Credit Score Simulator: Boost Your Financial Health Today

Understanding your credit score is crucial for financial health. A Credit Score Simulator can help you manage and improve your credit score effectively.

In today’s world, maintaining a good credit score is essential. It affects everything from loan approvals to interest rates. But many people find it challenging to understand what impacts their score. This is where a Credit Score Simulator like Credit Sesame comes into play. Credit Sesame provides a free and comprehensive tool that helps you monitor your credit score daily. It offers personalized advice on how to improve your score, making it easier for you to achieve your financial goals. Whether you’re looking to buy a home, get a better credit card, or simply want to improve your financial standing, Credit Sesame can guide you on your journey. Explore Credit Sesame now and take control of your credit health: Credit Sesame.

Introduction To The Credit Score Simulator

Understanding your credit score is crucial for financial health. The Credit Score Simulator offered by Credit Sesame is a powerful tool. It helps users understand how different actions affect their credit scores. Here, we will explore what this simulator is and its benefits.

What Is A Credit Score Simulator?

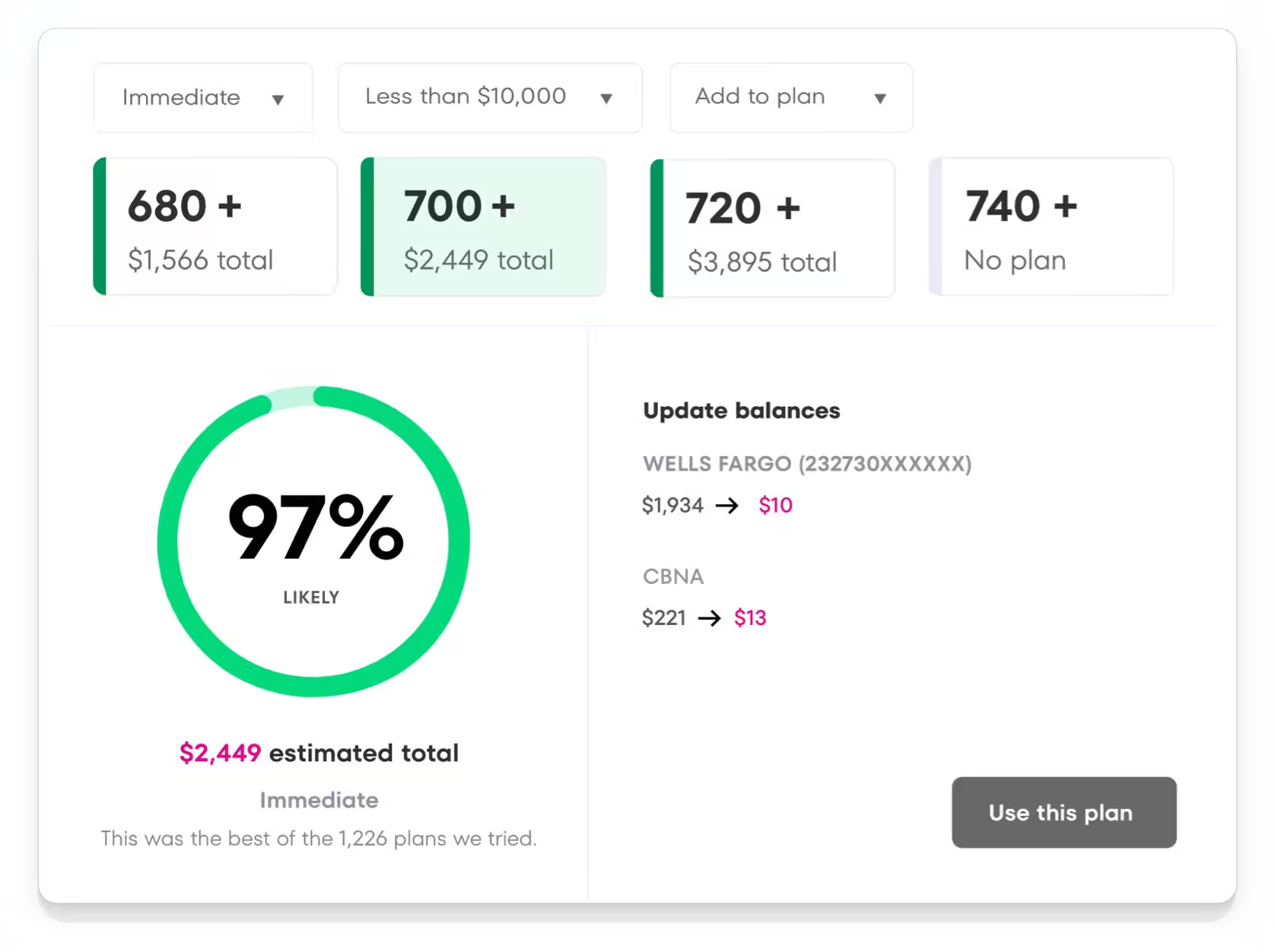

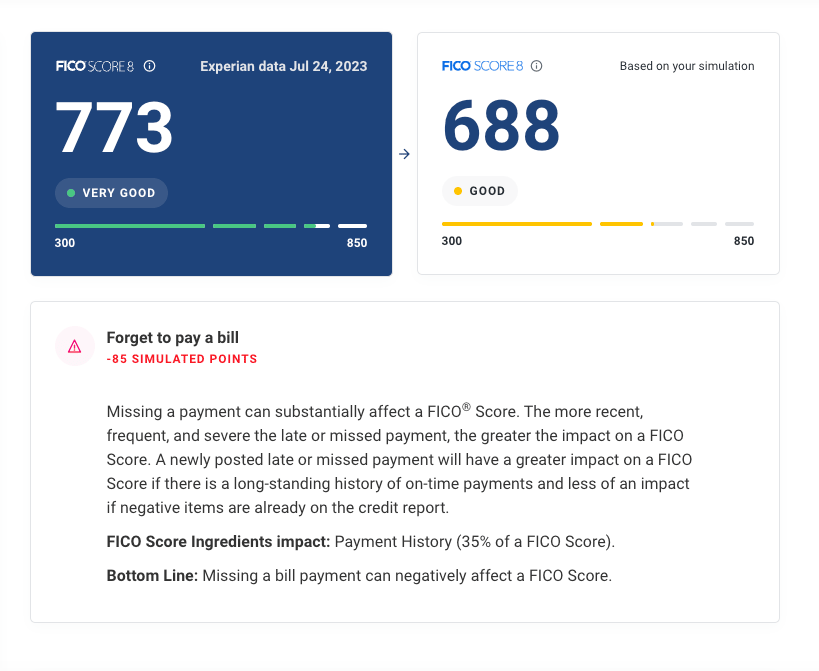

