Credit Repair Strategies: Proven Tips to Boost Your Score Fast

Are you struggling with poor credit? You’re not alone.

Many people face challenges with their credit scores and need effective solutions. This blog post will explore various credit repair strategies that can help you improve your financial health. Understanding credit repair is crucial. Your credit score impacts your ability to get loans, credit cards, and even housing. Poor credit can lead to higher interest rates and fees. Fortunately, there are steps you can take to repair your credit. From disputing errors on your credit report to managing your debts more effectively, these strategies can make a significant difference. One helpful tool is SoloSuit, which offers automated assistance for debt disputes and settlements. With the right strategies, you can take control of your credit and improve your financial future. For more information on how SoloSuit can assist you, visit SoloSuit.

Introduction To Credit Repair

Credit repair is the process of improving your credit score by addressing and resolving issues on your credit report. This involves disputing errors, negotiating with creditors, and adopting better financial habits. A good credit score opens the door to many financial opportunities and ensures better interest rates.

Understanding The Importance Of A Good Credit Score

A good credit score is crucial for financial health. It affects your ability to get loans, credit cards, and even employment. Higher scores indicate lower risk to lenders, resulting in better terms and conditions.

Here are some benefits of a good credit score:

- Lower interest rates on loans and credit cards

- Better approval chances for loans and rentals

- Higher credit limits

- More negotiating power

Overview Of Common Credit Issues

Many people face credit issues that can lower their scores. These issues often include:

| Credit Issue | Description |

|---|---|

| Late Payments | Missing or delaying payments harms your credit score. |

| High Credit Utilization | Using a large portion of your credit limit reduces your score. |

| Errors on Credit Report | Inaccurate information can unfairly lower your score. |

| Debt Collections | Unpaid debts sent to collections significantly impact your score. |

Understanding these common issues helps you identify and address them effectively.

Key Strategies To Repair Your Credit

Repairing your credit can seem daunting, but with the right strategies, it’s achievable. By focusing on key areas, you can improve your credit score and financial health. Let’s explore some effective strategies to repair your credit.

Reviewing Your Credit Report For Errors

Your credit report is a detailed record of your credit history. It’s crucial to review it regularly for any errors. Incorrect information can negatively impact your credit score.

Here are steps to review your credit report:

- Request a free copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion.

- Check for any unfamiliar accounts or incorrect balances.

- Look for outdated information, such as old addresses or employers.

Identifying errors early can prevent long-term damage to your credit score.

Disputing Inaccurate Information

If you find any errors on your credit report, it’s important to dispute them promptly. Inaccurate information can drag down your credit score.

Follow these steps to dispute inaccuracies:

- Gather evidence to support your claim, such as bank statements or payment receipts.

- Contact the credit bureau that issued the report with the error.

- Submit a formal dispute letter, including your evidence.

- Monitor the status of your dispute and follow up if necessary.

Disputing errors can help improve your credit score and ensure your report is accurate.

Paying Down High-interest Debt

High-interest debt can quickly accumulate and harm your credit score. Paying down this debt should be a priority.

Consider these tips to manage and reduce high-interest debt:

- Prioritize paying off credit cards and loans with the highest interest rates first.

- Make more than the minimum payment each month to reduce the principal balance faster.

- Consider consolidating your debt to lower your overall interest rates.

Reducing high-interest debt can improve your credit utilization ratio, which is a key factor in your credit score.

By reviewing your credit report, disputing inaccuracies, and paying down high-interest debt, you can take significant steps towards repairing your credit. Remember, consistent effort and patience are essential in this process.

Practical Tips To Boost Your Credit Score Fast

Boosting your credit score is crucial for financial health. Here are some practical tips to improve your credit score quickly.

Using A Secured Credit Card

A secured credit card can help build or rebuild your credit. It requires a cash deposit as collateral. This deposit usually equals your credit limit. Use the card responsibly by making small purchases and paying off the balance each month. This shows lenders you can manage credit well.

- Make timely payments to avoid late fees.

- Keep credit utilization low, ideally below 30%.

- Monitor your credit report for errors.

Becoming An Authorized User

Becoming an authorized user on someone else’s credit card can boost your credit score. The primary cardholder’s good payment history can benefit your credit report. Ensure the primary cardholder has a good credit history before joining.

