Credit Card Application Tips: Boost Approval Odds Today

Applying for a credit card can be an exciting yet daunting task. Many factors come into play, and understanding them can make the process smoother.

Navigating the world of credit cards requires knowledge and preparation. Whether you are looking to build credit, earn rewards, or simply manage expenses better, there are essential tips that can help you succeed in your credit card application. This guide will walk you through practical advice to increase your approval chances and choose the right card for your needs. With the right approach, you can make informed decisions and benefit from the perks credit cards offer. For more information, you can visit Credit Sesame.

Introduction To Credit Card Applications

Applying for a credit card can seem daunting. Understanding the process and the factors involved can make it easier. This guide provides tips to help you navigate credit card applications with confidence.

Understanding The Importance Of Credit Cards

Credit cards offer many benefits. They help build credit, provide convenience, and offer rewards. Here are some key reasons why having a credit card is important:

- Build Credit History: Regular use of a credit card helps establish a credit history.

- Improve Credit Score: Timely payments can boost your credit score.

- Convenience: Credit cards offer a hassle-free way to make purchases.

- Rewards: Many credit cards offer rewards like cashback or travel points.

Why Approval Odds Matter

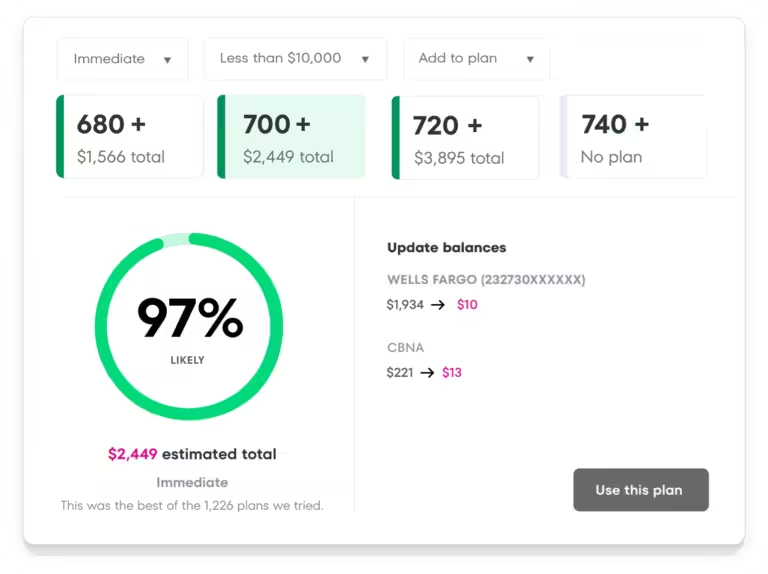

Approval odds indicate the likelihood of your credit card application being accepted. Knowing your approval odds can save time and prevent unnecessary credit inquiries. Here’s why it matters:

- Informed Decisions: Apply for cards where you have a higher chance of approval.

- Protect Credit Score: Avoid multiple rejections which can negatively impact your credit score.

- Personalized Offers: Services like Credit Sesame provide personalized credit offers based on your profile.

| Feature | Description |

|---|---|

| Daily Credit Score | Check your credit score daily and get updates on what impacts your score. |

| Credit Report Summary | View a summary of your credit report without needing a credit card. |

| Personalized Actions | Receive tailored advice to improve your credit score. |

| Credit Offers | Find the best financial offers with a high chance of approval based on your credit profile. |

Preparing For Your Credit Card Application

Applying for a credit card can be a significant step in managing your finances. To improve your chances of approval, preparation is key. Below are essential steps to prepare for your credit card application.

Assessing Your Credit Score

Your credit score plays a crucial role in your credit card application. It’s important to know where you stand before applying.

- Use services like Credit Sesame to check your credit score daily.

- Understand the factors impacting your score with the Sesame Grade system.

- Identify areas for improvement and take personalized actions to boost your score.