A Credit Score Simulator is an interactive tool. It allows users to see how various financial decisions might impact their credit score. Users can simulate actions such as paying off a credit card, taking out a new loan, or missing a payment. This helps in understanding the potential outcomes of these actions on their credit score.

Purpose And Benefits Of Using A Credit Score Simulator

The primary purpose of the Credit Score Simulator is to provide insight. It shows the potential impact of financial decisions on your credit score. The benefits are numerous:

- Daily Credit Score Monitoring: Keep track of your score regularly.

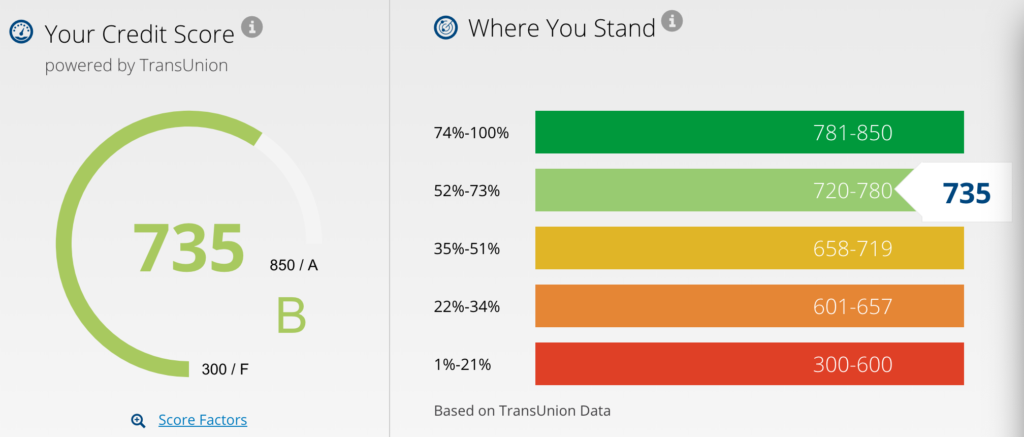

- Sesame Grade: Understand your score with a simple letter grade.

- Personalized Actions: Get tailored recommendations to improve your score.

Credit Sesame’s simulator also offers:

- Free Service: No cost to access basic features.

- No Credit Card Required: Access your score without sharing sensitive details.

- Secure Platform: Your data is protected with 256-bit encryption.

Using the Credit Score Simulator helps users make informed decisions. It supports better financial planning and credit management.

Key Features Of The Credit Score Simulator

The Credit Score Simulator by Credit Sesame offers an array of features designed to help users monitor and improve their credit scores. Let’s explore some of the key features that make this tool stand out.

