Credit Score Improvement Strategies: Boost Your Rating Fast

Improving your credit score can unlock better financial opportunities. It can lead to lower interest rates and more loan approvals.

In today’s world, having a good credit score is essential. Whether you want to buy a home, get a new car, or just have financial security, a good credit score is key. Many people struggle with this. But, there are effective strategies to help you improve your credit score. From timely payments to reducing debt, there are several steps you can take. If you are also looking to invest in real estate, SubTo can be an invaluable resource. It offers support and tools for both new and experienced investors. To learn more, visit SubTo. With the right strategies and resources, you can achieve your financial goals.

Introduction To Credit Score Improvement

Improving your credit score can seem daunting, but it’s achievable. Understanding the factors that influence your credit score is the first step. Let’s explore key strategies to help you enhance your credit score effectively.

Understanding Credit Scores

Your credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Credit bureaus calculate your score based on various factors.

| Factor | Percentage |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30%</td |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

Payment history and amounts owed have the most significant impact on your score. Keeping your balances low and paying bills on time are crucial steps.

Why Improving Your Credit Score Matters

A higher credit score opens doors to better financial opportunities. Here’s why improving your credit score is essential:

- Lower Interest Rates: Higher scores often mean lower interest rates on loans.

- Better Loan Approvals: Lenders are more likely to approve loans with favorable terms.

- Improved Credit Card Offers: Enjoy higher credit limits and better rewards.

- Housing Benefits: Landlords may prefer tenants with good credit.

Improving your credit score enhances your overall financial health. It can save you money and provide better access to credit.

Key Strategies To Boost Your Credit Score

Improving your credit score requires consistent effort and smart financial choices. Understanding and implementing key strategies can significantly enhance your creditworthiness. Here, we will discuss some essential methods to help boost your credit score effectively.

Paying Bills On Time

Paying bills on time is one of the most critical factors in improving your credit score. Late payments can have a severe impact on your credit report. Set up reminders or automatic payments to ensure you never miss a due date.

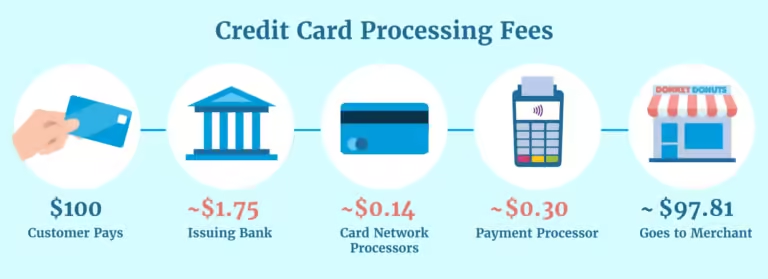

Reducing Outstanding Debt

Reducing outstanding debt can also improve your credit score. Focus on paying down high-interest debts first. Consider using the debt snowball method, where you pay off smaller debts first to build momentum.

| Debt Type | Interest Rate | Strategy |

|---|---|---|

| Credit Card | 15% | Pay more than the minimum payment |

| Personal Loan | 10% | Focus on higher interest debts first |

Avoiding New Credit Applications

Frequent new credit applications can negatively affect your credit score. Each new application results in a hard inquiry on your credit report. Limit new credit applications to only what is necessary.

- Review your credit report regularly to understand your current standing.

- Plan your credit needs and apply only when necessary.

- Monitor your credit utilization and keep it under 30%.

By implementing these strategies, you can steadily improve your credit score and achieve better financial health.

Leveraging Credit Monitoring Tools

Credit monitoring tools are essential for improving your credit score. They help you stay informed about changes to your credit report. By using these tools, you can take immediate action to correct errors and manage your credit responsibly.

How Credit Monitoring Works

Credit monitoring services track your credit report for changes. They alert you to new accounts, inquiries, and other significant updates. This allows you to address potential issues quickly. Here’s a simple breakdown of how they work:

- Monitor your credit reports from major bureaus.

- Send alerts for new activities or changes.

- Provide regular updates and credit score tracking.

- Offer resources to dispute inaccuracies.

Benefits Of Using Credit Monitoring Tools

Using credit monitoring tools comes with several benefits. They provide a proactive approach to managing your credit score. Here are some key advantages:

- Early Detection: Get notified of suspicious activities.

- Error Correction: Identify and dispute errors quickly.

- Score Tracking: Monitor your credit score regularly.

- Financial Planning: Better manage your financial goals.

These tools can help you maintain a healthy credit profile. They offer peace of mind and improved financial security.

