Financial Planning Tools: Optimize Your Future Finances

Managing finances can be overwhelming without the right tools. Financial planning tools can help you take control of your money and future.

These tools simplify budgeting, tracking expenses, and improving credit scores. In today’s fast-paced world, staying on top of your finances is crucial. Financial planning tools offer a range of services to help you manage your money better. One such tool is Credit Sesame, which provides free daily credit score updates and personalized credit improvement actions. With Credit Sesame, you can monitor your credit score, find the best credit offers, and even build your credit using everyday purchases. It’s a comprehensive solution for anyone looking to improve their financial health. Whether you’re trying to get out of debt or save for the future, financial planning tools like Credit Sesame can make the process easier and more effective. Start exploring how these tools can help you achieve your financial goals. Learn more about Credit Sesame here.

Introduction To Financial Planning Tools

Managing finances can be challenging, especially without the right tools. Financial planning tools help individuals and families navigate their financial journey. These tools offer insights and strategies for smarter decision-making.

What Are Financial Planning Tools?

Financial planning tools are applications or software designed to help people manage their finances. They can track expenses, create budgets, plan for retirement, and more. These tools provide a clear picture of one’s financial health.

Many tools offer features such as:

- Expense tracking

- Budget creation

- Investment management

- Debt reduction plans

- Retirement planning

For example, Credit Sesame is a financial tool that offers free daily credit score updates and personalized credit improvement actions. It helps users monitor their credit score and find the best credit offers.

The Importance Of Financial Planning

Effective financial planning is crucial. It helps individuals set realistic goals and achieve financial stability. Without a plan, it is easy to overspend or miss out on savings opportunities.

Here are some key benefits of financial planning:

| Benefit | Description |

|---|---|

| Goal Setting | Helps set and prioritize financial goals. |

| Debt Management | Provides strategies to reduce and manage debt. |

| Investment Planning | Guides on where and how to invest money. |

| Emergency Preparedness | Ensures funds are available for unexpected expenses. |

| Retirement Security | Helps save and plan for a comfortable retirement. |

Tools like Credit Sesame not only help with budgeting but also assist in improving credit scores. They provide personalized actions and recommendations based on the user’s credit profile.

By using financial planning tools, individuals can take control of their financial future. They can make informed decisions, avoid costly mistakes, and achieve their financial goals more efficiently.

Key Features Of Effective Financial Planning Tools

Effective financial planning tools offer numerous features to help you manage and grow your finances. From budgeting to tax optimization, these tools simplify complex processes, ensuring you stay on top of your financial health.

One of the core features of any financial planning tool is its budgeting capabilities. These tools allow you to create and manage budgets for various expenses. They help you track your spending, set financial goals, and ensure you live within your means. Credit Sesame provides personalized credit improvement actions and daily credit score updates, helping you monitor and adjust your budget based on real-time data.

Investment tracking is essential for understanding your portfolio’s performance. Effective tools offer detailed insights into your investments, including stocks, bonds, and other assets. They provide real-time data, performance analysis, and projections to help you make informed decisions. Credit Sesame does not specifically offer investment tracking, but its features can help you improve your financial standing, making you more investment-ready.

Planning for retirement is crucial for financial security. Effective tools offer retirement calculators, savings goals, and investment advice. They help you estimate how much you need to save and track your progress. Credit Sesame can assist in this by improving your credit score, potentially giving you access to better financial products and savings options.

Managing debt is a significant part of financial planning. Effective tools offer features to track, manage, and pay down debts. They provide strategies for reducing interest rates and consolidating debts. Credit Sesame offers tailored actions to improve your credit score, which can help you manage and reduce your debt more effectively.

Tax optimization features help you minimize your tax liabilities and maximize deductions. These tools offer tax calculators, advice, and filing assistance. They ensure you comply with tax laws while saving money. Credit Sesame does not directly offer tax optimization, but improving your credit score can lead to better financial products and potential tax benefits.

| Feature | Description | Credit Sesame |

|---|---|---|

| Budgeting Capabilities | Track expenses, set goals, manage budgets | Yes |

| Investment Tracking | Monitor and analyze investments | No |

| Retirement Planning | Calculate savings, set retirement goals | Indirectly |

| Debt Management | Track and pay down debts | Yes |

| Tax Optimization | Minimize tax liabilities, maximize deductions | No |

Budgeting Capabilities

Financial planning is crucial for a secure future. Effective budgeting tools help you manage your finances better. Credit Sesame offers various features to help you create and manage your budget efficiently.

