Solosuit Benefits: Simplify Debt Collection Defense

Navigating debt disputes can be daunting and stressful. SoloSuit offers a solution to ease this burden.

SoloSuit is an automated software designed to help individuals handle debt disputes efficiently. Whether responding to debt lawsuits or settling debts out of court, SoloSuit provides structured guidance through these challenging processes. Imagine reducing your debt burden without the need for extensive legal knowledge. SoloSuit’s services are available in all 50 states, offering nationwide coverage. With a proven track record of protecting $1.71 billion and aiding 262,000 people, SoloSuit stands as a reliable tool in the finance niche. By assisting users in compiling responses to lawsuits and negotiating settlements, SoloSuit helps you navigate the complex world of debt management. Learn more about SoloSuit and how it can assist you by visiting their website here.

Introduction To Solosuit

Navigating debt disputes can be daunting. SoloSuit offers a streamlined solution to manage these challenges. This automated software supports individuals in responding to debt lawsuits and settling debts outside of court. Let’s explore SoloSuit’s core features and benefits.

What Is Solosuit?

SoloSuit is an automated software designed to help individuals manage debt disputes. The software assists users in compiling their responses to debt lawsuits within 14-30 days of receiving the Complaint. An attorney reviews the responses before they are filed.

Purpose Of Solosuit In Debt Collection Defense

The primary purpose of SoloSuit is to provide structured assistance in legal processes. It helps users navigate debt collection defenses without being a substitute for an attorney. With nationwide coverage, SoloSuit is available in all 50 states.

Main features include:

- Respond to Debt Lawsuit: Guides users in preparing their responses to debt lawsuits.

- Settle a Debt: Assists in arranging settlements with collectors outside of court, potentially paying less than the face value of the debt.

With a proven track record, SoloSuit has protected $1.71 billion and helped 262,000 people. This software provides legal guidance, making it easier for individuals to handle debt disputes effectively.

Key Features Of Solosuit

SoloSuit is a powerful tool designed to help individuals manage and resolve debt disputes with ease. Below are the key features that make SoloSuit an invaluable resource for those facing debt lawsuits or looking to settle debts outside of court.

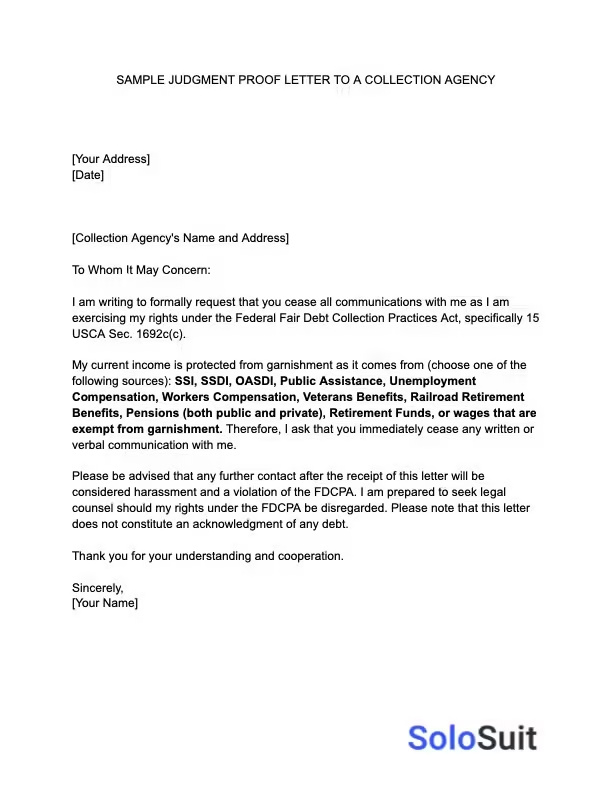

Automated Document Preparation

SoloSuit automates the preparation of legal documents, making it easier for users to respond to debt lawsuits. The software guides users through a series of questions to gather necessary information, ensuring that all required details are included. This feature saves time and reduces the risk of errors in legal documents.

Step-by-step Guidance

SoloSuit provides step-by-step guidance to help users navigate the complex legal process. It offers clear instructions on how to respond to debt lawsuits and settle debts. This structured assistance helps users feel more confident in managing their legal issues.

