Credit History Improvement: Proven Strategies for Success

Improving your credit history can feel overwhelming. But it doesn’t have to be.

A strong credit history is essential for securing loans, renting an apartment, or even landing a job. Many people struggle with improving their credit scores due to a lack of information or the right tools. Luckily, there are resources available to help you understand and enhance your credit profile. One such resource is Credit Sesame, a platform that offers free access to your credit score and report summaries. Credit Sesame not only provides valuable insights into your credit but also suggests personalized actions to boost your score. Let’s explore how you can improve your credit history effectively with the right strategies and tools. For more details, check out Credit Sesame: Credit Sesame.

Introduction To Credit History Improvement

Improving your credit history is crucial for financial health. Many people feel overwhelmed by this task. But with the right tools and knowledge, it becomes manageable. Let’s dive into the basics.

Understanding The Importance Of Credit History

Your credit history is a record of your financial behavior. It shows how you manage debt and pay bills. A good credit history opens doors to better financial opportunities.

Credit Sesame is a valuable platform for managing and improving your credit history. It offers daily credit scores and personalized advice. This makes it easier to understand your credit situation and take necessary actions.

How Credit History Affects Your Financial Life

Your credit history impacts many areas of your life. Here’s how:

- Loan Approval: Lenders check your credit history to decide if you are a reliable borrower.

- Interest Rates: Good credit history can lead to lower interest rates on loans and credit cards.

- Job Opportunities: Some employers review credit history during the hiring process.

Using Credit Sesame, you can see offers with high approval chances based on your credit profile. This reduces uncertainty in the application process.

