Credit Score Improvement Plan: Boost Your Financial Health Today

Having a good credit score is crucial for financial well-being. It can affect your ability to get loans, credit cards, and even housing.

If you’re struggling with a low credit score, you might feel overwhelmed and unsure where to start. But don’t worry! This blog will guide you through an effective credit score improvement plan. Improving your credit score may seem daunting, but with the right steps, it’s achievable. Understanding what impacts your credit score is the first step. This includes factors like payment history, credit utilization, and length of credit history. Once you know what affects your score, you can take targeted actions to improve it. This blog will provide you with practical tips and resources, including tools like Credit Sesame, which offers free credit monitoring and personalized advice. Ready to take control of your credit? Let’s get started! For more details and to sign up, visit Credit Sesame.

Introduction To Credit Score Improvement

Improving your credit score is essential for better financial health. A high credit score opens many opportunities. It can lead to lower interest rates and better loan terms. This section will guide you through the importance of a good credit score and the benefits it brings.

Understanding The Importance Of A Good Credit Score

Your credit score is a numerical representation of your creditworthiness. Lenders use it to decide if you qualify for loans or credit cards. A good credit score indicates that you are a responsible borrower. This can increase your chances of getting approved for credit.

Let’s look at what a good credit score can do:

- Lower interest rates on loans and credit cards.

- Higher approval odds for loans and mortgages.

- Better terms and conditions for financial products.

Maintaining a good credit score helps you save money and achieve financial goals faster. Credit Sesame offers tools and resources to help you understand and improve your credit score.

How A High Credit Score Can Benefit You Financially

A high credit score can lead to significant financial benefits. Here are some key advantages:

| Benefit | Description |

|---|---|

| Lower Interest Rates | Pay less in interest on loans and credit cards. |

| Higher Credit Limits | Access larger amounts of credit when needed. |

| Better Loan Terms | Qualify for loans with favorable terms and conditions. |

| More Credit Options | Choose from a variety of credit products. |

| Easier Approval | Get approved for rentals and utility services easily. |

Credit Sesame can help you achieve a higher credit score through personalized advice and daily credit monitoring. This can improve your financial stability and open doors to better opportunities.

Key Features Of An Effective Credit Score Improvement Plan

Improving your credit score is essential for better financial health. A well-rounded plan involves consistent efforts across several areas. Below are the key features that can help you achieve a higher credit score.

Regular Monitoring Of Credit Reports

Regularly checking your credit reports is crucial. It helps you track your progress and spot errors. Credit Sesame offers free credit monitoring with daily updates. This ensures you stay informed about any changes to your credit score.

