Personal Loan Eligibility: Unlock Your Financial Potential Today

When considering a personal loan, understanding eligibility is crucial. Knowing the requirements helps streamline the application process.

Personal loans can be a great solution for various financial needs, whether you’re planning a home improvement project, covering an unexpected expense, or consolidating debt. But before you apply, it’s important to know if you meet the eligibility criteria. Factors like credit score, income, employment status, and debt-to-income ratio play significant roles in determining your eligibility. This blog will guide you through the essential aspects of personal loan eligibility, helping you prepare and increase your chances of approval. By understanding these criteria, you can confidently explore your options and find the right loan for your needs. For more details, visit personalloans.com.

Introduction To Personal Loan Eligibility

Personal loans can be a vital financial tool. They provide funds for emergencies, home improvements, business startups, and more. Understanding how to qualify for a personal loan is crucial. This ensures you can access the funds when you need them.

Understanding Personal Loans

Personal loans are a form of credit provided by banks, credit unions, and online lenders. They range from $250 to $35,000. The loan terms vary from 3 to 72 months. They can be used for various purposes, including paying unexpected bills, funding a family getaway, or starting a business.

The application process is straightforward. You fill out a simple online form, and the funds can be available as soon as the next business day. The APR for personal loans typically ranges from 5.99% to 35.89%.

Purpose Of Checking Eligibility

Checking eligibility for a personal loan is essential. It helps you understand if you qualify for the loan amount you need. Lenders consider several factors, such as your credit score, income, and employment history. These factors determine if you are eligible for the loan and the interest rate you will receive.

Being eligible for a loan ensures you can access funds quickly without unnecessary delays. It also helps you avoid applying for loans that you may not qualify for, saving time and protecting your credit score.

| Loan Amount | APR Range | Loan Terms |

|---|---|---|

| $250 to $35,000 | 5.99% to 35.89% | 3 to 72 months |

By understanding personal loan eligibility, you can make informed decisions. This ensures you get the best possible loan terms and conditions.

Key Features That Determine Personal Loan Eligibility

Understanding the key features that determine personal loan eligibility can help you secure the best loan offer. Personal Loans® connects borrowers with lenders offering loans from $250 to $35,000. Let’s explore the key factors that affect your eligibility.

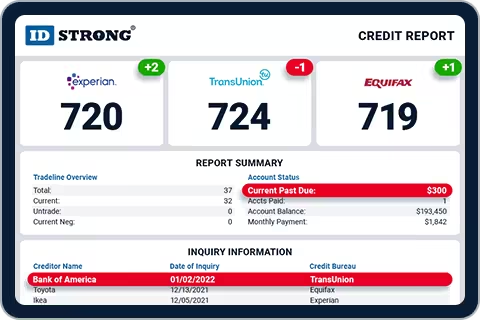

Credit Score And History

Your credit score plays a significant role in personal loan eligibility. Lenders use it to assess your creditworthiness. A higher credit score indicates responsible borrowing behavior. You can check your credit score through various credit monitoring services.

| Credit Score Range | Impact on Eligibility |

|---|---|

| 750 – 850 | Excellent – High approval chances |

| 700 – 749 | Good – Favorable terms |

| 650 – 699 | Fair – Limited options |

| 600 – 649 | Poor – Higher interest rates |

| 300 – 599 | Very Poor – Challenging to get approved |

Income And Employment Status

Lenders consider your income and employment status to determine if you can repay the loan. A stable job and a steady income improve your chances of approval. Self-employed individuals may need to provide additional documentation.

- Proof of income (pay stubs or tax returns)

- Employment verification

- Bank statements

Existing Debt And Financial Obligations

Your existing debt and financial obligations impact your loan eligibility. Lenders assess your debt-to-income (DTI) ratio to ensure you can manage additional debt. A lower DTI ratio is favorable.

- Calculate monthly debt payments

- Compare with monthly income

- Ensure DTI ratio is below 40%

Loan Amount And Purpose

The loan amount and purpose also affect eligibility. Lenders want to know how you plan to use the funds. Whether it’s for home improvement, debt consolidation, or other needs, clearly stating your purpose is essential.

