Identity Theft Protection: Essential Tips to Secure Your Identity

Identity theft is a growing concern in today’s digital age. Protecting your identity has never been more crucial.

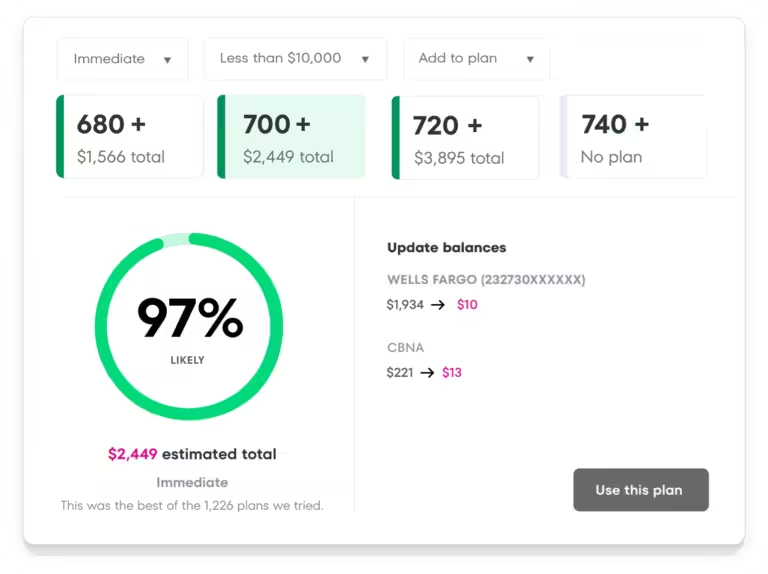

Identity theft can lead to financial loss and emotional distress. That’s why it’s vital to take steps to safeguard your personal information. Credit Sesame offers a free service that provides daily access to your credit score and report summary. This helps you monitor any changes and take action quickly if something seems off. With features like daily credit score updates, personalized recommendations, and tools to build your credit, Credit Sesame gives you the confidence and tools to protect your identity. Sign up today and gain peace of mind knowing your credit is in good hands. Learn more about Credit Sesame here.

Introduction To Identity Theft Protection

Identity theft is a growing concern in our digital age. Protecting your identity is crucial. Understanding how to safeguard your personal information can save you from significant financial and emotional distress.

Understanding Identity Theft

Identity theft occurs when someone uses your personal information without permission. This can include your name, Social Security number, or credit card details. Thieves can use this information to open new accounts, make purchases, or commit fraud. The impacts can be devastating. From damaged credit to legal issues, the fallout can be extensive.

There are various types of identity theft, such as:

- Financial Identity Theft: Using your credit card or bank details.

- Medical Identity Theft: Using your health insurance for medical treatments.

- Criminal Identity Theft: Giving your details during an arrest.

The Importance Of Protecting Your Identity

Protecting your identity is more important than ever. Data breaches and cyber-attacks are increasingly common. Here are key reasons to protect your identity:

- Prevent Financial Loss: Identity theft can drain your bank accounts.

- Maintain Good Credit: Unauthorized transactions can damage your credit score.

- Avoid Legal Troubles: Identity theft can lead to wrongful arrests.

Using services like Credit Sesame can be beneficial. Credit Sesame offers:

| Main Features | Benefits |

|---|---|

| Daily Credit Score Updates | Monitor changes in your credit score daily. |

| Personalized Actions | Receive customized tips to improve your credit score. |

| Best Offers | Find credit offers with high approval chances. |

| Credit Builder | Build credit using Sesame Cash with no credit check. |

Credit Sesame’s security measures, including 256-bit encryption, ensure your data remains private. This service can help you stay vigilant and protect your identity effectively.

Key Features Of Effective Identity Theft Protection

Identity theft protection is crucial in today’s digital world. It safeguards your personal and financial information. Effective identity theft protection services include several key features.

Monitoring Your Personal Information

Continuous monitoring of your personal information helps in early detection of any suspicious activities. Services like Credit Sesame provide daily credit score updates and a credit report summary.

