Credit Report Improvement: Boost Your Score in 30 Days

Improving your credit report can seem daunting. But it is achievable with the right steps.

A better credit report opens doors to better financial opportunities. From securing loans to getting favorable interest rates, a good credit report is essential. Understanding how to improve your credit report involves knowing what affects it. Many factors can influence your credit score, such as payment history, credit utilization, and length of credit history. By addressing these areas, you can work towards a better credit report. SoloSuit offers automated software to help navigate debt disputes and improve your credit report. Their services include responding to debt lawsuits and settling debts outside of court, providing professional assistance and convenience. Explore SoloSuit’s offerings to take control of your financial future. Learn more about SoloSuit and start improving your credit report today.

Introduction To Credit Report Improvement

Improving your credit report is vital for your financial health. A good credit score opens many doors. It helps you secure better loans, lower interest rates, and more favorable terms.

Why Improving Your Credit Score Is Important

Your credit score affects many aspects of your life. Here are some key reasons to improve it:

- Better Loan Approval: Lenders prefer borrowers with high credit scores.

- Lower Interest Rates: A good score can reduce your interest rates.

- Job Opportunities: Some employers check credit scores before hiring.

- Insurance Rates: Insurers may offer lower premiums to those with good credit.

Overview Of A 30-day Plan

Improving your credit score in 30 days is possible. Here’s a simple plan to get started:

- Check Your Credit Report: Obtain a free copy from major credit bureaus.

- Identify Errors: Look for mistakes or discrepancies in your report.

- Dispute Errors: Contact the credit bureau to correct any errors.

- Pay Down Balances: Reduce your credit card balances to below 30% of your limit.

- Settle Debts: Consider using services like Solo Debt Resolution Services to settle outstanding debts.

- Automate Payments: Set up automatic payments to avoid late fees.

- Limit New Credit Applications: Avoid applying for new credit during this period.

Solo Debt Resolution Services can help with the debt settlement step. Their automated software assists in responding to debt lawsuits and negotiating settlements outside of court. This can be a key part of your 30-day plan to improve your credit report.

| Feature | Description |

|---|---|

| Reply to a Debt Lawsuit | Help in responding to debt lawsuits with attorney review. |

| Settle a Debt | Negotiate settlements with debt collectors. |

Solo’s services are convenient and available in all 50 states. Professional assistance ensures that your responses are reviewed by attorneys before filing. This can make a significant difference in your credit report improvement efforts.

Understanding Your Credit Report

Knowing your credit report is crucial. It helps you understand your credit health. This knowledge can guide you in improving your credit score. A good credit score opens doors to better financial opportunities.

