Credit Repair Companies: Boost Your Financial Health Today

Navigating the world of credit repair can be daunting. Many find themselves overwhelmed by low credit scores and confusing credit reports.

This is where credit repair companies come into play. They offer specialized services to help individuals improve their credit scores, making financial goals more attainable. Credit repair companies analyze your credit reports and address any errors or issues. They help you understand the factors affecting your credit and provide strategies to improve it. With the right guidance, you can boost your score and gain better financial opportunities. One such helpful tool is Credit Sesame. It offers free daily credit score checks, personalized advice, and secure data protection. You can check out Credit Sesame here to start your credit repair journey today.

Introduction To Credit Repair Companies

Credit repair companies help individuals improve their credit scores by identifying and disputing errors on their credit reports. Understanding how these companies work and the benefits they offer can be crucial for anyone looking to enhance their financial health.

What Are Credit Repair Companies?

Credit repair companies specialize in analyzing credit reports and identifying inaccuracies or negative items that may be affecting credit scores. They work on behalf of clients to dispute these errors with credit bureaus and creditors.

These companies use various strategies to remove inaccurate or outdated information. They may also offer personalized advice to help clients build better credit habits over time.

The Importance Of Good Credit

A good credit score opens the door to many financial opportunities. It can lead to lower interest rates on loans and credit cards, better chances of approval for rental applications, and even job opportunities.

Good credit also provides a sense of financial security, making it easier to handle unexpected expenses and plan for the future. This is why maintaining a healthy credit score is essential.

| Feature | Credit Sesame |

|---|---|

| Daily Credit Score Check | Yes |

| Sesame Grade | Yes |

| Personalized Actions | Yes |

| Credit Offers | Yes |

| Credit Builder | Yes |

| Secure Data | Yes |

Credit Sesame is a free service that offers daily credit score checks and a comprehensive view of credit health. With personalized recommendations and secure data protection, it helps users improve their credit scores and make informed financial decisions.

Some of the key features include a Sesame Grade, which provides a clear letter grade based on the five major factors affecting credit scores, and access to the best credit offers with high chances of approval.

Whether you’re looking to build credit with everyday purchases or need tailored advice to reach your financial goals, Credit Sesame offers valuable tools and resources.

:fill(white):max_bytes(150000):strip_icc()/Credit_Firm-101624023efd4060a99ca114ed667359.jpg)

Key Features Of Credit Repair Services

Credit repair companies offer a range of services designed to help individuals improve their credit scores. These services are essential for anyone looking to enhance their financial health. Below, we’ll explore the key features of credit repair services.

Credit Report Analysis

A thorough credit report analysis is the first step. Credit repair companies review your credit report in detail. They identify errors, inaccuracies, or outdated information. This analysis helps pinpoint areas that need improvement.

Dispute Filing And Management

Dispute filing and management are crucial services offered by credit repair companies. They handle the process of disputing incorrect or unfair items on your credit report. This includes drafting dispute letters and managing responses from credit bureaus.

Credit Monitoring And Alerts

Credit repair companies often provide credit monitoring and alerts. This service keeps you informed of any changes to your credit report. Regular updates help you stay on top of your credit health. Alerts notify you of significant changes, allowing for prompt action if needed.

Personalized Credit Counseling

Personalized credit counseling is another key feature. Credit repair companies offer tailored advice based on your specific financial situation. Counselors provide strategies to improve your credit score. They also offer guidance on managing debt and making informed financial decisions.