Credit Sesame also offers a Sesame Grade to help you understand the major factors impacting your credit score. This continuous monitoring is essential for protecting your identity.

Alerts And Notifications

Timely alerts and notifications are vital for preventing identity theft. With Credit Sesame, you receive personalized actions to improve your credit score. This service can notify you of any changes in your credit report, enabling you to act quickly.

Real-time alerts help you stay informed and take immediate action if any suspicious activity is detected.

Identity Restoration Services

If your identity is compromised, restoration services are essential. These services assist in resolving issues and restoring your identity. Credit Sesame provides tools to help you improve your credit score, which can be part of the restoration process.

Having access to resources and support for identity restoration gives you peace of mind.

Insurance And Financial Protection

Effective identity theft protection services often include insurance and financial protection. This coverage can help mitigate the financial impact of identity theft. Credit Sesame’s Sesame Cash feature helps you build credit using everyday purchases, offering financial security without a credit check.

Understanding the benefits and features of identity theft protection services ensures that you stay protected and secure.

Essential Tips To Secure Your Identity

Identity theft is a growing concern in today’s digital world. Protecting your personal information is crucial to avoid financial and personal distress. Here are some essential tips to help you secure your identity effectively.

Using Strong And Unique Passwords

Create strong and unique passwords for each of your online accounts. Avoid using common words or easily guessable information like your name or birthdate. A strong password typically includes a mix of upper and lower case letters, numbers, and special characters. Consider using a password manager to keep track of your passwords securely.

Regularly Checking Your Credit Reports

Regularly check your credit reports to monitor any suspicious activity. Credit Sesame provides daily access to your credit score and credit report summary, helping you stay informed about changes. This service is free and does not require a credit card for sign-up. You can also receive personalized recommendations to improve your credit score.

Being Cautious With Personal Information Online

Be cautious when sharing personal information online. Avoid posting sensitive information on social media or other public platforms. Ensure that websites where you enter personal details are secure and use encryption. Credit Sesame uses 256-bit encryption to protect your data, ensuring it remains private and secure.

Recognizing Phishing Scams

Recognize and avoid phishing scams. These scams often come in the form of emails or messages that appear to be from legitimate sources, asking for personal information. Always verify the sender’s email address and avoid clicking on suspicious links. Report any phishing attempts to the relevant authorities.

Securing Your Devices And Networks

Secure your devices and networks to protect your personal information. Use antivirus software and keep it updated. Ensure your home Wi-Fi network is password-protected and avoid using public Wi-Fi for sensitive transactions. Regularly update your operating systems and applications to protect against security vulnerabilities.

For more information and tools to help you secure your identity, consider using Credit Sesame. Their services offer free access to credit scores and reports, personalized actions to improve your credit, and robust data protection.

Pros And Cons Of Identity Theft Protection Services

Identity theft protection services have become vital in today’s digital age. They offer various features to safeguard personal information. But are they worth it? Let’s delve into the benefits and potential drawbacks of these services.

Benefits Of Using Identity Theft Protection Services

Identity theft protection services provide numerous advantages to users. Here are some of the key benefits:

- Early Detection: These services monitor your personal information and alert you to suspicious activity quickly.

- Credit Monitoring: Regular updates on your credit report help you stay informed about any changes. Services like Credit Sesame offer daily credit score updates and credit report summaries.

- Financial Advice: Personalized recommendations can guide you on improving your credit score and financial health.

- Peace of Mind: Knowing that your data is protected by 256-bit encryption gives confidence and security.

- Comprehensive Protection: Some services include features like Sesame Cash, which builds credit without a credit check or security deposit.

Potential Drawbacks To Consider

While identity theft protection services offer many benefits, there are some potential drawbacks to consider:

- Cost: Premium features often come with fees. For example, Credit Sesame’s Sesame Cash has a $9.99 monthly fee, which can be waived under specific conditions.

- Limited Coverage: Some services might not cover all types of identity theft or may have limited insurance coverage.

- False Sense of Security: Relying solely on these services can make users complacent about other important security practices.

- Service Variability: The quality and scope of services can vary widely between providers.

By understanding these pros and cons, you can make an informed decision about identity theft protection services. For more information on Credit Sesame, visit their website.

