Credit Reporting Tools: Boost Your Financial Health Today

Understanding your credit score is vital. Credit reporting tools help you keep track.

Credit reporting tools offer you a clear view of your financial health. They provide detailed reports on your credit history and scores. By using these tools, you can identify errors and areas that need improvement. Staying on top of your credit can save you money and hassle in the long run. With so many options available, finding the right tool can be challenging. That’s why we’ve compiled information to guide you through the best options. Firstbase offers an all-in-one startup operating system. It simplifies incorporation, compliance, and bookkeeping. Perfect for business owners looking to streamline their financial management.

Introduction To Credit Reporting Tools

Credit reporting tools are essential for anyone wanting to maintain financial health. These tools provide vital information, allowing you to track your credit score and understand your financial standing. They help in making informed decisions about loans, credit cards, and other financial products.

What Are Credit Reporting Tools?

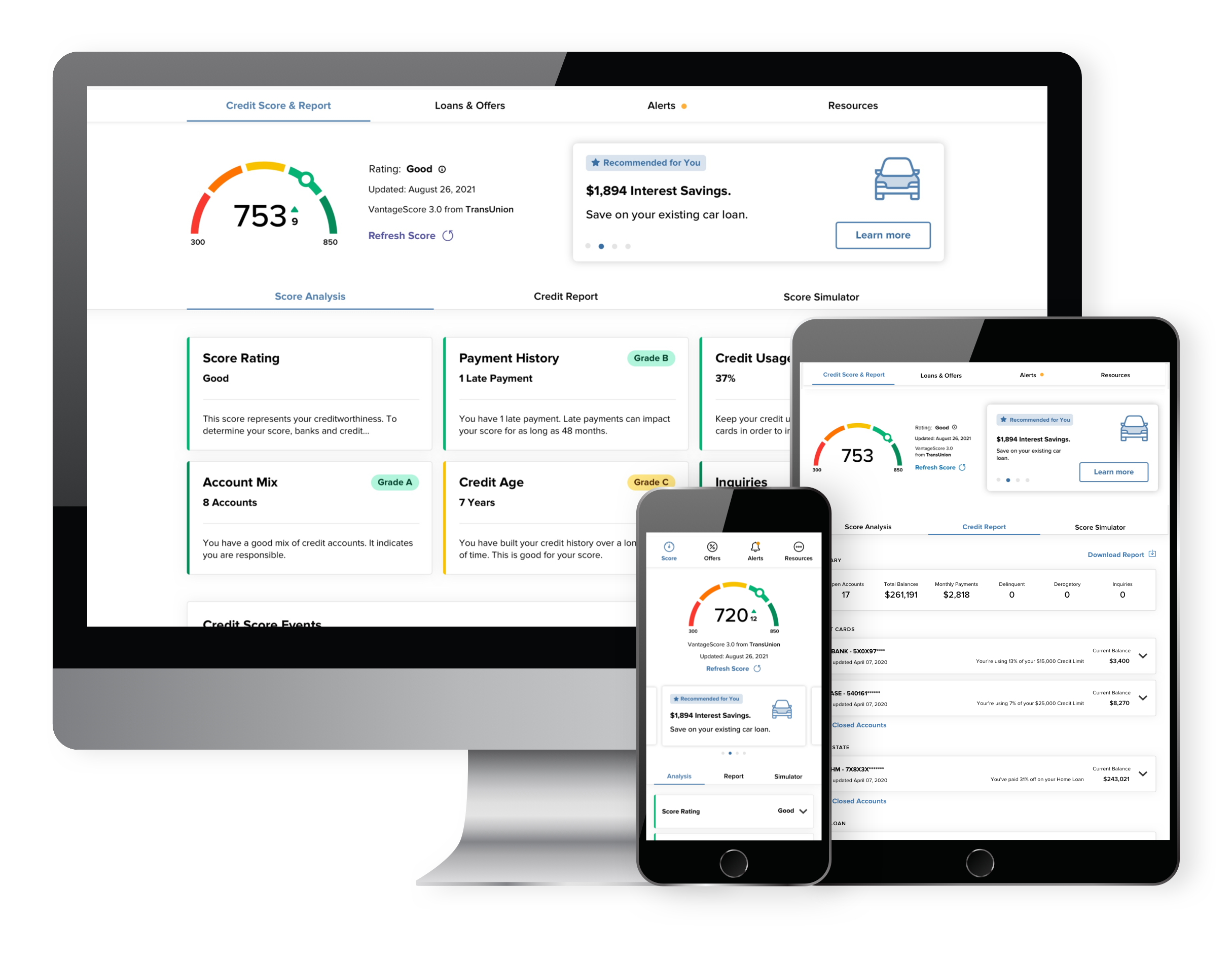

Credit reporting tools are software or online platforms that help you monitor and manage your credit score. They gather data from various credit bureaus and present it in an easy-to-understand format. These tools often include features like:

- Credit Score Tracking: Regular updates on your credit score.

- Credit Report Analysis: Detailed breakdown of your credit report.

- Alerts: Notifications for any significant changes in your credit profile.

- Recommendations: Tips to improve your credit score.

Some of the popular credit reporting tools include Credit Karma, Experian, and Equifax. These tools are designed to help you stay on top of your credit health, preventing surprises when applying for loans or credit cards.

The Importance Of Monitoring Your Credit

Monitoring your credit is crucial for maintaining financial stability. Here are some key reasons why:

| Reason | Explanation |

|---|---|

| Identity Theft Prevention: | Detect unauthorized activities early and take action. |

| Loan Approval: | Higher credit scores increase the chances of loan approval. |

| Interest Rates: | Better credit scores lead to lower interest rates on loans. |

| Financial Planning: | Understand your financial position for better planning. |

By using credit reporting tools, you can keep track of your credit score and take steps to improve it. Regular monitoring helps in catching errors and preventing fraud, thus ensuring your financial security. Maintaining a good credit score opens up better opportunities for borrowing and can save you money on interest rates. Always stay informed about your credit standing with reliable tools.

Key Features Of Credit Reporting Tools