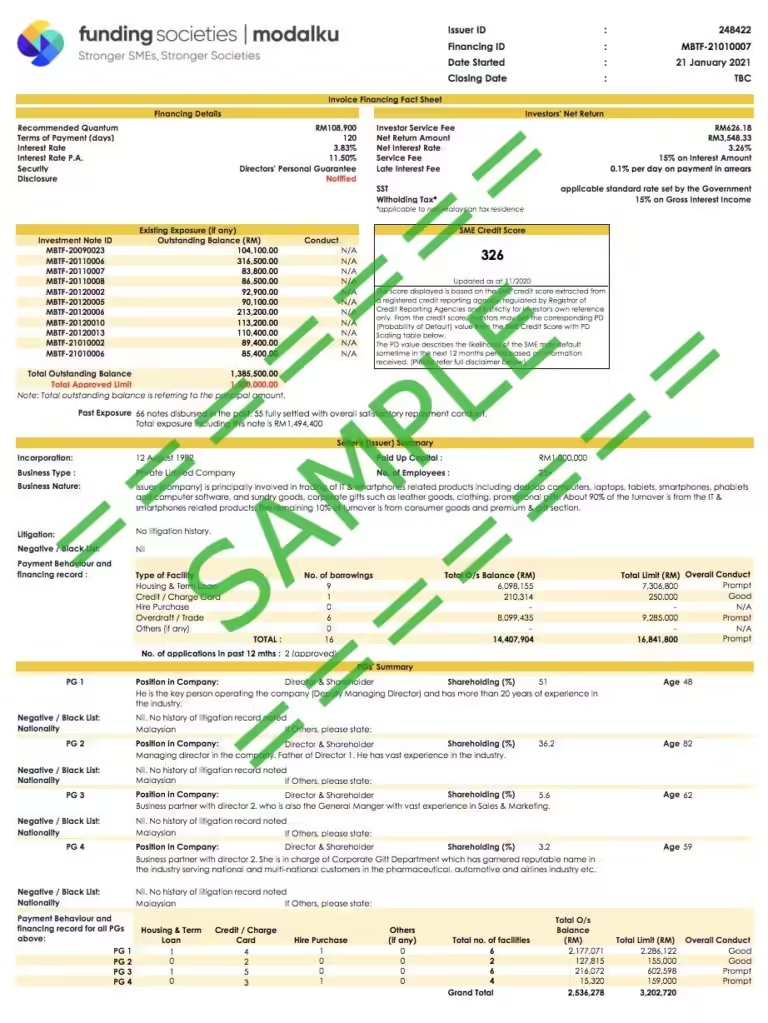

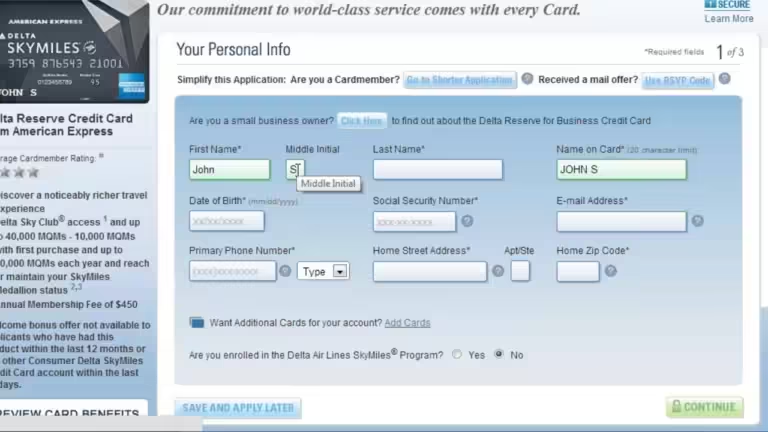

How To Obtain Your Credit Report

You can obtain your credit report from three major credit bureaus: Equifax, Experian, and TransUnion.

By law, you can get a free report once a year from each bureau. Visit annualcreditreport.com to request your free credit report.

You will need to provide your personal information like your name, address, Social Security number, and date of birth to verify your identity.

Breaking Down The Components Of A Credit Report

A credit report contains several sections. Each part tells a different story about your credit history.

| Component | Description |

|---|---|

| Personal Information | This includes your name, address, and Social Security number. |

| Credit Accounts | Lists your credit cards, loans, and their balances. It also shows the payment history for each account. |

| Credit Inquiries | Shows who has checked your credit report and when. Too many inquiries can lower your score. |

| Public Records | This section includes bankruptcies, foreclosures, and any legal judgments against you. |

| Collections | Lists any overdue debts sent to collection agencies. |

Understanding these components can help you identify areas that need improvement. For instance, paying off overdue debts can positively impact your credit score. Regularly checking your credit report ensures accuracy and helps you spot potential identity theft.

Identifying And Correcting Errors

Improving your credit report starts with identifying and correcting errors. Mistakes on your credit report can impact your credit score. Fixing these errors is crucial for a healthier financial life.

Common Mistakes Found In Credit Reports

Credit reports often contain common mistakes. Here are some typical errors:

- Incorrect Personal Information: Wrong names, addresses, or Social Security numbers.

- Duplicate Accounts: Multiple listings for the same account.

- Outdated Information: Closed accounts still showing as open.

- Incorrect Account Status: Accounts marked as late or delinquent incorrectly.

- Wrong Credit Limits: Incorrect credit limits that can affect your credit utilization ratio.