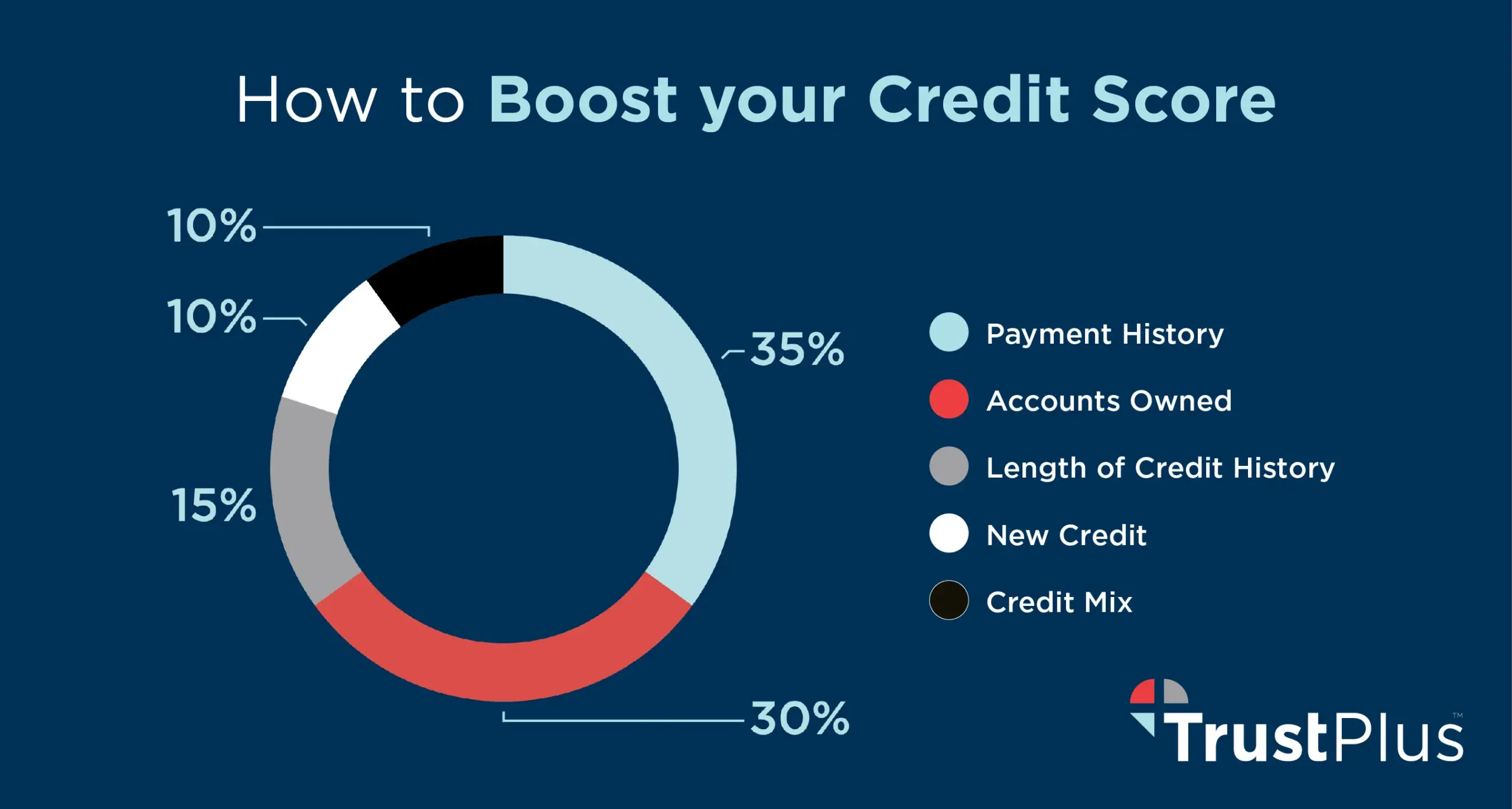

Credit Sesame provides a clear letter grade, known as the Sesame Grade. This grade reflects the five major factors affecting your credit score. Knowing this helps you focus on areas needing improvement.

Additionally, Credit Sesame’s Credit Builder feature helps you build credit with everyday purchases. This is done using a prepaid debit card, making it easier to improve your credit history over time.

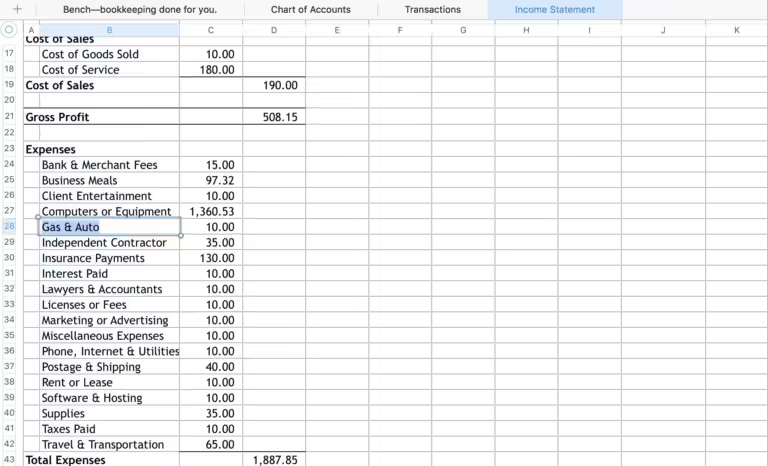

| Feature | Benefit |

|---|---|

| Daily Credit Score | Track progress and stay informed |

| Sesame Grade | Understand the five major factors affecting your score |

| Personalized Actions | Get tailored advice to improve your score |

| Best Offers | See offers with high approval chances |

| Credit Builder | Build credit with everyday purchases |

Managing your credit is easier with the Credit Sesame mobile app. It gives you access to all the features anytime, anywhere. This can help you stay on top of your credit history and make improvements as needed.

Key Strategies To Improve Your Credit History

Improving your credit history is essential for financial well-being. A good credit history can help you secure loans, credit cards, and better interest rates. Here are some key strategies to improve your credit history.

Paying Bills On Time

Paying your bills on time is crucial. Late payments can negatively affect your credit score. Set up reminders or automatic payments to ensure you never miss a due date. This habit can significantly improve your credit history over time.

Reducing Credit Card Balances

High credit card balances can hurt your credit score. Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit limit. Paying down your balances each month can improve your credit score.

Avoiding New Credit Applications

Each time you apply for new credit, it results in a hard inquiry on your credit report. Too many hard inquiries can lower your credit score. Avoid applying for new credit unless necessary. This can help maintain your current credit score.

Correcting Credit Report Errors

Errors on your credit report can negatively impact your score. Regularly check your credit report for inaccuracies. If you find any errors, dispute them with the credit bureaus. Correcting these errors can improve your credit history.

Using tools like Credit Sesame can help manage and monitor your credit. Credit Sesame provides daily credit scores, personalized advice, and helps you find the best credit offers. It’s a valuable resource for improving your credit history.

Unique Tools And Resources For Credit Improvement

Improving your credit history can feel daunting, but unique tools and resources can help. These tools provide valuable insights and strategies to boost your credit score. Below are some essential resources to consider.

