Credit Cards: Unlocking the Best Rewards and Benefits

Credit cards are a vital part of modern financial life. They offer convenience, rewards, and a way to build credit.

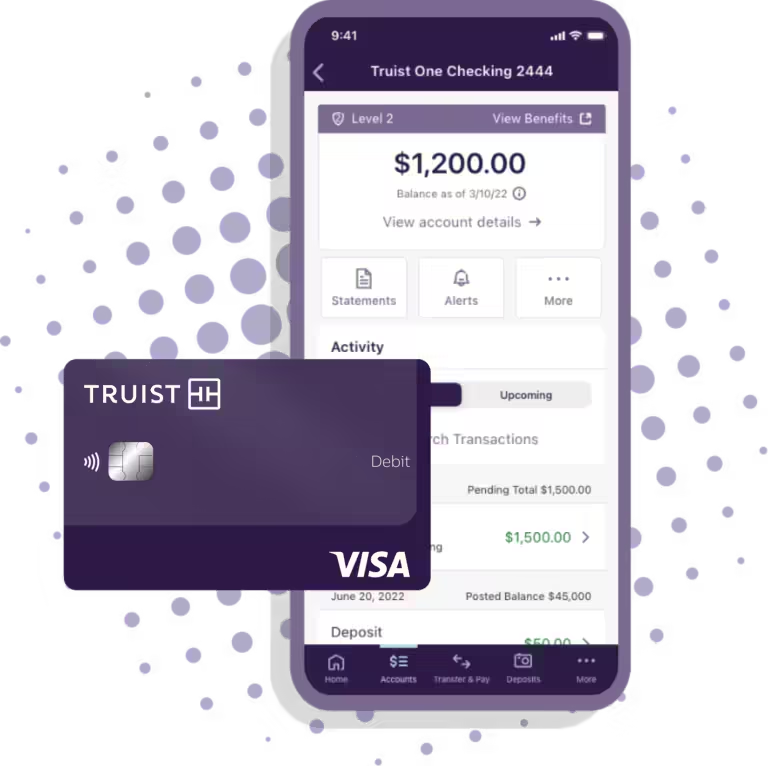

But not all credit cards are the same. Credit cards can help you manage expenses, earn rewards, and improve your credit score. One such option is Perpay. Perpay is a financial service that offers users a unique way to shop for top brands in electronics, home goods, apparel, and more. It provides a platform to make everyday purchases more accessible and helps users build credit by paying over time with their paycheck. With no interest or fees, and the ability to earn rewards, Perpay is an attractive option for many. Click here to learn more about Perpay and how it can benefit you.

Introduction To Credit Cards And Their Purpose

Credit cards are essential financial tools in modern life. They offer convenience and security for everyday purchases. Understanding how credit cards work helps users manage their finances better.

Understanding Credit Cards

A credit card is a plastic card issued by financial institutions. It allows cardholders to borrow funds to pay for goods and services. The borrowed amount must be repaid with interest if not paid in full by the due date.

- Credit Limit: The maximum amount you can borrow.

- Interest Rate: The cost of borrowing money on the card.

- Billing Cycle: The period for which transactions are recorded.

- Minimum Payment: The smallest amount you must pay to avoid penalties.

Credit cards offer benefits such as ease of use and building credit history. They are accepted worldwide, making them convenient for travel and online shopping.

Why Rewards And Benefits Matter

Credit cards often come with rewards and benefits. These can include cashback, travel points, or store discounts. The Perpay Credit Card, for example, offers 2% rewards on purchases to use in the Perpay Marketplace.

| Feature | Perpay Credit Card |

|---|---|

| Rewards Rate | 2% on purchases |

| Marketplace Access | $1,000 credit limit |

| Interest-Free Payments | Yes |

| Credit Building | Automatic payments from paycheck |

Rewards and benefits can significantly enhance the value of a credit card. They offer savings and perks that can add up over time. Choosing a card with the right rewards can help maximize your financial benefits.

Key Features Of Reward Credit Cards

Reward credit cards offer numerous benefits that make spending more rewarding. These cards provide various incentives, such as cash back, travel rewards, and points programs. Understanding these key features can help you maximize your benefits.

Sign-up Bonuses

One of the most attractive features of reward credit cards is the sign-up bonus. Many cards offer a substantial bonus when you spend a certain amount within the first few months. This can be a great way to earn a significant amount of rewards quickly.

- Large initial reward

- Usually requires a minimum spend

- Often worth hundreds of dollars

Cashback Rewards

Cashback rewards are a straightforward way to earn on everyday purchases. Many cards offer a percentage back on all purchases or higher rates in specific categories.

- Earn a percentage back on purchases

- Higher rates in specific categories like groceries or gas

- Cashback can be redeemed as statement credits or direct deposits

Travel Rewards

Travel rewards credit cards are perfect for those who love to travel. These cards often offer points or miles for every dollar spent, which can be redeemed for flights, hotels, and more.

