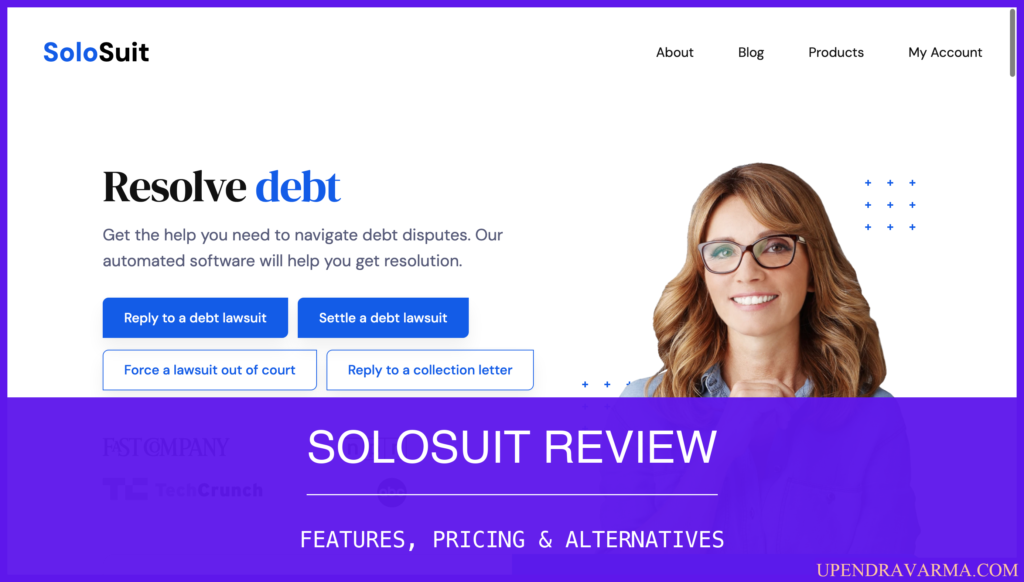

Solosuit Comparison: Unveiling the Best Legal Defense Options

When faced with debt disputes, finding the right tool to help can be daunting. SoloSuit is a popular choice for individuals dealing with such issues.

Comparing different solutions is crucial to make an informed decision. This blog post will delve into the features, benefits, and overall effectiveness of SoloSuit. Understanding these aspects can help you determine if SoloSuit is the right tool for managing your debt disputes.

Keep reading to explore how SoloSuit stands out and whether it fits your needs.

Introduction To Solosuit And Legal Defense Options

Dealing with debt disputes and lawsuits can be daunting. Many individuals find themselves overwhelmed and unsure of how to proceed. This is where SoloSuit comes in, offering a streamlined and supportive approach to navigating these legal challenges. Below, we will explore the necessity of legal defense and provide an overview of SoloSuit’s features and benefits.

Understanding The Need For Legal Defense

Debt lawsuits are a serious matter. Ignoring them can lead to default judgments, wage garnishments, or even property liens. Responding promptly and appropriately is crucial. This is why having a solid legal defense is necessary. It helps protect your rights and offers a chance to settle disputes effectively. Many individuals lack the expertise or resources to handle these issues on their own, making automated solutions and legal guidance vital.

Overview Of Solosuit

SoloSuit is an innovative tool designed to assist individuals in managing debt disputes. It offers a suite of features aimed at simplifying the legal response process.

| Feature | Description |

|---|---|

| Automated Response Compilation | Helps users respond to debt lawsuits within 14-30 days of receiving a Complaint. |

| Attorney Review | Legal responses are reviewed by an attorney before being filed. |

| Settlement Arrangement | Assists users in negotiating settlements with debt collectors to potentially pay less than the face value of the debt. |

SoloSuit is not just about responding to lawsuits. It also helps in negotiating settlements. This can often result in paying less than the original debt amount. The platform’s automated and attorney-reviewed solutions make it user-friendly and accessible for everyone.

Some key benefits of SoloSuit include:

- Legal Assistance: Provides guidance and support in responding to debt lawsuits and settling debts.

- Cost-Effective: Offers a realistic approach to resolving debt disputes without the need for a full court trial.

- Comprehensive Coverage: Available for users in all 50 states.

- User-Friendly: Simplifies the process of dealing with debt disputes through automated and attorney-reviewed solutions.

