Manage Credit Accounts Easily: Tips for Financial Success

Managing credit accounts can feel overwhelming. But it’s crucial for financial health.

Credit accounts, from credit cards to loans, impact your credit score. Understanding and managing them is vital. Poor management can lead to debt and a low credit score. Effective management can open doors to better financial opportunities. This guide will help you learn how to manage credit accounts efficiently, ensuring your financial stability. Let’s explore how you can take control of your credit accounts and improve your credit health. For a useful tool, check out Credit Sesame for daily credit score checks and personalized credit improvement actions.

Introduction To Managing Credit Accounts

Managing credit accounts is crucial for maintaining a healthy financial life. Understanding the ins and outs of credit management can help you improve your credit score and secure better financial opportunities. This guide will walk you through the essentials of managing credit accounts effectively.

Understanding Credit Accounts

Credit accounts come in various forms, such as credit cards, personal loans, and mortgages. Each type affects your credit score differently. Credit cards are revolving accounts, where you can borrow up to a limit and repay over time. Loans are installment accounts, with fixed payments over a set period.

Your credit report records all these accounts and their statuses. Monitoring this report regularly ensures you stay on top of your financial health. Services like Credit Sesame offer daily credit score checks and comprehensive monitoring to help you keep track of your credit accounts.

Importance Of Effective Credit Management

Effective credit management is vital for several reasons. It helps you maintain a good credit score, which is essential for securing loans, mortgages, and even employment opportunities. A good credit score can lead to lower interest rates and better terms on loans and credit cards.

Using tools like Credit Sesame, you can receive personalized actions to improve your credit score. The platform provides customized tips and credit product recommendations with high approval odds, helping you make informed decisions. Additionally, their Credit Builder feature allows you to build credit with everyday purchases, making credit management more accessible.

Table summarizing Credit Sesame’s main features:

| Feature | Description |

|---|---|

| Daily Credit Score Checks | Monitor your credit score daily and track changes |

| Sesame Grade | Understand your credit status with a clear letter grade |

| Personalized Actions | Receive tailored tips to improve your credit score |

| Credit Offers | Get credit product recommendations with high approval odds |

| Credit Builder | Build credit with everyday purchases via a prepaid debit card |

By leveraging these features, you can manage your credit accounts more effectively. This proactive approach can lead to significant improvements in your financial well-being.

Key Tips For Managing Credit Accounts

Effectively managing credit accounts is crucial for maintaining a healthy financial life. Below are some key tips that can help you stay on top of your credit accounts and improve your credit score.

Regularly Review Your Credit Reports

Consistently reviewing your credit reports helps identify errors and potential fraud. Services like Credit Sesame offer free daily credit score checks and credit report summaries. This ensures you stay informed about any changes or discrepancies in your credit profile.

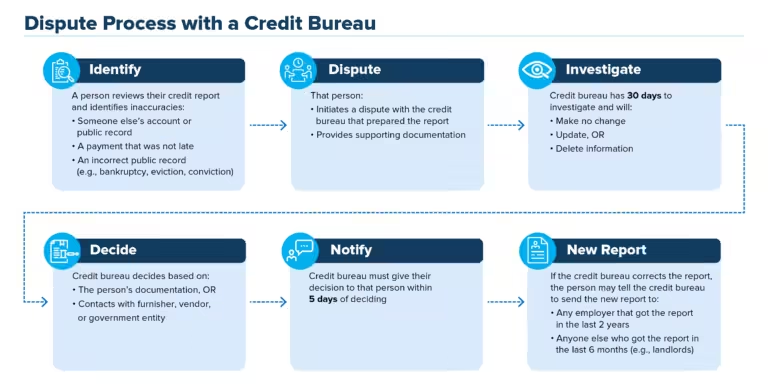

By regularly checking your credit reports, you can spot and dispute errors promptly, preventing them from negatively impacting your credit score.

Maintain A Low Credit Utilization Ratio

Keeping your credit utilization ratio low is vital. This ratio is the amount of credit you use compared to your total credit limit. Aim to use less than 30% of your available credit to maintain a good score.