Creating And Managing Budgets

Credit Sesame simplifies budget creation. It offers templates to plan your expenses. Users can categorize their spending and set limits for each category. This helps in monitoring where your money goes.

Managing budgets is straightforward. The platform provides insights into your spending patterns. It also offers recommendations to optimize your budget. This way, you can adjust your spending habits to meet your financial goals.

Tracking Spending Habits

Tracking spending is vital for financial health. Credit Sesame tracks every purchase. It offers a detailed report of your spending habits. Users can see where they overspend and make necessary adjustments.

Credit Sesame’s mobile app makes tracking easy. Access your spending reports anytime. The app sends alerts for unusual spending. This helps you stay on top of your finances and avoid unnecessary expenses.

Setting Financial Goals

Setting financial goals is essential for long-term success. Credit Sesame allows users to set and track their financial goals. You can define your goals and the platform will help you achieve them.

Whether you aim to pay off debt, save for a vacation, or build an emergency fund, Credit Sesame provides tailored advice. It offers personalized actions to improve your credit score, which is key to achieving your financial goals.

The platform also provides insights into how your spending affects your goals. This way, you can make informed decisions and stay motivated towards your financial objectives.

Investment Tracking

Investment tracking is a crucial component of financial planning. It helps you monitor and manage your investments effectively. By using the right tools, you can ensure your portfolio stays on track with your financial goals. Let’s explore some key aspects of investment tracking.

Portfolio Analysis

Portfolio analysis allows you to assess the performance of your investments. It helps you understand how your assets are allocated. This analysis can reveal trends and insights, enabling you to make informed decisions. Regular portfolio analysis can help optimize returns and mitigate risks.

Real-time Market Data

Access to real-time market data is essential for making timely investment decisions. This data includes stock prices, market indices, and economic indicators. Having up-to-date information helps you react quickly to market changes. It ensures that your investment strategy remains relevant and effective.

Performance Metrics

Performance metrics provide a quantitative measure of your investment’s success. Metrics like return on investment (ROI), alpha, and beta are key indicators. They help you evaluate the efficiency and profitability of your portfolio. Regularly reviewing these metrics can guide your investment choices and strategies.

| Feature | Benefits |

|---|---|

| Daily Credit Score Updates | Monitor your credit score daily and track changes. |

| Personalized Actions | Receive tailored actions to improve your credit score. |

| Credit Builder | Build credit with everyday purchases using a virtual secured credit card. |

| Mobile App | Access all features through the Credit Sesame app. |

- Free Credit Monitoring: No credit card required to sign up.

- High Approval Odds: Recommendations for credit products with high approval chances.

- Security: Data protection with 256-bit encryption.

- Sign up for Credit Sesame for free.

- Monitor your credit score daily.

- Take personalized actions to improve your score.

- Utilize the Credit Builder feature for better credit.

For more information, visit the Credit Sesame website.

Retirement Planning

Planning for retirement is a crucial step in ensuring a comfortable and financially secure future. Using the right tools can help you navigate the complexities of retirement planning and make informed decisions about your finances. In this section, we explore some essential tools for effective retirement planning.

Retirement Savings Calculators

Retirement savings calculators are invaluable tools that help you estimate how much you need to save for retirement. These calculators take into account various factors such as your current age, expected retirement age, current savings, and expected annual expenses during retirement. By providing a clear picture of your financial future, these calculators can help you set realistic savings goals and track your progress over time.

- Estimate future savings needs

- Track progress towards retirement goals

- Adjust savings strategies as needed

Social Security Planning

Understanding Social Security benefits is essential for retirement planning. Social Security planning tools can help you determine the best time to start claiming benefits, how much you can expect to receive, and how your benefits will fit into your overall retirement income strategy. These tools provide personalized estimates based on your earnings history and help you maximize your Social Security benefits.

