Credit Score Monitoring: Boost Your Financial Health Today

Credit score monitoring is vital for maintaining financial health. It helps you track your credit report and score regularly.

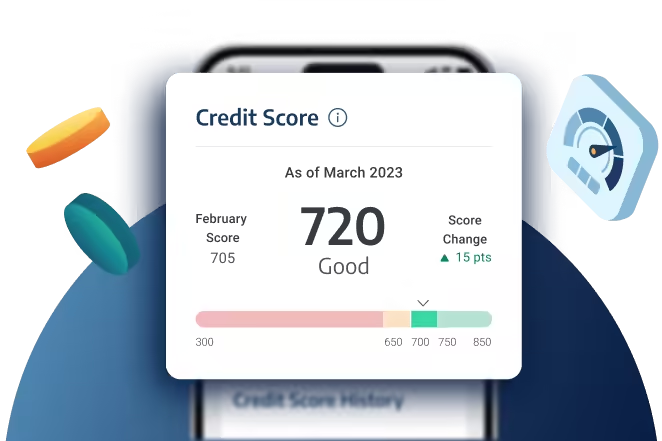

Understanding your credit score can save you from financial troubles and open doors to better opportunities. Credit Sesame, a digital platform, offers free access to your credit score and report summary. It provides daily updates, personalized actions, and credit-building tools. This service helps you improve your financial health and find the best credit offers. With Credit Sesame, you can manage your credit needs conveniently and securely. The platform ensures data protection and offers a straightforward way to build and monitor your credit. Start your credit score monitoring journey with Credit Sesame today.

Introduction To Credit Score Monitoring

Keeping track of your credit score is essential for managing your financial health. Credit score monitoring helps you stay informed about your credit status and take action to improve it. In this section, we will explore the importance of credit score monitoring and how it can benefit you.

What Is Credit Score Monitoring?

Credit score monitoring involves regularly checking your credit score and credit report. It helps you understand your financial standing and identifies any inaccuracies or potential fraud. Services like Credit Sesame provide tools to monitor your credit score daily and offer personalized advice to improve it.

Importance Of Monitoring Your Credit Score

Monitoring your credit score is crucial for several reasons:

- Early Detection of Fraud: Spot unauthorized activities and take immediate action.

- Improving Financial Health: Understand factors affecting your score and get personalized tips to enhance it.

- Better Loan and Credit Card Offers: Identify opportunities with higher approval chances.

- Financial Planning: Make informed decisions when planning major purchases or applying for credit.

Using a service like Credit Sesame gives you free access to your credit score and credit report summary. It provides daily updates, ensuring you stay informed about your credit status.

Credit Sesame Features

Credit Sesame offers a range of features to help you manage your credit:

| Feature | Description |

|---|---|

| Daily Credit Score Updates | Get your credit score updated daily without needing a credit card. |

| Credit Report Summary | View a detailed summary of your credit report. |

| Sesame Grade | Receive a letter grade based on the five major factors impacting your credit score. |

| Personalized Actions | Get tailored actions to help improve your credit score. |

| Credit Offers | Find the best credit offers with high approval chances based on your profile. |

| Credit Builder | Build credit using everyday purchases with no credit check or security deposit. |

With Credit Sesame, you can manage all your credit needs in one place. The platform’s security features ensure your data is protected, and your personal information is not sold to third parties.

Benefits Of Credit Sesame

- Free Access: No cost to sign up and access your credit score and report.

- Convenience: Manage all your credit needs through the website or mobile app.

- Security: Data is protected with 256-bit encryption.

- Confidence in Applications: See offers with high approval chances.

- Credit Building: Use debit card purchases to build credit, with fees potentially waived.

Credit Sesame’s average rating is 4.5/5 based on 564,000 reviews. Users appreciate the platform’s helpfulness, security, and ease of use.

Key Features Of Credit Score Monitoring Tools

Credit score monitoring tools offer numerous features that help you stay on top of your financial health. Understanding these features can aid in better managing and improving your credit score. Below are some essential features provided by platforms like Credit Sesame.

Real-time Alerts And Updates

Real-time alerts keep you informed about changes in your credit report. These alerts notify you about:

- New credit inquiries

- Account openings

- Missed payments

- Changes in your credit score

Credit Sesame offers daily credit score updates without needing a credit card. This feature helps you stay vigilant and quickly address any discrepancies.