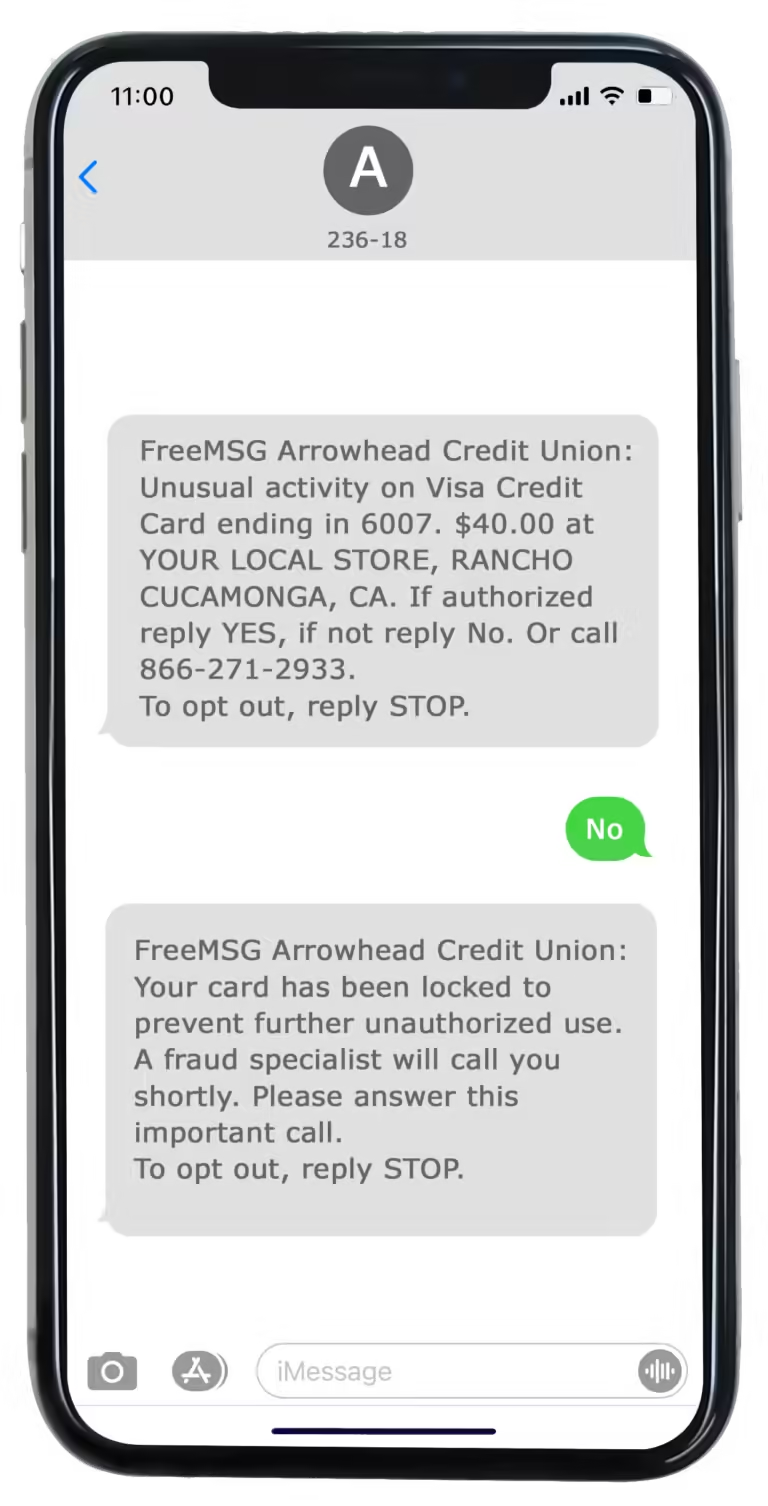

Timely Payment Of Bills And Debts

Paying bills on time is one of the most important factors in your credit score. Late payments can significantly lower your score. Set up reminders or automatic payments to ensure you never miss a due date. Credit Sesame’s tools can help you manage and track your payments effectively.

Reducing Outstanding Debt

High levels of outstanding debt can harm your credit score. Focus on paying down your debts to improve your credit utilization ratio. Use the personalized recommendations from Credit Sesame to create a debt repayment plan that works for you.

Diversifying Credit Mix

Having a mix of different types of credit can positively impact your score. This includes credit cards, mortgages, and installment loans. Credit Sesame can help you identify the best credit products to diversify your credit mix and improve your score.

Limiting New Credit Applications

Applying for too much new credit in a short period can lower your score. Be selective about new credit applications. Credit Sesame offers personalized credit offers with high approval odds, helping you choose wisely.

Using these key features in your credit score improvement plan can lead to significant progress. Credit Sesame provides the tools and resources you need to succeed. For more details, visit Credit Sesame.

Detailed Steps To Improve Your Credit Score

Improving your credit score can be a game-changer for your financial health. Follow these detailed steps to boost your credit score effectively. By focusing on key aspects like reviewing your credit reports, disputing errors, and managing your debts, you can set yourself up for financial success.

Obtaining And Reviewing Your Credit Reports

The first step to improving your credit score is to obtain and review your credit reports. You can get free credit reports from Credit Sesame. Carefully check the information provided in your credit report summary. Look for any discrepancies or errors that might be affecting your credit score.

Identifying And Disputing Errors

Errors on your credit report can significantly impact your credit score. Identify any inaccuracies in your report, such as incorrect personal information or inaccurate account statuses. Dispute these errors by contacting the credit bureau and providing necessary documentation to support your claim.

Creating A Payment Plan For Existing Debts

Existing debts can weigh heavily on your credit score. Create a structured payment plan to manage and reduce these debts. Prioritize high-interest debts first to minimize overall interest payments. Consistently making on-time payments will positively influence your credit score over time.

Strategies For Reducing Credit Card Balances

High credit card balances can negatively impact your credit utilization ratio. Implement strategies to reduce these balances, such as:

- Paying more than the minimum payment each month

- Utilizing balance transfer offers to lower interest rates

- Cutting back on non-essential expenses to allocate more funds towards debt repayment

Effective Use Of Credit Utilization Ratios

Your credit utilization ratio is a crucial factor in your credit score. Aim to keep your credit utilization below 30%. This means if you have a credit limit of $10,000, try to keep your balance below $3,000. Regularly monitor your credit utilization and make adjustments as needed to maintain a low ratio.