Credit Monitoring Services

Credit monitoring services are essential for tracking your credit status. They alert you to any changes in your credit report. Credit Sesame is a notable platform in this space. It offers a daily credit score check, helping you stay informed. The platform also provides a clear letter grade based on the five major factors affecting your credit score.

Here are some features of Credit Sesame:

- Daily Credit Score: Check your credit score every day for free.

- Sesame Grade: Get a letter grade for your credit score factors.

- Personalized Actions: Receive advice tailored to your credit profile.

- Best Offers: Discover credit offers with high approval odds.

- Credit Builder: Use a prepaid debit card to build credit.

Credit Builder Loans

Credit builder loans are another effective tool for credit improvement. These loans are designed to help people build or rebuild their credit. Unlike traditional loans, the money you borrow is held in a bank account until the loan is repaid. This ensures that you make regular payments, boosting your credit score over time.

Features of credit builder loans include:

- Helps establish a positive payment history.

- Often available to those with bad or no credit.

- Funds are secured, reducing lender risk.

Financial Literacy Programs

Financial literacy programs educate individuals on managing their finances effectively. These programs cover various topics, including budgeting, saving, and understanding credit. They are crucial for long-term financial health and credit improvement.

Benefits of financial literacy programs:

- Improves understanding of credit management.

- Teaches essential budgeting skills.

- Empowers individuals to make informed financial decisions.

Utilizing these tools and resources can significantly enhance your credit history. Credit Sesame offers a comprehensive suite of features to help you manage and improve your credit. Explore these options to take control of your financial future.

Pricing And Affordability Of Credit Improvement Tools

Improving your credit history can sometimes feel overwhelming. But understanding the cost and affordability of different credit improvement tools can make the process easier. Here’s a breakdown of various tools and their pricing structures.

Free Vs. Paid Credit Monitoring Services

When choosing between free and paid credit monitoring services, it’s important to understand what each offers. Credit Sesame provides a free service that includes daily credit score updates, personalized actions, and tailored credit offers. This can be a great starting point for many users.

Paid services, on the other hand, often come with additional features such as identity theft protection and more detailed credit reports. The cost can vary, but typically ranges from $10 to $30 per month. It’s crucial to weigh these costs against the benefits to determine which service meets your needs.

Cost-benefit Analysis Of Credit Builder Loans

Credit builder loans are designed to help improve your credit score by making timely payments. These loans usually have low interest rates and are a great option for building credit. The cost of such loans can range from $10 to $25 per month, depending on the lender and loan amount.

| Loan Amount | Monthly Payment | Interest Rate |

|---|---|---|

| $300 | $25 | 6% |

| $500 | $20 | 5% |

The benefits include an improved credit score and the potential to qualify for better financial products. This can outweigh the costs, especially if you are committed to improving your credit.

Affordable Financial Literacy Programs

Understanding how credit works is crucial for long-term financial health. Affordable financial literacy programs can provide this knowledge. Many online platforms offer free or low-cost courses on credit management, budgeting, and financial planning.

For instance, some programs might charge a one-time fee of $20 to $50. These courses often cover the basics of credit scores, how to read credit reports, and strategies for improving credit. Investing in financial literacy can yield high returns in terms of better financial decisions and improved credit scores.

By leveraging affordable tools like Credit Sesame, credit builder loans, and financial literacy programs, you can take significant steps towards improving your credit history without breaking the bank.

Pros And Cons Of Different Credit Improvement Strategies

Improving your credit history requires careful planning and consistent effort. There are various strategies available, each with its own advantages and disadvantages. Below, we will explore some common approaches to credit improvement and their respective pros and cons.

Advantages Of Timely Bill Payments

Paying bills on time is one of the most effective strategies to improve your credit history. Consistent, timely payments demonstrate financial responsibility to lenders and can significantly boost your credit score.

- Positive Impact on Credit Score: Regular on-time payments can lead to a higher credit score.

- Avoidance of Late Fees: Paying bills promptly helps you avoid late fees and penalties.

- Improved Creditworthiness: Lenders are more likely to approve loans and credit when they see a history of timely payments.

Disadvantages Of Excessive Credit Applications

Applying for multiple credit accounts within a short period can negatively affect your credit score. Each application can result in a hard inquiry, which may reduce your credit score temporarily.

- Negative Impact on Credit Score: Too many hard inquiries can lower your credit score.

- Perception of Financial Instability: Lenders may view frequent applications as a sign of financial distress.

- Increased Debt Risk: Applying for multiple credit lines can lead to higher debt levels if not managed responsibly.

