Credit Monitoring Services: Protect Your Financial Future Today

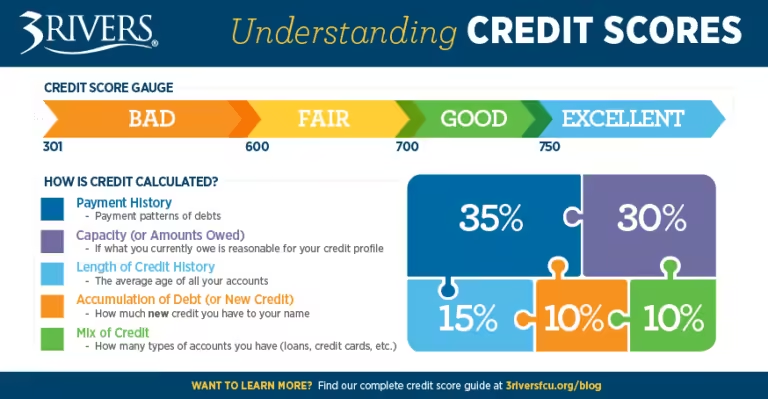

Understanding your credit score is crucial for financial health. Credit monitoring services help you stay on top of your credit status.

Credit Sesame, a leading name in this field, offers a free and user-friendly service. It provides daily updates on your credit score and a clear summary of your credit report. Credit Sesame is designed to help you understand your credit score better and offers personalized actions to improve it. With features like tailored credit offers and a credit builder tool, it’s a comprehensive service. Whether you’re looking to build, repair, or simply monitor your credit, Credit Sesame has you covered. For more information, you can check out their service here.

Introduction To Credit Monitoring Services

Credit monitoring services are essential tools in managing your financial health. They help you stay informed about your credit status and protect against identity theft. One such service is Credit Sesame. It offers daily updates on your credit score and personalized insights to improve your credit.

What Are Credit Monitoring Services?

Credit monitoring services track changes in your credit report. They alert you to significant updates like new accounts, inquiries, or changes in your credit score. These services help you understand the factors affecting your credit score and provide recommendations to improve it.

Importance Of Credit Monitoring

Monitoring your credit is crucial for several reasons:

- Identity Theft Protection: Alerts you to suspicious activities, helping prevent fraud.

- Credit Score Management: Keeps you informed about your credit score, so you can take actions to improve it.

- Financial Health: Helps you maintain a healthy credit profile, essential for loans and credit applications.

How Credit Monitoring Works

Credit monitoring services work by continuously tracking your credit report. Here’s how Credit Sesame operates:

| Feature | Description |

|---|---|

| Daily Credit Score Updates | Check your credit score daily and monitor any changes. |

| Sesame Grade | A letter grade based on the five major factors that impact your credit score. |

| Personalized Actions | Receive tailored actions to help improve your credit score. |

| Offers | Find the best credit offers with high chances of approval. |

| Credit Builder | Build credit with everyday purchases using a prepaid debit card and a virtual secured credit card. |

Credit Sesame provides these features for free, making it accessible to anyone. The service is designed to help you understand and improve your credit score. It also ensures your data security with 256-bit encryption.

For more details, visit the Credit Sesame website.

Key Features Of Credit Monitoring Services

Credit monitoring services provide essential tools to help manage and protect your credit. These services offer several key features that can significantly impact your financial health. Understanding these features can help you make informed decisions about your credit.

Real-time Alerts

Real-time alerts notify you of any significant changes to your credit profile. These alerts can include:

- New credit inquiries

- Updates to your credit report

- Potentially fraudulent activities

This immediate notification helps you stay on top of your credit status and address issues promptly.

Credit Score Tracking

Credit score tracking allows you to monitor your credit score daily. Credit Sesame offers this feature for free:

- Daily updates on your credit score

- A summary of your credit report

- Personalized insights and recommendations

Understanding your credit score helps you make better financial decisions.

Identity Theft Protection

Identity theft protection is crucial in today’s digital age. Credit monitoring services provide tools to safeguard your identity:

- Monitoring of personal information

- Alerts for suspicious activity

- Guidance on steps to take if your identity is compromised

These features help protect your personal information and prevent identity theft.

Fraud Detection Tools

Fraud detection tools are designed to identify and alert you to potentially fraudulent activities:

- Unusual spending patterns

- New accounts opened in your name

- Changes to your personal information

By detecting fraud early, you can take swift action to mitigate its impact.

Credit Report Updates

Regular credit report updates are essential for maintaining an accurate credit profile:

- Frequent updates to your credit report

- Detailed analysis of your credit history

- Identification of errors or discrepancies

Keeping your credit report up-to-date ensures that your credit score reflects your true financial behavior.

Pricing And Affordability Breakdown

Choosing the right credit monitoring service can depend heavily on pricing and affordability. This section delves into the different pricing structures, subscription plans, and the overall value for money you can expect from Credit Sesame.

Free Vs Paid Services

Credit Sesame offers a range of free and paid services. The free services include basic credit monitoring, personalized recommendations, and daily credit score updates. These services are sufficient for many users looking to keep an eye on their credit without any financial commitment.

For those seeking additional benefits, Credit Sesame’s Sesame Cash account comes with a monthly fee of $9.99. However, this fee can be waived with a $500 direct deposit or $1,000 in monthly spending. There is also a $3 monthly inactivity fee, which is waived if at least one transaction is made every 30 days.

