Financial Wellness Tips: Boost Your Savings and Reduce Debt

Financial wellness is essential for a stress-free life. It involves managing money wisely to meet your needs and goals.

In today’s world, managing finances can be challenging. Many people struggle with debts, expenses, and saving for the future. But don’t worry, there are simple tips to help you achieve financial wellness. These tips can guide you in building a stable financial foundation. From budgeting to using tools like Perpay, these strategies can make a big difference. Perpay offers a unique service that allows you to shop, build credit, and pay over time without interest. By following these tips, you can improve your financial health and enjoy a more secure future. So let’s dive into some practical financial wellness tips.

Introduction To Financial Wellness

Financial wellness is crucial for a stress-free life. It involves managing your finances effectively to reduce financial stress. By understanding financial wellness, you can make informed decisions that lead to financial stability and growth.

Understanding Financial Wellness

Financial wellness is the state of having a healthy financial situation. It includes aspects like budgeting, saving, investing, and managing debt. A key component is ensuring that your income covers your expenses, with some left over for savings and investments.

| Aspect | Description |

|---|---|

| Budgeting | Creating a plan to manage your money, ensuring expenses do not exceed income. |

| Saving | Setting aside money for future needs or emergencies. |

| Investing | Putting money into assets like stocks or bonds to grow wealth over time. |

| Managing Debt | Keeping debt levels manageable and paying off debts on time. |

Importance Of Financial Wellness

Financial wellness helps reduce stress and improve your quality of life. When your finances are in order, you can focus on other important aspects of life. Here are some benefits:

- Reduced Stress: Knowing you can meet your financial obligations lowers anxiety.

- Better Health: Less financial stress often leads to better physical and mental health.

- Future Security: Savings and investments provide a safety net for unexpected events.

- More Opportunities: Good financial health opens doors to new opportunities and experiences.

Using tools like Perpay can significantly enhance your financial wellness. Perpay offers a marketplace with $1,000 credit, a credit card with 2% rewards, and automatic payments to build credit. These features make managing and improving your financial health easier and more accessible.

Creating A Budget

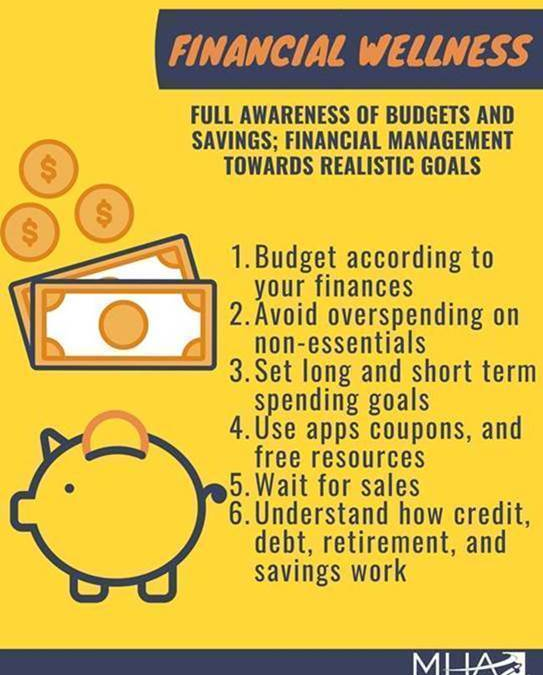

Creating a budget is a crucial step in achieving financial wellness. It allows you to track your income, manage expenses, and plan for future financial goals. A well-planned budget helps you avoid unnecessary debt and ensures you make the most of your earnings.

Steps To Create A Budget

- Calculate Your Income: Determine your total monthly income, including salary, freelance work, and any other sources.

- List Your Expenses: Write down all your monthly expenses, such as rent, utilities, groceries, transportation, and entertainment.

- Categorize Expenses: Separate your expenses into fixed (rent, utilities) and variable (dining out, entertainment) categories.

- Set Financial Goals: Identify short-term and long-term financial goals, like saving for a vacation or paying off debt.

- Track Your Spending: Monitor your spending habits and compare them against your budget to identify areas where you can cut back.

- Adjust as Needed: Review and adjust your budget regularly to ensure it aligns with your financial goals and circumstances.