Credit reporting tools are essential for maintaining a healthy credit profile. These tools offer multiple features that help you stay informed and secure. Let’s explore the key features:

Real-time Credit Score Updates

Staying updated with your credit score is crucial. Real-time credit score updates allow you to monitor your credit health constantly. This feature provides instant notifications whenever there is a change in your credit score. It helps you make informed decisions quickly.

Credit Report Monitoring

Credit report monitoring involves keeping a close watch on your credit report. This feature alerts you to any new inquiries, accounts, or changes to existing accounts. Continuous monitoring helps you detect errors or suspicious activity early, ensuring your credit report remains accurate.

Credit Score Simulator

Understanding how different actions affect your credit score can be challenging. The credit score simulator is a valuable tool that allows you to simulate various financial scenarios. By adjusting variables like credit card usage or loan repayments, you can see the potential impact on your credit score. This helps you make smarter financial decisions.

Identity Theft Protection

Identity theft can have devastating effects on your credit. Identity theft protection is an essential feature that offers surveillance and alerts for suspicious activities. It includes services like dark web monitoring and identity restoration support. This protection ensures your credit remains secure from fraudulent activities.

Pricing And Affordability

Choosing the right credit reporting tool can be challenging. Pricing and affordability play a crucial role in making an informed decision. With numerous options, it is essential to understand the cost implications and benefits of each tool.

Free Vs. Paid Credit Reporting Tools

There are both free and paid credit reporting tools available. Free tools offer basic features that may suffice for personal use. However, businesses might need advanced features.

| Type | Features | Ideal For |

|---|---|---|

| Free Tools |

|

Individuals |

| Paid Tools |

|

Businesses |

Cost-benefit Analysis Of Premium Features

Premium credit reporting tools come with a price tag, but they offer significant benefits. Businesses can save time and resources by leveraging these advanced features.

Consider the following benefits of premium tools:

- Real-time Monitoring: Get instant alerts for any changes in your credit report.

- Identity Theft Protection: Protect your business from potential fraud.

- Detailed Reports: Access comprehensive credit information, crucial for making informed decisions.

While premium tools might seem expensive initially, the long-term benefits often outweigh the costs. Investing in a reliable credit reporting tool can save your business from potential financial pitfalls.