Gathering Necessary Documentation

Having the right documents ready can streamline the application process. Here’s what you might need:

| Document | Purpose |

|---|---|

| Identification | To verify your identity (e.g., driver’s license, passport). |

| Proof of Income | To demonstrate your ability to repay (e.g., pay stubs, tax returns). |

| Bank Statements | To show your financial stability. |

Researching Different Credit Cards

Not all credit cards are the same. Research different options to find the best fit for your needs.

- Compare interest rates and annual fees.

- Look for cards that offer rewards or cash back.

- Check for cards with a high chance of approval based on your credit profile.

Credit Sesame can help you find the best financial offers tailored to your credit score.

With these steps, you can prepare effectively for your credit card application and improve your chances of approval. For more information, visit the Credit Sesame website.

Key Tips To Boost Approval Odds

Applying for a credit card can be a crucial step in managing your finances. To improve your chances of getting approved, it’s important to follow some key tips. These strategies can help you present a stronger application and increase your approval odds.

Improving Your Credit Score

Your credit score is one of the most important factors in a credit card application. Services like Credit Sesame provide daily access to your credit score and credit report summary. Here are some ways to improve your credit score:

- Pay your bills on time.

- Keep your credit card balances low.

- Avoid opening new accounts frequently.

- Check your credit report for errors and dispute any inaccuracies.

Reducing Existing Debt

Reducing your existing debt can positively impact your credit score and approval odds. Aim to lower your debt-to-income ratio by:

- Paying off high-interest debt first.

- Consolidating debts to lower interest rates.

- Making more than the minimum payments on your loans.

Avoiding Multiple Applications

Submitting multiple credit card applications within a short period can hurt your credit score and reduce your approval chances. To avoid this:

- Research and choose the best card for your needs.

- Use services like Credit Sesame to find credit offers with high chances of approval.

- Wait for at least six months before applying for another credit card.

Choosing The Right Card For Your Profile

Selecting the right card based on your credit profile is essential. Consider factors like:

| Factor | Details |

|---|---|

| Credit Score | Choose cards that match your credit score range. |

| Rewards | Pick cards offering rewards that align with your spending habits. |

| Fees | Look for cards with low or no annual fees. |

| Approval Odds | Use Credit Sesame to find cards with high approval odds based on your profile. |

By following these tips and using tools like Credit Sesame, you can increase your credit card approval odds and improve your financial health.

Understanding Credit Card Features And Benefits

Credit cards offer various features and benefits that can enhance your financial life. Understanding these can help you choose the right card. Here are some key aspects to consider.

Rewards Programs And Cashback Offers

Many credit cards come with rewards programs and cashback offers. These programs reward you for every dollar you spend. For example:

- Earn points for each purchase

- Redeem points for travel, merchandise, or gift cards

- Receive cashback as a statement credit

Using a card with a strong rewards program can save you money. Look for cards that align with your spending habits.

Introductory Apr And Balance Transfer Options

Credit cards often offer an introductory APR period. This is a low or 0% interest rate for a set time. It helps you save on interest for new purchases.

Balance transfer options allow you to move high-interest debt to a new card. This can simplify payments and reduce interest costs. Be aware of any transfer fees that may apply.

Annual Fees And Other Charges

Some cards come with an annual fee. This fee can range from $0 to several hundred dollars. Cards with higher fees often offer more benefits.

Other charges to consider include:

- Late payment fees

- Foreign transaction fees

- Cash advance fees

Review the fee structure of any card before applying. Ensure the benefits outweigh the costs.

Credit Sesame can help you find the best credit card offers based on your credit profile. Visit Credit Sesame to learn more.

Common Mistakes To Avoid

Applying for a credit card can be a daunting task. Many make simple errors that can hurt their chances of approval. Here are some common mistakes to avoid:

Ignoring Your Credit Report

One of the biggest mistakes is ignoring your credit report. Your credit report impacts your credit score. Review your credit report regularly to spot errors. Use services like Credit Sesame to access your daily credit score and report summary for free. Correct any inaccuracies to improve your score.