Although SoloSuit is a powerful tool, it is important to note that it does not guarantee case outcomes. It also does not replace the need for professional legal advice. Always consider consulting with an attorney for personalized legal guidance.

Key Features Of Solosuit

SoloSuit is a powerful tool designed to help individuals navigate debt disputes efficiently. Below, we explore some of its most important features that make it a valuable resource for anyone dealing with debt-related issues.

Automated Document Preparation

One of the standout features of SoloSuit is its Automated Document Preparation. This tool helps users compile legal responses quickly and accurately. The automation ensures that documents are prepared according to the specific legal requirements, saving users time and reducing the risk of errors.

- Quick and accurate document preparation

- Compliance with legal standards

- Time-saving automation

Guided Questionnaire

SoloSuit offers a Guided Questionnaire to help users provide the necessary information for their legal responses. This questionnaire is user-friendly and designed to simplify the process, even for those with no legal background. By answering straightforward questions, users can ensure their documents are complete and accurate.

- User-friendly interface

- Step-by-step guidance

- No legal background required

Court-ready Documents

After completing the guided questionnaire, SoloSuit generates Court-Ready Documents. These documents are reviewed by an attorney before being filed, ensuring they meet all legal requirements. This feature provides users with confidence that their responses are legally sound and ready for submission.

- Attorney-reviewed documents

- Ensures legal compliance

- Ready for court submission

SoloSuit’s features make it an invaluable tool for anyone facing debt disputes. Its automated document preparation, guided questionnaire, and court-ready documents simplify the legal process and provide peace of mind.

Unique Benefits Of Solosuit

SoloSuit offers unique benefits that simplify debt settlement and legal responses. This automated software is a valuable tool for individuals navigating debt disputes, responding to debt lawsuits, and settling debts outside of court. Let’s explore some of its key advantages.

Time-saving Automation

SoloSuit’s automated response compilation feature helps users respond to debt lawsuits within the required 14-30 days. This automation saves time and reduces stress. Users can rely on the software to generate accurate legal responses quickly.

The automation also streamlines the process of negotiating settlements. It assists users in compiling necessary documents and communicating with debt collectors. This efficiency allows users to focus on other important tasks.

User-friendly Interface

SoloSuit is designed with a user-friendly interface. The software guides users through each step of the process. This simplicity makes it accessible to individuals with no legal background.

Users can easily navigate the platform and complete tasks with minimal effort. The interface is intuitive and straightforward, ensuring a smooth experience for all users.

Affordable Legal Assistance

SoloSuit provides cost-effective legal assistance. It offers a realistic approach to resolving debt disputes without the need for a full court trial. This affordability makes it an attractive option for many individuals.

Legal responses are reviewed by an attorney before being filed, adding an extra layer of assurance. Users receive professional guidance at a fraction of the cost of traditional legal services.

Overall, SoloSuit’s unique benefits make it a powerful tool for managing debt disputes and legal responses efficiently and affordably.

Pricing And Affordability Of Solosuit

SoloSuit offers a cost-effective solution for dealing with debt disputes. It simplifies the legal process, making it accessible for individuals without the need for expensive legal services. Let’s explore the pricing structure and compare it with traditional legal services.

Subscription Plans

SoloSuit offers various subscription plans to cater to different needs. Although specific pricing details are not provided in the summary, the service is designed to be affordable. Here are some potential features of the subscription plans:

- Basic Plan: Automated response compilation and attorney review.

- Standard Plan: Includes the Basic Plan features plus additional negotiation support with debt collectors.

- Premium Plan: Comprehensive legal assistance, including settlement arrangements and full coverage across all 50 states.

Cost Comparison With Traditional Legal Services

Traditional legal services for debt disputes can be expensive. Here’s a comparative look at SoloSuit and traditional legal services:

| Service | SoloSuit | Traditional Legal Services |

|---|---|---|

| Initial Consultation | Free or Low Cost | $100 – $500 |

| Automated Response Compilation | Included | $500 – $2,000 |

| Attorney Review | Included | $1,000 – $5,000 |

| Settlement Arrangement | Included | $2,000 – $10,000 |

Using SoloSuit can save users significant amounts of money. Traditional legal services often charge high fees for consultations and legal filings. SoloSuit provides an affordable alternative with automated solutions and attorney-reviewed responses.