Personal Loans® offers flexible loan amounts ranging from $250 to $35,000, with terms from 3 to 72 months. Use the funds for:

- Emergencies

- Home improvement

- Business startups

- Unexpected bills

- Family getaways

By understanding these key features, you can better prepare for the loan application process. Visit Personal Loans® for more information.

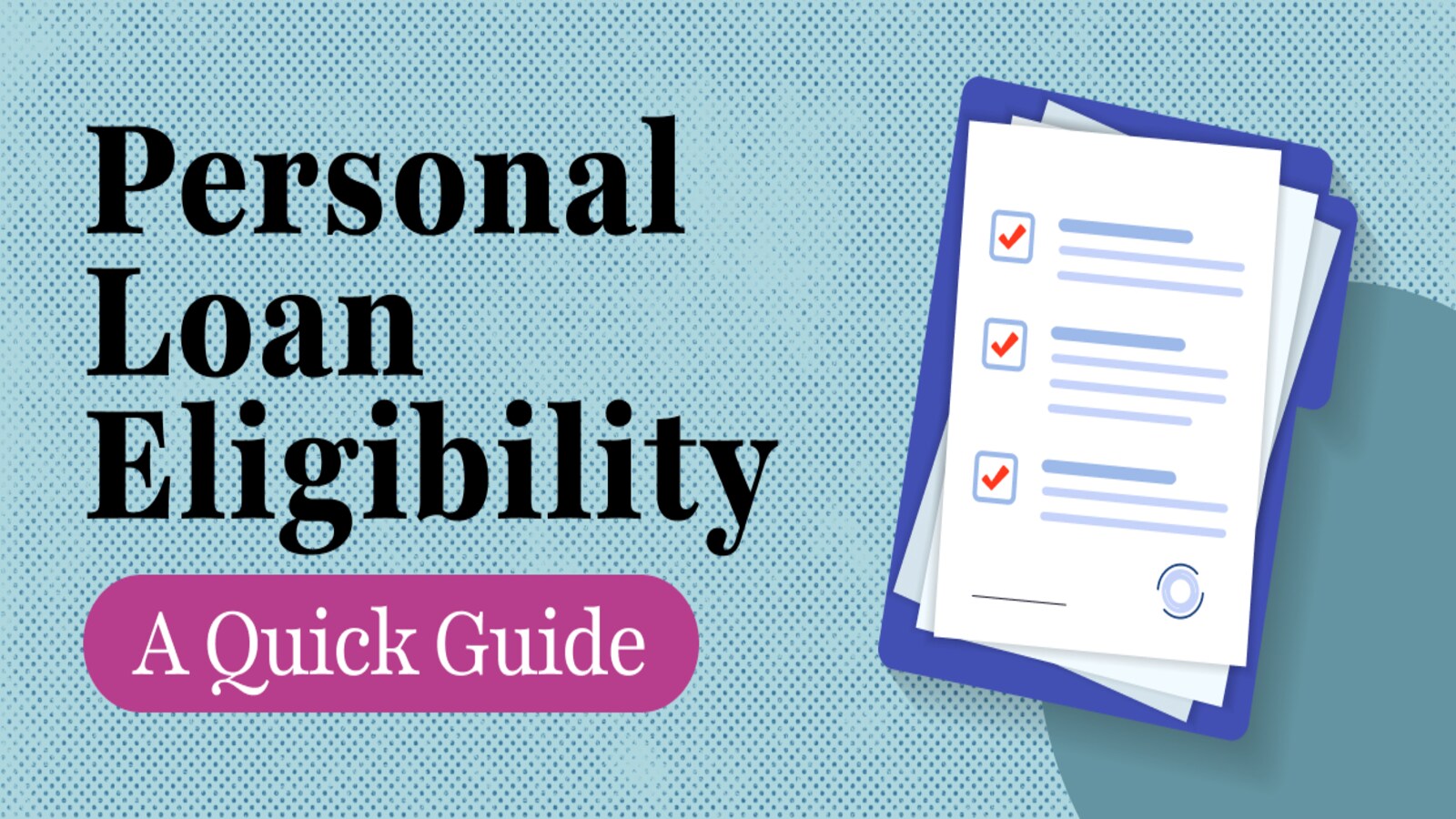

How To Check Your Personal Loan Eligibility

Before applying for a personal loan, it’s crucial to determine if you meet the eligibility criteria. Checking your eligibility can save time and increase your chances of approval. Below are some effective ways to check your personal loan eligibility.