Legal Knowledge Base

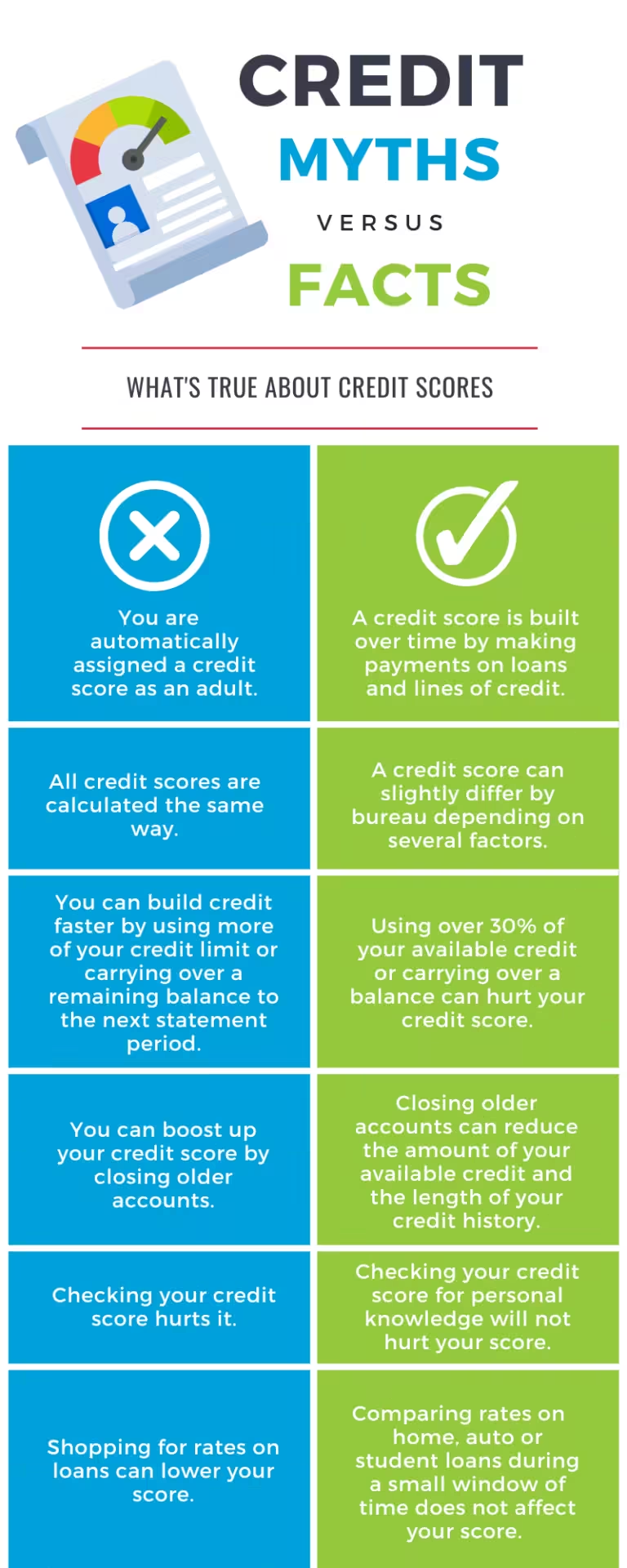

SoloSuit includes a comprehensive legal knowledge base that provides users with valuable information about debt laws and legal procedures. This resource helps users understand their rights and the legal processes involved in debt disputes.

User-friendly Interface

The software features a user-friendly interface designed to be intuitive and easy to use. Users can easily navigate through the various features and access the information they need without any technical difficulties. The simple layout ensures that even those with limited technical skills can use the tool effectively.

Secure Data Handling

SoloSuit takes data security seriously. The platform employs robust security measures to protect users’ personal and financial information. This ensures that all data is handled securely, giving users peace of mind while using the software.

In conclusion, SoloSuit’s key features make it an essential tool for anyone dealing with debt disputes. Its automated document preparation, step-by-step guidance, legal knowledge base, user-friendly interface, and secure data handling provide comprehensive support to users.

Pricing And Affordability Of Solosuit

SoloSuit offers a cost-effective solution for those facing debt disputes. It provides structured assistance without the high costs associated with hiring a lawyer. Let’s explore the pricing and affordability of SoloSuit.

Different Pricing Tiers

SoloSuit provides various pricing tiers to accommodate different needs and budgets. Each tier offers specific features to help users effectively manage their debt disputes.

| Tier | Features |

|---|---|

| Basic |

|

| Premium |

|

| Platinum |

|

Cost-effectiveness Compared To Hiring A Lawyer

Hiring a lawyer for debt disputes can be very expensive. SoloSuit offers an affordable alternative. The cost of SoloSuit services is significantly lower than traditional legal fees. Here are some key points:

- Lower upfront costs compared to hiring a lawyer.

- No hidden fees or surprise charges.

- Access to legal guidance without the high cost.

By using SoloSuit, individuals can save money while still receiving essential legal assistance.

Free Vs Paid Features

SoloSuit provides both free and paid features. The free features offer basic assistance, while the paid features unlock more comprehensive support.

| Feature | Free | Paid |

|---|---|---|

| Respond to Debt Lawsuit | Basic Guidance | Attorney Review |

| Settle a Debt | Basic Tips | Settlement Assistance |

The free features are perfect for those on a tight budget. Paid features offer more detailed support, which can be crucial for complex cases.

Pros And Cons Of Using Solosuit

SoloSuit is a tool designed to help individuals deal with debt disputes. It has several benefits and some limitations. Let’s explore the pros and cons of using SoloSuit.

Pros: Ease Of Use

SoloSuit is very easy to use. The software guides users step-by-step. You don’t need legal experience. It simplifies the response to debt lawsuits.