User-friendly Interface

The Credit Score Simulator boasts a user-friendly interface that is simple to navigate. Even those new to credit score monitoring can easily understand and use the tool. The dashboard provides clear and concise information, ensuring users can quickly access their credit score details.

Real-time Credit Score Updates

With the Credit Score Simulator, users receive real-time credit score updates. This feature allows users to stay informed about any changes to their credit score as they happen. Daily updates help users stay on top of their credit health and take immediate action if needed.

Personalized Credit Score Improvement Plans

The tool offers personalized credit score improvement plans. These plans include tailored recommendations to help users improve their credit scores. Credit Sesame analyzes the user’s credit profile and provides specific actions to achieve financial goals faster.

Comprehensive Credit Report Analysis

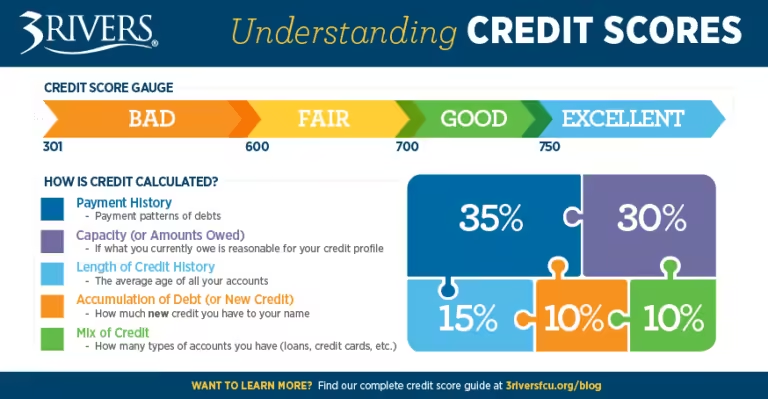

Credit Sesame’s Credit Score Simulator provides a comprehensive credit report analysis. This feature breaks down the five major factors impacting the user’s credit score. Users receive a clear letter grade, known as the Sesame Grade, for each factor. This analysis helps users understand what areas need improvement and how to address them.

In summary, the Credit Score Simulator by Credit Sesame offers a user-friendly interface, real-time updates, personalized improvement plans, and comprehensive credit report analysis. These features empower users to take control of their credit health with ease.

How Each Feature Benefits You

Credit Sesame offers a range of features designed to help you manage and improve your credit score. Understanding how each feature benefits you can make a big difference in your financial journey. Below, we explore these benefits in detail.

Simplifying Credit Score Management

Managing your credit score can be complex. Credit Sesame simplifies this with its Daily Credit Score Monitoring. You can check your credit score daily without hassle. This feature helps you see what factors impact your score.

Additionally, the Sesame Grade provides a clear letter grade based on the five major factors that impact credit scores. This makes it easier to understand your credit health at a glance.

Staying Informed With Real-time Updates

Staying updated on your credit status is crucial. Credit Sesame keeps you informed with real-time updates. These updates ensure you know any changes to your credit score immediately.

With this feature, you can take timely actions to address any issues. This proactive approach helps in maintaining a healthy credit score.

Tailored Strategies For Credit Score Improvement

Improving your credit score often requires specific actions. Credit Sesame offers Personalized Actions to help improve your credit score. These recommendations are tailored to your financial goals.

Moreover, the platform provides Tailored Offers with high chances of approval based on your credit profile. This ensures you make informed decisions that align with your credit status.

Understanding Your Credit Report In-depth

Understanding your credit report is essential for credit management. Credit Sesame offers tools to help you dive deep into your credit report. This includes detailed analysis and insights into factors affecting your score.

The platform also provides a secure environment with 256-bit encryption to protect your data. You can rest assured that your personal information is safe.

To summarize, Credit Sesame’s features offer comprehensive credit management. From monitoring your score daily to providing tailored actions and in-depth understanding of your credit report, each feature is designed to benefit you in your credit journey.

Pricing And Affordability

Understanding the pricing and affordability of Credit Sesame is crucial for users. Below is a detailed breakdown of the subscription plans, cost-benefit analysis, and a comparison of free versus paid features.

Subscription Plans Overview

| Plan | Features | Cost |

|---|---|---|

| Free Membership |

|

Free |

| Sesame Cash |

|

$9.99/month (waived with conditions) |

Cost-benefit Analysis

Credit Sesame offers significant value through its free and paid plans. Below is a simple cost-benefit analysis to help you decide:

- Free Membership: Provides essential tools for monitoring and improving credit scores without any cost. Ideal for users who need basic credit management.

- Sesame Cash: Offers advanced features like Credit Builder. The monthly fee is $9.99 but can be waived with $500 direct deposit or $1,000 monthly spending. This plan suits users who want to actively build their credit.