Popular Credit Monitoring Tools

There are several popular credit monitoring tools available. Each offers unique features to help you manage your credit effectively. Here’s a look at some of the best options:

| Tool | Features | Cost |

|---|---|---|

| Credit Karma | Free credit scores, alerts, and reports | Free |

| Experian CreditWorks | Daily FICO scores, alerts, and identity theft protection | Starting at $9.99/month |

| TransUnion Credit Monitoring | Credit alerts, score updates, and credit lock | Starting at $24.95/month |

| Identity Guard | Comprehensive identity theft protection and credit monitoring | Starting at $8.99/month |

Choosing the right tool depends on your needs. Consider features and costs before making a decision. Regular use of these tools can lead to significant improvements in your credit score.

Building A Strong Credit History

Building a strong credit history is essential for financial stability. It reflects your reliability in managing borrowed money. A good credit history opens doors to better loan terms and higher credit limits.

Importance Of Long-term Credit Accounts

Long-term credit accounts play a crucial role in your credit history. Lenders prefer borrowers with a long history of credit management. It shows your ability to handle credit responsibly over time.

- Long-standing accounts indicate stability.

- Closing old accounts can negatively impact your score.

- Keep accounts active by using them occasionally.

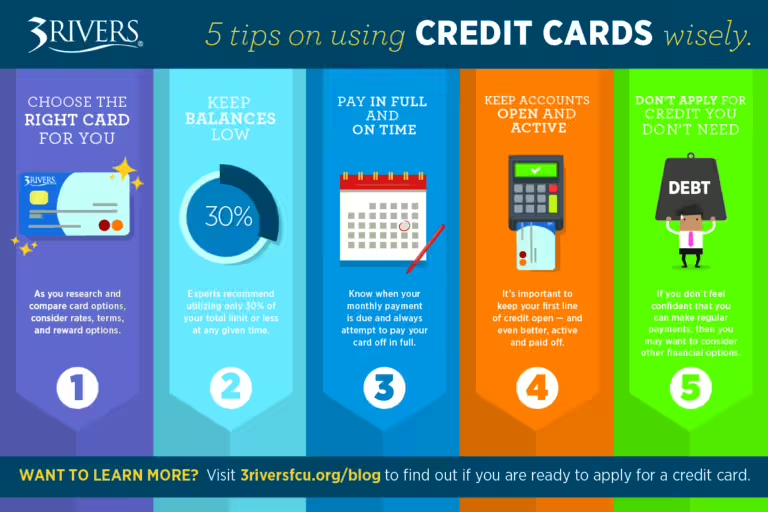

Using Credit Cards Responsibly

Credit cards are powerful tools for building credit. Use them wisely to improve your credit score. Always pay your bills on time and keep your balances low.

- Pay bills on time to avoid late fees and penalties.

- Keep balances low relative to your credit limit.

- Avoid maxing out your credit cards.

- Use credit for small, manageable purchases.

Secured Credit Cards For Credit Building

Secured credit cards are an excellent option for those starting or rebuilding credit. They require a security deposit, which acts as your credit limit. This makes them less risky for lenders and easier to obtain.

| Feature | Benefit |

|---|---|

| Security Deposit | Provides a credit limit |

| Easy Approval | Ideal for building or rebuilding credit |

| Reports to Credit Bureaus | Helps improve credit score |

Building a strong credit history takes time and effort. Utilize these strategies to enhance your creditworthiness and achieve financial goals.

Addressing Credit Report Errors

Identifying and fixing errors on your credit report is essential for improving your credit score. Mistakes can occur, and these inaccuracies can harm your financial health. Being proactive in addressing these errors can lead to a significant boost in your credit score.

Common Credit Report Errors

Credit report errors can vary, but some are more common than others. Here are a few typical mistakes:

- Incorrect Personal Information: Such as wrong name, address, or Social Security number.

- Account Errors: Including accounts that do not belong to you or incorrect account statuses.

- Duplicate Accounts: The same debt listed multiple times.

- Incorrect Balance or Credit Limit: Errors in the amount you owe or your credit limit.

Steps To Dispute And Correct Errors

Correcting errors on your credit report involves a few essential steps:

- Obtain Your Credit Report: Request copies from all three major credit bureaus: Equifax, Experian, and TransUnion.

- Identify Errors: Review each report for inaccuracies.

- Gather Documentation: Collect documents that support your claim, such as bank statements or correspondence.

- File a Dispute: Submit a dispute to the credit bureau where the error appears. You can typically do this online, by mail, or by phone.

- Contact the Creditor: Inform the creditor or lender about the error and provide supporting documents.

- Follow Up: Track the progress of your dispute and check for updates in your credit report.

Impact Of Correcting Errors On Your Score

Correcting errors on your credit report can have a positive impact on your credit score:

- Improved Accuracy: Ensuring the report reflects true information gives a clearer picture of your creditworthiness.

