Hassle-Free Credit Solutions: Simplify Your Financial Future

Navigating the world of credit solutions can be daunting. But what if there was a hassle-free way to manage it?

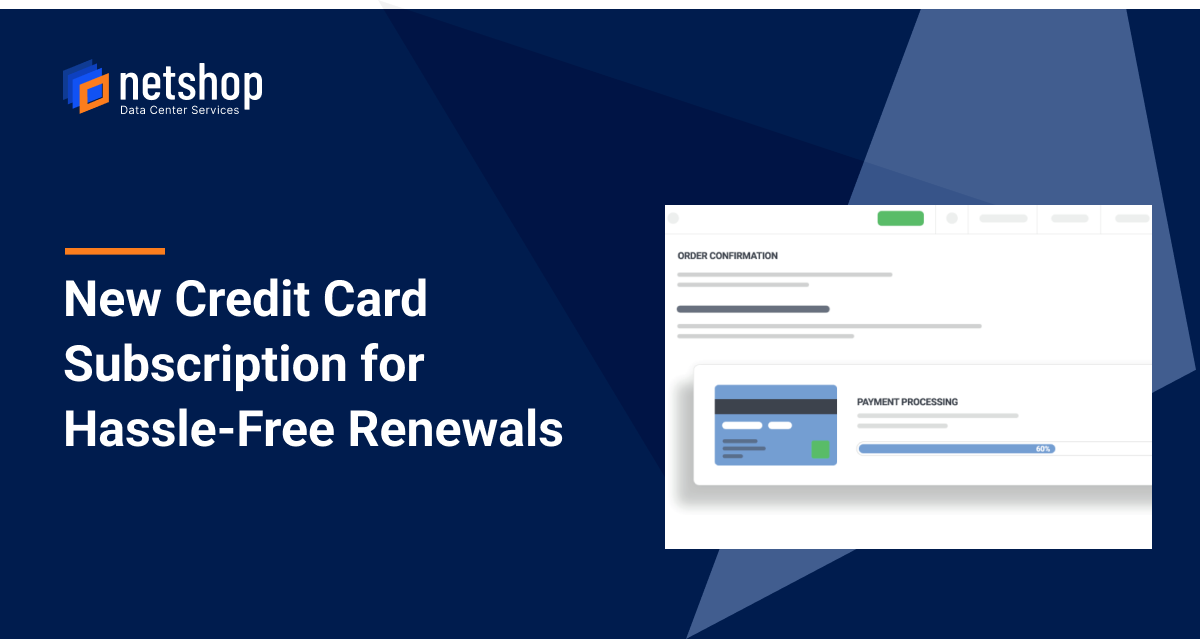

Introducing Perpay, a platform designed to simplify your credit journey. With Perpay, you can shop, build credit, and pay over time directly from your paycheck. This seamless process offers access to top brands in electronics, home goods, apparel, and more, all through their marketplace. Additionally, Perpay provides a credit card for broader purchasing options, earning you 2% rewards on your buys. No interest or fees mean you can build your credit score without hidden costs. Curious how Perpay can make your credit experience easier? Discover more about Perpay here and start your journey toward hassle-free credit solutions.

Introduction To Hassle-free Credit Solutions

Navigating the world of credit can be challenging. Many people seek simpler, more transparent options. This is where Hassle-Free Credit Solutions come into play. Designed for ease of use, these solutions help users manage credit effectively.

Understanding The Need For Simplified Credit Solutions

Many individuals face difficulties with traditional credit systems. Complex terms, high fees, and interest rates add to the confusion. People need straightforward options that provide clear benefits without hidden costs. Simplified credit solutions address these issues, offering transparency and ease of use.

A significant number of users struggle to maintain a positive credit history. Simplified solutions help by offering features that promote good credit habits. Easy-to-understand terms and automatic payments can lead to better credit scores over time.

Overview Of Hassle-free Credit Solutions

Perpay is an excellent example of a hassle-free credit solution. It combines shopping, credit building, and flexible payments. Users can access a marketplace with top brands in electronics, home goods, apparel, and more.

The Perpay Credit Card can be used anywhere Mastercard is accepted. It offers 2% rewards on purchases, which can be used on the Perpay Marketplace. This card also helps users build credit by making automatic payments from their paychecks.

| Feature | Details |

|---|---|

| Perpay Marketplace | Access to $1,000 credit for top brands |

| Perpay Credit Card | 2% rewards, usable anywhere Mastercard is accepted |

| Credit Building | Average credit score increase of 36 points in 3 months |

| No Interest or Fees | Pay over time without extra costs |

Perpay stands out with its no interest or fees policy. Users can manage payments directly from their paychecks, making it easier to keep up with due dates. This setup helps improve credit scores, as timely payments are reported to major credit bureaus.

