Credit Report Analysis: Uncover Hidden Secrets of Your Score

Understanding your credit report is essential for managing your financial health. A credit report analysis helps you see where you stand and what you can improve.

A detailed review of your credit report can reveal important information about your financial habits. It includes your credit history, outstanding debts, and payment patterns. This analysis can help you spot errors, understand your credit score, and find ways to improve it. Whether you aim to get a loan, rent an apartment, or simply maintain good financial health, knowing how to analyze your credit report is crucial. Dive into the world of credit report analysis to take control of your financial future. For those starting a business, check out how Firstbase can simplify incorporation and compliance, making your entrepreneurial journey smoother.

Introduction To Credit Report Analysis

Understanding your credit report is vital. It gives a clear picture of your financial health. Credit Report Analysis helps you know where you stand. This guide will walk you through the basics.

Understanding The Importance Of Your Credit Score

Your credit score affects many parts of your life. It influences loan approvals, interest rates, and even job opportunities. A high score means you’re seen as a reliable borrower. A low score can limit your financial options.

Your score is based on several factors:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit

- Recent credit inquiries

How Credit Report Analysis Can Help You

A thorough Credit Report Analysis can pinpoint areas that need improvement. It helps you understand the factors affecting your score. This analysis can guide you on steps to take for improving your credit health.

Benefits include:

- Identifying errors in your report

- Understanding your credit behavior

- Planning future financial decisions

Analyzing your credit report regularly is key. It ensures you stay on track with your financial goals. Implement these insights to build and maintain a healthy credit score.

Key Features Of Credit Report Analysis Tools

Credit report analysis tools are essential for maintaining a healthy financial profile. They provide in-depth insights into various aspects of your credit history. These tools help you understand your credit score, manage accounts, track credit utilization, and much more.

Comprehensive Credit Score Breakdown

A good credit report analysis tool offers a detailed breakdown of your credit score. This includes factors like payment history, amounts owed, and length of credit history. Understanding these components helps you identify areas for improvement. Knowing your credit score composition is crucial for maintaining a healthy financial status.

Detailed Account Histories

With detailed account histories, you can track your financial activities over time. This feature lists all your credit accounts, including mortgages, credit cards, and loans. It shows payment history, balances, and account status. Having access to this information makes it easier to spot discrepancies or unauthorized activities.

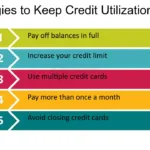

Credit Utilization Insights

Credit utilization is a significant factor affecting your credit score. Credit report analysis tools provide insights into your credit utilization ratio. This is the percentage of your available credit that you are using. Keeping your utilization low can positively impact your credit score.

Credit Inquiry Tracking

Every time a lender checks your credit, an inquiry is noted on your report. Tracking these inquiries helps you understand their impact on your credit score. Frequent credit checks can lower your score. Knowing who has accessed your report ensures there are no unauthorized inquiries.

Personalized Credit Improvement Tips

Personalized credit improvement tips are a valuable feature of credit report analysis tools. Based on your credit data, these tools offer tailored advice to improve your score. Actionable tips might include paying down high balances or consolidating debt. Following these recommendations helps boost your credit score over time.

Pricing And Affordability Of Credit Report Analysis Tools

Analyzing your credit report is essential for maintaining a healthy financial profile. Understanding the cost of these tools can help you make an informed choice. Here’s a detailed look at the pricing and affordability of credit report analysis tools.

Free Vs. Paid Services

Many credit report analysis tools offer both free and paid options. Free services typically provide basic features like:

- Access to your credit report

- Basic score tracking

- Alert notifications

On the other hand, paid services offer advanced features such as:

- In-depth credit analysis

- Detailed score breakdowns

- Personalized financial advice

- Identity theft protection

Choosing between free and paid services depends on your specific needs. Free tools are great for basic monitoring. Paid tools are better for comprehensive financial management.

Subscription Plans And Benefits

Subscription plans for credit report analysis tools can vary widely. They often include monthly or annual options. Here are some typical benefits of subscribing:

- Continuous credit monitoring

- Regular updates on score changes

- Access to detailed credit reports from all major bureaus

- Exclusive access to customer support

Here is a comparison table of common subscription plans:

| Plan Type | Monthly Cost | Annual Cost | Key Features |

|---|---|---|---|

| Basic | $10 | $100 | Basic monitoring, alerts |

| Premium | $20 | $200 | Detailed reports, financial advice |

| Ultimate | $30 | $300 | All features, identity protection |

Cost-effective Options For Budget-conscious Users

For those on a budget, there are several cost-effective options:

- Use free credit report tools for basic monitoring.

