Best Credit Cards For Rewards: Maximize Your Benefits Today

Credit cards offer a great way to earn rewards on everyday spending. The right credit card can turn your purchases into valuable points, cash back, or travel miles.

Finding the best credit card for rewards can be a game-changer for your finances. Whether you are looking for cash back, travel perks, or points for shopping, there’s a card out there that suits your needs. This guide will help you navigate the options and choose the best card for maximizing rewards. With the right card, you can earn significant benefits from your regular expenses. Keep reading to discover the top credit cards for rewards and how they can enhance your financial life. For those looking to improve their credit, consider using tools like Credit Sesame to monitor and build your credit.

Introduction To Rewards Credit Cards

Rewards credit cards offer a way to earn points, miles, or cashback on your everyday spending. They can be a great tool for maximizing your purchases, especially if you pay off your balance each month. Here, we’ll explore what rewards credit cards are and their purpose.

What Are Rewards Credit Cards?

Rewards credit cards provide incentives for using the card. These incentives usually come in the form of points, miles, or cashback. Every time you make a purchase, you earn rewards that you can redeem for various benefits.

There are different types of rewards credit cards:

- Cashback Cards: Earn a percentage of your spending back as cash.

- Travel Cards: Earn miles or points that can be redeemed for travel-related expenses.

- Points Cards: Earn points that can be used for various rewards, including gift cards, merchandise, and more.

The Purpose Of Rewards Credit Cards

The main goal of rewards credit cards is to provide added value to your spending. They encourage cardholders to use their credit cards more frequently by offering rewards for every purchase.

These cards can also help with:

- Saving Money: By earning cashback or points, you can reduce the overall cost of your purchases.

- Travel Perks: Travel rewards cards offer benefits like free flights, hotel stays, and access to airport lounges.

- Financial Flexibility: Rewards can be redeemed for a variety of options, providing flexibility in how you use them.

Choosing the right rewards credit card depends on your spending habits and financial goals. Always compare different cards and their benefits to find the best fit for you.

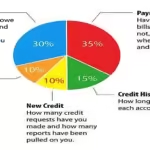

Key Features Of Top Rewards Credit Cards

Choosing the best credit card for rewards can be a daunting task. The key features of top rewards credit cards can help make that choice easier. These cards offer various benefits that cater to different financial habits and spending patterns. Understanding these features can help you maximize the benefits and rewards from your credit card.

Types Of Rewards Programs

Rewards credit cards generally come with different types of rewards programs. The three main types include:

- Cash Back: Earn a percentage of your spending back as cash.

- Points: Accumulate points that can be redeemed for various products or services.

- Miles: Ideal for travelers, these cards reward you with miles that can be used for flights and travel-related expenses.

Sign-up Bonuses And Promotional Offers

Many rewards credit cards offer generous sign-up bonuses. These are often based on spending a certain amount within the first few months. Promotional offers may include:

- Bonus Points: Earn extra points on initial spending.

- Introductory APR: Benefit from a low or 0% APR for an initial period.

- Cash Back Offers: Higher cash back rates on specific categories during the promotion period.

Cash Back Vs. Points Vs. Miles

Understanding the differences between cash back, points, and miles is crucial. Here is a comparison table:

| Type | Best For | Redemption Options |

|---|---|---|

| Cash Back | Everyday Purchases | Statement credits, checks, or direct deposits |

| Points | Flexible Spending | Gift cards, merchandise, travel, or cash back |

| Miles | Travel Expenses | Flights, hotels, car rentals, travel packages |

Annual Fees And Interest Rates

Annual fees and interest rates are important considerations. Some cards offer:

- No Annual Fee: Ideal for those who want to avoid extra costs.

- Low Interest Rates: Beneficial for those who carry a balance.

- Fee Waivers: Some cards waive fees for the first year or upon meeting specific criteria.

Additional Perks And Benefits

Top rewards credit cards often come with additional perks. These may include:

- Travel Insurance: Coverage for trip cancellations, lost luggage, and more.

- Purchase Protection: Coverage for damaged or stolen items.

- Extended Warranty: Additional warranty on purchases.

- Concierge Services: Personal assistance for various needs.

Understanding these key features can help you choose the best rewards credit card that fits your lifestyle and financial goals. Utilize tools like Credit Sesame to monitor your credit and find suitable credit offers that match your profile.

Comparing Popular Rewards Credit Cards

Finding the best rewards credit card can be daunting. Let’s compare some popular options to help you choose the right one for your needs. Each card has unique benefits that cater to different lifestyles and spending habits.

Card A: Overview And Key Benefits

Card A is designed for frequent travelers. It offers impressive travel perks and rewards.

- Sign-Up Bonus: Earn 50,000 points after spending $3,000 in the first three months.