The benefits of hassle-free credit solutions include convenient shopping, credit score improvement, and a rewards program. These features are designed to make managing credit less stressful and more beneficial. For more details, users can visit the Perpay website.

Key Features Of Hassle-free Credit Solutions

Hassle-free credit solutions offer a range of features designed to make managing finances easier. These features help users access credit, build a positive credit history, and enjoy flexible repayment options. Let’s dive into the key features that make hassle-free credit solutions like Perpay stand out.

Streamlined Application Process

Perpay’s application process is simple and quick. Users can apply online without affecting their FICO® score. This easy application ensures that users can access credit without unnecessary delays. The entire process is designed to be user-friendly, making it accessible for everyone.

Flexible Repayment Options

Perpay offers flexible repayment options by allowing payments directly from paychecks. This setup ensures that users can manage their payments without stress. The option to pay over time without incurring interest or fees adds an extra layer of convenience.

Transparent Fee Structures

One of the standout features of Perpay is its transparent fee structure. There are no hidden fees or interest charges. Users know exactly what they are paying, which helps in better financial planning. This transparency builds trust and ensures users are not caught off guard by unexpected costs.

Credit Score Improvement Programs

Perpay’s credit-building program is designed to help users improve their credit scores. By making automatic payments from paychecks, users can build a positive credit history. On average, users see a credit score increase of 36 points within the first three months. This feature makes Perpay an excellent option for those looking to improve their credit scores.

Benefits Of Using Hassle-free Credit Solutions

Hassle-free credit solutions offer numerous advantages that can simplify your financial life. They make managing finances easier, reduce stress, and help improve your credit score. Here are some benefits of using hassle-free credit solutions like Perpay.

Ease Of Access And Convenience

With Perpay, you have access to a marketplace featuring top brands in electronics, home goods, apparel, and more. You can shop with a $1,000 credit limit, making it easy to get what you need without the hassle of traditional credit applications. Perpay Credit Card lets you make purchases anywhere Mastercard is accepted, earning 2% rewards on all transactions.

Reduction Of Financial Stress

Perpay allows you to pay over time without interest or fees. This means you can manage your budget more effectively and avoid the stress of high-interest debt. Automatic payments directly from your paycheck ensure you never miss a payment, reducing the risk of late fees and further financial strain.

Enhanced Financial Planning

Using Perpay helps you plan your finances better. The platform’s no interest or fees policy means you know exactly what you owe, making it easier to budget. The rewards program also provides additional value, offering credits that can be used in the Perpay Marketplace.

Building And Repairing Credit

Perpay’s automatic payment system contributes to building a positive credit history. On-time payments are reported to major credit bureaus like Experian®, Equifax®, and TransUnion®. This can lead to an average credit score increase of 36 points within the first three months. It’s an excellent tool for those looking to improve their credit score without the traditional hurdles of interest and fees.

In conclusion, using hassle-free credit solutions like Perpay can provide significant benefits. They offer ease of access, reduce financial stress, enhance financial planning, and help build or repair your credit score.

Pricing And Affordability

Finding an affordable credit solution is key. Perpay offers a unique blend of affordability and transparency. Its features make it a standout choice for many.

Cost-effective Interest Rates

Perpay stands out with its no interest policy. Users can shop and pay over time without incurring additional costs. This makes budgeting easier and more predictable. Unlike many traditional credit cards, Perpay ensures that you save money in the long run.

No Hidden Fees

Transparency is crucial in financial products. Perpay ensures there are no hidden fees. What you see is what you get. This straightforward approach helps users manage their finances without surprise charges.

Comparison With Traditional Credit Solutions

Traditional credit solutions often come with high-interest rates and hidden fees. They can also negatively impact your credit score with hard inquiries. In contrast, Perpay:

- No interest or fees

- No impact on FICO® score

- Automatic payments from paychecks

- Credit score improvement

The table below highlights the differences:

| Feature | Perpay | Traditional Credit Solutions |

|---|---|---|

| Interest Rates | No interest | Variable, often high |

| Fees | No hidden fees | Annual, late, and hidden fees |

| Credit Impact | Improves credit score | Can negatively impact credit score |

| Application Impact | No impact on FICO® score | Hard inquiries affect FICO® score |

Perpay offers a hassle-free credit solution that is both affordable and transparent. It is a smart choice for those looking to build credit without the extra costs.

Pros And Cons Based On Real-world Usage

Perpay offers a unique way to shop, build credit, and pay over time. This section will look at the advantages and drawbacks of Perpay based on real-world usage. We will include user testimonials and feedback to provide a comprehensive view.

Advantages Experienced By Users

Users have reported several benefits while using Perpay:

- No Interest or Fees: Payments can be made over time without any additional costs.

- Credit Score Improvement: On-time payments lead to an average credit score increase of 36 points within the first three months.

