Credit Card Comparison Site: Find the Best Card for You

Choosing the right credit card can be overwhelming. With so many options available, where do you even start?

A credit card comparison site can make this process much easier. Credit card comparison sites help you understand the various features, benefits, and fees associated with different cards. They provide valuable insights, making it easier to choose a card that aligns with your financial goals. Whether you want to earn rewards, save on interest rates, or build your credit, these sites offer detailed information and user reviews. This helps you make an informed decision, saving you time and potentially money. In this post, we’ll explore how using a credit card comparison site can simplify your decision-making process and introduce you to some of the best platforms available. For business owners, consider checking out Firstbase for comprehensive financial solutions.

Introduction To Credit Card Comparison Sites

In the digital age, the search for the perfect credit card can be overwhelming. Credit card comparison sites simplify this process by providing comprehensive information in one place. These platforms help users make informed decisions quickly and efficiently. Let’s explore what these sites offer and why you should use them.

What Is A Credit Card Comparison Site?

A credit card comparison site is an online platform that allows users to compare various credit card options. It provides detailed information on interest rates, rewards, fees, and other features. These sites collect data from multiple credit card issuers to present a side-by-side comparison.

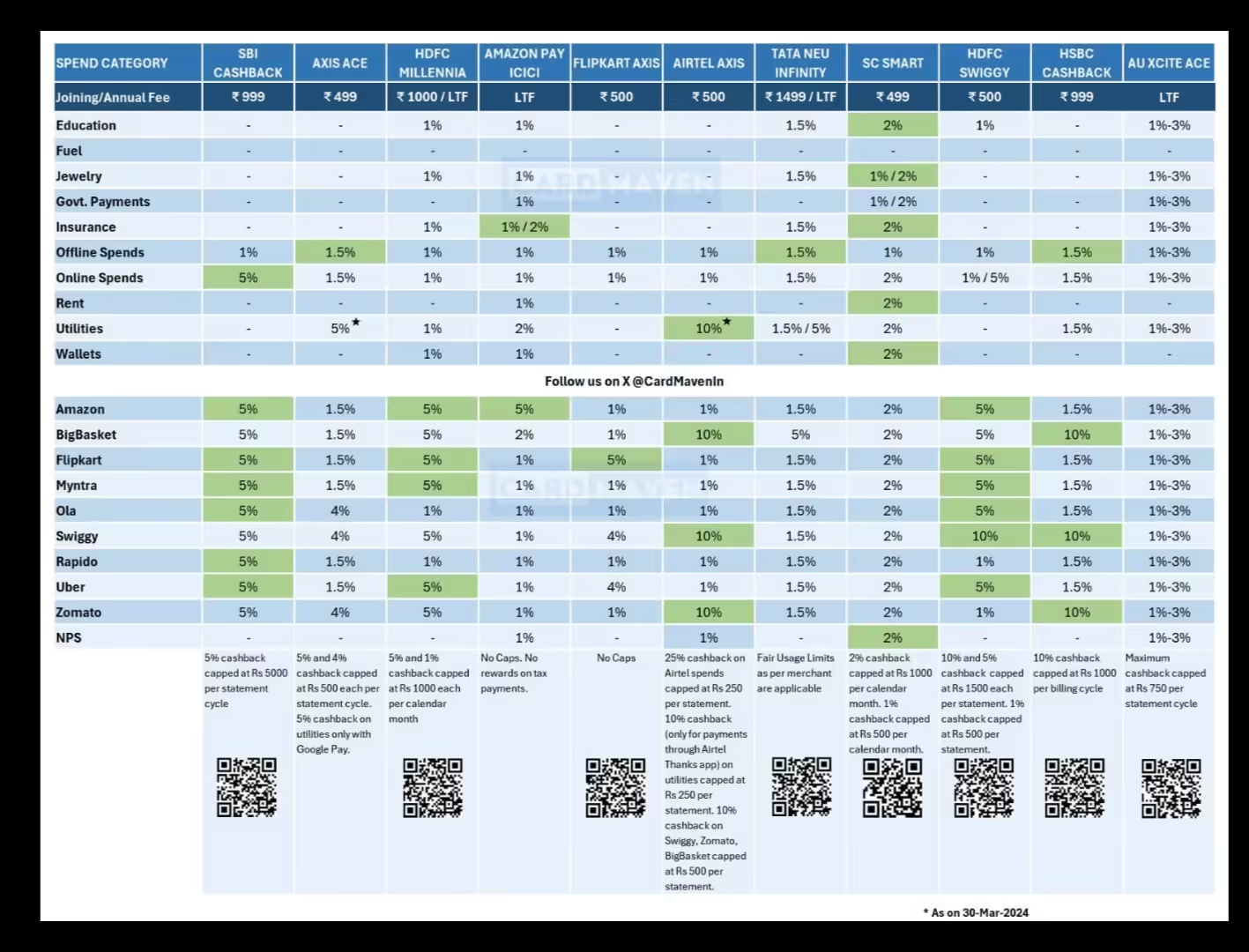

For example, a comparison site might display:

