Credit Score Ranges: Unlocking Your Financial Potential

Understanding credit score ranges is crucial for financial health. These ranges determine your ability to secure loans, credit cards, and more.

Credit scores are numerical representations of your creditworthiness. They range from poor to excellent, influencing lenders’ decisions. Knowing where you stand can help you take control of your finances. By understanding the different ranges, you can improve your score and access better financial products. This guide will explain the various credit score ranges and what they mean for you. Start by checking your credit score daily with Credit Sesame. It offers free access to your credit score and personalized recommendations to improve it. Stay informed, and take action to boost your credit health today!

Understanding Credit Scores

Credit scores are essential in the financial world. They influence loan approvals, interest rates, and even job prospects. Understanding these scores can help you make informed decisions and improve your financial health.

What Is A Credit Score?

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Lenders use this score to determine the risk of lending to you.

Your credit score is calculated based on your credit history. It includes factors like payment history, amounts owed, length of credit history, new credit, and types of credit used.

How Credit Scores Are Calculated

Credit scores are calculated using various factors. Here are the key components:

- Payment History: This makes up 35% of your score. It tracks if you’ve paid past credit accounts on time.

- Amounts Owed: This represents 30% of your score. It considers the total amount of debt you owe.

- Length of Credit History: This accounts for 15% of your score. It measures how long your credit accounts have been active.

- New Credit: This is 10% of your score. It looks at how many new accounts you have opened recently.

- Types of Credit Used: This also makes up 10% of your score. It evaluates the variety of credit accounts you have, such as credit cards, mortgages, and loans.

Each of these factors plays a crucial role in determining your credit score. Understanding them can help you manage your credit better.

Credit Sesame provides tools and personalized actions to help you improve your credit score. With daily credit score checks, you can see what impacts your score. The platform also offers the Sesame Grade, a clear letter grade based on five major factors affecting credit scores.

For more information, visit Credit Sesame.

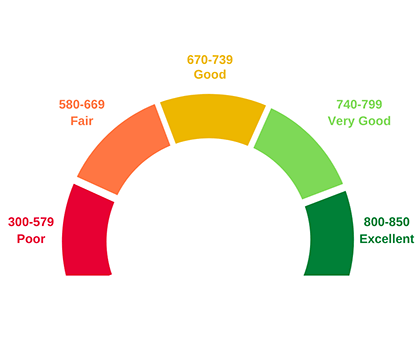

The Different Credit Score Ranges

Understanding credit score ranges is crucial for managing your financial health. Your credit score affects your ability to get loans, credit cards, and even housing. Here’s a breakdown of the different credit score ranges and what they mean.

Excellent Credit Score

An excellent credit score is typically between 800 and 850. Individuals in this range are considered the most creditworthy. They enjoy the best interest rates and terms on loans and credit cards.

Good Credit Score

A good credit score falls between 740 and 799. People with good credit are still seen as low-risk borrowers. They usually get favorable rates, though not as low as those with excellent scores.

Fair Credit Score

A fair credit score ranges from 670 to 739. This is considered an average score. Borrowers in this range may face higher interest rates and more stringent loan terms.

Poor Credit Score

A poor credit score is between 580 and 669. Borrowers with poor scores are seen as higher risk. They often experience difficulty getting approved for credit and face higher interest rates.

Very Poor Credit Score

A very poor credit score is any score below 580. Individuals in this range are considered very high risk. They may struggle to get approved for any form of credit and face the highest rates and fees.

Credit Sesame offers tools and personalized actions to help you improve your credit score. With features like daily credit score checks and personalized recommendations, you can work towards a better credit score.

| Credit Score Range | Category | Details |

|---|---|---|

| 800-850 | Excellent | Best rates and terms |

| 740-799 | Good | Favorable rates, slightly higher than excellent |

| 670-739 | Fair | Average rates, more stringent terms |

| 580-669 | Poor | Higher rates, difficulty in approval |

| Below 580 | Very Poor | Highest rates, most difficult approval |

Importance Of Knowing Your Credit Score Range

Knowing your credit score range is crucial. It affects many aspects of your financial life. Credit Sesame offers tools to help you track and improve your credit score. Understanding your credit score can open doors to better financial opportunities.

Impact On Loan Approvals

Your credit score range significantly impacts loan approvals. Lenders use your credit score to assess risk. A higher score means you are more likely to get approved for loans. Credit Sesame can help you monitor your credit score daily. This allows you to stay informed and take action to improve your score.

Influence On Interest Rates

Interest rates on loans are influenced by your credit score range. Higher scores often lead to lower interest rates. This can save you money over the life of a loan. Credit Sesame provides personalized actions to help boost your credit score. By improving your score, you can secure better interest rates on loans and credit cards.

Effect On Employment Opportunities

Employers may check your credit score during the hiring process. A good credit score can enhance your employment opportunities. Credit Sesame offers free credit score checks and personalized guidance. This helps you maintain a strong credit profile, which can be beneficial for job prospects.

Insurance Premiums

Insurance companies use credit scores to determine premiums. A higher credit score can result in lower insurance premiums. Credit Sesame offers tools to help you improve your credit score. By using these tools, you can potentially lower your insurance costs.

Credit Sesame provides numerous benefits:

- Free Access: Sign up and access credit scores and reports for free.

- Personalized Guidance: Receive tailored advice to improve credit scores.