- Convenient Shopping: Access to a wide range of products from top brands in electronics, home goods, apparel, and more.

- Rewards Program: Users earn 2% rewards on purchases, which can be used on the Perpay Marketplace.

Common Drawbacks And Limitations

While Perpay has many advantages, users have also noted some limitations:

- Credit Card Availability: The Perpay Credit Card is not available to residents of New Hampshire.

- Refund Policies: Specific details on returns or refunds are not clearly provided, requiring users to refer to the Marketplace Terms and Conditions.

- Credit Impact: Late payments may result in delinquent reporting to credit bureaus.

User Testimonials And Feedback

Here are some real-world testimonials from Perpay users:

| User | Feedback |

|---|---|

| John D. | “Perpay has helped me improve my credit score by 40 points. I love the convenience of shopping and paying over time.” |

| Sarah L. | “The rewards program is fantastic. I use my rewards to buy more items from the marketplace.” |

| Mike P. | “I wish the credit card was available in New Hampshire, but overall, Perpay has been great for my credit.” |

| Emily R. | “The lack of clear refund policies can be frustrating, but the no interest and fees make it worthwhile.” |

Ideal Users For Hassle-free Credit Solutions

Perpay offers a simple and effective way to manage credit. It’s perfect for those who want to build credit and shop with ease. Let’s explore who can benefit the most from Perpay’s hassle-free credit solutions.

Individuals With Low Or No Credit History

Many struggle with low or no credit history. Perpay helps by building credit through automatic payments. Users can access $1,000 credit to shop top brands. This helps in establishing a positive credit history.

Benefits:

- Automatic payments from paychecks

- Access to top brands in electronics, home goods, apparel, and more

- Average credit score increase of 36 points in 3 months

People Seeking Debt Consolidation

Debt consolidation can be challenging. Perpay’s credit solutions offer a structured way to manage payments. By consolidating debts into one payment, users can simplify their finances.

Advantages:

- No interest or fees

- Single, manageable payment

- Potential credit score improvement

Those In Need Of Emergency Funds

Emergencies require quick access to funds. Perpay provides a solution with its credit card. Users can use it anywhere Mastercard is accepted. This flexibility is crucial during unexpected situations.

Key Points:

- Immediate access to credit

- 2% rewards on purchases

- No interest or fees

Users Looking For Credit Score Improvement

Improving a credit score takes time and discipline. Perpay helps by reporting transactions to Experian®, Equifax®, and TransUnion®. Timely payments can boost credit scores significantly.

Highlights:

- Positive payment history

- Average increase of 36 points in 3 months

- Rewards program to earn more benefits

Perpay simplifies credit management for everyone. Whether building credit, consolidating debt, or managing emergencies, it offers a hassle-free solution.

Frequently Asked Questions

What Are Hassle-free Credit Solutions?

Hassle-free credit solutions are services that simplify credit approval. They offer quick, streamlined processes with minimal paperwork.

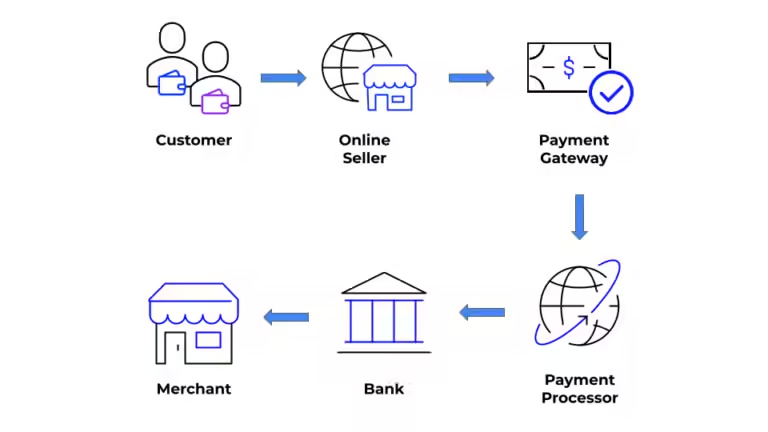

How Do Hassle-free Credit Solutions Work?

These solutions work by automating credit checks. They use advanced algorithms to quickly assess and approve applications.

Who Can Benefit From Hassle-free Credit Solutions?

Anyone needing quick credit approval can benefit. This includes individuals with urgent financial needs and businesses seeking fast funding.

Are Hassle-free Credit Solutions Safe?

Yes, they are generally safe. Reputable providers use secure systems to protect personal and financial information.

Conclusion

Experience hassle-free credit solutions with Perpay. Shop top brands easily. Build your credit score without stress. Enjoy zero interest or fees. Conveniently pay over time directly from your paycheck. Ready to simplify your credit journey? Explore Perpay here. Start shopping and boost your credit today!