Fast Credit Repair: Boost Your Score in Record Time

Repairing your credit quickly can seem like a daunting task. But with the right strategies, it’s entirely achievable.

In this post, we’ll explore effective methods for fast credit repair, guiding you step-by-step toward better financial health. Understanding credit repair is crucial for anyone looking to improve their financial standing. Poor credit can affect your life in many ways, from higher interest rates to difficulty getting loans. The good news is that there are proven techniques to help you repair your credit faster. By focusing on key areas such as timely payments, debt reduction, and monitoring your credit report, you can make significant progress. Let’s dive into these strategies and see how they can work for you. Explore more about credit repair with SubTo, which provides essential resources and a supportive community for real estate investors. Learn more here.

Introduction To Fast Credit Repair

Many people struggle with poor credit scores. A low credit score can affect your ability to get loans, rent an apartment, or even get a job. Fast credit repair can help you improve your credit score quickly and efficiently. In this section, we will explore what fast credit repair is and why it is important.

What Is Fast Credit Repair?

Fast credit repair involves a series of steps aimed at improving your credit score within a short period. This can include identifying and correcting errors on your credit report, paying off outstanding debts, and managing your credit responsibly. Fast credit repair services often work with credit bureaus to expedite the correction of inaccuracies on your credit report.

Why Credit Repair Is Important

Having a good credit score is crucial for many reasons. It can help you secure lower interest rates on loans and credit cards. It can also increase your chances of getting approved for a mortgage or a rental property. Good credit can even impact your job prospects, as some employers check credit scores during the hiring process.

Fast credit repair can help you achieve these benefits more quickly. By addressing issues on your credit report promptly, you can see improvements in your credit score in a shorter amount of time. This can open up new financial opportunities and provide peace of mind.

| Steps in Fast Credit Repair | Description |

|---|---|

| Identify Errors | Review your credit report for any inaccuracies. |

| Dispute Errors | Contact credit bureaus to correct any errors. |

| Pay Off Debts | Pay off outstanding debts or negotiate payment plans. |

| Manage Credit | Use credit responsibly to avoid future issues. |

In conclusion, fast credit repair is a valuable process for improving your credit score quickly. It involves taking proactive steps to correct errors on your credit report, paying off debts, and managing your credit responsibly. By doing so, you can enjoy the many benefits of having a good credit score, from lower interest rates to better job prospects.

Understanding Your Credit Score

Credit scores play a crucial role in your financial life. Knowing how your credit score works helps you make better financial decisions. A good credit score opens doors to better loan terms and interest rates. Let’s dive deeper to understand the components and impact of your credit score.

Components Of A Credit Score

Your credit score is a three-digit number that represents your creditworthiness. It ranges from 300 to 850. Here are the key components:

- Payment History – 35%: This is the most important factor. It tracks if you pay your bills on time.

- Amounts Owed – 30%: It shows how much debt you carry compared to your credit limits.

- Length of Credit History – 15%: Longer credit histories tend to be more favorable.

- New Credit – 10%: This includes the number of recently opened accounts and hard inquiries.

- Credit Mix – 10%: A variety of credit types (credit cards, mortgages) can be beneficial.

How Your Credit Score Affects Your Financial Life

Your credit score impacts many aspects of your financial life:

| Aspect | Impact |

|---|---|

| Loan Approval | Banks look at your credit score to decide if they will lend you money. |

| Interest Rates | Higher credit scores get lower interest rates, saving you money. |

| Credit Card Offers | Good credit scores lead to better credit card offers with more perks. |

| Renting a Home | Landlords check credit scores to decide if you are a reliable tenant. |

| Insurance Premiums | Some insurers use credit scores to set your premiums. |

Understanding your credit score is the first step to managing your financial health. Regularly check your score and take steps to improve it. This can lead to better financial opportunities and peace of mind.

Key Features Of Fast Credit Repair Services

Fast credit repair services offer essential features to help you improve your credit score quickly. These services are designed to address various aspects of your credit profile. Below are the key features of fast credit repair services:

Personalized Credit Analysis

One of the most important features of fast credit repair services is personalized credit analysis. Experts review your credit report to identify errors or negative items. They provide a tailored plan to address these issues. This step ensures that your credit repair process is efficient and targeted.

Dispute Resolution Services

Another crucial feature is dispute resolution services. Professionals will dispute inaccuracies on your credit report with credit bureaus. They handle the communication and documentation. This process helps remove erroneous information that negatively impacts your credit score.

Credit Monitoring Tools

Credit monitoring tools are essential for keeping track of your credit progress. These tools alert you to changes in your credit report. Regular monitoring helps you stay informed and take timely action if needed. It also protects you from identity theft and fraud.