Subscription Plans And Costs

Credit Sesame’s subscription plans are designed to be flexible and cater to different user needs. Below is a breakdown of the costs associated with the Sesame Cash account:

| Service | Cost | Waivers |

|---|---|---|

| Monthly Fee | $9.99 | Waived with $500 direct deposit or $1,000 monthly spending |

| Inactivity Fee | $3.00 | Waived with at least one transaction every 30 days |

There are no fees within the first 30 days of account opening, and additional fees may apply for international and out-of-network cash withdrawals, third-party services, and cash deposits.

Value For Money Analysis

Credit Sesame provides significant value for money, especially considering the comprehensive range of free services. The daily credit score updates, personalized recommendations, and credit offers are highly beneficial features that don’t cost anything.

The paid services under the Sesame Cash account offer added value for those looking for more robust credit-building tools. With the possibility of fee waivers through direct deposits or monthly spending, users can potentially avoid extra costs. The credit builder feature allows users to build credit with everyday purchases, making the service even more valuable.

Given the high user satisfaction, with an average rating of 4.8/5 from over 564K reviews, Credit Sesame stands out as an affordable and effective credit monitoring service.

Pros And Cons Of Credit Monitoring Services

Credit monitoring services like Credit Sesame are increasingly popular. They help users understand and improve their credit scores. However, these services come with both advantages and potential drawbacks. Here, we discuss the pros and cons of using credit monitoring services.

Advantages Of Using Credit Monitoring

Using credit monitoring services offers several benefits:

- Daily Credit Score Updates: Users can check their credit score daily. This helps in tracking any changes promptly.

- Sesame Grade: A letter grade based on five major factors impacting your credit score. This provides a clear understanding of your credit health.

- Personalized Actions: Receive tailored actions to improve your credit score. These recommendations are specific to your credit profile.

- Best Credit Offers: Find the best credit offers with high approval chances based on your profile.

- Credit Builder: Build credit with everyday purchases using a prepaid debit card and a virtual secured credit card.

Other benefits include:

- Free to Use: No credit card required for signing up and accessing basic services.

- Improved Credit Understanding: Clear insights into what impacts your credit score and how to improve it.

- Data Security: Protected with 256-bit encryption. No sale of personal information to third parties.

Potential Drawbacks And Limitations

Despite the benefits, credit monitoring services have some limitations:

- Fees: While basic services are free, some features like Sesame Cash have associated fees. For example, a $9.99 monthly fee is waived with a $500 direct deposit or $1,000 monthly spending.

- Inactivity Fees: A $3 monthly inactivity fee can apply if there are no transactions every 30 days. This fee is waived for the first 30 days of account opening.

- Limited Credit Bureau Data: Credit Sesame provides data from TransUnion only. This might not give a complete picture as other bureaus may have different information.

User Experiences And Feedback

Credit Sesame has received positive feedback from users. Here are some insights:

- Average Rating: 4.8/5 from 564K reviews.

- Positive Feedback: Users appreciate the detailed credit information. They find the service easy to use and effective in helping improve credit scores.

Overall, users find Credit Sesame beneficial in managing and improving their credit health. The service’s high security and user-friendly interface are often highlighted in reviews.

Specific Recommendations For Ideal Users

Credit monitoring services like Credit Sesame can be invaluable tools for maintaining and improving your credit health. But who are the ideal users for these services? Let’s break it down to help you understand if credit monitoring is right for you.

Who Should Use Credit Monitoring Services?

Credit monitoring services are particularly beneficial for those who want to keep a close eye on their credit scores. If you are:

- A person with a history of credit card debt

- Someone planning to apply for a mortgage

- A recent graduate building credit for the first time

- Concerned about identity theft and fraud

- Looking to improve your credit score for better financial opportunities

Then, credit monitoring services like Credit Sesame can provide the insights and tools you need.

Best Scenarios For Credit Monitoring

There are several scenarios where credit monitoring proves most beneficial:

- Recovering from Debt: If you are working on paying off credit card debt, daily updates from Credit Sesame can help you stay on track.

- Preparing for Major Purchases: Planning to buy a home or a car? Monitoring your credit can ensure you get the best interest rates.

- Starting Your Credit Journey: If you are new to credit, understanding how your actions impact your score is crucial.

- Protecting Against Fraud: Regular credit updates can alert you to any suspicious activity on your accounts.

Personalized Recommendations

One of the standout features of Credit Sesame is its personalized recommendations. Here’s how it works:

| Feature | Description |

|---|---|

| Daily Credit Score Updates | Check your credit score daily and monitor any changes. |

| Sesame Grade | Receive a letter grade based on the five major factors that impact your credit score. |

| Personalized Actions | Get tailored actions to help improve your credit score. |

| Offers | Find the best credit offers with high chances of approval based on your credit profile. |

These features ensure that you receive actionable insights specific to your credit situation, making it easier to improve your credit score over time.

For more details, visit the Credit Sesame website.

Frequently Asked Questions

What Are Credit Monitoring Services?

Credit monitoring services track changes in your credit report. They notify you of suspicious activities, helping protect against identity theft.

How Do Credit Monitoring Services Work?

Credit monitoring services scan your credit reports. They alert you to new accounts, inquiries, or changes, ensuring you stay informed.

Why Is Credit Monitoring Important?

Credit monitoring helps detect identity theft early. It allows you to address issues promptly, safeguarding your credit score.

Are Credit Monitoring Services Worth It?

Yes, credit monitoring services provide peace of mind. They offer early warnings of fraud, helping protect your financial health.

Conclusion

Credit monitoring is vital in today’s financial landscape. It helps you stay informed. Credit Sesame offers free updates on your credit score daily. Personalized insights help improve your credit score. Sign up for free with no credit card required. Protect your financial future and stay on top of your credit. Visit Credit Sesame to start monitoring your credit today.