Steps To Dispute And Correct Errors

Follow these steps to dispute and correct errors on your credit report:

- Review Your Credit Report: Obtain your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion.

- Identify Errors: Carefully check for any inaccuracies or discrepancies.

- Gather Evidence: Collect documents that support your claim, such as bank statements or payment receipts.

- Dispute the Error: Write a dispute letter to the credit bureau. Include your personal information, a description of the error, and the supporting evidence.

- Wait for Investigation: The credit bureau will investigate your dispute. This process can take up to 30 days.

- Follow Up: Check the status of your dispute. Ensure the error has been corrected.

Credit report errors can significantly impact your financial health. By identifying and correcting these mistakes, you can improve your credit score. SoloSuit can help navigate debt disputes and settle debts outside of court, simplifying the process of dealing with credit report errors.

Paying Down Balances

Improving your credit report often starts with paying down balances. Reducing the amount you owe on credit cards can significantly boost your credit score. It’s essential to approach this process strategically to maximize the impact on your financial health.

Strategies For Reducing Credit Card Debt

Several effective strategies can help reduce credit card debt. These strategies can improve your credit score and overall financial stability.

- Create a Budget: Track your income and expenses. Identify areas where you can cut back.

- Debt Snowball Method: Focus on paying off the smallest debt first. Then, move to the next smallest.

- Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first.

- Consolidate Debt: Consider a balance transfer card or personal loan. This can simplify payments and reduce interest rates.

Prioritizing High-interest Debts

Focusing on high-interest debts can save money and improve your credit score faster. High-interest debts accrue more interest over time, making them more expensive.

Here are steps to prioritize high-interest debts:

- List All Debts: Write down all your debts, including interest rates and balances.

- Identify High-Interest Debts: Highlight debts with the highest interest rates.

- Allocate Extra Funds: Direct any extra money towards paying off these high-interest debts first.

- Maintain Minimum Payments: Ensure you continue to make minimum payments on other debts.

By targeting high-interest debts, you can reduce the total interest paid and improve your credit report more effectively.

Solo Debt Resolution Services can assist in managing and settling debt disputes. Learn more about SoloSuit to see how they can help you navigate debt challenges.

Optimizing Credit Utilization

Optimizing your credit utilization is essential for improving your credit score. Your credit utilization ratio plays a significant role in determining your creditworthiness. Keeping this ratio low can have a positive impact on your credit report. Let’s explore the concept of credit utilization and some practical tips to manage it effectively.

Understanding Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you are using compared to your total available credit. It is expressed as a percentage. For example, if you have a credit limit of $10,000 and your current balance is $2,500, your credit utilization ratio is 25%.

Most financial experts recommend keeping your credit utilization ratio below 30%. A lower ratio indicates that you are using your credit responsibly, which can boost your credit score. This ratio is calculated for each credit card and overall for all your credit accounts.

Tips For Lowering Your Utilization

Here are some practical tips to help you lower your credit utilization ratio:

- Pay down your balances: Make larger payments to reduce your current balances quickly.

- Request a credit limit increase: Contact your credit card issuer to increase your credit limit, which will lower your utilization ratio.

- Spread out your expenses: Use multiple cards to distribute your spending instead of maxing out one card.

- Pay twice a month: Make payments more frequently to keep your balances low.

- Keep unused cards open: Closing a card reduces your total available credit, which can increase your utilization ratio.

By following these tips, you can effectively manage your credit utilization and see improvements in your credit report.

Building Positive Credit Habits

Improving your credit report can be a daunting task. Building positive credit habits is essential. It helps you regain control over your financial health. Below are some practical steps to guide you.

Setting Up Automatic Payments

Setting up automatic payments is a smart move. It ensures you never miss a payment. Missed payments can harm your credit score. Automatic payments help you stay on track.

Here’s how you can set it up:

- Log in to your bank account.

- Navigate to the bill pay section.

- Choose the bill you want to automate.

- Set the payment amount and date.

