Credit Assessment Tools: Essential for Financial Success

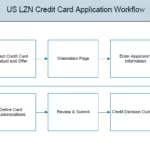

Credit assessment tools help businesses evaluate the creditworthiness of individuals and organizations. These tools are essential for making informed lending decisions.

Understanding and assessing credit is crucial for any financial institution. Credit assessment tools provide a systematic approach to evaluate the financial health and reliability of potential borrowers. By using these tools, businesses can minimize risks and make better lending decisions. The right tool can help you analyze credit scores, review financial histories, and predict future payment behaviors. In this blog post, we will explore the best credit assessment tools available, highlighting their features and benefits to help you choose the most suitable one for your needs. Stay tuned to discover how these tools can enhance your credit evaluation process. For a reliable credit assessment tool, consider using FairFigure.

.webp)

Introduction To Credit Assessment Tools

Understanding credit assessment tools is crucial for anyone managing finances. These tools help in evaluating the creditworthiness of individuals and businesses. They are essential in making informed lending decisions. Let’s explore more about these tools.

Understanding Credit Assessment

Credit assessment involves evaluating the financial history of a borrower. This process helps lenders determine the risk associated with lending money. It looks at various factors such as:

- Credit score

- Income level

- Debt-to-income ratio

- Payment history

Using credit assessment tools, lenders can make better lending decisions. These tools analyze financial data quickly and accurately.

Purpose And Importance Of Credit Assessment Tools

The main purpose of credit assessment tools is to minimize financial risk. They provide a detailed analysis of a borrower’s ability to repay the loan. This helps lenders in:

- Reducing default rates

- Improving loan approval processes

- Ensuring fair lending practices

Credit assessment tools are important for both lenders and borrowers. They create a transparent and reliable credit evaluation process. This builds trust and ensures financial stability.

Key Features Of Credit Assessment Tools

Credit assessment tools are vital for businesses to evaluate the creditworthiness of their clients. These tools help in making informed decisions by leveraging advanced features. Let’s explore the key features of these tools.

Automated Credit Scoring

Automated credit scoring is a major feature of credit assessment tools. This feature uses algorithms to analyze various data points. It provides a quick and accurate credit score. Businesses can save time and reduce human errors.

Real-time Data Analysis

Real-time data analysis allows businesses to get up-to-date information. Credit assessment tools pull data from multiple sources. This includes financial statements, credit history, and market trends. It ensures that decisions are based on the most current data available.

Risk Management Capabilities

Risk management capabilities help in identifying potential risks. These tools use predictive analytics to foresee possible credit defaults. Businesses can take proactive measures to mitigate risks. This feature is crucial for maintaining financial stability.

Integration With Financial Systems

Integration with financial systems is essential for seamless operations. Credit assessment tools can connect with existing financial software. This ensures data consistency and improves workflow efficiency. Businesses can have a unified view of financial data.

How Each Feature Benefits Users

Credit assessment tools like FairFigure offer numerous features that benefit users in various ways. These tools enhance decision-making, improve accuracy, mitigate risks, and streamline operations. Understanding how each feature works can help users make better financial decisions and manage their credit more effectively.

Enhancing Decision-making With Automated Credit Scoring

Automated credit scoring helps users make faster and more informed decisions. This feature uses complex algorithms to analyze credit data and generate scores. It reduces human error and bias, providing a more objective assessment. Users can rely on these scores to evaluate creditworthiness accurately and quickly.

Improving Accuracy Through Real-time Data Analysis

Real-time data analysis improves the accuracy of credit assessments. By accessing up-to-date information, users get a current view of an individual’s credit status. This feature helps detect any recent changes that might affect creditworthiness. Users can make more precise decisions based on the latest data.

Mitigating Risks With Risk Management Capabilities

Risk management capabilities help users identify and mitigate potential risks. These features analyze various risk factors and provide insights into potential credit issues. Users can take proactive measures to minimize risks, protecting their financial interests. This feature is crucial for businesses looking to maintain a healthy credit portfolio.

Streamlining Operations With Integration

Integration with other financial systems streamlines operations. Users can connect credit assessment tools with their existing financial software. This integration simplifies data management and reduces the need for manual input. It saves time and enhances efficiency, allowing users to focus on more strategic tasks.

Pricing And Affordability

Understanding the cost of credit assessment tools like FairFigure is crucial. Businesses need to evaluate the pricing models, cost-benefit analysis, and affordability for different business sizes. This ensures they make informed decisions that align with their financial capabilities.

Different Pricing Models

Credit assessment tools often offer various pricing models to cater to diverse business needs. Common models include:

- Subscription-based: Monthly or annual fees for continuous access to features and updates.

- Pay-per-use: Charges based on the number of assessments conducted.

- Tiered pricing: Different levels of service at varying price points, often based on the size of the business or volume of usage.

FairFigure provides flexible pricing models to ensure affordability and value for its users.