Free Vs. Paid Features

Comparing the free and paid features of Credit Sesame helps users understand the added value:

- Free Features:

- Daily credit score monitoring

- Sesame Grade

- Personalized actions

- Tailored offers

- Paid Features (Sesame Cash):

- Credit Builder

- Prepaid debit card for everyday purchases

- Virtual secured credit card

Both plans offer robust features. The free plan is suitable for basic credit management. The paid plan is ideal for those looking to build credit quickly.

Pros And Cons Of The Credit Score Simulator

The Credit Score Simulator by Credit Sesame offers users an insightful tool to manage and improve their credit scores. While it has several benefits, there are areas that need improvement. This section covers the pros and cons of using the Credit Score Simulator.

Advantages: Real-world Benefits

- Daily Credit Score Monitoring: Users can check their credit score every day. They can see what factors impact their score.

- Personalized Actions: The simulator provides tailored recommendations. These help users improve their credit scores faster.

- Offers: Users get tailored offers with high chances of approval. These offers are based on their credit profile.

- Free Service: There is no cost to sign up and use the basic features.

- No Credit Card Required: Users can access their credit score without entering credit card information.

Limitations: Areas For Improvement

- Monthly Fee: The Sesame Cash feature has a $9.99 monthly fee. This fee is waived if certain conditions are met.

- Inactivity Fee: An inactivity fee of $3 is applied if there is no money movement or purchase within a 30-day period.

- Additional Fees: Extra charges may apply for international and out-of-network cash withdrawals, third-party services, and cash deposits.

| Feature | Details |

|---|---|

| Daily Credit Score Monitoring | Check your credit score daily and see impacting factors. |

| Personalized Actions | Get tailored recommendations to improve your credit score. |

| Offers | Receive tailored offers with high chances of approval. |

| Monthly Fee | $9.99, waived if certain conditions are met. |

| Inactivity Fee | $3 if no money movement or purchase within 30 days. |

Credit Sesame’s Credit Score Simulator offers many benefits. Daily monitoring and personalized actions can significantly help users. Yet, some fees might be a concern for some users. Overall, understanding these pros and cons can help users make informed decisions about managing their credit.

Ideal Users And Scenarios

The Credit Score Simulator by Credit Sesame is a powerful tool designed for a variety of users. It helps individuals understand how different actions affect their credit scores. This section will delve into who benefits most from using the simulator and the best situations for its utilization.

Who Should Use The Credit Score Simulator?

Credit Sesame offers tools for different types of users. Below are some groups that can benefit from the Credit Score Simulator:

- Young Adults: Individuals new to credit can learn how different financial actions impact their scores.

- Home Buyers: Those planning to purchase a home can simulate how improving their credit score affects mortgage offers.

- Individuals with Poor Credit: Users working to repair their credit can use the tool to see potential improvements.

- Frequent Travelers: People applying for new credit cards to maximize travel rewards can assess the impact on their scores.

- Loan Seekers: Those considering personal or auto loans can predict the outcomes of their credit behavior.

Best Situations For Utilizing The Tool

The Credit Score Simulator is useful in various scenarios. Here are some of the best situations to use the tool:

- Before Applying for a Loan: Understand how paying off debts or closing accounts will affect your score.

- Planning Large Purchases: Assess how financing options for large purchases impact your credit.

- Credit Card Management: Determine the effects of opening new cards or increasing limits.

- Debt Repayment Strategies: Test different debt repayment plans to see which improves your score the most.

- Financial Planning: Use the simulator to make informed decisions about your financial future.

For more details on how Credit Sesame can help you manage and build your credit, visit their official website.

Frequently Asked Questions

What Is A Credit Score Simulator?

A credit score simulator is an online tool. It predicts how certain actions impact your credit score. It helps users make informed financial decisions.

How Accurate Is A Credit Score Simulator?

Credit score simulators provide estimates. They are generally accurate but not exact. Various factors influence your actual credit score.

Can A Credit Score Simulator Improve My Score?

A credit score simulator itself doesn’t improve your score. It helps you understand the impact of financial actions. This knowledge can guide you in improving your credit score.

Do Credit Score Simulators Affect My Score?

No, using a credit score simulator does not affect your score. It only provides a simulated result based on your inputs.

Conclusion

Using a credit score simulator can be a game changer. It helps you understand and improve your financial health. Credit Sesame offers tools and personalized actions to boost your credit score. Regular monitoring keeps you informed and secure. Start your credit journey today with Credit Sesame. It’s free, simple, and effective. Manage your credit confidently and achieve your financial goals faster. Explore your options now and take control of your credit future.