Tools And Apps For Budgeting

Using tools and apps can simplify the budgeting process and help you stay on track. Here are some popular options:

- Mint: A free app that connects to your bank accounts, categorizes expenses, and provides insights on spending habits.

- YNAB (You Need a Budget): A paid app that focuses on proactive budgeting and helps you allocate funds for future expenses.

- EveryDollar: A user-friendly app that allows you to create a zero-based budget and track your spending.

- Goodbudget: An envelope budgeting app that helps you allocate money for different expense categories.

- Perpay: A financial service offering a marketplace with $1,000 credit, a credit card with 2% rewards, and automatic payments from your paycheck to build credit.

These tools can be valuable assets in managing your finances effectively. Choose one that fits your needs and start creating a budget today.

Boosting Your Savings

Boosting your savings is an essential step towards achieving financial wellness. It helps you prepare for unexpected expenses and ensures a secure financial future. Here are some effective strategies to increase your savings.

Automating Savings

Automating your savings can be a game-changer. Set up automatic transfers from your checking account to your savings account. This way, you save without even thinking about it. It reduces the temptation to spend money that you should be saving. Many banks offer automated savings plans, making it easy to set up and manage.

High-yield Savings Accounts

Consider opening a high-yield savings account. These accounts offer higher interest rates than regular savings accounts. This means your money grows faster. Research different banks and compare their interest rates. Choose the one that offers the best returns. This simple step can significantly boost your savings over time.

Cutting Unnecessary Expenses

Identify and cut unnecessary expenses. Review your monthly budget and look for areas where you can reduce spending. This could include dining out less, canceling unused subscriptions, or finding cheaper alternatives for certain services. Small changes can add up to significant savings over time.

Perpay can also help manage your expenses and savings effectively. With features like:

- Perpay Marketplace: Access to $1,000 credit for shopping.

- Perpay Credit Card: Earn 2% rewards on purchases.

- Credit Building: Automatic payments help improve credit scores.

- Interest-Free Payments: No interest or fees on purchases.

- Convenience: Pay over time with deductions from your paycheck.

These features can assist you in managing your finances more efficiently, ensuring that you save more and spend wisely.

For more information, visit the Perpay website.

Strategies To Reduce Debt

Reducing debt can be a challenging task, but with the right strategies, it becomes more manageable. From choosing the best repayment method to negotiating lower interest rates, there are several approaches to consider. Let’s explore effective strategies to help you reduce your debt.

Debt Snowball Vs. Debt Avalanche Methods

Two popular methods for debt repayment are the Debt Snowball and the Debt Avalanche methods. Each has its own benefits and can be effective based on your financial situation and personal preferences.

| Debt Snowball Method | Debt Avalanche Method |

|---|---|

| Focus on paying off the smallest debt first. | Focus on paying off the highest interest debt first. |

| Provides quick wins and motivation. | Saves more money on interest over time. |

| Ideal for those who need immediate gratification. | Ideal for those who want to minimize overall interest. |

Consolidating Debt

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify payments and reduce the total amount of interest paid over time.

- Use a personal loan to pay off credit card debt.

- Consider a balance transfer credit card with a 0% interest period.

- Look into a debt consolidation program through a financial advisor or service.

Consolidating debt can make your financial obligations more manageable and less stressful.

Negotiating Lower Interest Rates

Another effective strategy is negotiating lower interest rates on your existing debts. This can reduce the total amount you owe and make your monthly payments more affordable.

- Contact your creditors and request a lower interest rate.

- Provide a valid reason, such as a good payment history or financial hardship.

- Consider transferring your balance to a lower-interest card.

Negotiating lower interest rates can significantly impact your debt repayment journey and help you achieve financial wellness faster.

Building An Emergency Fund

Creating an emergency fund is vital for financial stability. It acts as a safety net in case of unexpected expenses. Below, we’ll explore the importance of an emergency fund, how much to save, and where to keep your emergency fund.

Importance Of An Emergency Fund

An emergency fund provides financial security. It helps cover sudden expenses such as medical bills, car repairs, or job loss. Without it, you may need to take on debt or sell assets to manage these costs.

Having an emergency fund reduces stress. You can handle financial emergencies calmly. It also prevents the need to rely on high-interest loans or credit cards, which can worsen your financial situation.