Pros And Cons Of Credit Reporting Tools

Credit reporting tools have become essential for businesses. They offer insights into financial health and aid decision-making. But like any tool, they have their advantages and limitations.

Advantages Of Using Credit Reporting Tools

There are several benefits to using credit reporting tools:

- Accurate Financial Insights: These tools provide detailed reports on credit scores and history.

- Improved Decision Making: Businesses can make informed decisions based on the data.

- Time Efficiency: Automated processes save time compared to manual checks.

- Risk Mitigation: Helps identify potential risks and avoid bad credit decisions.

Credit reporting tools like Firstbase One can integrate multiple financial services, making it easier for businesses to manage their finances efficiently.

Potential Drawbacks And Limitations

Despite the benefits, there are some drawbacks to consider:

- Cost: Some tools can be expensive, especially for small businesses.

- Data Privacy: Handling sensitive financial data requires robust security measures.

- Complexity: Some tools might have a steep learning curve.

- Dependence on Accuracy: Inaccurate data can lead to poor decision-making.

Understanding these limitations can help businesses make the most of credit reporting tools while avoiding potential pitfalls.

| Feature | Advantage | Limitation |

|---|---|---|

| Automated Processes | Saves Time | Can be Costly |

| Data Insights | Improves Decision Making | Requires Accurate Data |

| Risk Mitigation | Identifies Risks | Needs Robust Security |

Credit reporting tools, like Firstbase One, offer significant benefits but also come with challenges. Weighing the pros and cons can help businesses decide on the best approach for their needs.

Specific Recommendations For Ideal Users

Credit reporting tools are essential for a wide range of users. Different tools cater to different needs, whether you’re an individual, a small business owner, or a financial advisor. Below are specific recommendations tailored to each type of user.

Best Tools For Individuals

Individuals seeking to improve their credit scores or monitor their credit reports can benefit from tools like Credit Karma and Experian. These tools provide free credit scores, detailed reports, and personalized tips to boost your credit health.

- Credit Karma: Offers free credit scores and reports from TransUnion and Equifax.

- Experian: Provides access to your Experian credit report and FICO score.

Best Tools For Small Business Owners

Small business owners need tools that offer comprehensive financial management. Firstbase One stands out with its all-in-one startup operating system. It simplifies incorporation, compliance, bookkeeping, and taxes.

| Feature | Details |

|---|---|

| Incorporation | Form your LLC or C-Corp with automated processes. |

| Mailroom | Get a premium physical US address and virtual mailbox. |

| Agent | Compliance in all states with registered agent services. |

| Accounting | Full-service accrual bookkeeping and timely financial reporting. |

| Tax Filing | Simplifies tax filing for both corporate and personal returns. |

Best Tools For Financial Advisors

Financial advisors require tools that provide comprehensive insights and analytics. CreditSignal by Dun & Bradstreet and Nav are excellent choices. These tools offer detailed business credit reports and analytics.

- CreditSignal: Monitors changes in your Dun & Bradstreet scores and ratings.

- Nav: Provides business and personal credit scores, and detailed reports.

Each of these tools provides valuable insights and helps manage financial health effectively.

Frequently Asked Questions

What Are Credit Reporting Tools?

Credit reporting tools help individuals monitor their credit scores and reports. These tools provide insights into credit health.

How Do Credit Reporting Tools Work?

Credit reporting tools gather information from credit bureaus. They present the data in an understandable format, helping users track their credit status.

Are Credit Reporting Tools Accurate?

Yes, credit reporting tools use data from reputable credit bureaus. They offer accurate and up-to-date information on your credit history.

Why Should I Use Credit Reporting Tools?

Credit reporting tools help you stay informed about your credit status. They alert you to changes and potential issues.

Conclusion

Credit reporting tools are crucial for business success. They help track credit scores and histories. Using effective tools can streamline this process. Consider exploring comprehensive solutions like Firstbase One. It simplifies incorporation, compliance, and bookkeeping. Save time and reduce costs with automated processes. For more details, visit Firstbase and discover how it can benefit your business. Stay informed and make smarter financial decisions with the right tools.