Rebuilding Credit: Proven Strategies for Financial Recovery

Rebuilding credit can seem daunting, but it’s entirely possible. With the right strategies, you can improve your financial health.

If your credit score has taken a hit, don’t worry. Many people have been in your shoes and successfully rebuilt their credit. It’s all about taking the right steps and being consistent. In this blog post, we’ll guide you through the process of rebuilding your credit. From understanding your credit report to making timely payments, we’ll cover essential tips and strategies. Plus, we’ll introduce helpful resources like PersonalLoans.com that can assist you in this journey. Let’s get started on the path to better credit and a brighter financial future.

Introduction To Rebuilding Credit

Rebuilding credit can feel daunting, but it’s a crucial step toward financial stability. Understanding the basics of credit scores, the importance of good credit, and common causes of credit damage can help you start on the right path.

Understanding Credit Scores

Credit scores are numerical representations of your creditworthiness. They range from 300 to 850, with higher scores indicating better credit health. Lenders use these scores to evaluate the risk of lending money to you.

The main factors influencing your credit score include:

- Payment History: Timely payments boost your score, while late payments harm it.

- Credit Utilization: The amount of credit used compared to the total available credit.

- Credit History Length: Longer credit histories tend to improve your score.

- New Credit: Frequent new credit inquiries can negatively impact your score.

- Credit Mix: A diverse mix of credit types (e.g., credit cards, mortgages) can benefit your score.

The Importance Of Good Credit

Good credit opens doors to many financial opportunities. Here are some key benefits:

- Lower Interest Rates: With good credit, you qualify for lower interest rates on loans and credit cards.

- Higher Loan Approvals: Lenders are more likely to approve your loan applications.

- Better Insurance Rates: Some insurers offer lower premiums to individuals with good credit.

- Rental Opportunities: Landlords often check credit scores before approving rental applications.

Common Causes Of Credit Damage

Understanding the common causes of credit damage can help you avoid pitfalls:

- Late Payments: Missing or delaying bill payments is one of the most significant factors that hurt your credit score.

- High Credit Utilization: Using a large portion of your available credit can negatively impact your score.

- Defaulting on Loans: Failing to repay loans leads to severe credit damage.

- Bankruptcy: Filing for bankruptcy has a long-lasting negative effect on your credit.

- Frequent Credit Inquiries: Applying for multiple credit accounts in a short period can lower your score.

To rebuild your credit, consider services like PersonalLoans.com. This service connects you with lenders offering flexible loan options. It’s a helpful step in managing your finances and improving your credit score.

Assessing Your Current Credit Situation

Rebuilding your credit can feel like an uphill battle, but it all starts with a single step: assessing your current credit situation. Understanding where you stand with your credit is crucial for making informed decisions that help improve your financial health.

Obtaining Your Credit Report

The first step in this journey is to obtain your credit report. You are entitled to a free credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion, once every 12 months. Reviewing your credit report helps you understand your credit history and current standing.

- Visit AnnualCreditReport.com to request your free reports.

- Ensure you get reports from all three bureaus for a comprehensive view.

Identifying Errors And Disputing Them

Errors on your credit report can significantly impact your credit score. Carefully review each report for inaccuracies such as incorrect personal information, accounts that aren’t yours, or outdated data.

- Mark any discrepancies you find.

- Contact the credit bureau to dispute errors.

- Provide any documentation that supports your claim.

Correcting these errors can lead to a quick boost in your credit score, so it is worth the effort.

Understanding Your Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you are using compared to your total credit limit. This ratio plays a significant role in your credit score. Keeping this ratio below 30% is generally recommended.

| Credit Card | Credit Limit | Current Balance | Utilization Ratio |

|---|---|---|---|

| Card A | $5,000 | $1,500 | 30% |

| Card B | $3,000 | $900 | 30% |

To calculate your credit utilization ratio, divide your current balance by your credit limit, then multiply by 100 to get a percentage.

Example: $1,500 (balance) ÷ $5,000 (limit) × 100 = 30%

By understanding and improving these aspects of your credit, you can take control of your financial future and start the process of rebuilding your credit.

Proven Strategies For Improving Your Credit Score

Rebuilding your credit score can seem daunting, but it is achievable with the right strategies. Improving your credit score involves consistent financial habits and a thorough understanding of how credit works. Let’s explore some proven strategies that can help you boost your credit score effectively.