- Determine optimal claiming age

- Estimate Social Security benefits

- Integrate benefits with other income sources

Pension Management

For those with pensions, managing these benefits is a critical part of retirement planning. Pension management tools help you understand your pension options, including lump-sum payouts versus annuity payments. These tools can also assist in making decisions about survivor benefits, ensuring that your loved ones are financially protected. By effectively managing your pension, you can enhance your overall retirement security.

- Evaluate lump-sum vs annuity options

- Plan for survivor benefits

- Optimize pension payouts

| Tool | Purpose |

|---|---|

| Retirement Savings Calculators | Estimate savings needs and track progress |

| Social Security Planning | Maximize Social Security benefits |

| Pension Management | Optimize pension payouts and survivor benefits |

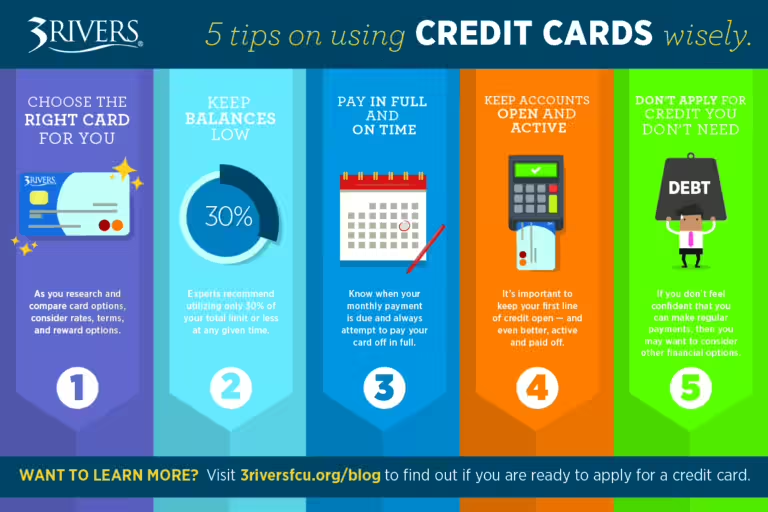

Debt Management

Managing debt can feel overwhelming, but using the right tools can make a significant difference. Debt management involves creating a plan to repay your debts systematically. This section highlights some of the most effective tools for debt management.

Loan Repayment Schedules

Creating a loan repayment schedule is essential to track your payments and stay on top of your debt. These schedules help you understand the timeline of your repayments and the total interest you will pay. A good repayment schedule includes:

- Loan amount

- Interest rate

- Monthly payment amount

- Payment due dates

Using an online tool or spreadsheet can help you visualize your repayment plan and ensure you never miss a payment.

Interest Rate Calculators

Calculating the interest rate on your loans is crucial for managing debt effectively. Interest rate calculators allow you to determine how much interest you will pay over the life of your loan. These calculators typically require:

- Loan principal amount

- Interest rate

- Loan term

By inputting these details, you can see the impact of different interest rates and make informed decisions about refinancing or consolidating loans.

Debt Reduction Strategies

Several debt reduction strategies can help you pay off debt faster and save on interest. Some popular strategies include:

- Debt Snowball Method: Focus on paying off the smallest debt first while making minimum payments on others. Once the smallest debt is paid, move to the next smallest.

- Debt Avalanche Method: Pay off the debt with the highest interest rate first, then move to the next highest rate.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate. This simplifies payments and can reduce overall interest costs.

Choosing the right strategy depends on your personal financial situation and goals.

By using tools like Credit Sesame, you can receive personalized credit improvement actions and daily credit score updates. These features can help you manage your debt more effectively and achieve your financial goals.

| Feature | Details |

|---|---|

| Daily Credit Score Updates | Get your credit score daily and monitor changes. |

| Personalized Actions | Receive tailored actions to improve your credit score. |

| Credit Offers | Find the best offers with high approval chances. |

For more details, visit Credit Sesame.

Tax Optimization

Tax optimization is a crucial element of financial planning. It helps you maximize your savings and minimize your tax liabilities. Using the right tools, you can streamline your tax processes and ensure compliance. Here are some key components of tax optimization to consider.

Tax Filing Assistance

Efficient tax filing is essential for accurate and timely tax submissions. Many financial planning tools offer tax filing assistance. This feature guides you through the filing process and ensures you do not miss any important details.

For example, platforms like Credit Sesame may provide tax-related insights based on your financial data. Using these insights, you can prepare your tax documents more effectively.