- Ask a trusted friend or family member with good credit.

- Ensure they have a low credit utilization rate.

- Monitor the account activity regularly.

Negotiating With Creditors

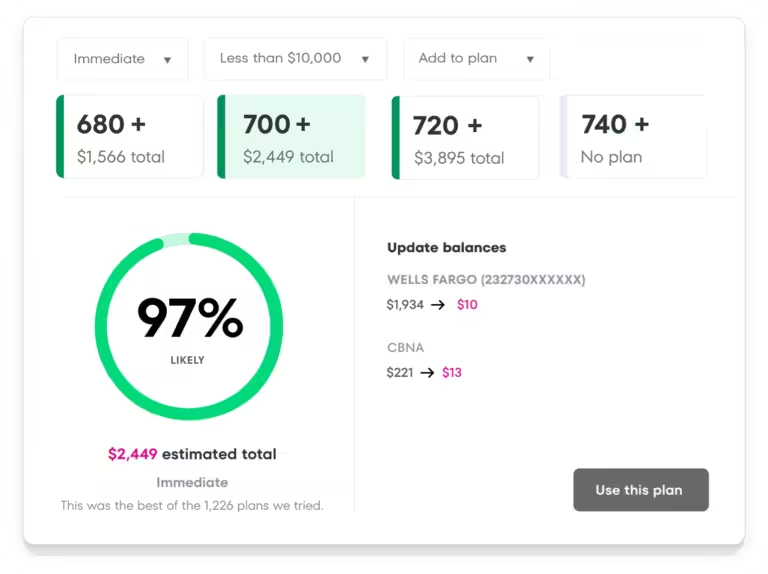

Negotiating with creditors can help reduce your debt and improve your credit score. SoloSuit provides automated assistance to help with debt disputes. It helps respond to debt lawsuits and settle debts outside of court.

| Steps | Description |

|---|---|

| 1. Contact Creditors | Explain your financial situation and request a payment plan. |

| 2. Use SoloSuit | SoloSuit helps compile responses and negotiate settlements. |

| 3. Attorney Review | Ensure responses are reviewed by an attorney before filing. |

By following these strategies, you can improve your credit score and secure a better financial future. For more information on handling debt disputes, visit SoloSuit.

Long-term Credit Repair Tactics

Repairing credit takes time and dedication. Long-term strategies ensure lasting improvements. Focusing on key areas can help rebuild credit effectively.

Establishing A Consistent Payment History

Paying bills on time is crucial. Timely payments build a positive payment history. Consider setting up automatic payments to avoid missing due dates. Regularly monitor your accounts and ensure all payments are reported accurately. A strong payment history is the foundation of good credit.

Keeping Your Credit Utilization Low

Credit utilization impacts your credit score significantly. Aim to keep your credit utilization below 30%. This means using less than 30% of your available credit. For example, if you have a credit limit of $10,000, try to keep your balance below $3,000.

Here are some tips to manage credit utilization:

- Pay off balances in full each month.

- Request a credit limit increase.

- Spread out purchases across multiple cards.

Avoiding New Credit Inquiries

Frequent credit inquiries can lower your score. Each inquiry indicates potential new debt. Limit new credit applications to maintain a stable credit profile.

Follow these steps to avoid unnecessary inquiries:

- Apply for new credit only when necessary.

- Space out credit applications over time.

- Check your credit report for unauthorized inquiries.

Implementing these long-term tactics can gradually improve your credit score. Consistency and patience are key to successful credit repair.

Understanding Credit Repair Services

Credit repair services can help improve your credit score. These services identify errors in your credit report and dispute them with credit bureaus. Understanding how these services work can help you decide if they are right for you.

Evaluating Professional Credit Repair Companies

Evaluating professional credit repair companies is crucial. Look for these key features:

- Transparency: Clear explanation of services and fees.

- Reputation: Positive reviews and customer testimonials.

- Compliance: Adherence to the Credit Repair Organizations Act (CROA).

- Guarantees: Money-back guarantees if no improvements are made.

Check the company’s track record. Ensure they have successfully helped others. Verify their standing with the Better Business Bureau (BBB).