Credit Report Access And Analysis

Accessing and analyzing your credit report is crucial for understanding your credit health. Credit monitoring tools provide:

- Detailed credit report summaries

- Breakdown of credit factors

- Personalized action plans

Credit Sesame offers a credit report summary and Sesame Grade, a letter grade based on five major credit factors.

Score Simulation And Forecasting Tools

Score simulation tools allow you to see how different financial decisions impact your credit score. These tools can simulate:

- Opening new credit accounts

- Paying off debt

- Making late payments

Credit Sesame provides personalized actions to help improve your score. This can help you make informed financial decisions.

Identity Theft Protection

Identity theft protection is essential for safeguarding your financial health. Credit monitoring tools typically offer:

- Real-time alerts for suspicious activities

- Identity theft insurance

- Fraud resolution support

Credit Sesame ensures data protection with 256-bit encryption and does not sell your personal information to third parties.

| Feature | Credit Sesame |

|---|---|

| Real-Time Alerts | Daily Credit Score Updates |

| Credit Report Access | Credit Report Summary, Sesame Grade |

| Score Simulation | Personalized Actions |

| Identity Theft Protection | 256-bit Encryption, No Data Selling |

Pricing And Affordability

Monitoring your credit score is crucial for maintaining financial health. Understanding pricing and affordability can help you decide between free and premium services.

Free Vs. Paid Credit Monitoring Services

Credit Sesame offers a free service providing access to your credit score and credit report summary. This free tier includes:

- Daily Credit Score Updates: Get your credit score daily without needing a credit card.

- Credit Report Summary: View a detailed summary of your credit report.

- Sesame Grade: A clear letter grade based on the five major factors impacting your credit score.

- Personalized Actions: Receive tailored actions to help improve your credit score.

- Credit Offers: Find the best credit offers with a high chance of approval based on your credit profile.

Credit Sesame also offers a paid service, Sesame Cash, with additional features:

- Monthly Fee: $9.99, waivable with $500 direct deposit or $1,000 monthly spending.

- Inactivity Fee: $3, waivable with at least one transaction per month.

- First 30 Days: No fees charged.

- Extra Fees: International and out-of-network cash withdrawals, third-party, and cash deposits.

Cost-benefit Analysis Of Premium Services

Evaluating the benefits of premium services against their costs can guide your decision. Here’s a breakdown of what you get with Credit Sesame’s Sesame Cash:

| Feature | Free Service | Sesame Cash |

|---|---|---|

| Daily Credit Score Updates | Yes | Yes |

| Credit Report Summary | Yes | Yes |

| Sesame Grade | Yes | Yes |

| Personalized Actions | Yes | Yes |

| Credit Offers | Yes | Yes |

| Credit Builder | No | Yes |

| Fee Waivers | No | Yes, based on usage |

The free service suffices for basic credit score monitoring. Yet, the premium service adds value with credit-building tools and fee waivers. Consider your financial habits and goals before choosing.

Pros And Cons Of Credit Score Monitoring

Monitoring your credit score regularly can be very beneficial. However, it also has some drawbacks. Let’s explore the pros and cons of credit score monitoring.

Benefits Of Regular Credit Monitoring

Regular credit monitoring offers several significant benefits:

- Early Detection of Fraud: Spot unauthorized activities quickly and take action.

- Improved Credit Score: Take personalized actions to enhance your score.

- Better Financial Management: Manage your financial health with ease.

- Access to Credit Offers: Find credit options with high approval chances.

- Convenience: Access and manage your credit information in one place.

Potential Drawbacks And Limitations

While credit monitoring has many advantages, there are also some limitations:

- Cost: Some services may have fees, like Sesame Cash’s $9.99 monthly fee.

- Inactivity Fees: A $3 monthly inactivity fee if no transactions occur.

- Limited Protection: Monitoring alone cannot prevent identity theft.

- Data Security: Despite encryption, data breaches are always a risk.