Deductions And Credits

Understanding eligible deductions and credits can significantly reduce your tax burden. Financial planning tools help you identify all available deductions and credits. This ensures you claim every benefit you are entitled to.

For instance, using Credit Sesame’s personalized actions, you may receive tailored advice on potential tax savings. This advice can include tips on claiming specific deductions and credits based on your credit and financial profile.

Year-round Tax Planning

Tax planning is not just for tax season. Year-round tax planning helps you stay prepared and avoid last-minute stress. Financial tools assist in maintaining a record of your financial activities throughout the year.

With Credit Sesame, you can keep track of your credit score and report summary daily. This continuous monitoring helps you make informed decisions that can impact your tax situation positively.

| Feature | Benefit |

|---|---|

| Daily Credit Score Updates | Monitor changes and plan for tax implications |

| Personalized Actions | Receive tax-related advice based on your profile |

| Credit Offers | Find offers with high approval chances, influencing your financial plan |

Overall, integrating tax optimization into your financial planning using tools like Credit Sesame can lead to better financial health and reduced tax liabilities. Start today to take control of your tax planning and enjoy the benefits year-round.

Pricing And Affordability Of Financial Planning Tools

Financial planning tools can vary greatly in terms of pricing and affordability. Understanding the differences between free and paid tools, subscription models, and the overall value for money can help you make an informed decision.

Free Vs. Paid Tools

Many financial planning tools, like Credit Sesame, offer a range of free services. These include daily credit score updates, personalized actions for credit improvement, and access to various credit offers. The primary advantage of free tools is that they provide essential services without any cost, making them accessible to a broad audience.

On the other hand, paid tools often come with enhanced features and more comprehensive support. For example, Credit Sesame’s Sesame Cash account involves a $9.99 monthly fee, which can be waived under certain conditions. This account offers additional benefits such as using everyday purchases to build credit without a credit check or security deposit.

Subscription Models

Subscription models are common in the financial planning tools market. These models can range from monthly to annual subscriptions, offering different levels of service. For instance, Credit Sesame has a monthly fee for its Sesame Cash account, but this fee can be waived by meeting specific account activity conditions.

Subscription models provide flexibility, allowing users to choose a plan that fits their needs and budget. They often include tiered services, where higher subscription levels unlock more features and benefits.

Value For Money

Determining the value for money involves comparing the features and benefits of a tool against its cost. Free tools like Credit Sesame offer significant value by providing essential services at no cost. Users can monitor their credit score and receive personalized actions to improve it without any financial commitment.

Paid tools, while costing money, often provide enhanced features that justify the expense. For example, the Sesame Cash account allows users to build credit using everyday purchases, which can be a valuable service for those looking to improve their credit score. Additionally, the security commitment with 256-bit encryption and no selling of personal information adds to the overall value.

| Feature | Free | Paid |

|---|---|---|

| Daily Credit Score Updates | Yes | Yes |

| Personalized Actions | Yes | Yes |

| Credit Offers | Yes | Yes |

| Credit Builder | No | Yes |

| Mobile App | Yes | Yes |

| Monthly Fee | No | $9.99 (waivable) |

In summary, evaluating the pricing and affordability of financial planning tools involves considering the benefits provided by free versus paid tools, understanding different subscription models, and assessing the overall value for money. Each option has its own advantages, so it’s important to choose the one that best fits your financial planning needs.

Pros And Cons Of Financial Planning Tools

Financial planning tools have become essential in managing personal finances. They offer numerous benefits but also come with certain limitations. Understanding these can help users make better decisions about incorporating these tools into their financial strategies.

Advantages Of Using Financial Planning Tools

Financial planning tools like Credit Sesame offer several benefits that make managing money simpler and more effective.

- Daily Credit Score Updates: Users get daily updates on their credit scores, allowing them to monitor changes closely.

- Personalized Actions: The tool provides tailored actions to improve credit scores, making it easier to follow specific steps.

- High Approval Odds: It recommends credit products with a high chance of approval based on individual credit profiles.

- Credit Building: Users can build credit with everyday purchases using a debit card linked to a virtual secured credit card.

- Free Service: The service is free for daily credit score updates, personalized actions, and credit offers.

