Debt Management Resources: Essential Tools for Financial Stability

Managing debt can feel overwhelming. Finding the right resources can make all the difference.

Debt management resources provide tools and strategies to help you take control of your finances. These resources can guide you in organizing your debt, setting up payment plans, and improving your credit score. Whether you are struggling to make ends meet or simply want to be more financially savvy, having access to the right resources is crucial. One such valuable resource is Credit Sesame. It offers free daily credit score updates and a summary of your credit report. With personalized actions and credit offers, Credit Sesame helps users monitor and improve their credit. Discover how Credit Sesame can assist you in managing your debt effectively by visiting their website here.

Introduction To Debt Management Resources

Managing debt can be a daunting task. With the right tools and resources, it becomes easier and more manageable. Debt management resources provide individuals with the necessary knowledge and strategies to handle their debts effectively.

Understanding Debt Management

Debt management involves strategies and techniques to reduce and eliminate debt. It includes creating a budget, negotiating with creditors, and exploring debt relief options. By understanding debt management, individuals can take control of their financial future.

One effective resource for managing debt is Credit Sesame. This free service offers daily credit score updates and a summary of your credit report. It helps users monitor their credit, understand their score, and take actions to improve it.

Key features of Credit Sesame include:

- Daily Credit Score Updates: Get your credit score and report summary daily.

- Sesame Grade: A clear letter grade based on the five major factors that impact your credit score.

- Personalized Actions: Receive suggestions to help improve your credit score.

- Credit Offers: Find the best credit offers with a high chance of approval.

- Credit Builder: Build credit using everyday purchases with Sesame Cash.

The Importance Of Financial Stability

Financial stability is crucial for maintaining a healthy financial life. It ensures you can meet your financial obligations and save for future goals. Without stability, debt can spiral out of control, leading to stress and financial hardship.

Using resources like Credit Sesame can help achieve financial stability. The service provides personalized actions to improve your credit score. Better credit scores can lead to lower interest rates and better loan terms. This can save money and help manage debt more effectively.

Benefits of using Credit Sesame include:

| Benefit | Description |

|---|---|

| Free Access | No cost to sign up or access basic features. |

| No Credit Card Required | Sign up without needing to provide credit card information. |

| Time-Saving | Quickly see your credit score and receive personalized recommendations. |

| Confidence in Applications | Apply for credit with greater confidence by seeing offers tailored to your profile. |

| Secure | Uses 256-bit encryption to protect your data. |

In conclusion, using debt management resources like Credit Sesame can make a significant difference. They provide the tools needed to understand and improve your financial situation.

Key Features Of Debt Management Tools

Managing debt can be challenging, but using the right tools can make it easier. Debt management tools offer essential features to help you stay on top of your finances. Below are some key features that can help you manage and reduce your debt effectively.

Budgeting tools are essential for tracking your income and expenses. They help you create a realistic budget and stick to it. These tools can show you where your money goes and help you identify areas to cut back.

- Track income and expenses

- Create and manage budgets

- Identify spending habits

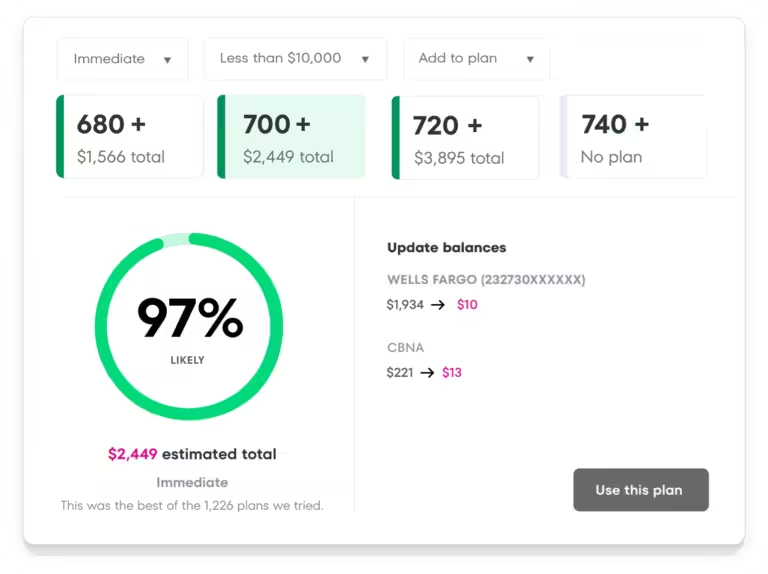

Debt repayment calculators help you plan your debt repayment strategy. These calculators can show you how long it will take to pay off your debt and how much interest you will pay. They can also help you compare different repayment plans.