Online Eligibility Calculators

Many financial websites offer online eligibility calculators. These tools are simple to use and provide instant results. You need to input basic details like your income, age, credit score, and loan amount. The calculator then assesses your eligibility based on the provided information.

For example, Personal Loans® offers an easy-to-use online application form. Within minutes, you can know if you qualify for a loan ranging from $250 to $35,000. This can be a quick way to understand your loan options without affecting your credit score.

Consulting With Financial Institutions

Another effective method is consulting directly with financial institutions. Many banks and lenders have customer service representatives who can help you understand their loan eligibility criteria. You may need to provide information such as your income, employment status, and credit history.

For instance, if you reach out to Personal Loans®, they can connect you with a network of lenders. This way, you get tailored advice and can explore various loan options suitable for your financial needs.

Documents Required For Eligibility Check

When checking your eligibility, you will need to have certain documents ready. These documents verify your identity, income, and creditworthiness. Here are some common documents required:

- Proof of Identity: Passport, Driver’s License, or National ID

- Proof of Income: Recent pay stubs, tax returns, or bank statements

- Proof of Address: Utility bills, rental agreements, or mortgage statements

- Credit Report: Most lenders will check your credit score and history

Having these documents prepared can streamline the eligibility check process. This ensures you can quickly and efficiently apply for a personal loan.

Using these methods, you can easily determine your personal loan eligibility. Whether you use online calculators, consult financial institutions, or gather necessary documents, being prepared helps you make informed decisions.

Factors That Can Improve Your Personal Loan Eligibility

Enhancing your personal loan eligibility can lead to better loan offers and terms. Understanding the factors that influence eligibility can help you make informed decisions. Below are key factors that can improve your personal loan eligibility.

Improving Your Credit Score

Your credit score is a crucial factor in loan eligibility. A higher credit score signifies reliability and reduces the lender’s risk. Here are some steps to improve your credit score:

- Pay bills on time.

- Maintain a low credit utilization ratio.

- Avoid applying for multiple credit accounts in a short period.

- Regularly review your credit report for errors.

Increasing Your Income

Higher income can significantly boost your loan eligibility. Lenders prefer borrowers with a stable and sufficient income. Consider the following ways to increase your income:

- Seek a higher-paying job or ask for a raise.

- Pursue additional income sources like freelancing or part-time jobs.

- Ensure all income sources are documented properly.

Reducing Existing Debt

High existing debt can negatively impact your loan eligibility. Reducing your debt-to-income ratio can make you a more attractive borrower. Follow these tips to reduce existing debt:

- Pay off high-interest debts first.

- Consolidate debts to manage payments better.

- Create a budget and stick to it.

- Avoid accumulating new debt.

Providing Collateral

Offering collateral can enhance your loan eligibility. Collateral reduces the lender’s risk, leading to better loan terms. Common collateral options include:

- Real estate property.

- Vehicles.

- Valuable assets like jewelry or savings accounts.

Ensure the collateral is well-documented and meets the lender’s requirements.

Pros And Cons Of Personal Loans

Personal loans can be a useful financial tool for managing unexpected expenses or consolidating debt. But, like any financial product, they come with both advantages and drawbacks. Understanding the pros and cons of personal loans helps you make an informed decision about whether they are the right choice for your financial situation.

Advantages Of Personal Loans

| Benefit | Description |

|---|---|

| Fast Funding | Quick online application process with potential funding by the next business day. |

| Flexible Usage | Loans can be used for emergencies, home improvement, business startups, unexpected bills, or family getaways. |

| Competitive Rates | Access to a wide network of lenders offering competitive rates. |

| Security | Advanced data encryption technology for secure information handling. |

- Free Service: No hidden fees, no upfront costs, and no obligation.

- Loan Amounts: $250 to $35,000.

- Loan Terms: 3 to 72 months.