Cost-benefit Analysis

Conducting a cost-benefit analysis helps determine the value of investing in credit assessment tools. Consider the following factors:

| Cost Factors | Benefits |

|---|---|

| Initial setup fee | Improved credit risk management |

| Subscription or usage fees | Access to comprehensive credit data |

| Training and support costs | Enhanced decision-making capabilities |

Weighing these costs against the potential benefits ensures that businesses make informed financial decisions.

Affordability For Different Business Sizes

FairFigure caters to businesses of all sizes, offering tailored pricing options. For small businesses, affordability is key to ensuring access to essential tools without straining budgets. Mid-sized and large enterprises benefit from scalable solutions that accommodate growth and increased usage.

Here’s a breakdown:

- Small Businesses: Competitive pricing with essential features.

- Mid-sized Enterprises: Advanced features with scalable options.

- Large Corporations: Comprehensive packages with premium support.

FairFigure’s flexible pricing ensures that businesses, regardless of their size, can effectively manage their credit assessments.

Pros And Cons Of Credit Assessment Tools

Credit assessment tools like FairFigure are essential in the financial sector. They help businesses evaluate the creditworthiness of potential borrowers. Understanding the advantages and limitations of these tools can aid in making informed decisions.

Advantages Of Using Credit Assessment Tools

Credit assessment tools provide several benefits:

- Accuracy: They use data-driven methods to assess credit risk.

- Efficiency: Automating the assessment process saves time.

- Consistency: Standardized criteria ensure fair evaluations.

- Risk Mitigation: Identifying high-risk borrowers reduces financial losses.

- Data Analysis: They offer detailed reports for better decision-making.

| Feature | Benefit |

|---|---|

| Automated Processing | Speeds up credit evaluations |

| Data Accuracy | Reduces human error |

| Risk Analysis | Highlights potential risks |

| Comprehensive Reports | Detailed insights for informed decisions |

Potential Drawbacks And Limitations

While credit assessment tools offer many advantages, there are also some limitations:

- Cost: High-quality tools may be expensive.

- Data Dependency: They rely on accurate and up-to-date data.

- Technical Issues: System errors can disrupt operations.

- Complexity: Some tools require technical expertise to operate.

- Privacy Concerns: Handling sensitive data requires stringent security measures.

Understanding these pros and cons helps in choosing the right credit assessment tool.

Specific Recommendations For Ideal Users

FairFigure offers robust credit assessment tools suitable for various users. Each user type can leverage FairFigure’s features to enhance their financial decision-making processes. Here’s a detailed look at who can benefit from FairFigure.

Best Use Cases For Small Businesses

Small businesses can use FairFigure to assess the creditworthiness of potential clients and partners. This helps in making informed decisions and minimizing financial risks. Key benefits include:

- Quick assessments for timely decision-making

- Easy integration with existing financial systems

- Affordable pricing plans for small business budgets

Benefits For Large Enterprises

Large enterprises can leverage FairFigure for in-depth credit analysis. This is crucial for managing extensive client portfolios and ensuring financial stability. Advantages include:

- Comprehensive reports for detailed insights

- Advanced analytics for strategic planning

- Scalability to handle large volumes of data

Ideal For Financial Institutions

Financial institutions, such as banks and credit unions, can use FairFigure to enhance their credit evaluation processes. This ensures accurate risk assessment and better loan management. Highlights include:

- Regulatory compliance support

- Integration with existing financial infrastructure

- High accuracy in credit scoring

Suitability For Individual Consumers

Individual consumers can use FairFigure to monitor their credit scores and make informed financial decisions. This helps in maintaining a healthy credit profile. Key features are:

- Easy-to-understand credit reports

- Personalized tips for improving credit scores

- Access to real-time credit updates

Frequently Asked Questions

What Are Credit Assessment Tools?

Credit assessment tools evaluate a person’s or business’s creditworthiness. They analyze financial data, credit history, and other factors. These tools help lenders make informed decisions. They aim to reduce financial risks.

Why Are Credit Assessment Tools Important?

Credit assessment tools help lenders manage risk. They ensure informed lending decisions. These tools improve loan approval accuracy. They also protect lenders from potential defaults.

How Do Credit Assessment Tools Work?

Credit assessment tools analyze financial data. They review credit history, income, and debts. These tools use algorithms to generate credit scores. They provide a comprehensive risk evaluation.

What Factors Do Credit Assessment Tools Consider?

Credit assessment tools consider various factors. These include credit history, income, debts, and employment status. They also analyze payment patterns and financial stability.

Conclusion

Credit assessment tools are vital for managing financial health. They help businesses make informed decisions. By using these tools, you can monitor and improve your credit. For those looking for reliable options, consider FairFigure for effective credit solutions. Visit FairFigure to learn more. Remember, informed credit decisions lead to better financial stability. Stay proactive and keep your credit in check.