Credit Sesame’s Credit Builder feature can help you manage and maintain a low credit utilization ratio by linking a prepaid debit card to a virtual secured credit card. This allows you to build credit with everyday purchases.

Set Up Automatic Payments

Late payments can severely damage your credit score. Setting up automatic payments ensures your bills are always paid on time. This reduces the risk of missing a payment.

Most credit card companies and services like Credit Sesame allow you to set up automatic payments, giving you peace of mind and helping you avoid late fees.

Prioritize High-interest Debts

Focus on paying off high-interest debts first. This strategy helps reduce the amount of interest you pay over time. Create a list of your debts, noting the interest rates, and prioritize payments accordingly.

By tackling high-interest debts first, you can save money and improve your credit score faster. Credit Sesame offers personalized guidance and recommendations to help you manage and reduce your debt effectively.

| Feature | Benefit |

|---|---|

| Daily Credit Score Checks | Monitor changes and stay informed |

| Sesame Grade | Understand your credit status with a clear letter grade |

| Personalized Actions | Receive customized tips to improve your credit score |

| Credit Offers | Get recommendations for credit products with high approval odds |

| Credit Builder | Build credit with everyday purchases |

For more information on managing your credit accounts, visit the Credit Sesame website.

Utilizing Tools And Resources

Managing credit accounts can seem overwhelming. Fortunately, various tools and resources are available to help you stay on top of your finances. Using the right tools can make a significant difference in improving your credit score and managing debt. Below, we explore some of the best resources available for managing your credit accounts.