- APR Range: 5.99% to 35.89%.

Drawbacks Of Personal Loans

- High Interest Rates: Some personal loans come with high APRs, especially for borrowers with lower credit scores.

- Origination Fees: Some lenders may charge fees to process your loan.

- Potential for Debt: If not managed properly, personal loans can lead to a cycle of debt.

- Impact on Credit Score: Missing payments can negatively affect your credit score.

Before choosing a personal loan, carefully consider both the benefits and drawbacks. Make sure it aligns with your financial needs and repayment ability.

Ideal Scenarios For Taking A Personal Loan

Personal loans can be a valuable financial tool for various needs. Understanding the ideal scenarios for taking a personal loan can help you make an informed decision. Below, we explore some common situations where a personal loan might be beneficial.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify monthly payments and reduce overall interest costs. With Personal Loans®, you can consolidate debts ranging from $250 to $35,000, making it easier to manage your finances.

Home Renovation

Home renovation projects can be expensive, but a personal loan can provide the necessary funds. Whether you need to update your kitchen, bathroom, or another part of your home, Personal Loans® offers flexible loan amounts and terms to suit your project needs.

Major Purchases

Sometimes, you might need to make a significant purchase, such as buying new appliances or furniture. A personal loan can help you spread the cost over time. With competitive rates and terms ranging from 3 to 72 months, Personal Loans® can make major purchases more manageable.

Emergency Expenses

Unexpected expenses can arise at any time, such as medical bills or car repairs. Having access to quick funds through a personal loan can provide peace of mind. Personal Loans® offers fast funding, with potential access to funds by the next business day, ensuring you can handle emergencies promptly.

For more information, visit PersonalLoans.com.

Conclusion: Unlocking Your Financial Potential

Understanding your personal loan eligibility is key to unlocking your financial potential. By knowing the factors that influence eligibility, you can better prepare and increase your chances of securing a loan. Let’s summarize the key points and final thoughts on loan eligibility and financial planning.

Summarizing Key Points

- Credit Score: A higher credit score improves your chances.

- Income: Steady income shows you can repay the loan.

- Employment History: Stable job history is a positive factor.

- Debt-to-Income Ratio: Lower ratios are more favorable.

- Loan Amount and Terms: Choose amounts and terms you can manage.

PersonalLoans.com offers a simple online application for loans ranging from $250 to $35,000. With loan terms between 3 to 72 months and APRs from 5.99% to 35.89%, you have options that fit various needs. This service provides fast funding, potentially as soon as the next business day, and flexible usage for emergencies, home improvement, and more.

Final Thoughts On Loan Eligibility And Financial Planning

Planning your finances carefully is crucial. Consider your current financial situation and future goals. Borrow responsibly and ensure you can meet repayment terms to avoid additional financial strain. PersonalLoans.com connects borrowers with a network of lenders, offering competitive rates and secure data handling. Always review loan offers thoroughly before acceptance to ensure they meet your needs.

By understanding personal loan eligibility and planning effectively, you can unlock your financial potential responsibly and confidently.

Frequently Asked Questions

What Is Personal Loan Eligibility?

Personal loan eligibility refers to the criteria lenders use to determine if you qualify for a loan. These criteria often include your credit score, income, employment status, and debt-to-income ratio.

How Does Credit Score Affect Loan Eligibility?

A higher credit score increases your chances of loan approval. It also helps you secure better interest rates. Lenders view high credit scores as a sign of financial responsibility.

What Income Is Required For A Personal Loan?

Lenders typically require a stable income for loan approval. The specific amount varies by lender. Generally, a higher income improves your chances of qualifying for a personal loan.

Can Self-employed Individuals Get A Personal Loan?

Yes, self-employed individuals can get personal loans. Lenders may require additional documentation, such as tax returns and business financial statements, to verify income stability.

Conclusion

Understanding personal loan eligibility can simplify your borrowing process. Evaluate your financial situation and credit score. Assess available options to find the best fit. Personal Loans® offers a user-friendly service connecting you to multiple lenders. Ready to explore your options? Click here to get started with Personal Loans®. Make informed decisions and secure the financial support you need.