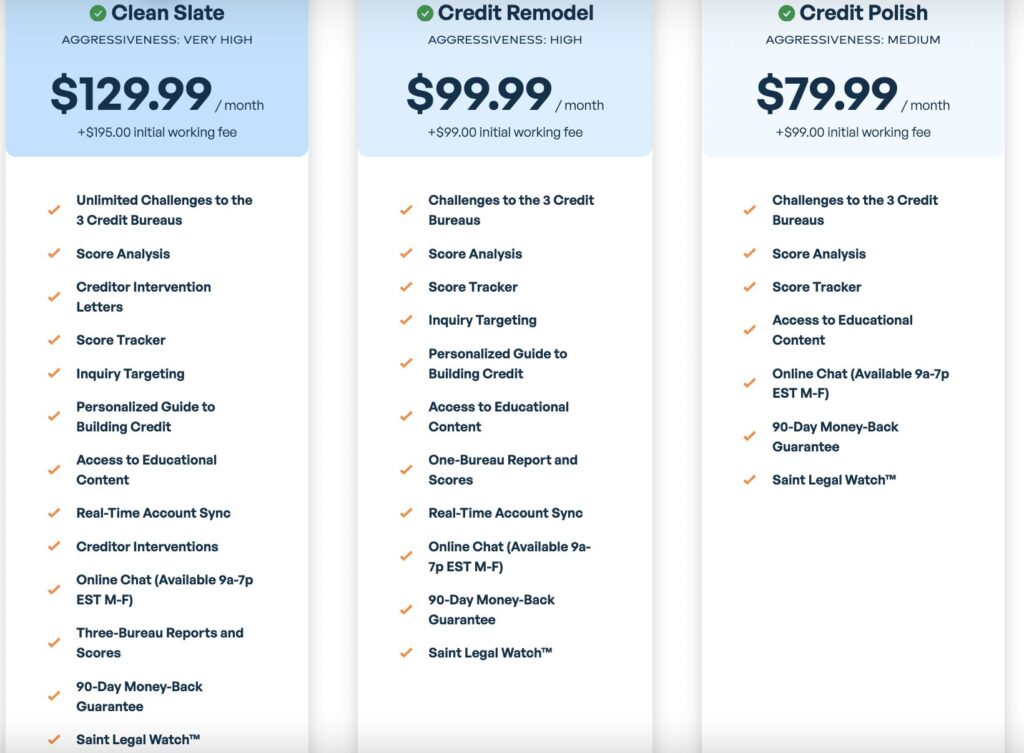

Pricing And Affordability Of Credit Repair Services

Credit repair services can vary greatly in cost. Understanding the pricing and affordability of these services is essential. This section will break down the typical costs, compare free and paid services, and explore money-back guarantees.

Typical Cost Breakdown

Credit repair services often have different pricing structures. Here is a typical cost breakdown:

| Service Type | Cost |

|---|---|

| Initial Setup Fee | $19 – $99 |

| Monthly Fees | $49 – $129 |

| Individual Dispute Fees | $10 – $15 per item |

These fees cover various services. This includes credit report analysis, dispute letter drafting, and ongoing monitoring.

Free Vs. Paid Services

There are both free and paid credit repair services. Free services, like Credit Sesame, offer basic features. These include daily credit score checks and credit report summaries.

- Free Services: No cost, basic credit monitoring, personalized advice.

- Paid Services: Comprehensive repair, detailed dispute handling, faster results.

Paid services often provide more comprehensive solutions. They handle detailed disputes and offer faster results. Credit Sesame provides a free service but has additional paid features like Sesame Cash.

Money-back Guarantees

Many credit repair companies offer money-back guarantees. This ensures customer satisfaction. These guarantees vary by company:

- Satisfaction Guarantee: Full refund if no improvement in credit score.

- Time-Based Guarantee: Refund if no results within a specified period.

Understanding these guarantees can provide peace of mind. It ensures that your investment in credit repair services is protected.

Credit Sesame offers free access to credit monitoring and personalized advice. This makes it an affordable option for those seeking to improve their credit score.

Pros And Cons Of Using Credit Repair Companies

Credit repair companies like Credit Sesame offer tools and resources to help improve your credit score. They provide a convenient way to manage and repair your credit. However, it’s important to consider both the advantages and potential drawbacks before deciding to use their services.

Advantages Of Professional Credit Repair

- Daily Credit Score Check: Monitor your credit score daily and track changes.

- Sesame Grade: Understand your credit health with a clear letter grade based on key factors.

- Personalized Actions: Get tailored recommendations to improve your credit score.

- Credit Offers: Access high-approval credit offers, increasing chances of approval.

- Credit Builder: Build credit using everyday purchases with a prepaid debit card and virtual secured credit card.

- Secure Data: Enjoy peace of mind with 256-bit encryption protecting your data.

Potential Drawbacks To Consider

- Monthly Fees: While the core service is free, additional services like Sesame Cash have a $9.99 monthly fee and a $3 monthly inactivity fee.

- Limited Free Features: Some advanced features may require a paid subscription.

- Initial Setup: Setting up and understanding the service can take time.