Diy Credit Repair Vs. Professional Services

Choosing between DIY credit repair and professional services depends on your situation:

| DIY Credit Repair | Professional Services |

|---|---|

| Cost: Low, mainly time investment. | Cost: Service fees apply. |

| Effort: Requires learning and constant follow-up. | Effort: Minimal, handled by experts. |

| Control: You handle all communications. | Control: Company manages disputes and negotiations. |

| Speed: May be slower without expertise. | Speed: Potentially faster due to experience. |

SoloSuit is an automated software that can assist with debt disputes. It helps users respond to debt lawsuits and settle debts outside of court. The software compiles a response, which is reviewed by an attorney before filing. SoloSuit has helped many people and is available nationwide.

Both approaches have their pros and cons. Weigh your options carefully. Choose the method that fits your needs and resources.

Pros And Cons Of Credit Repair Methods

Credit repair involves strategies to improve your credit score. There are different methods available, each with its own pros and cons. Understanding these can help you choose the best approach for your situation.

Benefits Of Diy Credit Repair

Doing it yourself can be cost-effective. You avoid fees charged by professionals. You also gain a better understanding of your credit report.

Here are some benefits:

- Cost Savings: No need to pay for professional services.

- Control: You manage the process and decisions.

- Learning Opportunity: Understanding credit reports and scores better.

Potential Downsides Of Professional Credit Repair

While professional credit repair services can be helpful, they come with some downsides. Here are a few to consider:

- Cost: Professional services can be expensive.

- Trust Issues: Some services might not deliver as promised.

- Lack of Control: Less involvement in the process can be a disadvantage.

Whether you choose DIY or professional credit repair, consider your needs and resources. SoloSuit offers automated assistance for managing debt, which can complement your credit repair strategy. It helps users respond to debt lawsuits and settle debts outside of court.

For more details, visit SoloSuit.

Specific Recommendations For Ideal Users

Understanding credit repair strategies can help you improve your credit score. The right approach depends on your unique situation. Here are some specific recommendations for ideal users.

Who Should Consider Diy Credit Repair?

DIY credit repair is ideal for individuals who have:

- A basic understanding of credit reports.

- Time to dispute errors on their credit reports.

- Willingness to learn about credit laws.

- Simple errors that need correction.

These users can use tools like SoloSuit to manage debt disputes. SoloSuit automates responses to debt lawsuits and helps settle debts outside of court. This software is user-friendly and offers attorney-reviewed responses.

When To Seek Professional Help

Consider seeking professional help if you:

- Have a complex credit situation.

- Feel overwhelmed by the process.

- Need expert advice on legal matters.

- Don’t have time to handle disputes yourself.

Professionals can provide personalized strategies and navigate intricate credit issues. SoloSuit can still be a valuable tool, simplifying the process and providing nationwide coverage. It ensures that responses are reviewed by an attorney before filing, offering peace of mind.

Here’s a quick comparison of when to choose DIY credit repair versus professional help:

| Criteria | DIY Credit Repair | Professional Help |

|---|---|---|

| Complexity of Credit Issues | Simple | Complex |

| Time Availability | Plenty of Time | Limited Time |

| Legal Knowledge | Basic Understanding | Expert Advice Needed |

SoloSuit is a beneficial tool whether you choose DIY or professional help. It simplifies responding to debt lawsuits and settling debts, ensuring your responses are reviewed by professionals.

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of improving your credit score. It involves disputing errors on your credit report. This can help you qualify for better interest rates and financial products.

How Long Does Credit Repair Take?

Credit repair typically takes three to six months. The duration depends on the number of errors and your credit history. Continuous monitoring and timely actions can speed up the process.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. Start by obtaining your credit report and identifying errors. Dispute inaccuracies with credit bureaus and take steps to improve your credit habits.

What Are Common Credit Report Errors?

Common credit report errors include incorrect personal information, duplicate accounts, and inaccurate payment history. Identifying and disputing these errors can help improve your credit score.

Conclusion

Repairing credit takes time and effort but it is achievable. Use these strategies to improve your credit score effectively. Remember, staying consistent is key. For debt disputes, consider using SoloSuit. It simplifies the process and offers professional help. A better credit score can open up financial opportunities. Start your journey today and stay committed. Your financial health is worth it.