Pros: Accessibility

SoloSuit is available in all 50 states. This nationwide coverage ensures that anyone can use it. It offers legal guidance without needing an attorney.

Pros: Affordability

SoloSuit is more affordable than hiring a lawyer. It helps you settle debts outside of court. This can save you money in the long run.

Cons: Limitations In Complex Cases

SoloSuit may not handle very complex cases well. It offers basic legal assistance. For complicated legal issues, consulting a lawyer is better.

Cons: Dependence On User Accuracy

SoloSuit relies on the accuracy of user information. Mistakes in data entry can affect outcomes. Users must be careful to provide correct information.

SoloSuit offers a mix of benefits and limitations. It can be a helpful tool for many, but it is not a substitute for professional legal advice in complex situations.

Ideal Users And Scenarios For Solosuit

Solosuit is designed to assist individuals in navigating debt disputes effectively. It provides structured assistance in legal processes, making it easier for people to respond to debt lawsuits and settle debts outside of court. Let’s explore who can benefit most from Solosuit and the best scenarios to use it.

Who Can Benefit Most From Solosuit?

- Individuals facing debt lawsuits: Solosuit helps people compile their response to a debt lawsuit within 14-30 days of receiving the Complaint.

- People seeking debt settlement: Users can arrange settlements with collectors outside of court, often paying less than the face value of the debt.

- Residents in any state: Solosuit is available nationwide, providing assistance across all 50 states.

Best Situations To Use Solosuit

- When sued for debt: If you receive a Complaint, use Solosuit to prepare and file a response.

- To avoid court settlements: Solosuit helps negotiate settlements outside of court, potentially saving money.

- Need for legal guidance: Solosuit offers structured assistance without being a substitute for an attorney.

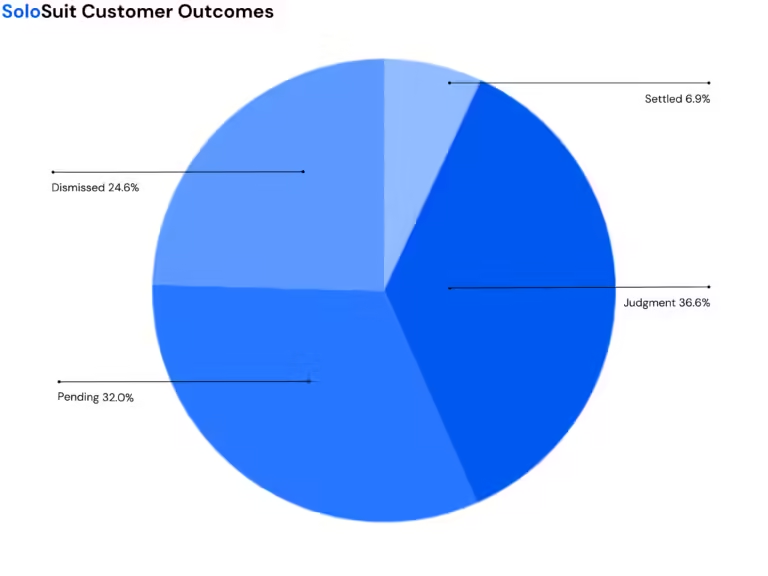

Real-world Success Stories

Solosuit has a proven track record with over $1.71 billion protected and 262,000 people helped. Here are some success stories:

- John from Texas: John used Solosuit to respond to a debt lawsuit and successfully negotiated a settlement, paying less than he owed.

- Mary in California: Faced with a debt lawsuit, Mary utilized Solosuit’s services to file her response on time, avoiding additional legal complications.

- Michael in New York: Michael settled his debt outside of court with the help of Solosuit, significantly reducing his financial burden.

These examples highlight how Solosuit can be a valuable tool for individuals dealing with debt disputes across various scenarios.

Frequently Asked Questions

What Are The Key Benefits Of Solosuit?

Solosuit simplifies the legal process by providing user-friendly tools. It helps you respond to lawsuits quickly. The platform offers affordable legal assistance, making it accessible to everyone. Solosuit also ensures your documents are properly formatted and filed.

How Does Solosuit Save Time?

Solosuit automates the response process, saving you hours of research. It guides you step-by-step, reducing the time spent on paperwork. The platform’s efficiency lets you focus on other important tasks.

Is Solosuit Cost-effective?

Yes, Solosuit is budget-friendly. It offers affordable legal help, making it accessible to more people. The platform eliminates the need for expensive lawyer fees. You get quality legal assistance without breaking the bank.

Can Solosuit Help With All Types Of Lawsuits?

Solosuit assists with various civil lawsuits, including debt collection and small claims. It provides tailored responses for different case types. The platform is versatile and adaptable to different legal scenarios.

Conclusion

SoloSuit offers significant benefits for managing debt disputes. It provides legal guidance, helping you respond to debt lawsuits swiftly. You can also settle debts outside of court, saving time and money. With nationwide coverage, SoloSuit assists users across all 50 states. Over 262,000 people have benefited, with $1.71 billion protected. For more details, visit SoloSuit. Simplify your debt management today!