- Estimate repayment time

- Calculate interest costs

- Compare repayment plans

Credit score monitoring is crucial for keeping track of your credit health. Tools like Credit Sesame provide daily credit score updates and a summary of your credit report. This helps you understand your score and take actions to improve it.

| Feature | Details |

|---|---|

| Daily Credit Score Updates | Get your credit score and report summary daily. |

| Sesame Grade | A clear letter grade based on the five major factors impacting your score. |

| Personalized Actions | Receive suggestions to help improve your credit score. |

| Credit Offers | Find the best credit offers with a high chance of approval. |

Financial education resources are vital for understanding debt and how to manage it. These resources include blog articles, tips, and guides on credit, budgeting, and debt management. They provide valuable information to help you make informed financial decisions.

- Blog articles on credit-related topics

- Tips and guides on how to use credit

- Information on building and understanding credit scores

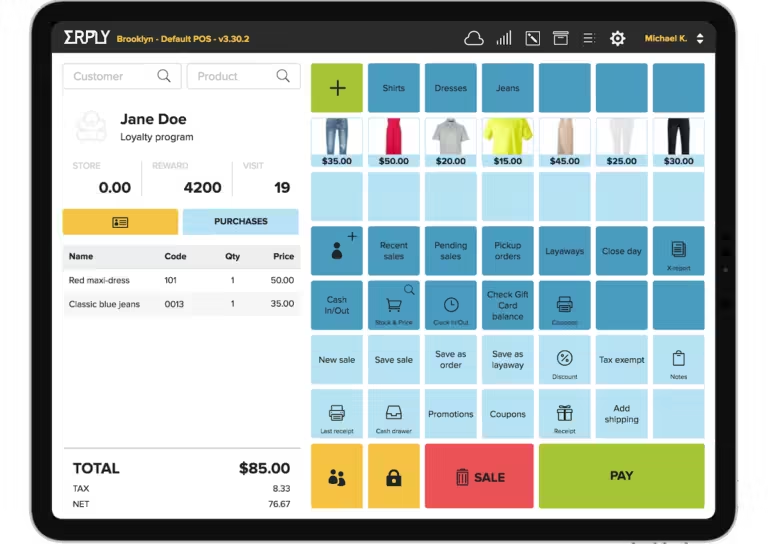

Budgeting Tools

Managing debt effectively starts with understanding your financial situation. This is where budgeting tools come into play. They help you track your expenses, plan your budget, and ultimately, manage your debt better. Below, we discuss how these tools can help you and explore some popular options.

How Budgeting Tools Help You Track Expenses

Budgeting tools are essential for tracking your expenses. They allow you to categorize your spending, so you know exactly where your money goes. This helps you identify areas where you can cut costs. Most tools offer visual aids like charts and graphs. These visuals make it easier to understand your spending habits. Additionally, they provide alerts and reminders to help you stay on track with your budget.

Popular Budgeting Tools And Their Benefits

There are several budgeting tools available that can help you manage your finances:

| Tool Name | Key Features | Benefits |

|---|---|---|

| Mint |

|

|

| YNAB (You Need A Budget) |

|

|

| Credit Sesame |

|

|

Using these budgeting tools can provide significant benefits. They help you stay on top of your finances and make informed decisions. Remember, the key to effective debt management lies in being aware of your spending and planning accordingly.

Debt Repayment Calculators

Debt repayment calculators are powerful tools that help individuals manage their debt. These calculators provide insights into how long it will take to pay off debt and the best strategies to do so. By inputting various data points, users can create a personalized repayment plan to manage their finances better.

How Debt Repayment Calculators Work

Debt repayment calculators require users to enter specific details about their debt. This information typically includes:

- Total Debt Amount: The full amount owed.

- Interest Rate: The annual interest rate of the debt.

- Monthly Payment: How much you can pay each month.

- Additional Payments: Any extra payments you can make.

Once these details are entered, the calculator generates a detailed repayment schedule. This schedule shows the timeline for paying off the debt, including how much interest will be paid over time. Some calculators offer additional features, such as comparing different repayment strategies or prioritizing debts with higher interest rates.

The Benefits Of Using Debt Repayment Calculators

Using debt repayment calculators offers several benefits:

- Clarity and Organization: See your entire debt picture at a glance.

- Motivation: Track your progress and stay motivated as you see your debt decrease.

- Customization: Adjust your payment plans to fit your financial situation.

- Savings: Identify strategies to minimize interest payments.