Pros And Cons Of Solosuit

SoloSuit is a self-help tool designed for those dealing with debt disputes. It offers automated software to help individuals respond to debt lawsuits and negotiate settlements. Below, we explore the advantages and potential drawbacks of using SoloSuit.

Advantages Of Using Solosuit

SoloSuit provides several benefits to individuals facing debt-related issues.

- Automated Response Compilation: Helps users respond to debt lawsuits within the required 14-30 days.

- Attorney Review: Legal responses reviewed by an attorney before filing.

- Settlement Arrangement: Assists in negotiating settlements to potentially pay less than the debt’s face value.

- Legal Assistance: Offers guidance and support in responding to debt lawsuits and settling debts.

- Cost-Effective: Provides a realistic approach to resolving debt disputes without a full court trial.

- Comprehensive Coverage: Available for users in all 50 states.

- User-Friendly: Simplifies dealing with debt disputes through automated and attorney-reviewed solutions.

Potential Drawbacks And Limitations

While SoloSuit offers many advantages, there are some limitations to consider.

- No Guarantees: SoloSuit does not provide any guarantees regarding case outcomes.

- Not a Substitute for Legal Advice: It is not a replacement for an attorney or law firm and does not offer legal advice.

- Terms of Service: Usage of SoloSuit’s products is governed by its Terms of Service, Privacy Policy, and Legal Disclaimer.

- Specific Pricing Details: Pricing details are not provided in the summary.

Ideal Users And Scenarios For Solosuit

SoloSuit is perfect for individuals facing debt collection and needing a straightforward solution. It’s ideal for those wanting to handle legal forms without a lawyer. SoloSuit helps users respond to lawsuits easily and efficiently.

SoloSuit is designed to assist individuals facing debt disputes, providing an automated, user-friendly approach. It caters to a wide range of users and scenarios, making it a versatile tool in the realm of debt management and settlement.Who Can Benefit The Most From Solosuit?

Individuals with Debt Lawsuits: Those who have received a Complaint and need to respond within 14-30 days can use SoloSuit. The automated response compilation helps in preparing legal responses efficiently.

People Seeking Legal Guidance: Users looking for support in understanding and navigating debt lawsuits can benefit. SoloSuit provides attorney-reviewed responses, ensuring legal accuracy.

Cost-Conscious Users: SoloSuit offers a cost-effective solution for resolving debt disputes. It is ideal for those who cannot afford a full court trial or extensive legal fees.

Nationwide Users: SoloSuit provides comprehensive coverage across all 50 states, making it accessible to a broad audience.

Specific Situations Where Solosuit Excels

Responding to Debt Lawsuits: The automated response feature ensures timely and accurate responses to debt lawsuits. Users can compile their legal responses quickly and have them reviewed by an attorney before filing.

Negotiating Settlements: SoloSuit excels in assisting users to negotiate settlements with debt collectors. This can potentially result in paying less than the face value of the debt.

Legal Support Without Full Trials: For users who prefer to avoid court trials, SoloSuit offers a realistic approach to settling debts outside of court. This can save time and reduce the stress associated with legal proceedings.

User-Friendly Experience: SoloSuit simplifies the complex process of dealing with debt disputes. Its automated and attorney-reviewed solutions make it easier for users to manage their debt issues without extensive legal knowledge.

| Feature | Description |

|---|---|

| Automated Response Compilation | Helps users respond to debt lawsuits within the required 14-30 days. |

| Attorney Review | Legal responses are reviewed by an attorney before being filed. |

| Settlement Arrangement | Assists users in negotiating settlements with debt collectors. |

| Cost-Effective | Offers a realistic approach to resolving debt disputes without a full court trial. |

| Comprehensive Coverage | Available for users in all 50 states. |

| User-Friendly | Simplifies the process of dealing with debt disputes through automated solutions. |

Comparison With Other Legal Defense Options

SoloSuit offers a unique, automated solution for individuals facing debt disputes. How does it stack up against traditional legal services and other legal tech solutions? Let’s explore.