- Potential Score Increase: Removing inaccuracies, like false delinquencies, can lead to a higher score.

- Better Loan Terms: A higher score can result in better interest rates and loan terms.

Taking the time to address and correct errors on your credit report is a crucial step in improving your financial health. By ensuring your credit report is accurate, you pave the way for a stronger credit score and better financial opportunities.

Effective Budgeting And Financial Planning

Improving your credit score requires a strategic approach. Effective budgeting and financial planning play a crucial role. This section explores how creating a realistic budget, tracking spending habits, and setting financial goals can lead to better credit scores.

Creating A Realistic Budget

Start by listing all sources of income. Then, outline your monthly expenses. Use a table to categorize and visualize your budget:

| Income | Amount |

|---|---|

| Salary | $3000 |

| Freelancing | $500 |

| Expenses | Amount |

|---|---|

| Rent | $1200 |

| Groceries | $300 |

| Utilities | $150 |

| Transportation | $100 |

| Entertainment | $150 |

Ensure your budget is realistic. Avoid overestimating your income or underestimating your expenses.

Tracking Spending Habits

Track your spending to identify patterns. Use apps or spreadsheets to record every expense. This helps in recognizing areas where you can cut costs.

- Record all transactions daily.

- Review your spending weekly.

- Adjust your budget based on spending trends.

Tracking spending is essential for maintaining control over your finances. It helps you stay within your budget and avoid unnecessary debts.

Setting Financial Goals

Setting clear financial goals is vital for improving your credit score. Define both short-term and long-term goals. Here are some examples:

- Pay off credit card debt within six months.

- Save $1000 in an emergency fund within three months.

- Increase savings by 10% over the next year.

Write down your goals and track your progress. Adjust your budget to prioritize these goals.

Effective budgeting and financial planning require discipline. Consistently applying these strategies will lead to better financial health and improved credit scores.

Seeking Professional Help

Improving your credit score can sometimes feel overwhelming. Seeking professional help could be a wise decision. Credit counselors are professionals who offer valuable guidance and support. They help you navigate the complexities of credit score improvement.

When To Consider Credit Counseling

Consider credit counseling if you struggle to manage your debts. Signs include missing payments, high credit card balances, or feeling overwhelmed by financial stress. If you are unsure where to start, a credit counselor can provide a clear path forward.

Benefits Of Working With A Credit Counselor

Working with a credit counselor offers many benefits. They provide personalized advice tailored to your financial situation. This can include creating a budget, negotiating with creditors, and offering debt management plans.

- Personalized Guidance: Tailored advice to improve your specific situation.

- Budgeting Assistance: Help in creating a realistic and effective budget.

- Negotiation with Creditors: They can negotiate for lower interest rates or payment plans.

- Debt Management Plans: Structured plans to help you pay off your debts systematically.

Finding A Reputable Credit Counseling Service

Finding a reputable credit counseling service is crucial. Look for services accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These organizations ensure the quality and reliability of the counseling services.

Additionally, check for the following when selecting a service:

- Accreditation: Ensure the service is accredited by a recognized body.

- Reviews and Testimonials: Look for positive reviews and testimonials from past clients.

- Transparency: The service should be upfront about fees and offer a clear plan of action.

- Non-profit Status: Non-profit services often provide more affordable and reliable assistance.

By seeking professional help, you can take significant steps towards improving your credit score. Professional credit counselors provide the expertise and support needed to navigate your financial challenges.

Pros And Cons Of Credit Repair Services

Credit repair services can help improve your credit score. They offer professional assistance, but it is important to understand both the advantages and potential drawbacks. This section covers the pros and cons to help you make an informed decision.

Advantages Of Using Credit Repair Services

- Expert Knowledge: Credit repair companies have experts who understand the laws and regulations. They can efficiently handle disputes and negotiations.

- Time-Saving: These services save you time by handling the complex paperwork and communications with credit bureaus.

- Stress Reduction: Professionals manage the process, reducing the stress associated with credit repair. They provide support and guidance throughout.

- Customized Plans: Many services offer personalized strategies tailored to your specific credit situation. This ensures more effective results.

Potential Drawbacks And Scams

While there are benefits, there are also potential downsides to consider.

- Cost: Credit repair services can be expensive. Fees vary, and some companies charge high rates for their services.

- Scams: Not all credit repair companies are legitimate. Be cautious of scams that promise quick fixes or guarantees.

- Limited Results: Some negative items cannot be removed from your credit report. No service can remove accurate information.

- Time Frame: Credit repair is not an overnight process. It can take months to see significant improvements.

Choosing A Reliable Credit Repair Service

To avoid scams and ensure effective results, choose a reliable credit repair service. Follow these tips:

- Research: Look for reviews and testimonials from previous clients. Verify the company’s reputation and credibility.

