on track with your budget.

Fairfigure Credit Card Solutions cater to different needs and lifestyles. Whether you travel, shop online, or stick to a budget, there’s a card for you.

Frequently Asked Questions

What Is Fairfigure Credit Card Solutions?

Fairfigure Credit Card Solutions is a financial service provider. They offer various credit card options. Their goal is to cater to different financial needs.

How Do I Apply For A Fairfigure Credit Card?

You can apply online through their website. The application process is simple and quick. Ensure you meet the eligibility criteria.

What Are The Benefits Of Fairfigure Credit Cards?

Fairfigure credit cards offer various rewards and cashback. They also provide fraud protection and easy payment options. These benefits enhance your financial flexibility.

Are There Any Fees For Fairfigure Credit Cards?

Yes, Fairfigure credit cards may have annual fees. Other fees include late payment and foreign transaction fees. Always read the terms carefully.

Conclusion

FairFigure Credit Card Solutions offer practical options for your business needs. Their services help manage finances with ease. Simple and clear. Discover more about how FairFigure can benefit you. Explore their offerings here. Make informed decisions for your credit card needs today.