- Data Source: Credit data is provided by TransUnion, which may not cover all credit bureaus.

- Fee Waivers: Monthly and inactivity fees can be waived, but specific conditions must be met.

Choosing whether to use a credit repair company involves weighing these pros and cons to determine if the service aligns with your financial goals and needs.

Ideal Users For Credit Repair Services

Credit repair services can be beneficial for many individuals. These services help to improve credit scores and resolve issues on credit reports. Credit Sesame is one such service that provides valuable tools and resources.

Who Can Benefit Most?

Credit repair services are ideal for those struggling with poor credit scores. Individuals with inconsistent credit histories can also benefit. Those who have experienced financial setbacks might find these services helpful.

Here are some specific groups that can gain the most:

- People with low credit scores

- Individuals who have faced bankruptcy

- Consumers with errors on their credit reports

- Those looking to make significant financial decisions, like buying a house or car

Specific Scenarios For Using Credit Repair Services

There are various scenarios where credit repair services can be particularly useful. Let’s explore some common situations:

| Scenario | How Credit Repair Services Help |

|---|---|

| High Debt Levels | Provide strategies to manage and reduce debt. |

| Credit Report Errors | Help dispute and correct inaccuracies on credit reports. |

| Bankruptcy or Foreclosure | Assist in rebuilding credit after significant financial setbacks. |

| Identity Theft | Offer solutions to recover from fraudulent activities. |

Credit Sesame offers a comprehensive service to monitor and improve credit. With features like daily credit score checks and personalized advice, users can stay on top of their credit health. The Sesame Grade provides a clear understanding of the factors affecting their credit score.

Using services like Credit Sesame can lead to better financial decisions. Whether aiming for high approval odds or personalized financial goals, the benefits are significant. Plus, the service is free and secure, with no initial fees required.

Conclusion: Enhancing Your Financial Health With Credit Repair

Credit repair companies like Credit Sesame provide essential tools to improve your financial health. With the right approach, you can achieve a better credit score and make informed financial decisions. Let’s summarize the benefits and offer final recommendations.

Summarizing The Benefits

Credit Sesame offers a range of benefits that make it an excellent choice for credit repair:

- Free Access: No credit card is required to sign up and use the service.

- Daily Credit Score Check: Monitor your credit score daily and see changes.

- Sesame Grade: Understand your credit health with a clear letter grade.

- Personalized Actions: Get recommendations to improve your credit score.

- Credit Offers: Access the best credit offers with high approval chances.

- Credit Builder: Build credit using everyday purchases with a prepaid debit card and virtual secured credit card.

- Secure Data: Enjoy peace of mind with 256-bit encryption protecting your data.

Final Recommendations

To enhance your financial health effectively, consider these final recommendations:

- Regular Monitoring: Check your credit score daily to stay informed.

- Understand Your Sesame Grade: Use it to identify areas needing improvement.

- Follow Personalized Actions: Implement tailored suggestions to boost your credit score.

- Leverage Credit Offers: Apply for credit products that suit your financial needs and have high approval odds.

- Utilize Credit Builder: Use the prepaid debit card and virtual secured credit card to build credit.

By following these recommendations, you can make significant strides in improving your credit score. Credit Sesame offers the tools and resources to guide you on this journey, ensuring you reach your financial goals faster.

Frequently Asked Questions

What Are Credit Repair Companies?

Credit repair companies help improve your credit score. They identify and dispute errors on your credit report. They work on your behalf with credit bureaus and creditors.

Are Credit Repair Companies Legitimate?

Yes, many credit repair companies are legitimate. However, some scams exist. Research thoroughly and choose a reputable company. Check reviews and credentials.

How Much Do Credit Repair Companies Charge?

Credit repair companies typically charge between $19 and $149 per month. Fees vary based on the services provided. Some may charge a one-time setup fee.

How Long Does Credit Repair Take?

Credit repair usually takes three to six months. The duration depends on the complexity of your credit issues. Patience and persistence are key.

Conclusion

Choosing the right credit repair company is crucial. It can greatly impact your financial health. Credit Sesame offers a free, comprehensive service. It helps you monitor and improve your credit score. With daily updates and personalized advice, you can make informed decisions. Start your credit repair journey today with Credit Sesame and take control of your financial future.