This way, your bills are always paid on time. Timely payments improve your credit score.

Using Credit Responsibly

Using credit responsibly means not maxing out your cards. Keep your credit utilization ratio below 30%. This shows lenders you can manage credit well.

Consider these tips:

- Pay your balance in full each month.

- Avoid unnecessary purchases.

- Check your credit report regularly for errors.

Responsible credit use builds a strong credit history.

By following these steps, you can improve your credit report. Tools like SoloSuit can also assist. Solo offers automated software to help with debt disputes. Their services include:

| Service | Description |

|---|---|

| Reply to a Debt Lawsuit | Help in compiling a response to a debt lawsuit. Attorney review and filing services are included. |

| Settle a Debt | SoloSettle helps negotiate settlements with debt collectors. Resolves disputes outside of court. |

Solo’s automated software simplifies dealing with debt disputes. It is available in all 50 states. Visit SoloSuit for more information.

Leveraging Credit-boosting Tools

Improving your credit score can seem daunting, but several tools can help. Leveraging these tools can make the process smoother and more efficient. Below, we explore two effective methods: secured credit cards and credit builder loans.

Secured Credit Cards

Secured credit cards are a great way to build or rebuild your credit. Unlike regular credit cards, they require a security deposit. This deposit acts as your credit limit. For example, if you deposit $300, your credit limit will be $300. This makes it easier to manage spending and avoid debt.

Using a secured credit card responsibly can positively impact your credit score. Ensure you make payments on time and keep your balance low. Over time, your credit score will improve, and you may become eligible for an unsecured credit card.

| Feature | Details |

|---|---|

| Deposit Required | Yes, usually equal to your credit limit |

| Credit Limit | Equal to your deposit |

| Impact on Credit Score | Positive if used responsibly |

Credit Builder Loans

Credit builder loans are another effective tool for improving your credit. These loans are designed specifically to help you build credit. Unlike traditional loans, you do not receive the loan amount upfront. Instead, the money is held in a savings account while you make monthly payments.

Once you complete the payments, you receive the loan amount. The lender reports your payment history to credit bureaus, helping to build your credit score. These loans are ideal for those with no credit history or poor credit scores.

- No upfront funds: Loan amount is held in savings.

- Monthly Payments: Build your credit with each on-time payment.

- Positive Impact: Payment history is reported to credit bureaus.

Monitoring Your Progress

Improving your credit report is an ongoing process. It requires consistent effort and attention. Regularly monitoring your progress ensures that you stay on track and make necessary adjustments. In this section, we’ll discuss how to effectively monitor your progress.

Regularly Checking Your Credit Score

One key aspect of monitoring your progress is to regularly check your credit score. This allows you to see the impact of your efforts and catch any errors early. There are several ways to check your credit score:

- Use free online services

- Request a free annual report from major credit bureaus

- Subscribe to credit monitoring services

Checking your score monthly helps you stay informed about your financial health. It also helps you identify any sudden changes that need immediate attention.

Adjusting Your Strategy Based On Results

After reviewing your credit score, you might need to adjust your strategy. If you see positive changes, continue with your current plan. If not, consider making some changes. Here are some steps to adjust your strategy:

- Analyze your credit report for negative items

- Dispute any inaccuracies with credit bureaus

- Pay down high-interest debts first

- Set up automated payments to avoid late fees

- Seek professional advice if needed

Remember, improving your credit report is a journey. It requires patience and persistence. By regularly checking your credit score and adjusting your strategy based on the results, you can steadily improve your financial health.

For those dealing with debt disputes, consider using Solo Debt Resolution Services. Solo offers automated software to help individuals navigate debt disputes. Their services include:

| Main Features | Benefits |

|---|---|

| Reply to a Debt Lawsuit | Assistance in compiling a response with attorney review and filing services |

| Settle a Debt | SoloSettle helps negotiate settlements with debt collectors |

Using Solo services can simplify the process of dealing with debt disputes. It provides professional assistance and is available in all 50 states.