| Credit Card | Interest Rate | Annual Fee | Rewards |

|---|---|---|---|

| Card A | 15.99% | $0 | 1.5% cashback |

| Card B | 18.99% | $95 | 2% travel rewards |

Why Use A Credit Card Comparison Site?

There are several reasons to use a credit card comparison site:

- Time-saving: Quickly compare multiple options in one place.

- Informed decisions: Access detailed information on each card.

- Cost-effective: Find cards with the best rates and rewards.

- User reviews: Read real user experiences and ratings.

Using a comparison site also helps avoid hidden fees and unfavorable terms. You can filter cards based on your preferences, such as no annual fee, low APR, or specific rewards.

Overall, credit card comparison sites are a valuable tool for anyone looking to optimize their financial choices. They provide transparency and convenience, making the selection process straightforward and efficient.

Key Features Of A Good Credit Card Comparison Site

Choosing the right credit card can be overwhelming. A good credit card comparison site helps simplify this process. Here are the key features that make a credit card comparison site effective and user-friendly.

Comprehensive Database Of Credit Cards

A great comparison site should have a comprehensive database of credit cards. This database includes all types of credit cards such as rewards cards, travel cards, and business cards. Users can compare various options available in the market.

A well-maintained database ensures that users find the best credit card for their needs.

User-friendly Interface And Navigation

The site must have a user-friendly interface. Easy navigation helps users to find information quickly. The design should be clean and intuitive. This reduces the time spent searching for specific details.

Clear buttons and labels guide users through the comparison process.

Advanced Search And Filter Options

Advanced search and filter options are essential. Users can filter credit cards based on interest rates, rewards, annual fees, and more. This helps in narrowing down choices.

Advanced search features save users time and help them find the best credit card suited to their specific needs.

Up-to-date Information And Rates

Providing up-to-date information is crucial. A good site regularly updates the interest rates, fees, and offers. This ensures that users have the latest data to make informed decisions.

Accurate and current information builds trust with users.

Detailed Card Reviews And Ratings

Detailed reviews and ratings of each credit card are important. Users can read about the pros and cons, user experiences, and expert opinions. Ratings help in quickly identifying top-rated cards.

Honest reviews and ratings provide valuable insights for making the best choice.

Personalized Recommendations

Personalized recommendations enhance the user experience. The site should offer suggestions based on user preferences and spending habits. This can be done through a simple questionnaire.

Personalized recommendations make the process of finding the ideal credit card easier and more efficient.

How To Use A Credit Card Comparison Site Effectively

Credit card comparison sites can save you time and money. By comparing different cards, you find the one that suits your needs best. This guide will help you use these sites effectively.

Setting Your Priorities And Preferences

Before you start comparing, know what you need. Do you want a card with low interest rates? Or are you after rewards and cashback? List your priorities. This makes the comparison process smoother.

Understanding Comparison Metrics

Comparison sites use various metrics to evaluate credit cards. Key metrics include:

- Annual Percentage Rate (APR): The yearly interest rate.

- Annual Fees: The yearly cost to hold the card.

- Rewards: Points, miles, or cashback you can earn.

- Credit Limit: The maximum amount you can borrow.

Knowing these metrics helps you make informed decisions.

Reading And Interpreting Reviews

User reviews provide insights into real experiences. Look for patterns in the reviews. Are users happy with customer service? Do they face hidden fees? This information is crucial.

Don’t just look at the star ratings. Read the detailed reviews to understand the pros and cons of each card.

Utilizing Filter And Search Tools

Most comparison sites offer filters and search tools. Use these to narrow down your options. Filter by interest rate, rewards, or credit score requirements.

For example, if you need a card with no annual fee, set that as a filter. This ensures you see only relevant options.

Search tools can also help. Type in specific features you want, like “travel rewards” or “low APR”. This makes your search more efficient.

By following these steps, you can effectively use a credit card comparison site. This ensures you find the best credit card for your needs.