Paying Bills On Time

One of the most important factors in your credit score is your payment history. Paying bills on time shows lenders that you are reliable and can manage your finances responsibly.

- Set up automatic payments to ensure you never miss a due date.

- Use reminders on your phone or calendar for payment dates.

- If you struggle with multiple bills, consolidate them if possible.

Reducing Debt

High levels of debt can negatively impact your credit score. Reducing debt not only improves your credit score but also provides financial relief.

- Create a budget to manage your expenses and prioritize debt payments.

- Consider using the debt snowball or avalanche methods to pay off debts.

- Avoid taking on new debt while trying to reduce existing balances.

Keeping Credit Card Balances Low

Your credit utilization ratio plays a significant role in your credit score. Keeping credit card balances low helps maintain a healthy credit utilization ratio.

- Aim to use less than 30% of your total credit limit.

- Pay off your credit card balances in full each month if possible.

- If you have multiple credit cards, spread out your spending to keep balances low.

By following these strategies, you can steadily improve your credit score. For more financial tips and loan options, visit PersonalLoans.com.

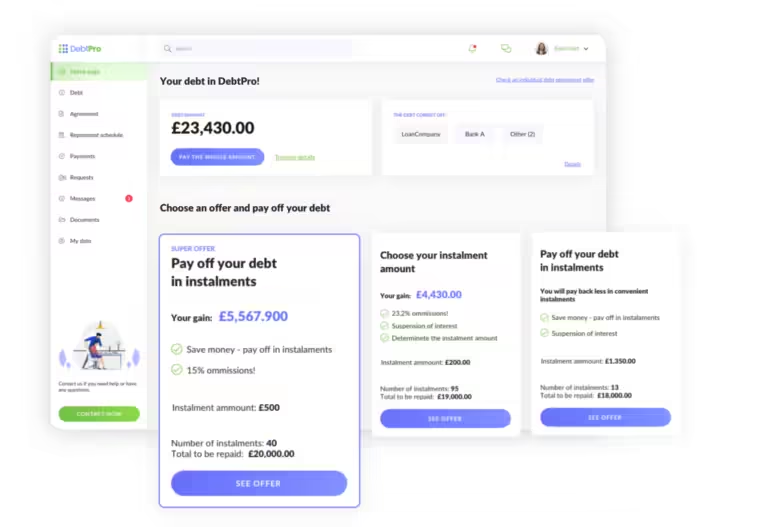

Utilizing Credit-building Tools

Rebuilding credit can be a challenging task. Fortunately, there are several credit-building tools available to help you improve your credit score. Utilizing these tools effectively can lead to significant progress over time. This section discusses some of the most effective credit-building tools.

Secured Credit Cards

Secured credit cards are an excellent way to rebuild credit. These cards require a cash deposit as collateral, which usually serves as your credit limit. By using a secured credit card responsibly, you can demonstrate good credit habits.

- Easy approval compared to unsecured cards

- Helps establish a positive payment history

- Reports to major credit bureaus

- Make small purchases regularly

- Pay off your balance in full each month

- Keep your credit utilization low

Credit-builder Loans

Credit-builder loans are designed specifically for credit-building purposes. With these loans, the borrowed amount is held in a savings account while you make payments. Once the loan is paid off, the funds are released to you.

- Helps establish a positive payment history

- Reports to major credit bureaus

- Builds savings while improving credit

- Choose a loan with affordable monthly payments

- Make all payments on time

- Monitor your credit report for improvements

Authorized User Status

Becoming an authorized user on someone else’s credit card can help you rebuild credit. As an authorized user, you are added to an existing credit card account. The account’s positive payment history can benefit your credit score.

- No credit check required

- Access to a longer credit history

- Potential improvement in credit score

- Ask a trusted family member or friend

- Ensure the primary account holder has good credit

- Monitor your credit report for changes

Utilizing these credit-building tools can be an effective strategy to rebuild your credit. By understanding and applying these methods, you can take significant steps towards improving your credit score.

Avoiding Common Credit Mistakes

Rebuilding credit can seem challenging, but avoiding common credit mistakes can make the process smoother. By understanding and steering clear of these pitfalls, you can enhance your credit score more effectively.