Debt Management Plans

Finally, fast credit repair services may offer debt management plans. These plans help you manage and reduce your debt effectively. Experts create a customized strategy to pay off your debts. This approach improves your credit score over time and ensures financial stability.

How Fast Credit Repair Services Work

Fast credit repair services help improve your credit score quickly. They use proven strategies to address credit issues. Here’s a look at how these services work.

Initial Credit Assessment

The process begins with an initial credit assessment. The service provider reviews your credit report. They identify negative items that need attention. This includes late payments, defaults, and inaccuracies. Understanding these issues is crucial for creating an effective plan.

Tailored Action Plans

Next, they develop a tailored action plan. This plan addresses your specific credit issues. It includes steps to dispute inaccuracies. It also suggests ways to pay down debt. The goal is to improve your credit score as quickly as possible.

Here is what an action plan may include:

- Disputing incorrect entries on your credit report.

- Negotiating with creditors to remove negative items.

- Creating a budget to manage debt repayment.

Ongoing Progress Tracking

Ongoing progress tracking is a key feature of fast credit repair services. They monitor changes in your credit report. They provide regular updates on your progress. Adjustments to the action plan are made as needed. This ensures you stay on track to achieve your credit goals.

A typical progress tracking report might include:

| Month | Credit Score | Improvement Actions |

|---|---|---|

| January | 580 | Disputed 3 inaccuracies |

| February | 600 | Paid off one credit card |

| March | 620 | Removed one negative item |

Regular monitoring ensures continuous improvement. It helps you achieve a better credit score faster.

Pricing And Affordability

Understanding the costs involved in fast credit repair is crucial. Pricing can vary based on the service provider and the extent of your credit issues. Let’s break down the costs and see how they compare to the benefits of improving your credit score.

Cost Breakdown Of Credit Repair Services

Credit repair services typically involve several fees. Here’s a breakdown:

| Service | Cost Range |

|---|---|

| Initial Setup Fee | $50 – $150 |

| Monthly Fee | $79 – $129 per month |

| Per Deletion Fee | $25 – $50 per item |

Some services may charge a one-time setup fee. Others might bill monthly or per item removed from your credit report.

Comparing Costs Vs. Benefits

Is the cost of credit repair worth it? Consider the benefits:

- Lower Interest Rates: A higher credit score can lead to lower interest rates on loans and credit cards.

- Better Loan Approvals: Improve your chances of getting approved for loans.

- Higher Credit Limits: With a better score, you may qualify for higher credit limits.

By investing in credit repair, you could save money in the long run. Lower interest rates and better loan terms can lead to significant savings.

Remember, the value of these benefits can far outweigh the initial costs. Improved credit can open doors to better financial opportunities.

Pros And Cons Of Fast Credit Repair

Fast credit repair can be a game-changer for those seeking to improve their credit scores quickly. However, like any financial service, it comes with its own set of advantages and potential drawbacks. Below, we will explore the pros and cons of using fast credit repair services.

Advantages Of Using Fast Credit Repair Services

- Quick Results: Fast credit repair services aim to improve your credit score in a short period, often within 30-60 days.

- Professional Expertise: These services are managed by experts who understand the intricacies of credit reports and scoring.

- Time-Saving: Instead of navigating the complexities of credit repair on your own, professionals handle the legwork, saving you time and effort.

- Error Correction: Fast credit repair services can identify and dispute errors on your credit report, which can significantly boost your score.

- Financial Planning: Some services offer additional financial advice and planning to help maintain your improved credit score.

Potential Drawbacks To Consider

- Cost: Fast credit repair services can be expensive, with fees ranging from hundreds to thousands of dollars.

- Temporary Fix: Quick fixes may not address the underlying financial habits that led to poor credit, risking future issues.

- Scams: The industry has its share of scams and fraudulent companies, making it essential to research and choose reputable services.

- Legal Limitations: Some credit repair strategies may push the boundaries of legal practices, potentially leading to further issues.

- Not Guaranteed: Despite the promises, no service can guarantee a specific increase in your credit score.

Specific Recommendations For Ideal Users

Fast credit repair services are valuable for many people. They help improve credit scores quickly. This section will guide you on who can benefit most and in which scenarios fast credit repair is most effective.

Who Can Benefit Most From Fast Credit Repair?

Fast credit repair is ideal for several groups:

- Real Estate Investors: Investors seeking loans for property purchases.

- Individuals with Low Credit Scores: Those aiming to improve creditworthiness.

- Entrepreneurs: Business owners needing credit for expansion.

- First-time Home Buyers: Buyers needing better credit for mortgage approval.

- People with Negative Marks: Those with errors or disputes on their credit reports.

Scenarios Where Fast Credit Repair Is Most Effective

Fast credit repair works best in specific situations:

- Urgent Loan Approvals: When you need a loan quickly for urgent needs.