In summary, by following these detailed steps, you can improve your credit score and achieve better financial health. Using tools like Credit Sesame, you can monitor your progress and receive personalized recommendations tailored to your financial situation.

| Action | Impact on Credit Score |

|---|---|

| Obtaining and Reviewing Credit Reports | Identifies errors and discrepancies |

| Identifying and Disputing Errors | Corrects inaccuracies affecting score |

| Creating a Payment Plan | Improves payment history |

| Reducing Credit Card Balances | Lowers credit utilization ratio |

| Effective Credit Utilization | Maintains a healthy credit score |

For more details and to sign up, visit Credit Sesame.

The Role Of Credit Counseling Services

Credit counseling services play a crucial role in helping individuals improve their credit scores. These services offer professional guidance and strategies to manage debt, create budgets, and understand credit reports. Utilizing such services can provide a structured path towards financial stability and credit score enhancement.

When To Consider Credit Counseling

Consider credit counseling if you:

- Are struggling with high levels of debt.

- Have missed multiple payments.

- Are unsure how to read your credit report.

- Feel overwhelmed by your financial situation.

Credit counseling can be a valuable resource during these times. It offers expert advice and personalized plans tailored to your specific financial needs.

How To Choose A Reputable Credit Counseling Service

When choosing a credit counseling service, look for the following:

- Accreditation: Ensure the service is accredited by a reputable organization.

- Transparency: Review their fees and services. Avoid hidden charges.

- Reviews: Read customer reviews and ratings.

- Experience: Check the service’s experience in the industry.

These factors help ensure you receive reliable and effective credit counseling.

Benefits Of Professional Credit Guidance

Professional credit guidance offers several benefits:

| Benefit | Description |

|---|---|

| Personalized Plans | Receive tailored strategies to improve your credit score. |

| Expert Advice | Gain insights from experienced professionals in credit management. |

| Debt Management | Get help in managing and reducing your debt. |

| Financial Education | Learn how to maintain a healthy credit score. |

Using services like Credit Sesame can complement credit counseling. Credit Sesame provides daily credit scores, credit report summaries, and personalized actions to improve your credit score. With its comprehensive tools and resources, Credit Sesame helps you understand and manage your credit effectively.

For more details and to sign up, visit Credit Sesame’s official website.

Pros And Cons Of Diy Credit Score Improvement

Improving your credit score can open doors to better financial opportunities. Some people prefer to handle this process themselves. Let’s explore the advantages and disadvantages of managing your own credit score improvement.

Advantages Of Managing Credit Score Improvement Yourself

Taking charge of your credit score can be empowering. Here are some key advantages:

- Cost Savings: You avoid paying fees to credit repair agencies.

- Control: You have full control over your financial decisions.

- Education: You learn valuable financial skills by understanding credit factors.

- Personalized Actions: Services like Credit Sesame provide tailored advice to improve your score.

Potential Challenges And Pitfalls

Managing your credit score can be daunting. Consider these potential challenges:

- Time-Consuming: It requires consistent effort and patience.

- Complexity: Understanding all credit factors can be challenging for beginners.

- Potential Mistakes: Errors in handling disputes can lead to further issues.

When Professional Help Might Be Necessary

In some cases, professional help may be beneficial. Consider seeking help if:

- You have a very low credit score and need quick improvement.

- Your credit report has multiple errors or identity theft issues.

- You lack time or confidence to handle disputes and negotiations.

While DIY credit score improvement has its perks, it also comes with challenges. Whether you choose to manage it yourself or seek help, tools like Credit Sesame can guide you through the process with personalized advice and daily credit monitoring.

Pricing And Affordability Of Credit Improvement Solutions

Improving your credit score can be a game-changer for your financial health. But how much will it cost you? Understanding the pricing and affordability of various credit improvement solutions is crucial. Let’s explore the costs associated with credit monitoring services, credit counseling fees, and free or low-cost resources available for credit improvement.

Cost Of Credit Monitoring Services

Many credit monitoring services offer various pricing plans. For instance, Credit Sesame provides a free service where users can access their credit score, report summary, and personalized actions. This can be an excellent option for those who need basic monitoring without spending a dime.

Credit Sesame’s Sesame Cash feature has a $9.99 monthly fee, which can be waived if you meet certain conditions, such as depositing $500 or spending $1,000 monthly. Additionally, there is a $3 monthly inactivity fee, waived if there is account activity every 30 days. Be aware of potential international and out-of-network cash withdrawal fees, as well as third-party fees.

Fees Associated With Credit Counseling

Credit counseling services often come with fees, though these can vary widely. Some credit counseling agencies offer their services for free or at a low cost. Generally, these fees are used to cover the expense of providing educational materials and personalized counseling sessions.

It’s essential to research and compare different credit counseling services to find one that fits your budget and needs. Look for non-profit organizations that may offer lower fees or even free initial consultations.

