Responsible Credit Usage: Mastering Smart Financial Habits

Using credit responsibly is essential for your financial health. It can open doors but also lead to debt if mismanaged.

Understanding how to use credit wisely can help you avoid pitfalls and build a strong financial future. This blog will guide you through the principles of responsible credit usage. Whether you’re a student, a small business owner, or just starting out, knowing how to manage credit can make a big difference. We’ll cover key strategies and tips to help you maintain a healthy credit score, manage debt effectively, and use credit as a tool for growth. Ready to take control of your financial journey? Let’s get started! For those launching a business, check out Firstbase. It’s an all-in-one platform that simplifies incorporation, compliance, bookkeeping, and more.

Introduction To Responsible Credit Usage

Responsible credit usage is crucial for maintaining financial health. Using credit wisely can help build a positive credit history. This can lead to better loan terms and financial opportunities in the future.

Understanding Credit And Its Importance

Credit is the ability to borrow money with the promise to repay it later. It is essential for buying a home, car, or even starting a business. Good credit can open many financial doors.

Credit is typically represented by a credit score. This score ranges from 300 to 850, with higher scores indicating better creditworthiness. Banks, lenders, and even some employers may check your credit score.

Credit scores are influenced by:

- Payment history

- Credit utilization

- Length of credit history

- New credit inquiries

- Types of credit accounts

Maintaining a good credit score is vital. It affects your ability to secure loans, credit cards, and sometimes even rental agreements.

Why Responsible Credit Usage Matters

Responsible credit usage helps you avoid debt and financial stress. It ensures that you can manage your finances effectively.

Here are some key reasons why responsible credit usage matters:

- Avoiding High Interest Rates: Carrying large balances can lead to high interest payments. Paying off balances promptly helps save money.

- Building a Positive Credit History: Regular, on-time payments build a strong credit history. This can help secure better loan terms in the future.

- Increasing Financial Opportunities: Good credit opens doors to better financial products. It can also lead to lower insurance premiums and better rental terms.

- Preventing Debt Accumulation: Using credit responsibly prevents debt from piling up. It helps maintain financial stability.

Practicing responsible credit usage involves:

- Paying bills on time

- Keeping credit card balances low

- Avoiding unnecessary credit inquiries

- Regularly checking your credit report for errors

By following these principles, you can maintain a healthy credit profile. This will benefit you in both your personal and professional life.

Key Features Of Smart Financial Habits

Developing smart financial habits is crucial for maintaining a healthy financial life. Responsible credit usage plays a significant role in this process. Here are some key features that can help you manage your finances wisely.

Budgeting And Tracking Expenses

Creating a budget is the foundation of smart financial habits. It helps you plan your spending and ensure you live within your means. Track all expenses to see where your money goes. Use tools or apps to monitor your budget and make adjustments as needed.

- Set clear financial goals

- List all income sources

- Record daily expenses

- Review and adjust monthly

Building And Maintaining A Healthy Credit Score

A good credit score opens doors to better financial opportunities. Pay your bills on time and keep credit card balances low. Monitor your credit report regularly to check for errors and fix them promptly.

- Pay bills by their due date

- Keep credit utilization below 30%

- Avoid unnecessary credit inquiries

- Check credit reports annually

Understanding Interest Rates And Fees

Knowing how interest rates and fees work can save you money. Credit cards often come with interest rates that can add up quickly if balances are not paid in full. Understand the terms and conditions of your credit cards to avoid unexpected charges.

| Type | Explanation |

|---|---|

| APR | Annual Percentage Rate, the cost of borrowing |

| Late Fees | Charges for missing payment deadlines |

| Annual Fees | Yearly charge for using the credit card |

Using Credit For Emergency Situations Only

Credit should not be used for everyday purchases. Reserve credit cards for emergencies or large, planned expenses. This helps you avoid accumulating unnecessary debt and keeps your finances in check.

- Emergency medical expenses

- Unexpected home repairs

- Major car repairs

Avoiding Impulse Purchases

Impulse buying can derail your financial goals. Before making a purchase, ask yourself if it is necessary. Stick to your budget and make planned purchases to avoid unnecessary debt.