- Opt for annual plans to save on monthly fees.

- Look for discounts or promotional offers.

Some services also provide pay-per-use models. This allows you to pay only for specific features when needed. Combining free and low-cost tools can provide a comprehensive solution.

Choosing the right credit report analysis tool involves weighing the costs against the benefits. Whether opting for free services or paid subscriptions, make sure it meets your financial goals.

Pros And Cons Of Using Credit Report Analysis Tools

Credit report analysis tools have revolutionized how we manage our credit health. These tools offer various advantages and some limitations that users need to consider. Let’s delve into the pros and cons based on real-world usage and potential drawbacks.

Advantages Based On Real-world Usage

- Accurate Insights: These tools provide precise details on your credit score and history.

- Time-Saving: Automated reports save significant time compared to manual calculations.

- User-Friendly: Many tools feature easy-to-understand dashboards and alerts.

- Early Detection: They help identify errors and potential fraud quickly.

- Financial Planning: Useful for planning loans, mortgages, and other financial decisions.

| Feature | Benefit |

|---|---|

| Automated Reports | Saves time and reduces human error |

| Alerts and Notifications | Immediate updates on changes to your credit report |

| User-Friendly Interface | Easy for users to navigate and understand |

Potential Drawbacks And Limitations

- Cost: Premium features may come at a high price.

- Data Accuracy: Some tools might not have the latest information.

- Privacy Concerns: Sharing personal data poses privacy risks.

- Dependence on Technology: Requires internet access and device compatibility.

- Learning Curve: Initial setup and understanding might be challenging.

Understanding both the strengths and weaknesses of credit report analysis tools allows users to make informed choices. These tools, like Firstbase One, offer comprehensive solutions for managing credit and business finances effectively.

Specific Recommendations For Ideal Users

Credit report analysis is essential for users aiming to understand their financial health. The analysis tools vary in complexity and features, making them suitable for different user groups. Below are specific recommendations for ideal users.

Best Tools For First-time Users

First-time users require tools that are easy to navigate and understand. Firstbase One offers an intuitive interface, making it an excellent choice for beginners. Key features include:

- Incorporation: Automates the formation of LLC or C-Corp, eliminating paperwork.

- Mailroom: Provides a premium physical US address and virtual mailbox for business mail management.

- Agent Services: Ensures compliance in every state with registered agent services.

These features simplify the administrative tasks, allowing first-time users to focus on their core business operations.

Advanced Features For Financial Experts

Financial experts need more advanced features to analyze credit reports in detail. Firstbase One caters to these needs with:

- Accounting: Offers a powerful accounting platform with full-service accrual bookkeeping.

- Tax Filing: Simplifies tax filing for both US-based and international founders.

- Equity Management: Easy captable creation and equity assignment, including free 83(B) filings.

These advanced features provide comprehensive insights and help in making informed financial decisions.

Ideal Scenarios For Using Credit Report Analysis Tools

Credit report analysis tools are beneficial in various scenarios, including:

| Scenario | Benefit |

|---|---|

| Starting a Business | Helps in understanding financial health and securing funding. |

| Managing Compliance | Ensures all legal and tax obligations are met. |

| Expanding Operations | Provides detailed financial analysis to support growth decisions. |

Firstbase One integrates multiple tools into one platform, making it ideal for various business scenarios. This all-in-one approach saves time and money, providing a seamless experience for users.

Frequently Asked Questions

What Is A Credit Report Analysis?

A credit report analysis is a detailed review of your credit report. It helps identify errors, evaluate financial health, and improve credit scores.

Why Is Credit Report Analysis Important?

Credit report analysis is crucial for managing your financial health. It helps you spot errors, detect fraud, and improve your creditworthiness.

How Often Should I Analyze My Credit Report?

You should analyze your credit report at least once a year. Regular checks help you stay informed about your financial status.

What Factors Are Reviewed In Credit Report Analysis?

A credit report analysis reviews your payment history, credit utilization, account types, and recent credit inquiries. These factors influence your credit score.

Conclusion

Analyzing your credit report is essential for financial health. It helps identify errors, understand creditworthiness, and plan for the future. Regular checks ensure accuracy, helping you make informed decisions. For business owners, tools like Firstbase One can simplify financial management. This all-in-one platform handles incorporation, compliance, and more, saving time and hassle. Stay proactive with your credit and consider solutions that streamline your business processes. Start today, and take control of your financial future.