Pricing And Affordability Breakdown

Understanding the pricing structure is crucial when selecting a credit card comparison site. It helps in making an informed decision, ensuring you get the best value for your money. Here, we delve into the different pricing models, potential additional costs, and hidden fees associated with credit card comparison sites.

Free Vs. Paid Comparison Sites

Free comparison sites often generate revenue through advertisements or affiliate commissions. They provide a broad overview of available credit cards. These sites are ideal for users who want a quick comparison without any financial commitment.

- Pros: No cost, quick access to information.

- Cons: May have limited features, potential bias due to affiliate links.

Paid comparison sites, on the other hand, offer more detailed insights and advanced tools. Users may benefit from personalized recommendations and in-depth analyses. These sites are suitable for those who seek comprehensive comparisons and are willing to invest in a premium service.

- Pros: Detailed insights, advanced tools, personalized recommendations.

- Cons: Subscription fees, potential extra costs for premium features.

Additional Costs Or Hidden Fees

When using a credit card comparison site, it’s essential to be aware of any additional costs or hidden fees. These can include:

- Subscription Fees: Some paid sites charge monthly or annual fees for access to premium features.

- Transaction Fees: If the site offers services beyond comparison, like applying for cards directly, there may be transaction fees involved.

- Data Access Fees: Charges for accessing detailed credit reports or historical data might apply.

To avoid unexpected costs, always read the terms of service and pricing details carefully. Transparent sites will clearly list all potential fees, ensuring you can make an informed decision without any surprises.

| Feature | Free Sites | Paid Sites |

|---|---|---|

| Cost | None | Subscription Fees |

| Features | Basic | Advanced |

| Potential Bias | High (Ads/Affiliates) | Low |

| Personalization | Limited | High |

Choosing the right credit card comparison site depends on your needs and budget. Whether you opt for a free or paid site, understanding the pricing and potential hidden fees will help you make an informed decision.

Pros And Cons Of Using Credit Card Comparison Sites

Credit card comparison sites provide a convenient way to find the best card for your needs. These sites offer a range of features and benefits, but it’s important to understand both the pros and cons before relying on them.

Pros: Time-saving And Convenience

Credit card comparison sites save time by aggregating information from multiple sources. Instead of visiting various bank websites, you can find all the details in one place. This centralized approach makes it easier to compare key features, like interest rates, rewards, and fees.

Convenience is another significant advantage. These sites are user-friendly and often include filters to narrow down choices based on your specific needs. Whether you want a card with low interest or great rewards, you can quickly find relevant options.

Additionally, many comparison sites offer tools like calculators and detailed reviews. These resources help you make informed decisions without extensive research.

Cons: Potential For Bias And Incomplete Information

Despite the benefits, credit card comparison sites may have potential biases. Some sites prioritize cards from specific issuers due to affiliate agreements. This means you might not see the best options available.

Incomplete information is another drawback. Not all sites update their data regularly, leading to outdated or missing details. This can result in choosing a card that isn’t the best fit for your needs.

It’s also important to note that comparison sites might not include all available cards. Some issuers don’t list their products on these platforms, so you might miss out on better deals.

Specific Recommendations For Different Users

Choosing the right credit card can be challenging. It’s essential to consider your spending habits and financial goals. Here are some specific recommendations for different users, ensuring you find the best match for your needs.

Best Comparison Sites For Cashback Seekers

If you love earning cashback, using a comparison site can help you find the best deals. Look for platforms that highlight cards offering high cashback rates on everyday purchases like groceries, gas, and dining. Some top recommendations include:

- NerdWallet: Offers a detailed comparison of cashback cards, including user reviews and expert insights.

- Bankrate: Provides a comprehensive list of cards with significant cashback rewards, along with easy-to-understand ratings.

- The Points Guy: Focuses on maximizing your cashback with tips and tricks from financial experts.

Top Choices For Travel Rewards Enthusiasts

For those who travel frequently, finding a card with excellent travel rewards is crucial. Comparison sites can help you locate cards that offer points or miles for flights, hotels, and more. Recommended sites include:

- CreditCards.com: Features a wide range of travel rewards cards, with detailed comparisons to help you choose the best option.

- Travel + Leisure: Offers expert advice and comparisons of cards that cater to frequent travelers.

- U.S. News: Provides in-depth reviews and rankings of the best travel rewards credit cards available.

Ideal Sites For Balance Transfer Options

If you need to transfer a balance, some comparison sites specialize in cards with low or 0% introductory APR on balance transfers. This can save you money on interest payments. Consider the following sites:

- WalletHub: Offers a comprehensive comparison of balance transfer cards, including user ratings and expert reviews.