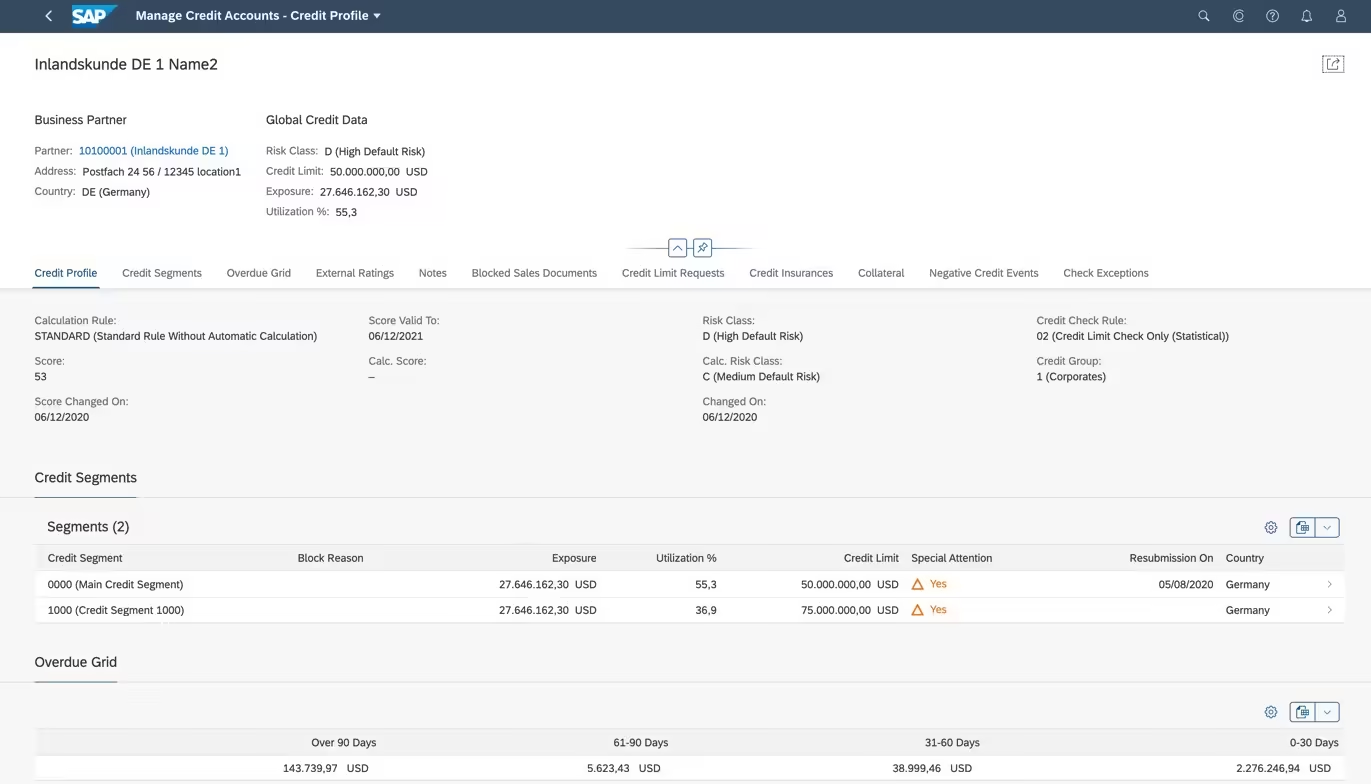

Credit Monitoring Services

Credit monitoring services like Credit Sesame provide a comprehensive overview of your credit status. With Credit Sesame, you can check your credit score daily and receive personalized tips to improve it. The platform offers a clear letter grade based on five major factors, helping you understand your credit status better. Additionally, Credit Sesame recommends credit products with high approval odds, making it easier to find suitable credit offers.

- Daily Credit Score Checks: Monitor changes in your credit score daily.

- Sesame Grade: Get a letter grade based on your credit status.

- Personalized Actions: Receive customized tips to improve your credit score.

- Credit Offers: Apply for credit products with confidence.

Budgeting Apps

Budgeting apps are essential for managing your finances and keeping track of your spending. These apps help you create and stick to a budget, ensuring you allocate funds effectively. Many apps offer features like expense tracking, bill reminders, and financial goal setting. Using a budgeting app can help you avoid overspending and ensure that you have enough funds to pay off your credit accounts.

- Expense Tracking: Keep track of your daily spending.

- Bill Reminders: Get notifications for upcoming bills.

- Financial Goals: Set and achieve your financial goals.

Debt Repayment Calculators

Debt repayment calculators are valuable tools for understanding how long it will take to pay off your debt. These calculators help you create a repayment plan by showing the impact of different payment amounts and interest rates. By using a debt repayment calculator, you can develop a strategy to pay off your debt faster and save on interest.

- Repayment Plan: Create a plan to pay off your debt.

- Interest Savings: See how different payment amounts affect interest.

- Timeframe: Understand how long it will take to pay off your debt.

Utilizing these tools and resources can help you manage your credit accounts more effectively, leading to better financial health and improved credit scores.

Understanding Credit Scores

Understanding your credit score is crucial for managing credit accounts. A credit score is a three-digit number that reflects your creditworthiness. Financial institutions use this score to determine your eligibility for loans, credit cards, and other financial products.

Factors That Influence Credit Scores

Several factors influence your credit score, including:

- Payment History: Timely payments positively impact your score.

- Credit Utilization: Using less than 30% of your available credit is ideal.

- Length of Credit History: Older accounts boost your score.

- New Credit: Frequent new credit inquiries can lower your score.

- Credit Mix: Having a variety of credit types (loans, credit cards) is beneficial.

How To Improve Your Credit Score

Improving your credit score takes time and consistent effort. Here are some actionable steps:

- Pay Bills on Time: Late payments hurt your score.

- Reduce Debt: Aim to pay off high-interest debts first.

- Check Credit Reports Regularly: Look for errors and dispute them.

- Limit New Credit Applications: Too many inquiries can lower your score.

- Keep Credit Utilization Low: Ideally, below 30% of your credit limit.

Common Misconceptions About Credit Scores

There are many myths about credit scores. Here are a few:

- Checking Your Own Credit Hurts Your Score: This is not true. Self-checks are considered soft inquiries.

- Closing Old Accounts Improves Your Score: Closing accounts can actually shorten your credit history.