Pros And Cons Of Rapid Credit Improvement

Improving your credit score quickly can be tempting. But, it has both benefits and drawbacks. Let’s explore them to help you decide if it’s right for you.

Benefits Of A Quick Credit Score Boost

A rapid credit score boost can offer several advantages:

- Lower Interest Rates: A higher credit score often leads to lower interest rates on loans and credit cards.

- Better Loan Approval Chances: A good credit score increases your chances of getting loan approvals.

- Higher Credit Limits: Creditors may offer you higher credit limits, giving you more financial flexibility.

- Improved Negotiation Power: A solid credit score can give you leverage when negotiating terms with creditors.

These benefits can make a quick credit improvement appealing. But, it’s important to weigh them against potential drawbacks.

Potential Drawbacks And Pitfalls

Rapid credit improvement can also have some pitfalls:

- Short-Term Solutions: Quick fixes may not address underlying financial issues.

- Potential Scams: Some companies promise rapid improvement but are scams.

- Temporary Boost: Quick improvements might not last if not followed by healthy financial habits.

- High Costs: Services for rapid improvement can be expensive and may not be worth the investment.

Consider these potential drawbacks carefully. Weigh them against the benefits to make an informed decision.

For those dealing with debt issues, services like Solo Debt Resolution Services can help. They offer automated software to assist with debt disputes. This includes responding to debt lawsuits and settling debts outside of court. Their professional assistance ensures responses are reviewed by attorneys. Plus, the convenience of automated software simplifies the process.

Solo’s services are available in all 50 states. They provide a valuable tool for managing debt disputes. But remember, Solo is not a law firm and does not provide legal advice. It serves as a self-help tool, ensuring users must agree to their terms.

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)

Conclusion And Recommendations

Improving your credit report requires careful planning and consistent effort. Here, we will summarize the key steps and offer long-term maintenance tips.

Summary Of Key Steps

- Obtain Your Credit Report: Request a free credit report from each of the three major credit bureaus.

- Review for Errors: Check for inaccuracies and dispute any errors you find.

- Pay Off Debts: Focus on paying off outstanding debts, especially high-interest ones.

- Settle Debts: Use services like Solo Debt Resolution Services to negotiate and settle debts.

- Maintain Low Balances: Keep your credit card balances low relative to your credit limit.

- Make Timely Payments: Ensure all your bills are paid on time to build a positive payment history.

Long-term Credit Maintenance Tips

To maintain a good credit score over the long term, consider these tips:

- Regular Monitoring: Regularly check your credit report for updates and inaccuracies.

- Use Credit Wisely: Only use credit for necessary purchases and ensure you can pay off the balances.

- Limit New Accounts: Avoid opening multiple new credit accounts in a short period.

- Keep Old Accounts Open: Length of credit history impacts your score, so keep older accounts open.

- Build an Emergency Fund: Having savings can prevent you from missing payments during financial difficulties.

Using these strategies can help you achieve and maintain a strong credit profile. For debt settlement and legal assistance, consider Solo Debt Resolution Services.

Frequently Asked Questions

How To Improve My Credit Report?

Improving your credit report involves paying bills on time, reducing debt, and checking for errors. Regularly review your credit report for inaccuracies.

What Affects My Credit Report?

Your credit report is affected by payment history, credit utilization, length of credit history, and new credit inquiries. Keeping these factors in check helps improve your credit score.

How Often Should I Check My Credit Report?

You should check your credit report at least once a year. Regular monitoring helps detect errors and potential fraud early.

Can Errors On My Credit Report Be Fixed?

Yes, errors on your credit report can be disputed. Contact the credit bureau and the information provider to correct inaccuracies.

Conclusion

Improving your credit report can seem tough but it’s achievable. Start by understanding your credit report. Dispute errors and pay down debt. Use tools like SoloSuit to handle debt disputes. SoloSuit offers automated software to assist with debt lawsuits and settlements. It simplifies the debt resolution process. For more information, visit SoloSuit. Take control of your financial future today. Your credit health matters. Every step makes a difference. Stay committed and see positive changes.