- Make a shopping list

- Set a spending limit

- Wait 24 hours before buying

- Evaluate the necessity of the item

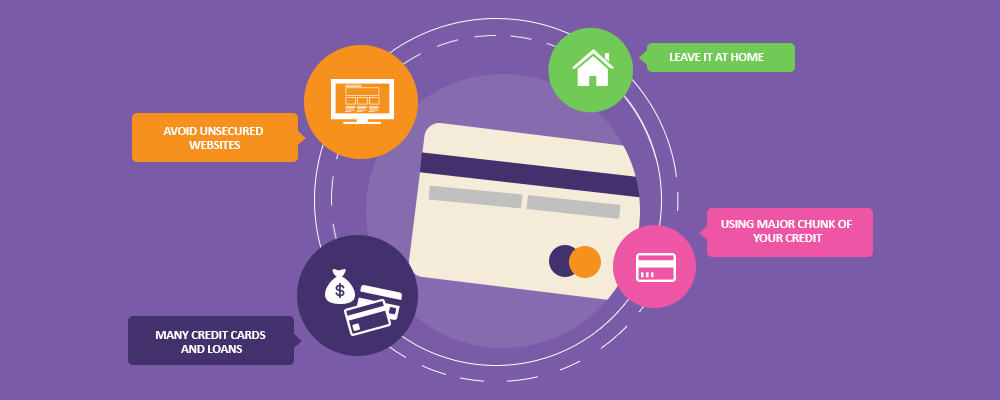

Strategies For Effective Credit Management

Managing credit responsibly is essential for maintaining financial health. Understanding effective credit management strategies can help you stay on top of your finances and avoid potential pitfalls. Here are some key strategies to ensure you use your credit wisely and maintain a good credit score.

Setting Up Automatic Payments

One of the simplest ways to manage credit effectively is by setting up automatic payments. This ensures that your bills are paid on time, every time. Late payments can negatively impact your credit score, so automating them helps avoid this risk.

- Automate payments for credit cards and loans.

- Ensure sufficient funds in your bank account to cover these payments.

- Set reminders to review automated transactions periodically.

Keeping Credit Utilization Low

Another critical strategy is to keep your credit utilization ratio low. This ratio is the percentage of your credit limit that you are currently using. A lower ratio indicates responsible credit usage and positively affects your credit score.

| Credit Limit | Current Balance | Utilization Ratio |

|---|---|---|

| $10,000 | $2,000 | 20% |

| $5,000 | $1,250 | 25% |

- Keep your utilization below 30%.

- Pay down balances to lower your ratio.

- Request a higher credit limit if needed.

Regularly Reviewing Credit Reports

Regularly reviewing your credit reports is crucial. This helps you identify errors and detect any fraudulent activity. You are entitled to a free credit report from each of the three major credit bureaus annually.

- Request your free credit report from Equifax, Experian, and TransUnion.

- Check for inaccuracies and report any errors immediately.

- Monitor for signs of identity theft.

Negotiating Better Terms With Creditors

If you find yourself struggling with credit card debt, consider negotiating better terms with your creditors. Many creditors are willing to lower interest rates or offer a payment plan to help you manage your debt more effectively.

- Contact your creditor and explain your situation.

- Request a lower interest rate or a more manageable payment plan.

- Document any agreements made for future reference.

These strategies can help you manage credit more effectively and maintain a strong financial standing. By implementing these practices, you can ensure responsible credit usage and avoid the pitfalls of debt.

Pricing And Affordability Of Credit Products

Understanding the pricing and affordability of credit products is crucial. It helps you manage costs and avoid debt. Let’s explore how to compare interest rates, understand different types of credit, and find cost-effective options.

Comparing Interest Rates And Fees

Interest rates and fees vary across credit products. It’s essential to compare them. Here’s a simple table to help you understand the differences:

| Credit Product | Interest Rate | Fees |

|---|---|---|

| Credit Card | 15% – 25% | Annual fee, late payment fee |

| Personal Loan | 5% – 20% | Origination fee, prepayment fee |

| Mortgage | 3% – 6% | Application fee, appraisal fee |

By comparing these rates and fees, you can choose the most affordable option for your needs.

Understanding Different Types Of Credit Products

There are various credit products available. Each serves different purposes. Here are a few common types:

- Credit Cards: Ideal for daily purchases. Offers flexibility but comes with high interest rates.

- Personal Loans: Useful for large expenses like medical bills. Generally lower interest rates than credit cards.

- Mortgages: For buying property. Long-term loans with relatively low interest rates.

Choosing the right type depends on your specific needs and financial situation.