- Travel Rewards: 2x points on travel and dining, 1x point on all other purchases.

- Annual Fee: $95, waived for the first year.

- Additional Perks: No foreign transaction fees, airport lounge access.

Card B: Overview And Key Benefits

Card B is perfect for those who love cashback rewards. It provides excellent cashback rates on everyday purchases.

- Sign-Up Bonus: $200 cashback after spending $500 in the first three months.

- Cashback Rewards: 5% cashback on grocery store purchases, 1% on all other purchases.

- Annual Fee: No annual fee.

- Additional Perks: Cashback match for the first year.

Card C: Overview And Key Benefits

Card C is ideal for balance transfers and those seeking low interest rates. It offers a long introductory APR period.

- Sign-Up Bonus: None.

- Balance Transfer: 0% APR for 18 months on balance transfers.

- Annual Fee: $0.

- Additional Perks: Access to credit score monitoring and financial tools.

Card D: Overview And Key Benefits

Card D offers a mix of travel and cashback rewards. It’s suited for those wanting a versatile rewards program.

- Sign-Up Bonus: 40,000 points after spending $1,000 in the first three months.

- Rewards Program: 3x points on travel and dining, 1x point on all other purchases.

- Annual Fee: $95.

- Additional Perks: Travel insurance and purchase protection.

When choosing a rewards credit card, consider your spending habits and lifestyle. Each card offers unique benefits that can enhance your financial experience.

Pricing And Affordability Breakdown

When choosing a credit card for rewards, understanding the pricing and affordability is crucial. This section will break down the costs involved, helping you make an informed decision.

Annual Fees: Are They Worth It?

Many credit cards come with annual fees, which can range from $0 to over $500. While a higher annual fee might seem daunting, it often comes with premium benefits.

Consider the rewards and perks offered. For example:

- Travel credits

- Cashback offers

- Exclusive access to airport lounges

If these perks align with your spending habits, the annual fee could be worth it. On the other hand, if you prefer a no-fee card, there are still many excellent options available.

Interest Rates: How They Affect Your Rewards

Interest rates play a significant role in the value of your rewards. If you carry a balance, high interest rates can quickly negate the benefits of any rewards earned.

Here’s a quick comparison:

| Card Type | Typical Interest Rate | Rewards Impact |

|---|---|---|

| Low-Interest Cards | 10-15% | Minimal impact on rewards |

| Standard Cards | 15-20% | Moderate impact on rewards |

| High-Interest Cards | 20%+ | Significant impact on rewards |

To maximize rewards, aim to pay off your balance in full each month.

Hidden Costs To Watch Out For

Beyond annual fees and interest rates, be aware of other hidden costs. These can include:

- Foreign transaction fees

- Late payment fees

- Balance transfer fees

These fees can add up and reduce the overall value of your rewards. Always read the fine print and understand all potential costs before applying for a card.

For instance, Credit Sesame offers valuable insights into credit card offers, helping you choose cards with high approval odds and minimal hidden fees.

Pros And Cons Of Using Rewards Credit Cards

Rewards credit cards can be an excellent tool for those looking to maximize their spending. They offer various benefits but also come with certain drawbacks. Understanding both sides can help you make an informed decision.

Advantages Of Rewards Credit Cards

Using rewards credit cards can offer several benefits:

- Earn Points or Cash Back: Rewards credit cards allow you to earn points or cash back on everyday purchases. This can translate into significant savings over time.

- Travel Perks: Many rewards cards offer travel-related benefits such as free checked bags, priority boarding, and access to airport lounges.

- Sign-Up Bonuses: Many cards offer substantial sign-up bonuses if you meet the spending requirements within the initial months. This can be a quick way to earn rewards.

- Flexibility: Rewards can often be redeemed in various ways, from statement credits to gift cards and travel expenses.

- Credit Building: Responsible use of rewards credit cards can help you build and maintain a good credit score.

Potential Drawbacks To Consider

While rewards credit cards offer many benefits, there are some drawbacks to consider:

- Annual Fees: Many rewards credit cards come with annual fees that can offset the benefits if you do not maximize the rewards.

- High-Interest Rates: These cards often have higher interest rates. If you carry a balance, the interest charges can outweigh the rewards earned.

- Complex Reward Structures: Some cards have complicated reward structures that make it difficult to understand how to maximize your benefits.

- Spending Temptation: The lure of earning more rewards can sometimes lead to overspending, resulting in debt accumulation.

- Limited Redemption Options: Certain cards may have limited options for redeeming rewards, making it challenging to use them effectively.

By carefully evaluating the pros and cons of rewards credit cards, you can decide if they are a good fit for your financial needs.