How Much To Save

The amount to save varies based on your expenses. A general rule of thumb is to save at least three to six months’ worth of living expenses. This amount ensures you can cover essential costs without income.

To calculate your target amount:

- List your monthly expenses.

- Multiply the total by three to six months.

For example, if your monthly expenses are $2,000, aim to save between $6,000 and $12,000.

Where To Keep Your Emergency Fund

Keep your emergency fund in a safe, accessible place. Consider these options:

- High-Yield Savings Account: These accounts offer higher interest rates than regular savings accounts. They are easily accessible and provide some growth on your savings.

- Money Market Account: This option combines features of savings and checking accounts. It offers higher interest rates and check-writing capabilities.

- Cash Management Account: These accounts are available through financial service providers like Perpay. They offer easy access to funds and competitive interest rates.

Avoid investing your emergency fund in stocks or other volatile assets. These can lose value quickly and may not be available when needed.

For more financial tools, consider using services like Perpay. It offers access to credit and helps build your credit score through automatic payments.

Smart Investing Tips

Investing wisely can help secure your financial future. Understanding key investment principles is essential. Here are some smart investing tips to guide you.

Understanding Different Investment Options

There are various investment options available. Each has its own benefits and risks. Some common options include:

- Stocks: Ownership in a company, with potential for high returns but also high risk.

- Bonds: Loans to companies or governments, offering lower risk and steady returns.

- Mutual Funds: Pools of money from many investors to buy a diversified portfolio of stocks and bonds.

- Real Estate: Investing in property can provide rental income and potential value appreciation.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded like stocks on an exchange.

Choosing the right mix of these options is crucial for a balanced portfolio.

Risk Management In Investing

Managing risk is key to successful investing. Here are some strategies:

- Diversification: Spread your investments across various assets to reduce risk.

- Asset Allocation: Allocate your investments based on your risk tolerance and time horizon.

- Regular Reviews: Monitor your investments and adjust as needed to stay aligned with your goals.

- Emergency Fund: Keep a portion of your funds in a low-risk account to handle unexpected expenses.

These strategies help protect your investments from market volatility.

Long-term Vs. Short-term Investments

Investments can be categorized based on the time frame:

| Long-Term Investments | Short-Term Investments |

|---|---|

| Held for several years or decades. | Held for a few months or years. |

| Examples: Retirement accounts, real estate. | Examples: Savings accounts, certificates of deposit (CDs). |

| Higher potential for growth. | Lower risk and more liquidity. |

Understanding the difference helps you choose the right strategy for your goals.

Managing Credit Wisely

Managing credit wisely is essential for financial wellness. It involves understanding your credit score, improving it, and avoiding common mistakes. This section provides practical tips to help you manage credit effectively.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Higher scores indicate better credit health. Key factors influencing credit scores include:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit

- New credit inquiries

Understanding these factors helps in managing and improving your credit score.

Tips To Improve Your Credit Score

Improving your credit score takes time and consistent effort. Here are some effective tips:

- Pay your bills on time: Late payments negatively affect your score.

- Keep credit utilization low: Aim to use less than 30% of your available credit.

- Maintain old accounts: Longer credit histories boost your score.

- Avoid frequent credit inquiries: Too many inquiries can lower your score.

- Review your credit report: Check for errors and dispute inaccuracies.

Using tools like the Perpay Credit Card can also help. It offers automatic payments directly from your paycheck, which builds a positive credit history. Users have reported an average credit score increase of 36 points within the first three months.

Avoiding Common Credit Mistakes

Many people make mistakes that hurt their credit scores. Avoid these common pitfalls:

- Missing payments: Always pay at least the minimum amount on time.

- Maxing out credit cards: High credit utilization harms your score.

- Closing old accounts: Keep old accounts open to maintain a longer credit history.

- Applying for too much credit: Multiple applications in a short period can lower your score.

- Ignoring your credit report: Regularly review your report to catch and dispute errors.

Using services like Perpay can help manage credit better. Perpay allows users to shop for products and pay over time with interest-free payments, building a positive credit history.

For more details, visit the Perpay website.

Seeking Professional Financial Advice

Managing your finances can be complex and overwhelming. Seeking professional financial advice is crucial for creating a sound financial plan. A financial advisor can help you navigate your financial goals, investments, and planning for the future.