Free And Low-cost Resources For Credit Improvement

There are numerous free and low-cost resources available for those looking to improve their credit scores. Websites like Credit Sesame offer free tools and resources, including daily credit scores, credit report summaries, and personalized advice on improving your credit score.

- Government Websites: Many government websites provide free information on managing and improving your credit.

- Non-Profit Organizations: Non-profits often offer free credit counseling and educational resources.

- Financial Blogs and Articles: Many financial websites and blogs provide valuable tips and strategies for improving your credit score.

Taking advantage of these free and low-cost resources can help you make significant improvements to your credit score without spending a fortune.

Ideal Users For Different Credit Improvement Strategies

Improving your credit score requires different strategies depending on your unique situation. Whether you’re a young adult, dealing with significant debt, or planning a major purchase, there are tailored approaches to help you succeed.

Best Practices For Young Adults

Young adults often start with little or no credit history. Building a strong foundation early can set you up for future financial success. Here are some effective strategies:

- Start with a secured credit card: This type of card requires a cash deposit as collateral, making it easier to get approved with no credit history.

- Become an authorized user: Ask a family member with good credit to add you to their credit card account. This can help you build credit without the responsibility of managing a card.

- Pay bills on time: Consistently paying your rent, utilities, and other bills on time can positively impact your credit score over time.

Strategies For Individuals With Significant Debt

If you’re dealing with significant debt, it can be challenging to improve your credit score. Focus on these strategies to manage debt and boost your score:

- Prioritize paying down high-interest debt: Focus on paying off credit cards and loans with the highest interest rates first.

- Consolidate your debt: Consider a debt consolidation loan to combine multiple debts into one monthly payment, often at a lower interest rate.

- Create a budget: Track your income and expenses to identify areas where you can cut back and allocate more funds toward debt repayment.

- Seek professional advice: A credit counselor can help you create a personalized plan to manage and reduce your debt.

Tips For Those Looking To Buy A Home Or Car

Planning to buy a home or car? Your credit score plays a crucial role in securing favorable loan terms. Follow these tips to improve your score before making a major purchase:

- Check your credit report: Ensure there are no errors or inaccuracies that could negatively impact your score. Correct any mistakes promptly.

- Reduce your credit utilization ratio: Aim to keep your credit card balances below 30% of your total available credit.

- Avoid new credit inquiries: Multiple credit inquiries in a short period can lower your score. Only apply for new credit when necessary.

- Pay off small debts: Clearing small debts can boost your score and show lenders you’re responsible with credit.

For personalized recommendations and tools to improve your credit score, consider using Credit Sesame. With features like daily credit score updates and tailored actions, you can take control of your credit journey.

Conclusion: Taking Control Of Your Credit Score Today

Improving your credit score can feel overwhelming. But with a clear plan, it becomes manageable. Understanding and managing your credit score is crucial for financial health. Using tools like Credit Sesame can make this journey easier.

Summarizing Key Takeaways

- Daily Credit Score: Monitor your score daily at no cost.

- Credit Report Summary: Get an instant summary of your credit report.

- Sesame Grade: Understand the five major factors affecting your score.

- Personalized Actions: Receive tailored recommendations to improve your score.

- Credit Offers: Find credit offers that match your profile.

- Credit Builder: Build credit using everyday purchases.

Encouragement To Take Action

Start today by signing up for Credit Sesame. It’s free and easy. Monitoring your credit score daily helps you stay on top of your financial health. Implement personalized actions to see improvements over time. Take control of your financial future with informed decisions.

Resources For Further Learning And Support

For more information and to sign up, visit Credit Sesame. Explore their tools and resources to improve your credit score. Use their personalized advice to achieve your financial goals faster. Don’t wait, start your credit improvement plan today.

Frequently Asked Questions

How Can I Improve My Credit Score Quickly?

Pay bills on time, reduce credit card balances, and avoid new credit inquiries. These actions can boost your score quickly.

What Is A Good Credit Score?

A good credit score ranges from 670 to 739. It reflects responsible credit use and timely payments.

How Often Should I Check My Credit Score?

Check your credit score at least once a month. Regular monitoring helps spot errors and track progress.

Does Paying Off Debt Improve My Credit Score?

Yes, paying off debt can improve your credit score. It reduces your credit utilization ratio and shows financial responsibility.

Conclusion

Improving your credit score takes time, patience, and consistent effort. Utilizing resources like Credit Sesame can help you track progress and stay informed. Their tools offer daily updates and personalized advice to guide your journey. To learn more about their free services, visit Credit Sesame. Start taking control of your financial future today.