Potential Drawbacks And Limitations

While financial planning tools offer many advantages, they also have some limitations.

- Fee Waivers Conditions: Monthly and inactivity fees can be waived, but only if specific account activity conditions are met.

- Additional Fees: There are fees for international and out-of-network cash withdrawals, third-party services, and cash deposits.

- Limited Functionality: Some tools may not cover all financial aspects, requiring users to use multiple tools for comprehensive planning.

- Data Security Concerns: Although Credit Sesame uses 256-bit encryption, some users may still worry about data security.

Recommendations For Ideal Users And Scenarios

Financial planning tools are essential for various life stages. Each tool caters to different needs, from young professionals managing their first salaries to families planning for their children’s education and retirement. Here, we recommend the ideal users for specific financial planning tools and the scenarios where they can be most beneficial.

Best Tools For Young Professionals

Young professionals often need tools that help them manage their finances efficiently. They require solutions that offer budgeting, expense tracking, and credit monitoring. Credit Sesame is an excellent choice for young professionals due to its comprehensive features:

- Daily Credit Score Updates: Helps users monitor their credit score and understand their financial health.

- Personalized Actions: Provides tailored advice to improve credit scores.

- Credit Offers: Recommends credit products with high approval odds.

- Mobile App: Allows easy access to all features on the go.

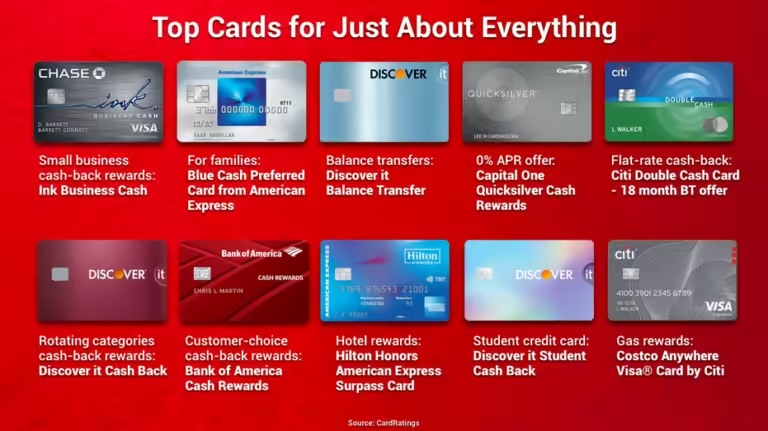

Tools For Families And Parents

Families and parents often need tools that assist with budgeting, saving for education, and managing household expenses. Here are some recommendations:

- YNAB (You Need A Budget): Helps with budgeting and expense tracking.

- Mint: Offers comprehensive financial tracking and bill reminders.

- Credit Sesame: Useful for monitoring and improving family credit scores with features like Sesame Grade and Credit Builder.

Retirement Focused Tools

Planning for retirement requires tools that offer investment tracking, retirement goal setting, and financial forecasting. Ideal tools include:

- Personal Capital: Provides investment tracking and retirement planning calculators.

- Vanguard: Offers low-cost retirement investment options and planning tools.

- Credit Sesame: Although primarily for credit monitoring, its personalized actions can help improve creditworthiness, essential for securing favorable retirement loans or credit products.

Choosing the right financial planning tool depends on your current life stage and financial goals. Whether you are a young professional, a parent, or planning for retirement, there are tools designed to help you achieve financial success.

Frequently Asked Questions

What Are Financial Planning Tools?

Financial planning tools are software or apps. They help in managing your finances. They include budgeting, investment tracking, and retirement planning features.

Why Use Financial Planning Tools?

They simplify managing finances. They provide insights into spending and saving. They help achieve financial goals effectively.

Which Is The Best Financial Planning Tool?

The best tool varies for everyone. Popular options include Mint, YNAB, and Personal Capital. Choose one that fits your needs.

How Do Financial Planning Tools Work?

They track your income and expenses. They help set budgets and financial goals. They offer reports and insights for better financial decisions.

Conclusion

Financial planning tools can greatly simplify managing your finances. They help you stay organized, set goals, and track progress. Tools like Credit Sesame offer daily credit score updates and personalized credit improvement actions. With these resources, you can make informed decisions and improve your financial health. Start using these tools today to take control of your financial future.