Applying For Cards Outside Your Credit Range

Applying for cards outside your credit range can lead to rejections. Each rejection impacts your credit score negatively. Use Credit Sesame to understand your credit profile. They offer personalized financial products that match your credit score. This increases your chances of approval.

Overlooking Terms And Conditions

Many overlook the terms and conditions of credit cards. This can lead to unexpected fees and penalties. Always read the terms carefully. Look for details on interest rates, annual fees, and other charges. Services like Credit Sesame can help you find credit offers with favorable terms. Make informed decisions to avoid future problems.

By avoiding these common mistakes, you can improve your chances of getting the right credit card. Use tools like Credit Sesame to stay informed and make smarter choices.

Specific Recommendations For Different Users

Applying for a credit card can be a daunting task, especially with so many options available. Different users have varying needs and financial situations, which is why targeted advice can be incredibly helpful. Below are specific recommendations for students, individuals with poor credit, and frequent travelers.

Tips For Students And First-time Applicants

Students and first-time applicants often have limited credit history. It’s essential for them to start building their credit profile early. Here are some tips:

- Choose a Student Credit Card: Many banks offer credit cards specifically designed for students. These cards often have lower credit limits and fewer fees.

- Use Credit Sesame: Leverage Credit Sesame to monitor your credit score daily and understand the factors affecting it.

- Pay on Time: Make sure to pay your bill on time every month. This builds a positive payment history.

- Keep Balances Low: Try to keep your credit utilization ratio below 30%. This means not using more than 30% of your available credit.

Advice For Individuals With Poor Credit

Individuals with poor credit can find it challenging to get approved for a new credit card. Here are some strategies to improve your chances:

- Secured Credit Cards: Consider applying for a secured credit card. This requires a security deposit but helps rebuild your credit.

- Credit Sesame’s Personalized Actions: Use Credit Sesame’s personalized advice to take steps to improve your credit score.

- Review Credit Reports: Regularly check your credit report for errors and dispute any inaccuracies.

- Limit New Applications: Avoid applying for multiple credit cards in a short period. Each application can lower your score slightly.

Guidance For Frequent Travelers

Frequent travelers should focus on credit cards that offer travel rewards and benefits. Here are key points to consider:

- Travel Rewards: Look for cards that offer points or miles for every dollar spent. These can be redeemed for flights, hotels, and more.

- No Foreign Transaction Fees: Choose a card that doesn’t charge foreign transaction fees. This saves money while spending abroad.

- Travel Insurance: Some cards offer travel insurance, including trip cancellation and lost luggage coverage.

- Access to Airport Lounges: Premium travel cards often offer access to airport lounges, providing a comfortable place to wait for flights.

Using a service like Credit Sesame can help find cards with high approval odds tailored to your credit profile. This can make the application process smoother and more successful.

Frequently Asked Questions

How To Improve Credit Score For Application?

Improving your credit score involves paying bills on time, reducing debt, and checking your credit report for errors. Avoid closing old accounts. Keep credit utilization low. Regularly monitor your credit score.

What Documents Are Needed For Credit Card Application?

Common documents include proof of identity, address, and income. Examples are a driver’s license, utility bills, and pay stubs. Ensure all documents are current. Some issuers may request additional documentation.

How Long Does Approval Process Take?

The approval process can take minutes to weeks. Online applications often get faster responses. Paper applications may take longer. Check with the issuer for specific timelines. Always provide accurate information to avoid delays.

Can I Apply For Multiple Credit Cards?

Yes, you can apply for multiple cards. However, multiple applications may impact your credit score. Each application results in a hard inquiry. Too many inquiries can lower your score. Space out applications to minimize impact.

Conclusion

Applying for a credit card requires careful consideration and preparation. Following these tips can increase your chances of approval. Remember to check your credit score regularly and keep your finances in order. For a user-friendly way to monitor your credit, try Credit Sesame. They offer free daily credit score updates and personalized advice. By staying informed and proactive, you can make smarter financial decisions. Happy credit card hunting!