- Transparency: Ensure the company is transparent about their fees, services, and expected outcomes.

- Accreditations: Check if the company is accredited by organizations like the Better Business Bureau (BBB).

- Consultations: Opt for companies that offer free consultations to discuss your credit situation and potential strategies.

- Contracts: Read the contract carefully. Ensure there are no hidden fees or unrealistic promises.

Using credit repair services can be beneficial, but it’s crucial to weigh the pros and cons. Choose a reputable company to ensure a positive experience and effective results.

Recommendations For Specific Scenarios

Improving your credit score depends on your unique situation. Below are tailored recommendations for different scenarios to help you boost your credit score effectively.

For Individuals With No Credit History

Starting your credit journey can be daunting. Follow these steps to establish a solid foundation:

- Apply for a Secured Credit Card: These cards require a deposit, which serves as your credit limit.

- Become an Authorized User: Ask a family member with good credit to add you to their account.

- Use a Credit-Builder Loan: These loans are designed to help you build credit by making regular payments.

- Pay Bills on Time: Consistency in paying utility and phone bills can help establish credit.

For Those Recovering From Bankruptcy

Recovering from bankruptcy takes time and effort. Here are some strategies:

- Check Your Credit Report: Ensure all bankruptcy-related debts are correctly reported as discharged.

- Rebuild with a Secured Credit Card: This can help establish positive credit history post-bankruptcy.

- Keep Credit Utilization Low: Use only a small portion of your available credit to avoid high utilization.

- Set Up Payment Reminders: Timely payments are crucial for rebuilding credit.

For People With High Credit Utilization

High credit utilization can hurt your credit score. Consider these tips:

- Pay Down Balances: Focus on reducing your credit card balances to lower your utilization rate.

- Request a Credit Limit Increase: A higher limit can improve your utilization ratio, but avoid additional spending.

- Use Multiple Payments: Make more than one payment in a billing cycle to keep balances low.

- Avoid New Debt: Focus on paying off existing debt rather than accumulating new debt.

Conclusion And Final Tips

Improving your credit score takes time, patience, and consistent effort. By following the strategies outlined in this guide, you can enhance your financial health and enjoy the benefits of a higher credit score. Let’s recap the key strategies and provide some final tips for maintaining a healthy credit score and developing long-term financial habits.

Recap Of Key Strategies

- Pay Bills on Time: Ensure that all your bills are paid on or before their due dates.

- Reduce Credit Card Balances: Keep your credit card balances low to reduce your credit utilization ratio.

- Avoid New Credit Applications: Limit the number of new credit applications you submit.

- Check Credit Reports Regularly: Regularly review your credit reports for errors and discrepancies.

- Use Credit Wisely: Use your credit cards and loans responsibly to build a positive credit history.

Maintaining A Healthy Credit Score

Maintaining a healthy credit score requires ongoing effort. Here are some tips to help you keep your score in good shape:

- Monitor Your Credit: Regularly check your credit reports from the three major credit bureaus.

- Set Payment Reminders: Use reminders or automatic payments to ensure you never miss a payment.

- Keep Old Accounts Open: Length of credit history impacts your score. Keep old accounts open to maintain a longer credit history.

Long-term Financial Habits

Developing good financial habits is essential for maintaining a high credit score and overall financial health. Consider these long-term strategies:

- Build an Emergency Fund: Save at least three to six months’ worth of expenses for emergencies.

- Create a Budget: Plan and track your monthly expenses to avoid overspending.

- Invest Wisely: Consider investing in assets that can provide long-term growth and stability.

By implementing these strategies and maintaining healthy financial habits, you can achieve and sustain a strong credit score, paving the way for better financial opportunities in the future.

Frequently Asked Questions

How Can I Quickly Improve My Credit Score?

To quickly improve your credit score, pay off outstanding debts. Ensure timely payments of all bills. Check your credit report for errors and dispute inaccuracies.

Does Paying Off Debt Improve Credit Score?

Yes, paying off debt can significantly improve your credit score. It reduces your credit utilization ratio and shows responsible financial behavior.

How Often Should I Check My Credit Report?

You should check your credit report at least once a year. Regularly reviewing helps identify errors and detect potential fraud early.

Can Closing A Credit Card Hurt My Credit Score?

Yes, closing a credit card can hurt your credit score. It can increase your credit utilization ratio and reduce your credit history length.

Conclusion

Improving your credit score can feel overwhelming. But it’s possible with the right strategies. Consistent monitoring and good financial habits make a difference. Remember, patience is key. Small steps lead to big changes. Ready to take your first step in real estate investing? Explore the educational resources at Subto. It offers support for both new and seasoned investors. Build your financial future with confidence. Join a community of learners and achievers today!