- Earn points or miles on purchases

- Redeem for flights, hotels, and travel experiences

- May include travel perks like airport lounge access or free checked bags

Points And Miles Programs

Points and miles programs allow you to earn rewards that can be redeemed for various benefits. These programs often offer flexibility in how you can use your points or miles.

- Earn points or miles on every purchase

- Redeem for a variety of rewards including travel, merchandise, and gift cards

- Transfer points to partner loyalty programs

In summary, reward credit cards offer a variety of benefits that can enhance your spending power. From sign-up bonuses to cashback and travel rewards, these features provide significant value to cardholders.

How Reward Credit Cards Add Value

Reward credit cards offer numerous benefits that enhance your daily financial activities. They provide a range of perks, from cashback on purchases to travel benefits. Let’s explore how these cards add value to your financial life.

Enhancing Everyday Purchases

With reward credit cards like Perpay, everyday purchases become more rewarding. By using the Perpay Credit Card, you earn 2% rewards on every purchase. This makes routine spending more beneficial.

The Perpay Marketplace offers access to top brands in electronics, home goods, and apparel. You can use your rewards here, making shopping more affordable. Additionally, payments are interest-free, so you save money while building your credit.

- Earn 2% rewards on all purchases.

- Interest-free payments on the Perpay Marketplace.

- Access to a $1,000 credit limit for shopping.

Travel Perks And Benefits

Reward credit cards often come with travel benefits. While the Perpay Credit Card focuses on everyday spending, many reward cards offer perks like travel insurance, airport lounge access, and discounts on flights and hotels.

These benefits make travel more convenient and affordable. If you travel frequently, consider a card that offers these perks. It can save you money and enhance your travel experience.

Exclusive Offers And Discounts

Reward credit cards provide access to exclusive offers and discounts. With the Perpay Credit Card, you can shop top brands without interest or fees. This makes high-quality products more accessible.

Other reward cards may offer special deals on dining, entertainment, and more. Look for cards that match your spending habits to maximize these benefits. Exclusive offers can significantly reduce your expenses.

| Benefit | Description |

|---|---|

| 2% Rewards | Earn on every purchase with the Perpay Credit Card. |

| Interest-Free Payments | Pay over time without interest or fees. |

| Exclusive Discounts | Access to top brands and special offers. |

Using reward credit cards wisely can enhance your financial life. They offer valuable benefits that make everyday spending and travel more rewarding.

Pricing And Affordability Of Reward Credit Cards

Reward credit cards offer numerous benefits, but it’s important to understand their pricing and affordability. Knowing the costs associated with these cards can help you make informed decisions. Let’s break down the key factors.

Annual Fees

Many reward credit cards come with annual fees. These fees can range from $0 to several hundred dollars, depending on the card’s benefits. For instance, the Perpay Credit Card offers access to a $1,000 credit limit without interest or fees, making it an affordable option for many users.

Interest Rates

The interest rates on reward credit cards can vary widely. It’s crucial to understand the APR (Annual Percentage Rate) associated with your card. While Perpay offers interest-free payments, other cards might charge high-interest rates, especially if you carry a balance.

Foreign Transaction Fees

If you travel often, be aware of foreign transaction fees. These fees are charged on purchases made outside your home country. Some reward cards waive these fees, while others might charge up to 3% per transaction. The Perpay Credit Card allows you to earn 2% rewards on all purchases, adding value without additional fees.

Balance Transfer Options

Consider the balance transfer options available with reward credit cards. Balance transfers can help you manage debt more effectively. Some cards offer promotional balance transfer rates, allowing you to pay off balances from other cards at lower rates. Always check the terms and fees associated with these transfers.

| Card Feature | Perpay Credit Card |

|---|---|

| Annual Fee | None |

| Interest Rate | Interest-Free |

| Foreign Transaction Fee | None |

| Balance Transfer Options | Not Specified |

Understanding these factors helps you choose a reward credit card that fits your needs and budget. The Perpay Credit Card, for instance, offers significant benefits with no interest or fees, making it a great option for those looking to build credit and earn rewards.

Pros And Cons Of Using Reward Credit Cards

Reward credit cards offer many benefits, but they also come with some risks. Understanding both sides can help you make an informed decision. Below, we discuss the advantages and potential drawbacks of using reward credit cards.

Advantages Of Reward Credit Cards

- Earn Rewards: Get points, miles, or cashback on purchases. For example, the Perpay Credit Card offers 2% rewards to shop on the Perpay Marketplace.

- Boost Credit Score: Regular use and timely payments can improve your credit score. Perpay users see an average increase of 36 points within the first three months.

- Interest-Free Payments: Many cards, like Perpay, allow you to pay over time without interest.

- Exclusive Access: Some cards offer special access to products or services. Perpay gives you a $1,000 credit limit to shop top brands.