- Only Credit Card Debt Affects Your Score: All types of debt, including loans, influence your score.

- Income Affects Credit Score: Your income does not impact your score, but it affects your ability to repay.

For those seeking to better manage their credit, Credit Sesame offers valuable tools and insights. With daily credit score checks, personalized actions, and comprehensive monitoring, users can stay on top of their credit health.

Common Pitfalls To Avoid

Managing credit accounts can be challenging. Many people make avoidable mistakes. These mistakes can negatively impact your credit score and financial health. Below are some common pitfalls to avoid.

Missing Payment Deadlines

Missing payment deadlines is a common mistake. It can harm your credit score. Always pay your bills on time. Set reminders or use automatic payments to avoid missing deadlines.

Applying For Too Many Credit Accounts

Applying for too many credit accounts in a short period is risky. Each application can lower your credit score. Limit the number of credit accounts you apply for. Focus on managing your existing accounts well.

Ignoring Your Credit Report Errors

Ignoring errors on your credit report can be costly. Mistakes can lower your credit score. Check your credit report regularly. Use services like Credit Sesame to monitor your credit score and report. Address any errors you find immediately.

| Common Pitfall | Impact |

|---|---|

| Missing Payment Deadlines | Lower credit score, late fees |

| Applying for Too Many Credit Accounts | Hard inquiries, lower credit score |

| Ignoring Your Credit Report Errors | Inaccurate credit score, potential loan denials |

By avoiding these common pitfalls, you can maintain a healthy credit score and improve your financial standing. Services like Credit Sesame offer tools and personalized advice to help you manage your credit effectively.

Real-world Benefits Of Good Credit Management

Good credit management brings many benefits that can improve your financial life. It helps you get better deals and offers, making it easier to manage your money. Let’s explore some key benefits of managing your credit well.

Lower Interest Rates On Loans

One significant benefit of good credit management is lower interest rates on loans. Lenders see you as a low-risk borrower if you have a high credit score. This means they are willing to offer you loans at lower interest rates. Lower interest rates mean you pay less over the life of the loan, saving you money.

For example:

| Credit Score Range | Interest Rate on Personal Loan |

|---|---|

| Excellent (750+) | 5% – 10% |

| Good (700-749) | 10% – 15% |

| Fair (650-699) | 15% – 20% |

With a higher credit score, you can enjoy much lower interest rates, reducing your monthly payments and total loan cost.

Better Approval Rates For Credit Applications

Good credit management also leads to better approval rates for credit applications. Credit Sesame can help you get recommendations for credit products with high approval odds. When you apply for a new credit card or loan, a good credit score increases your chances of being approved.

Here are some factors that improve with good credit management:

- Higher approval rates for loans and credit cards

- Access to premium credit cards with better rewards

- Improved terms and conditions on financial products

With better approval rates, you can choose from various credit products and select the ones that best suit your needs.

Increased Financial Security

Good credit management brings increased financial security. Monitoring your credit score daily with Credit Sesame helps you stay on top of your credit health. You can quickly spot any errors or fraudulent activity and take action immediately.

Increased financial security can be achieved through:

- Regular monitoring of your credit score

- Understanding your credit status with Sesame Grade

- Receiving personalized tips to improve your credit score

By managing your credit well, you ensure that your financial future is secure. It allows you to plan for big purchases, emergencies, and other financial goals with confidence.

Personalized Recommendations For Different Financial Situations

Managing credit accounts can be challenging. Credit Sesame offers tailored advice for various financial situations. Whether you’re new to credit or dealing with high debt, personalized recommendations can help you take control of your financial future.

For Young Adults And First-time Credit Users

Starting your credit journey can be daunting. Credit Sesame provides daily credit score checks and credit report summaries to help you monitor your credit health. Here are some tips:

- Understand Your Sesame Grade: This feature gives you a clear picture of your credit status with a letter grade.

- Use a Credit Builder: Consider using a prepaid debit card linked to a virtual secured credit card to build credit through everyday purchases.