Avoiding Late Payments

Late payments can significantly harm your credit score. Always pay at least the minimum amount due on time. Setting up automatic payments or reminders can help you stay on track. Even one late payment can linger on your credit report for years, so prioritize timely payments.

Limiting Hard Inquiries

Each time you apply for credit, it results in a hard inquiry on your credit report. Too many hard inquiries within a short period can lower your credit score. Only apply for credit when necessary and be mindful of the potential impact on your credit score.

Understanding The Impact Of Closing Accounts

Closing credit accounts may seem like a good idea, but it can actually hurt your credit score. Closed accounts reduce your total available credit, which can increase your credit utilization ratio. It’s often better to keep accounts open, even if you don’t use them frequently, to maintain a healthy credit profile.

Monitoring Your Progress

Rebuilding credit is a journey, and monitoring your progress is crucial. Keeping track of your credit score, using credit monitoring services, and setting financial goals can help you stay on the right path. Here’s how to do it effectively.

Regularly Checking Your Credit Score

Regularly checking your credit score is essential to monitor your credit health. It helps you identify trends and spot any errors early. Most major credit bureaus offer free credit reports annually. You can also use services like PersonalLoans.com to understand your credit standing better. Knowing your score helps you make informed decisions.

Using Credit Monitoring Services

Credit monitoring services provide real-time updates on changes to your credit report. These services alert you about new accounts, inquiries, and potential fraud. PersonalLoans.com offers a simple online form to connect you with lenders, providing you with a comprehensive view of your financial health. Consistent monitoring can prevent identity theft and keep your credit score intact.

Setting Financial Goals

Setting financial goals gives you a clear roadmap for rebuilding credit. Start with small, achievable targets like paying off high-interest debt. Use the loans from PersonalLoans.com wisely for emergencies or home improvements. Establishing goals keeps you motivated and focused. It also helps in creating a budget and sticking to it.

Specific Recommendations For Different Situations

Rebuilding credit can be challenging, but tailored strategies for different scenarios can make the process smoother. Here are specific recommendations for various situations:

Recent Graduates

Recent graduates often face difficulties establishing credit. Here are some steps to help:

- Apply for a secured credit card. Use it responsibly to build a credit history.

- Consider a credit-builder loan. These loans are designed to help build credit.

- Become an authorized user. Ask a family member to add you to their credit card.

- Monitor your credit report. Ensure there are no errors that could affect your score.

Individuals Recovering From Bankruptcy

Recovering from bankruptcy requires patience and strategic planning:

- Start with a secured credit card. It helps rebuild credit with responsible use.

- Consider a credit-builder loan. These loans can aid in establishing a positive payment history.

- Pay all bills on time. Timely payments are crucial for rebuilding credit.

- Keep credit utilization low. Aim to use less than 30% of your available credit.

Those With No Credit History

For individuals with no credit history, taking the first steps can be daunting:

- Apply for a secured credit card. This is an excellent way to start building credit.

- Consider a credit-builder loan. These are specifically designed for those new to credit.

- Use a co-signer. A co-signer with good credit can help you get approved for loans.

- Rent reporting services. Some services report your rent payments to credit bureaus.

Building or rebuilding credit takes time and consistency. Utilize resources like PersonalLoans.com to explore loan options that can assist in your financial journey.

Frequently Asked Questions

How Can I Rebuild My Credit Score?

Start by checking your credit report for errors. Pay bills on time and reduce debt. Consider secured credit cards or credit-builder loans.

How Long Does It Take To Rebuild Credit?

Rebuilding credit usually takes about six months to a year. The exact timeline depends on your financial habits and the severity of previous issues.

What Is A Secured Credit Card?

A secured credit card requires a cash deposit as collateral. It helps build credit by reporting your payments to credit bureaus.

Will Paying Off Debt Improve My Credit Score?

Yes, paying off debt can improve your credit score. It reduces your credit utilization ratio and shows responsible financial behavior.

Conclusion

Rebuilding credit takes time and patience. Stay consistent with your efforts. Remember, every small step counts. Track your progress and celebrate milestones. For financial assistance, consider using PersonalLoans.com. This service connects you to lenders offering various loan options. Whether you need funds for emergencies or unexpected bills, you can find competitive rates and flexible terms. Always review loan offers carefully. Start your journey to better credit today. Reliable support is just a click away. Keep moving forward and stay dedicated. Your financial future looks brighter with every step.