Potential Drawbacks And Risks

- High Fees: Some reward cards come with annual fees or high-interest rates. Perpay, however, does not charge interest or fees.

- Impact on Credit: Missed payments can harm your credit score. Although Perpay helps build credit, failure to make timely payments can negatively impact your score.

- Limited Availability: Some cards are only available in certain regions. For example, the Perpay Credit Card is not available to residents of New Hampshire.

- Complex Terms: Understanding the terms and conditions can be challenging. Always read the fine print to know what you’re signing up for.

By weighing the pros and cons, you can decide if a reward credit card is right for you. Remember to use your card responsibly to maximize the benefits and minimize the risks.

Specific Recommendations For Ideal Users

Choosing the right credit card can make a big difference in your financial journey. Different cards are suitable for various spending habits and lifestyles. Below are specific recommendations for ideal users, categorized to help you find the best fit.

Best For Frequent Travelers

If you love to travel, the Perpay Credit Card could be an excellent option. You can use it anywhere Mastercard is accepted, making it perfect for booking flights, hotels, and car rentals. Here’s what you need to know:

- 2% rewards: Earn rewards on every purchase, which you can use on the Perpay Marketplace.

- No interest or fees: Enjoy your travels without worrying about extra costs.

- Credit building: Improve your credit score with automatic payments from your paycheck.

Best For Everyday Spenders

For those who make regular purchases, the Perpay Credit Card is a great companion. It offers several benefits that cater to everyday spenders:

- Perpay Marketplace: Access a $1,000 credit limit to shop for electronics, home goods, and more.

- Interest-free payments: Pay over time without any interest or fees.

- Credit score improvement: Automatic payments help enhance your credit score, with an average increase of 36 points in three months.

Best For Business Owners

Business owners can also benefit from the Perpay Credit Card. This card can help manage business expenses and improve your financial health:

- High credit limit: Use the $1,000 credit limit to purchase essential business supplies.

- Rewards program: Earn 2% rewards on all purchases, which can be used for future business expenses on the Perpay Marketplace.

- Build credit: Automatic payments from your paycheck help build a positive credit history, which is crucial for future business loans or credit lines.

Each user has unique needs, and choosing the right credit card can provide significant benefits. Whether you are a frequent traveler, an everyday spender, or a business owner, the Perpay Credit Card offers valuable features to suit your lifestyle.

Conclusion And Final Thoughts

Credit cards offer convenience and various benefits. They also require responsible use to avoid debt. Understanding terms and conditions is crucial.

Credit cards can be a valuable financial tool when used responsibly. Selecting the right card tailored to your needs can maximize rewards and benefits, and improve your overall financial health.Maximizing Rewards And Benefits

Using credit cards wisely can help you earn valuable rewards and benefits. With Perpay, you can access a $1,000 credit limit without any interest or fees. This allows you to make everyday purchases more accessible. Key Benefits of Perpay:- Interest-Free Payments: Pay over time with no interest or fees.

- 2% Rewards: Earn rewards with the Perpay Credit Card to use on future purchases.

- Credit Building: Automatic payments help improve your credit score.

Choosing The Right Card For Your Needs

Choosing the right credit card involves considering your spending habits and financial goals. Perpay offers a unique advantage by allowing you to shop and build credit without accruing interest or fees. Factors to Consider:- Credit Limit: Perpay provides a $1,000 credit limit, which is accessible for many.

- Rewards: The 2% rewards can be used on future purchases within the Perpay Marketplace.

- Credit Score Improvement: The average credit score increase is 36 points within three months.

- Automatic Payments: Ensures timely payments, aiding in credit score improvement.

| Feature | Perpay Benefits |

|---|---|

| Credit Limit | $1,000 |

| Interest-Free | Yes |

| Rewards | 2% on Perpay Marketplace |

| Credit Score Improvement | Average increase of 36 points |

Frequently Asked Questions

What Are The Benefits Of Using Credit Cards?

Credit cards offer rewards, cashback, and travel points. They also provide purchase protection and fraud liability coverage. Credit cards help in building credit history when used responsibly.

How Do Credit Cards Impact Credit Score?

Using credit cards responsibly improves credit score. Timely payments and low credit utilization are key factors. High balances can negatively affect your score.

Can I Use A Credit Card For Online Shopping?

Yes, credit cards are widely accepted for online purchases. They offer added security features and fraud protection. Ensure your card details are kept secure.

What Are The Types Of Credit Cards Available?

There are various types of credit cards including rewards, cashback, travel, and secured cards. Each type offers different benefits catering to specific needs.

Conclusion

Choosing the right credit card can be a game-changer for your finances. Perpay offers a unique solution with its $1,000 interest-free credit limit. The Perpay credit card helps build your credit score over time with easy paycheck deductions. Shop top brands while earning rewards. This makes budgeting simple and stress-free. Ready to explore Perpay? Visit Perpay now and start improving your financial health today.