- Personalized Actions: Follow customized tips to improve your credit score.

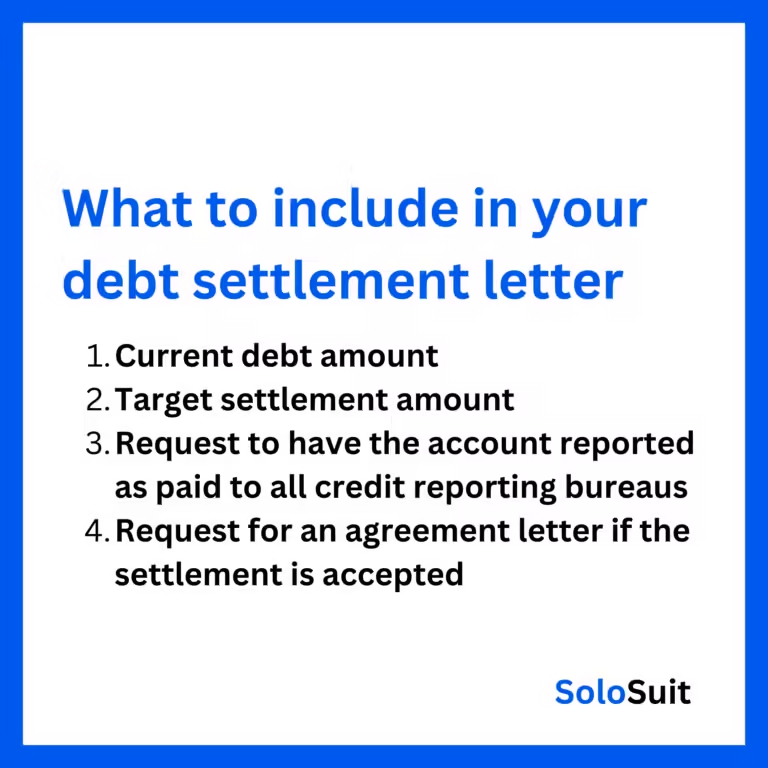

For Individuals With High Debt Levels

High debt levels can be overwhelming. Credit Sesame can help you manage and reduce your debt effectively. Follow these recommendations:

- Monitor Your Credit Score Daily: Keep track of your credit score to see how your debt levels affect it.

- Explore Credit Offers: Get recommendations for credit products with high approval odds that may offer better terms.

- Take Advantage of Personalized Guidance: Receive tailored actions to help you manage and reduce your debt.

For Those Looking To Improve Their Credit Score

Improving your credit score requires consistent effort. Credit Sesame offers several tools to help you achieve this goal:

| Feature | Description |

|---|---|

| Daily Credit Score Checks | Monitor changes in your credit score daily to stay informed. |

| Personalized Actions | Receive customized tips to take actions that can improve your score. |

| Credit Builder | Use a prepaid debit card linked to a virtual secured credit card to build credit through everyday purchases. |

By following these personalized recommendations, you can effectively manage your credit accounts and achieve your financial goals.

Frequently Asked Questions

How Do I Manage My Credit Accounts?

Managing credit accounts involves tracking balances, paying bills on time, and staying within credit limits. Regularly review statements for errors.

What Are The Benefits Of Managing Credit Accounts Well?

Properly managing credit accounts improves your credit score, lowers interest rates, and increases financial stability.

How Can I Improve My Credit Score?

To improve your credit score, pay bills on time, reduce debt, and avoid opening too many new accounts.

What Tools Can Help Manage Credit Accounts?

Tools like budgeting apps, credit monitoring services, and automatic payment setups can help manage credit accounts efficiently.

Conclusion

Managing credit accounts doesn’t have to be overwhelming. Simple steps make a difference. Regularly monitor your credit score. Use tools like Credit Sesame for daily updates. Personalized advice helps improve your credit. Want to learn more? Visit Credit Sesame for detailed guidance. Stay proactive with your credit health. Make informed decisions. A better credit score is achievable.