Solosuit Vs. Traditional Legal Services

Traditional legal services involve hiring an attorney to handle debt lawsuits. This process can be costly and time-consuming. SoloSuit, on the other hand, provides a more cost-effective and efficient alternative.

| Feature | SoloSuit | Traditional Legal Services |

|---|---|---|

| Cost | Lower | Higher |

| Response Time | Quick (Automated) | Variable (Dependent on attorney availability) |

| Attorney Review | Included | Standard |

| Ease of Use | User-Friendly | Complex |

| Availability | All 50 States | Varies |

Using SoloSuit, users can quickly compile and file responses to debt lawsuits. This is often within the required 14-30 days. Traditional legal services may involve multiple appointments and a longer timeline.

Solosuit Vs. Other Legal Tech Solutions

Other legal tech solutions also provide automated services for handling legal matters. How does SoloSuit compare?

- Automated Response Compilation: SoloSuit excels at helping users respond to debt lawsuits quickly. Many other legal tech solutions may focus on a wider range of legal issues, diluting their effectiveness in debt disputes.

- Attorney Review: SoloSuit includes attorney review of legal responses, ensuring accuracy. Some legal tech solutions may not offer this feature, risking errors in critical documents.

- Settlement Arrangement: SoloSuit assists in negotiating settlements with debt collectors. This can potentially reduce the amount owed. Other solutions might not provide tailored negotiation help for debt settlements.

- User-Friendly: SoloSuit simplifies the process for users. It provides easy-to-follow steps and automation. Many legal tech solutions can be more complex, requiring a steeper learning curve.

SoloSuit stands out for its focus on debt disputes. It provides specialized tools and attorney-reviewed responses, making it a strong choice for those looking to resolve debt issues efficiently and effectively.

Conclusion: Choosing The Right Legal Defense Tool

Selecting the appropriate legal defense tool is crucial when facing debt disputes. SoloSettle offers a comprehensive and user-friendly solution to handle these challenges efficiently. Here, we summarize the key points and provide final recommendations.

Summary Of Key Points

- Automated Response Compilation: SoloSettle helps users respond to debt lawsuits within the required timeframe.

- Attorney Review: Legal responses are reviewed by an attorney before filing, ensuring accuracy and compliance.

- Settlement Arrangement: Assists in negotiating settlements with debt collectors, potentially reducing the debt amount.

- Legal Assistance: Provides guidance and support in responding to debt lawsuits and settling debts.

- Cost-Effective: Offers a practical approach to resolving debt disputes without the need for a full court trial.

- Comprehensive Coverage: Available for users in all 50 states.

- User-Friendly: Simplifies the process of dealing with debt disputes through automated and attorney-reviewed solutions.

Final Recommendations

Based on the features and benefits of SoloSettle, it is evident that this tool is designed to assist individuals effectively in managing debt disputes. Here are our final recommendations:

- Consider Your Needs: Assess whether you need an automated tool to help respond to debt lawsuits and negotiate settlements.

- Evaluate the Costs: Review the pricing details and determine if SoloSettle fits within your budget.

- Understand the Limitations: Acknowledge that SoloSettle is not a substitute for an attorney and does not provide legal advice.

- Read the Terms: Familiarize yourself with SoloSettle’s Terms of Service, Privacy Policy, and Legal Disclaimer.

Choosing the right legal defense tool can significantly impact your financial well-being. SoloSettle offers a structured and supportive approach to resolving debt disputes, making it a valuable option for many individuals.

Frequently Asked Questions

What Is Solosuit?

Solosuit is an online tool that helps users respond to debt lawsuits. It simplifies the legal process for individuals.

How Does Solosuit Work?

Solosuit guides users through a questionnaire to create a legal response. It then generates the necessary documents for court.

Is Solosuit Free To Use?

Solosuit offers both free and paid options. The free version allows basic document creation, while the paid version includes additional features.

Can Solosuit Help With All Types Of Debt?

Solosuit primarily assists with credit card and medical debt. It may not be suitable for other types of debt.

Conclusion

SoloSuit offers a practical solution for navigating debt disputes. It simplifies the process and provides legal support, making it easier to manage debt lawsuits. With automated responses and attorney reviews, users gain confidence in handling their cases. SoloSuit’s user-friendly approach and nationwide availability ensure comprehensive coverage. Interested in learning more? Visit the SoloSuit website for detailed information and start taking control of your debt disputes today. Click here to explore SoloSuit.