Understanding these pros and cons can help you decide if credit score monitoring suits your needs.

| Pros | Cons |

|---|---|

| Early fraud detection | Potential costs |

| Improved credit score | Inactivity fees |

| Better financial management | Limited protection |

| Access to credit offers | Risk of data breaches |

Credit monitoring with Credit Sesame can provide free access to your credit score and report summary. This can help you stay on top of your financial health. But be aware of possible fees and limitations. For more details, visit their website.

Ideal Users And Scenarios For Credit Score Monitoring

Monitoring your credit score is crucial for maintaining financial health. It can help prevent identity theft, ensure loan approval, and improve creditworthiness. The following sections explore who should use credit score monitoring and the best situations to utilize these tools.

Who Should Use Credit Score Monitoring?

Credit score monitoring is essential for various individuals:

- Young Adults: Those new to credit need to build and monitor their credit history.

- Loan Applicants: Ensuring a good score before applying for a mortgage or car loan is vital.

- Identity Theft Victims: Monitoring helps detect unauthorized activities promptly.

- Frequent Credit Card Users: Helps manage and keep track of credit usage.

- Small Business Owners: Maintains a healthy credit score for business financing.

Best Situations To Utilize Credit Monitoring Tools

Credit monitoring tools like Credit Sesame are invaluable in several scenarios:

- Before Major Purchases: Planning to buy a home or a car? Monitoring ensures your credit is in top shape.

- After Identity Theft: Regular updates help catch any discrepancies or unauthorized activities early.

- During Financial Recovery: If recovering from debt, monitoring progress can be encouraging.

- For Building Credit: Tools like Credit Sesame’s Credit Builder can aid in credit-building efforts.

- To Take Advantage of Offers: Personalized credit offers based on your profile can save money and time.

Using Credit Sesame, users can receive daily credit score updates, view detailed credit report summaries, and get personalized actions to improve their credit score.

Conclusion: Enhancing Financial Health Through Credit Score Monitoring

Monitoring your credit score is crucial for maintaining and improving your financial health. With Credit Sesame, you can easily access your credit information and take steps to enhance your financial well-being. Below, we summarize the benefits and provide final recommendations for effectively using Credit Sesame.

Summary Of Benefits

Credit Sesame offers numerous advantages for users aiming to manage their credit scores:

- Free Access: No cost to sign up and access your credit score and report.

- Daily Credit Score Updates: Receive daily updates without needing a credit card.

- Credit Report Summary: View a detailed summary of your credit report.

- Personalized Actions: Get tailored actions to improve your credit score.

- Credit Offers: Find credit offers with high approval chances based on your profile.

- Credit Builder: Build credit using everyday purchases with no credit check or security deposit required.

- Security: Data is protected with 256-bit encryption, ensuring your information remains secure.

Final Recommendations

To maximize the benefits of Credit Sesame, consider the following tips:

- Check Your Score Regularly: Use the daily updates to stay informed about your credit status.

- Follow Personalized Actions: Implement the tailored actions provided to improve your score.

- Utilize Credit Builder: Make everyday purchases with the Credit Builder feature to enhance your credit.

- Review Credit Offers: Check for high-approval credit offers that suit your profile.

- Maintain Security: Ensure your data remains protected by regularly updating your security settings.

By leveraging these features, you can effectively manage and improve your credit score, paving the way for a healthier financial future.

Frequently Asked Questions

What Is Credit Score Monitoring?

Credit score monitoring tracks changes in your credit score. It helps you stay informed about your credit health. Regular monitoring can alert you to potential fraud or errors.

Why Is Credit Score Monitoring Important?

Credit score monitoring is vital for maintaining good credit health. It helps detect identity theft early. It also ensures your credit report is accurate.

How Often Should I Monitor My Credit Score?

You should monitor your credit score at least monthly. Regular checks help you catch inaccuracies early. It also keeps you informed about your financial health.

Can Credit Score Monitoring Improve My Score?

Monitoring your credit score alone doesn’t improve it. However, it helps you make informed decisions. Identifying errors and correcting them can boost your score.

Conclusion

Monitoring your credit score is crucial for financial health. It helps you make informed decisions. Credit Sesame offers tools to track and improve your score. Their platform is free and easy to use. Access your credit score daily and get personalized tips. Start managing your credit effectively today with Credit Sesame. Stay proactive and secure your financial future.