Benefits And Drawbacks Of Using Credit Monitoring Services

Credit monitoring services, like Credit Sesame, offer tools to track your credit score and report. These services can help you identify areas for improvement and protect against identity theft.

| Benefits | Drawbacks |

|---|---|

|

|

Incorporating these strategies into your financial habits can help you improve your credit history. Be mindful of the pros and cons associated with each approach to make the best decisions for your financial health.

Specific Recommendations For Ideal Users Or Scenarios

Improving credit history can be different for each individual. Here are some specific recommendations for three ideal user scenarios: young adults starting to build credit, individuals with poor credit histories, and homebuyers and loan applicants.

Best Strategies For Young Adults Starting To Build Credit

Young adults can benefit greatly from starting their credit journey with Credit Sesame. Here are some effective strategies:

- Check Credit Scores Daily: Use Credit Sesame’s daily credit score feature to monitor your progress.

- Utilize Sesame Grade: Understand the five major factors affecting your credit score with Sesame Grade.

- Start with a Secured Credit Card: Apply for a secured credit card to start building your credit history.

- Make Small Purchases: Use a credit card for small, manageable purchases and pay off the balance in full each month.

- Set Up Automatic Payments: Ensure timely payments by setting up automatic bill payments.

Effective Approaches For Individuals With Poor Credit Histories

Individuals with poor credit can improve their scores with the following approaches:

- Personalized Actions: Follow the personalized advice provided by Credit Sesame to improve your score.

- Pay Down Debt: Focus on paying down existing debt, especially high-interest credit cards.

- Dispute Inaccuracies: Check your credit report for errors and dispute any inaccuracies you find.

- Limit New Credit Applications: Avoid applying for new credit frequently, as this can lower your score.

- Use a Credit Builder Loan: Consider a credit builder loan to add positive payment history to your credit report.

Tailored Advice For Homebuyers And Loan Applicants

Homebuyers and loan applicants need a strong credit profile. Here are some tailored tips:

- Monitor Your Credit Report: Use Credit Sesame to regularly monitor your credit report for any changes.

- Improve Your Debt-to-Income Ratio: Pay down debt and avoid taking on new debt to improve your debt-to-income ratio.

- Address Negative Items: Work on resolving any negative items on your credit report, such as late payments or collections.

- Get Pre-Approved Offers: Use Credit Sesame’s feature to find credit offers with high approval chances.

- Save for a Larger Down Payment: A larger down payment can improve your loan approval odds and get you better terms.

Conclusion: Achieving Long-term Success In Credit History Improvement

Improving your credit history is a journey requiring dedication and informed actions. Utilizing tools like Credit Sesame can significantly help in this process.

Summarizing Key Takeaways

Throughout your journey to a better credit history, remember these key points:

- Regular Monitoring: Use Credit Sesame to check your credit score daily.

- Personalized Actions: Follow tailored advice to improve your credit score.

- Credit Builder: Use Credit Sesame’s prepaid debit card to build credit with everyday purchases.

- High Approval Chances: Apply for credit offers with high approval odds displayed by Credit Sesame.

Encouragement And Next Steps

Consistency is crucial in maintaining a healthy credit history. Here are some steps to keep you on track:

- Daily Check: Regularly monitor your credit score using Credit Sesame’s free daily credit score feature.

- Utilize Resources: Take advantage of the personalized actions suggested by Credit Sesame.

- Stay Informed: Use the Sesame Grade to understand factors affecting your credit score.

- Plan Smartly: Apply for credit products with the highest chances of approval as shown in Credit Sesame.

Remember, improving your credit history is a gradual process. Keep using the tools and resources provided by Credit Sesame to achieve long-term success.

For more information, visit Credit Sesame.

Frequently Asked Questions

How Can I Improve My Credit History?

To improve your credit history, pay your bills on time. Keep your credit card balances low. Avoid opening many new accounts quickly.

How Long Does Credit History Improvement Take?

Improving your credit history can take several months. Consistent good habits will gradually improve your score.

Does Paying Off Debt Improve Credit History?

Yes, paying off debt improves your credit history. It reduces your credit utilization and shows responsible behavior.

Can Checking My Credit Score Lower It?

No, checking your own credit score doesn’t lower it. This is known as a soft inquiry and doesn’t affect your score.

Conclusion

Improving your credit history is essential for financial stability. Taking small, consistent steps can make a big difference. Regularly check your credit score and report. For free and personalized advice, consider using Credit Sesame. Their tools help manage and improve your credit. Stay informed and proactive. Better credit opens doors to more financial opportunities. Start today and see the benefits grow over time.