Pricing And Affordability Of Identity Theft Protection Services

Identity theft protection services offer peace of mind and security. However, the cost of these services can vary significantly. Understanding the pricing models, comparing costs, and evaluating value for money can help you make an informed decision.

Overview Of Pricing Models

Identity theft protection services typically follow three main pricing models:

- Free Services: Some services, like Credit Sesame, offer basic features at no cost. These may include daily credit score updates and personalized recommendations.

- Monthly Subscription: Many services charge a monthly fee. For example, Credit Sesame offers a Sesame Cash account with a monthly fee of $9.99, which can be waived under certain conditions.

- Annual Subscription: Some providers offer annual plans at a discounted rate compared to monthly subscriptions.

Comparing Costs Of Different Services

Below is a table comparing the costs of various identity theft protection services:

| Service | Free Plan | Monthly Plan | Annual Plan | Additional Fees |

|---|---|---|---|---|

| Credit Sesame | Yes | $9.99 (waived with $500 deposit or $1,000 spend) | N/A | $3 inactivity fee, international withdrawal fees |

| Service A | No | $14.99 | $149.99 | None |

| Service B | Yes | $12.99 | $129.99 | Transaction fees |

Evaluating Value For Money

Evaluating the value for money involves considering the features and benefits offered by each service:

- Features: Look at the features provided. Credit Sesame, for example, offers daily credit score updates, personalized actions, and best credit offers.

- Benefits: Consider the benefits. Credit Sesame provides free access, confidence in applications, and secure data protection.

- Customer Reviews: Check customer reviews. Credit Sesame has an average rating of 4.8 out of 5 from 564K reviews.

In summary, understanding the pricing and affordability of identity theft protection services is crucial. By comparing costs and evaluating value for money, you can select a service that meets your needs and budget.

Specific Recommendations For Ideal Users Or Scenarios

Identity theft protection is crucial in the digital age. Knowing who needs it and when can prevent financial and personal distress. Below, we detail specific recommendations for ideal users and scenarios.

Who Should Consider Identity Theft Protection

Not everyone needs identity theft protection, but certain groups benefit greatly:

- Frequent Online Shoppers: Regularly sharing credit card information online increases risk.

- Individuals with High Credit Limits: Higher limits make you an attractive target for thieves.

- People with Poor Credit History: They may be more vulnerable to fraudulent activities.

- Business Owners: Sensitive business data can be targeted and misused.

Scenarios Where Identity Theft Protection Is Crucial

Consider the following scenarios to understand where identity theft protection becomes essential:

| Scenario | Reason |

|---|---|

| Frequent Travel | Travelers often use public Wi-Fi, which can be insecure. |

| Data Breach Victim | Past breaches can lead to future identity theft. |

| Large Social Media Presence | Public profiles can reveal personal information. |

| Using Shared Computers | Shared devices can compromise your data security. |

Identity theft protection, such as services offered by Credit Sesame, can help monitor and safeguard your personal and financial information. Credit Sesame provides daily credit score updates, personalized recommendations, and tools to improve your credit score, all while ensuring data security with 256-bit encryption.

Frequently Asked Questions

What Is Identity Theft?

Identity theft occurs when someone uses your personal information without permission. This can include your name, Social Security number, or credit card details.

How Can I Protect Myself From Identity Theft?

Protect yourself by using strong passwords, monitoring your credit reports, and being cautious with personal information. Avoid sharing details online.

What Are Signs Of Identity Theft?

Unusual bank transactions, unexpected bills, and unfamiliar accounts are signs. Monitor your credit report regularly to detect issues early.

Can Identity Theft Affect My Credit Score?

Yes, identity theft can negatively impact your credit score. Fraudulent activities can lead to unpaid bills and increased debt.

Conclusion

Protecting your identity is crucial in today’s digital age. Using services like Credit Sesame can help you monitor and improve your credit score. Daily updates and personalized actions offer peace of mind. Safe, secure, and easy to use, it’s a valuable tool for safeguarding your financial future. Start managing your credit today and stay one step ahead of identity theft.