Evaluating Cost-effective Credit Options

To find cost-effective credit options, consider the following steps:

- Compare interest rates and fees from multiple lenders.

- Check for any hidden fees or charges.

- Read customer reviews to gauge lender reliability.

- Use online calculators to estimate total costs.

By following these steps, you can secure a credit product that fits your budget and financial goals.

Pros And Cons Of Using Credit

Using credit can be a double-edged sword. It offers many benefits but also poses certain risks. Understanding both sides can help you make informed decisions about using credit responsibly.

Advantages Of Credit Usage

Credit can be highly beneficial in numerous ways. Here are some of the key advantages:

- Convenience: Credit cards provide a convenient way to pay for purchases without carrying cash.

- Build Credit History: Regularly using credit and paying on time helps build a strong credit history, which is crucial for future financial opportunities.

- Rewards and Perks: Many credit cards offer rewards, cash back, or travel points, adding extra value to your purchases.

- Emergency Funds: Credit can serve as a financial backup in emergencies, ensuring you have access to funds when needed.

- Purchase Protection: Credit cards often provide protection against fraud and unauthorized purchases.

Potential Risks And Drawbacks

While credit has its advantages, it also comes with potential risks. Here are some drawbacks to consider:

- Debt Accumulation: It is easy to accumulate debt if you overspend and do not pay off your balance regularly.

- High Interest Rates: Credit cards often come with high interest rates, making it expensive to carry a balance.

- Impact on Credit Score: Late payments and high credit utilization can negatively affect your credit score.

- Fees: There can be various fees associated with credit cards, including annual fees, late payment fees, and foreign transaction fees.

- Temptation to Overspend: The convenience of credit can lead to impulsive purchases and overspending.

Balancing the benefits and risks of credit usage is key to maintaining financial health. Make sure to use credit responsibly to maximize its advantages while minimizing the potential downsides.

Recommendations For Ideal Credit Usage Scenarios

Understanding how to use credit responsibly is crucial for financial health. Here are some scenarios where using credit can be beneficial.

Using Credit To Build Financial Stability

Using credit wisely can help you build financial stability. Here are some key points:

- Pay bills on time: Timely payments improve your credit score.

- Keep balances low: High credit utilization can hurt your score.

- Diversify credit types: Use a mix of credit cards and loans.

Building a good credit history helps in securing better loan terms in the future. Always monitor your credit report for errors.

Leveraging Credit For Major Purchases

Credit can be a valuable tool for major purchases. These include:

- Home purchases

- Automobile financing

- Education expenses

For instance, a mortgage requires a good credit score for better interest rates. Use credit cards with rewards for big purchases to earn points or cashback.

Credit Usage For Small Business Financing

Small business owners can use credit to finance their ventures. Firstbase offers an all-in-one startup operating system. Here are its main features:

| Feature | Description |

|---|---|

| Incorporation | Automates LLC or C-Corp formation without paperwork. |

| Mailroom | Provides a premium US address for business mail. |

| Agent | Ensures compliance with registered agent services. |

| Accounting | Offers full-service accrual bookkeeping. |

| Tax Filing | Simplifies state and federal tax filing. |

| Banking | Provides quick approval for a US bank account. |

Small businesses can benefit from using credit for startup costs, inventory, and operational expenses. Firstbase streamlines this process, making it easier for entrepreneurs to succeed.

For more details or to start your business with Firstbase, visit their official website.

Frequently Asked Questions

What Is Responsible Credit Usage?

Responsible credit usage means using credit wisely. It involves paying bills on time and keeping balances low. It also includes monitoring your credit report regularly.

How Can I Improve My Credit Score?

To improve your credit score, pay bills on time. Keep credit card balances low. Check your credit report for errors.

Why Is Credit Monitoring Important?

Credit monitoring helps you detect fraud early. It also allows you to track changes to your credit score. Regular monitoring can prevent identity theft.

What Are The Benefits Of A Good Credit Score?

A good credit score can lower interest rates. It also helps in getting loan approvals. Additionally, it can provide better credit card offers.

Conclusion

Responsible credit usage is crucial for financial health. Monitor your spending. Pay bills on time. Understand interest rates and fees. Avoid maxing out credit limits. Build a solid credit history. These practices ensure a stable financial future. Need help managing your business finances? Consider using Firstbase for comprehensive support. Their tools simplify incorporation, compliance, and accounting. Start your journey towards responsible credit usage today.