- Money Under 30: Provides insights into the best balance transfer cards for young adults and those looking to manage debt.

- Finder: Features a detailed list of cards with favorable balance transfer terms and conditions.

Best Platforms For Low-interest Rate Cards

For those who carry a balance, finding a card with a low-interest rate is essential. Some comparison sites specialize in highlighting cards with low APRs, helping you save on interest charges. Top recommendations include:

- ValuePenguin: Offers detailed comparisons of low-interest rate cards, including expert reviews and user feedback.

- CompareCards: Provides a comprehensive list of cards with low APRs, along with easy-to-understand ratings and reviews.

- CardRatings: Features in-depth reviews and comparisons of the best low-interest rate credit cards available.

Real-world Usage And User Experiences

Understanding how a credit card performs in real-world scenarios is crucial. Potential users want to know how others have benefited from the card. In this section, we will explore user experiences and real-world usage of credit cards. This includes a detailed case study and testimonials from actual users.

Case Study: Finding The Best Card For A Frequent Traveler

Meet John, a frequent traveler, who needed a credit card that offers great travel rewards. He used Firstbase, a credit card comparison site, to find the best option. John compared multiple cards based on:

- Travel rewards

- Annual fees

- Foreign transaction fees

- Customer service

Here is a summary of John’s findings:

| Card | Travel Rewards | Annual Fee | Foreign Transaction Fee | Customer Service Rating |

|---|---|---|---|---|

| Card A | 5x points on travel | $95 | None | 4.5/5 |

| Card B | 3x points on travel | $0 | 3% | 4/5 |

| Card C | 2x points on travel | $50 | 1% | 3.5/5 |

John chose Card A due to its high travel rewards and no foreign transaction fees. He saved money and earned more points on his trips.

User Testimonials And Feedback

Real user feedback is invaluable. Here are some testimonials from Firstbase users:

“Firstbase helped me find the perfect card for my startup. The process was seamless and saved me a lot of time.” – Tyler Tringas, Founder

“Starting a company has never been easier. Firstbase’s platform is accessible and democratizes the process.” – Henry Ward, CEO

“The incorporation process was efficient and personalized. I highly recommend Firstbase.” – Danny Olinsky, Co-founder

“Firstbase significantly impacted our startup. The support and services offered are top-notch.” – Jared Friedman, Partner

These testimonials highlight the positive experiences users have had with Firstbase. They showcase the platform’s efficiency, accessibility, and personalized approach.

Frequently Asked Questions

What Is A Credit Card Comparison Site?

A credit card comparison site helps users compare different credit card offers. It provides detailed information on interest rates, rewards, and fees.

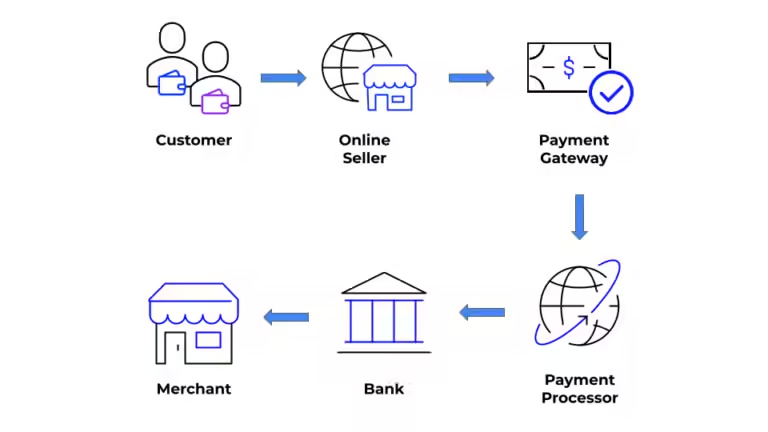

How Do Credit Card Comparison Sites Work?

Credit card comparison sites aggregate data from various credit card issuers. They present it in an easy-to-understand format, allowing users to make informed decisions.

Why Use A Credit Card Comparison Site?

Using a credit card comparison site saves time and effort. It helps you find the best credit card tailored to your needs.

Are Credit Card Comparison Sites Reliable?

Most credit card comparison sites are reliable and updated regularly. They offer accurate information to help you make the best choice.

Conclusion

Choosing the right credit card can be overwhelming. A credit card comparison site simplifies this process. It helps find the best card for your needs. Consider using Firstbase One for business incorporation and financial management. Visit Firstbase to learn more. Simplify your business journey today.