- Fixing Errors: When there are inaccuracies on your credit report.

- Debt Management: When consolidating or negotiating debt.

- Major Purchases: Preparing for significant purchases like a car or home.

- Credit Card Applications: Improving chances for credit card approvals.

Fast credit repair services can be a game-changer. They offer quick improvements and effective solutions. Choose wisely and enhance your financial health.

| Scenario | Benefit |

|---|---|

| Urgent Loan Approvals | Quick access to needed funds |

| Fixing Errors | Removing inaccuracies |

| Debt Management | Better debt handling |

| Major Purchases | Higher purchase approval chances |

| Credit Card Applications | Improved approval rates |

Remember, fast credit repair is a tool. It helps you achieve your financial goals effectively and efficiently.

Diy Tips For Fast Credit Repair

Repairing your credit can feel like a daunting task. But with the right steps, you can make significant improvements. Here are some DIY tips for fast credit repair that you can start today.

Reviewing Your Credit Report

Begin by reviewing your credit report from all three major credit bureaus. Look for any errors or discrepancies. Dispute inaccuracies immediately to ensure your report is accurate.

| Credit Bureau | Website |

|---|---|

| Equifax | equifax.com |

| Experian | experian.com |

| TransUnion | transunion.com |

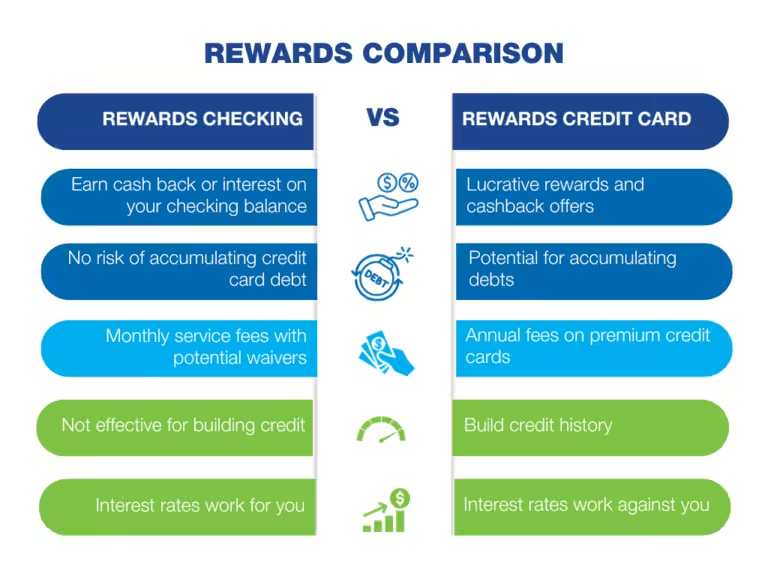

Paying Down High Balances

Focus on paying down high balances on your credit cards. Aim to keep your credit utilization ratio below 30%. This can significantly boost your credit score.

- Pay more than the minimum payment.

- Consider a balance transfer to reduce interest rates.

- Prioritize paying off high-interest accounts first.

Avoiding New Debt

Avoiding new debt is crucial while repairing your credit. Refrain from opening new credit accounts or taking out new loans. This can help stabilize your financial situation.

- Stick to a budget.

- Use cash or debit for purchases.

- Focus on needs, not wants.

Maintaining Good Credit Habits

Develop and maintain good credit habits to sustain your improved credit score. Pay your bills on time and keep your credit card balances low. Regularly review your credit report.

Set up payment reminders to ensure you never miss a due date. Consider enrolling in automatic payments for recurring bills.

By following these DIY tips, you can take control of your credit and see improvements faster than you might expect.

Frequently Asked Questions

What Is Fast Credit Repair?

Fast credit repair involves quickly improving your credit score. This can be done by disputing errors, paying off debts, and reducing credit utilization.

How Can I Repair My Credit Fast?

To repair your credit fast, dispute inaccuracies, pay down high balances, and avoid late payments. Consistently monitor your credit report.

How Long Does Fast Credit Repair Take?

Fast credit repair typically takes 30 to 90 days. The exact time depends on the specific issues being addressed.

Is Fast Credit Repair Effective?

Fast credit repair can be effective if done correctly. It requires addressing errors, reducing debt, and maintaining good financial habits.

Conclusion

Improving your credit doesn’t have to be a lengthy process. By taking consistent steps, you can see positive changes quickly. SubTo offers valuable resources for real estate investors, which can aid in creative financing. Access expert guidance and practical tools for your credit repair journey. The supportive community at SubTo can motivate and inspire you. Start your path to better credit and real estate success today with SubTo. For more information, visit SubTo.