When To Consult A Financial Advisor

Not everyone needs a financial advisor, but there are times when their expertise can be invaluable:

- Major Life Events: Getting married, having a child, buying a home, or retiring.

- Complex Financial Situations: Inheriting money, dealing with significant debt, or planning for education expenses.

- Investment Planning: Creating an investment strategy, diversifying your portfolio, or managing risk.

Types Of Financial Advisors

There are different types of financial advisors, each specializing in various areas:

| Type of Advisor | Description |

|---|---|

| Certified Financial Planner (CFP) | Provides comprehensive financial planning, including investments, insurance, and retirement. |

| Investment Advisor | Focuses on investment strategies and portfolio management. |

| Robo-Advisor | Online platforms offering automated, algorithm-driven financial planning services. |

Questions To Ask Your Financial Advisor

Before choosing a financial advisor, ask these essential questions:

- What are your qualifications and experience? Ensure they have the right credentials and experience in financial planning.

- How do you charge for your services? Understand their fee structure, whether it’s a flat fee, hourly rate, or commission-based.

- What is your investment philosophy? Their approach should align with your financial goals and risk tolerance.

- Can you provide references? Speaking with current or past clients can give you insight into their reliability and service quality.

If you are looking to manage your finances better, consider using services like Perpay. It offers a marketplace with top brands, a credit card for flexible spending, and helps build your credit through automatic payments from your paycheck.

Maintaining Financial Wellness

Maintaining financial wellness is crucial for a stable and stress-free life. It involves regular monitoring of your finances, staying informed about financial matters, and adapting to life changes. This section will provide tips on how to keep your financial health in check.

Regular Financial Checkups

Just like your health, your finances need regular checkups. It helps you stay on track and avoid financial pitfalls. Here are some steps to follow:

- Monthly Budget Review: Examine your income and expenses.

- Debt Analysis: Assess your debt levels and repayment plans.

- Savings Check: Ensure you are meeting your savings goals.

Using tools like Perpay can be beneficial. With Perpay, you can shop for various products and pay over time, which helps in managing your budget. Plus, it offers a credit card that can be used anywhere Mastercard is accepted, earning 2% rewards on purchases.

Staying Educated On Financial Matters

Knowledge is power, especially in finance. Staying educated helps you make informed decisions. Here are some ways to stay informed:

- Read financial news and blogs regularly.

- Attend webinars and workshops on personal finance.

- Use financial apps and tools to get personalized advice.

Perpay not only provides a marketplace with top brands but also helps in building your credit. Automatic payments from your paycheck can increase your credit score by an average of 36 points within three months. This feature can be a valuable educational tool for understanding credit building.

Adapting To Life Changes

Life changes can affect your finances. Be prepared to adapt your financial plan. Here are some scenarios and tips:

| Life Change | Financial Tip |

|---|---|

| New Job | Adjust your budget to match your new income. |

| Marriage | Combine finances and set joint financial goals. |

| Having a Child | Start a savings plan for future expenses. |

Tools like Perpay can make these transitions smoother. Its interest-free payments and convenient paycheck deductions allow for flexible spending. This can be particularly useful during significant life changes.

Maintaining financial wellness requires a proactive approach. Regular checkups, staying educated, and adapting to life changes are key strategies for financial health. Tools like Perpay can assist in managing these aspects effectively.

Frequently Asked Questions

What Is Financial Wellness?

Financial wellness is the state of being in control of your finances. It involves managing debt, saving, budgeting, and planning for the future.

How To Improve Financial Wellness?

To improve financial wellness, create a budget, track expenses, and save regularly. Also, pay off debt and invest for long-term goals.

Why Is Budgeting Important For Financial Wellness?

Budgeting helps you manage your money effectively. It ensures you spend within your means and save for future goals.

How Can I Reduce Financial Stress?

Reduce financial stress by creating a financial plan. Prioritize debt repayment, build an emergency fund, and seek professional advice if needed.

Conclusion

Achieving financial wellness takes time and effort. Start small and stay consistent. Incorporate these tips into your routine for lasting benefits. Tools like Perpay can help. They offer a marketplace, a credit card, and credit building support. With patience, you will see positive changes. Stay focused, and keep learning. Your financial health is worth it.