- Confidence in Applications: View offers with high approval odds, saving time and reducing negative marks.

- Credit Building: Easily build credit through everyday spending using Sesame Cash.

Knowing your credit score range is vital. It impacts loans, interest rates, employment, and insurance. Credit Sesame can help you stay on top of your credit and improve your financial health.

How To Improve Your Credit Score

Improving your credit score opens doors to better financial opportunities. Achieving a higher credit score can lead to lower interest rates on loans and credit cards. Here’s a guide on how to boost your credit score efficiently.

Paying Bills On Time

One of the most critical factors in your credit score is payment history. Paying bills on time shows lenders you are reliable. To ensure timely payments, set up automatic payments or reminders. Even one missed payment can negatively impact your score.

Reducing Debt

High debt levels can lower your credit score. Aim to reduce your debt by prioritizing high-interest debts first. Use strategies like the debt snowball or avalanche method. Keeping your credit utilization below 30% also helps in improving your score.

Avoiding New Credit Applications

Each new credit application can result in a hard inquiry on your credit report. Too many hard inquiries can lower your score. Avoid applying for new credit unless necessary. Instead, focus on managing existing credit responsibly.

Regularly Checking Your Credit Report

Regularly checking your credit report helps you spot errors. Incorrect information can lower your score. Utilize free services like Credit Sesame to monitor your credit report. Dispute any inaccuracies with the credit bureau to ensure your report is accurate.

Credit Sesame offers tools and recommendations for improving your credit score. It provides personalized actions based on your credit profile. Regular monitoring and proactive steps can lead to a healthier credit score.

Tools And Resources For Monitoring Your Credit Score

Monitoring your credit score is crucial for maintaining financial health. Various tools and resources can help you keep track of your credit status. Here, we discuss some of the best options available.

Credit Monitoring Services

Credit monitoring services provide real-time alerts about changes in your credit report. These services can help you spot suspicious activity and protect against identity theft. One popular option is Credit Sesame.

| Service | Features | Cost |

|---|---|---|

| Credit Sesame |

|

Free |

Credit Sesame offers free daily credit scores and credit report summaries. There is no need to provide a credit card for this service. It also provides personalized actions to help improve your credit score.

Free Credit Score Websites

Several websites offer free credit score checks without any cost. These platforms allow you to view your credit score and report summaries. Some popular websites include:

- Credit Sesame: Provides daily credit scores and report summaries for free.

- Credit Karma: Offers free credit scores and credit monitoring.

- AnnualCreditReport.com: Allows you to get a free credit report from each of the three major credit bureaus once a year.

These websites make it easy to monitor your credit score without incurring any costs.

Financial Advisors

Financial advisors can provide personalized advice on how to improve and maintain a good credit score. They offer tailored strategies based on your financial situation. Consulting a financial advisor can help you:

- Understand the factors affecting your credit score.

- Develop a plan to improve your credit score.

- Receive guidance on credit-related decisions.

Using these tools and resources can help you stay informed about your credit status. Regular monitoring can lead to better financial decisions and a healthier credit score.

Common Myths About Credit Scores

Many people believe various myths about credit scores. These myths can cause confusion and poor financial decisions. Here, we debunk some of the most common myths to help you understand your credit score better.

Checking Your Own Credit Hurts Your Score

One common myth is that checking your own credit score will hurt it. This is not true. Checking your own credit is considered a “soft inquiry” and does not affect your score.

With tools like Credit Sesame, you can check your credit score daily for free without any negative impact. This allows you to stay informed and take action to improve your credit.

Closing Old Accounts Improves Your Score

Another myth is that closing old credit accounts will improve your credit score. Closing accounts can actually harm your score. Your credit history length is a factor in your credit score.

When you close an old account, you shorten your credit history. It’s better to keep old accounts open and use them occasionally. This shows a longer credit history and responsible use.

Only Big Purchases Affect Your Score

Many people think only large purchases affect their credit score. This is a myth. All types of credit usage, big or small, can impact your score.

Regular, everyday purchases and timely payments can help build your credit. Credit Sesame’s Credit Builder feature allows you to build credit with daily spending, without requiring a credit check or security deposit.

Frequently Asked Questions

What Is A Good Credit Score Range?

A good credit score range is typically between 670 and 739. This range indicates that you are a reliable borrower. It can help you secure better loan terms and lower interest rates.

How Can I Improve My Credit Score?

To improve your credit score, pay your bills on time. Keep your credit card balances low and avoid opening too many new accounts. Regularly check your credit report for errors and dispute any inaccuracies.

Why Is My Credit Score Important?

Your credit score is important because it affects your ability to get loans and credit cards. It also influences the interest rates you are offered. A higher score can save you money and improve your financial opportunities.

What Factors Affect My Credit Score?

Several factors affect your credit score, including payment history, credit utilization, length of credit history, and new credit inquiries. Maintaining good habits in these areas can help you achieve and maintain a good score.

Conclusion

Understanding credit score ranges empowers you to manage your finances better. Keep an eye on your credit score regularly. Use tools like Credit Sesame for daily updates and guidance. Improving your credit score can open doors to better financial opportunities. With the right steps, you can achieve a strong credit profile. Stay informed, take action, and watch your credit score improve over time. Remember, maintaining good credit is essential for financial health. Visit Credit Sesame for more details and start your journey to better credit today.