Recommendations For Ideal Users

Choosing the right credit card can be daunting. However, the right card maximizes rewards based on your spending habits. Here are our top picks for various types of users.

Best Rewards Credit Cards For Frequent Travelers

Frequent travelers benefit most from cards that offer travel rewards. These cards provide points or miles for every dollar spent on travel-related expenses.

- Chase Sapphire Preferred Card: Earn 2x points on travel and dining. Get 25% more value when you redeem for travel through Chase Ultimate Rewards.

- Capital One Venture Rewards Credit Card: Earn 2x miles on every purchase. Get a one-time bonus of 60,000 miles after spending $3,000 on purchases in the first 3 months.

Best Rewards Credit Cards For Everyday Spending

Everyday spending cards offer rewards on routine purchases like groceries and gas. These cards can help you earn while you shop for your daily needs.

- Blue Cash Preferred Card from American Express: Earn 6% cash back at U.S. supermarkets and on select streaming subscriptions.

- Citi Double Cash Card: Earn 2% cash back on all purchases. Get 1% when you buy and an additional 1% as you pay.

Best Rewards Credit Cards For Business Owners

Business owners need cards that offer rewards on business-related expenses. These cards often provide additional perks like travel benefits and purchase protection.

- Ink Business Preferred Credit Card: Earn 3x points on travel, shipping, internet, cable, and phone services, and advertising purchases made with social media sites and search engines.

- Capital One Spark Cash for Business: Earn 2% cash back on all business purchases with no limits or category restrictions.

Best Rewards Credit Cards For Students

Student cards offer rewards for those new to credit. These cards often come with educational resources to help students manage their credit responsibly.

- Discover it Student Cash Back: Earn 5% cash back on rotating categories each quarter. Get a dollar-for-dollar match of all the cash back earned at the end of your first year.

- Journey Student Rewards from Capital One: Earn 1% cash back on all purchases. Get an extra 0.25% cash back when you pay on time.

Conclusion: Maximizing Your Rewards

Choosing the best credit card for rewards can be challenging, but the benefits are worth the effort. By selecting the right card and using it wisely, you can maximize your rewards and improve your financial health. Here are some tips to help you get the most out of your rewards credit card.

Tips For Maximizing Your Rewards

- Understand Your Spending Habits: Identify where you spend the most money and choose a card that offers rewards in those categories.

- Pay Your Balance in Full: Avoid interest charges by paying your balance in full each month.

- Use Multiple Cards: Consider using different cards for different spending categories to maximize rewards.

- Take Advantage of Sign-Up Bonuses: Look for cards with generous sign-up bonuses and meet the spending requirements to earn them.

- Redeem Rewards Wisely: Use your rewards for the best value, whether it’s travel, cash back, or gift cards.

- Stay Informed: Keep track of your rewards and any changes to your credit card terms and conditions.

Final Thoughts On Choosing The Right Card

Choosing the right rewards credit card depends on your financial goals and spending habits. Consider the following factors:

- Annual Fees: Some cards have annual fees that can be offset by the rewards you earn.

- Interest Rates: Look for cards with low interest rates if you plan to carry a balance.

- Rewards Structure: Choose a card that offers the most rewards for your spending habits.

- Additional Benefits: Consider other benefits such as travel insurance, purchase protection, and extended warranties.

Credit Sesame can help you find the best credit card for your needs. With its free credit monitoring service, daily credit score updates, and personalized tips, Credit Sesame provides valuable tools to manage and build your credit. Visit Credit Sesame to learn more and start maximizing your rewards today.

Frequently Asked Questions

What Are The Top Credit Cards For Rewards?

The top credit cards for rewards include Chase Sapphire Preferred, Capital One Venture Rewards, and American Express Gold Card. These cards offer excellent reward rates, flexible redemption options, and various perks.

Which Credit Card Offers The Best Travel Rewards?

The Chase Sapphire Preferred card offers the best travel rewards. It provides 2x points on travel and dining, plus a valuable sign-up bonus. Points can be transferred to multiple travel partners.

What Is The Best Cashback Credit Card?

The Citi Double Cash Card is one of the best cashback credit cards. It offers 2% cashback on all purchases, with no category restrictions.

How Can I Maximize Credit Card Rewards?

To maximize credit card rewards, use cards strategically based on spending categories, pay your balance in full, and take advantage of sign-up bonuses and promotional offers.

Conclusion

Choosing the best rewards credit card can greatly enhance your financial journey. Evaluate your spending habits and pick a card that maximizes your benefits. Don’t forget to monitor your credit regularly. For effective credit management and monitoring, consider using Credit Sesame. It offers daily updates and personalized tips to help you improve your credit. Stay informed and make smart decisions to enjoy the full potential of your rewards credit card.