These calculators can be especially helpful for users of Credit Sesame, a service offering daily credit score updates and personalized actions to improve your credit. By integrating debt repayment calculators into your financial routine, you can gain greater control over your debt and work towards a healthier financial future.

For more information on Credit Sesame, visit their website and explore their range of tools and resources to help you manage and improve your credit.

Credit Score Monitoring

Monitoring your credit score is an essential practice for maintaining financial health. It helps you understand your creditworthiness and take steps to improve it. Let’s explore why monitoring your credit score is important and the top tools available for this purpose.

Why Monitoring Your Credit Score Is Important

Your credit score affects many aspects of your financial life. It influences loan approvals, interest rates, and even job opportunities. Regular monitoring can help you:

- Detect Fraud: Spot any suspicious activity early.

- Improve Your Score: Identify areas needing improvement.

- Stay Informed: Keep track of your financial progress.

Staying on top of your credit score ensures you are prepared for any financial decisions. It provides a clearer picture of your financial standing and helps you make informed choices.

Top Credit Score Monitoring Tools

| Tool | Features | Benefits |

|---|---|---|

| Credit Sesame |

|

|

| Credit Karma |

|

|

| Experian |

|

|

These tools provide valuable insights and protection. They help you stay proactive about your financial health. With resources like Credit Sesame, you can receive daily updates and personalized advice. This ensures you always know where you stand and what steps to take next.

Financial Education Resources

Understanding debt management is crucial for maintaining financial health. Financial education resources provide the knowledge needed to manage debt effectively. These resources offer tools and information to help you make informed decisions about your finances.

Types Of Financial Education Resources

Various types of financial education resources can help you improve your financial literacy. Some of the most common include:

- Online Courses: Many websites offer free and paid courses on budgeting, saving, and managing debt. These courses are often self-paced and can be accessed from anywhere.

- Books and eBooks: Numerous books cover financial topics in detail, providing strategies and tips from experts.

- Workshops and Seminars: Local community centers and financial institutions often host events to educate the public on financial topics.

- Financial Blogs: Websites like Credit Sesame offer blogs with articles on credit-related topics, tips, and guides.

- Apps and Tools: Financial apps such as Credit Sesame provide daily updates, personalized actions, and credit offers to help you manage your credit score.

How Financial Education Resources Can Help You

Utilizing financial education resources can provide numerous benefits:

- Improved Knowledge: By learning about credit scores, budgeting, and debt management, you can make better financial decisions.

- Personalized Guidance: Resources like Credit Sesame offer personalized actions to help you improve your credit score.

- Confidence: Understanding your financial situation gives you the confidence to apply for credit and make significant purchases.

- Security: Services like Credit Sesame use 256-bit encryption to protect your data, ensuring your financial information is safe.

Financial education resources are invaluable for anyone looking to improve their financial health. Whether through online courses, books, or apps like Credit Sesame, these tools provide the knowledge and confidence needed to manage debt effectively.

Pricing And Affordability Of Debt Management Tools

Understanding the pricing and affordability of debt management tools is crucial. Many users seek affordable solutions to manage their debts effectively. This section explores the costs associated with popular debt management tools and compares free versus paid options.

Cost Of Popular Debt Management Tools

Debt management tools vary widely in terms of cost. Some tools offer basic services for free, while others require a subscription fee. Below is a table detailing the pricing of some popular debt management tools:

| Tool | Basic Service | Premium Service |

|---|---|---|

| Credit Sesame | Free | $9.99/month (Sesame Cash fees) |

| Mint | Free | $4.99/month (ad-free experience) |

| Credit Karma | Free | N/A |

Credit Sesame offers a comprehensive free service. It includes daily credit score updates and personalized actions. For more advanced features, such as Sesame Cash, a monthly fee applies.

Free Vs Paid Tools: Which Is Better?

Choosing between free and paid debt management tools depends on your needs. Free tools like Credit Sesame provide essential services without cost. They offer daily credit score updates and credit offers with a high chance of approval.

Paid tools, on the other hand, often provide additional features. For example, Credit Sesame’s Sesame Cash includes a $9.99 monthly fee but offers credit building through everyday purchases. This can be advantageous for users looking to build their credit quickly.

Free Tools:

- No cost to sign up

- Access to basic features

- Useful for monitoring and understanding credit scores

Paid Tools:

- Additional features and services

- Credit building and tailored recommendations

- Potential fee waivers based on usage

Ultimately, the choice depends on your financial goals and budget. Free tools provide a good starting point, while paid options offer advanced features for more in-depth debt management.

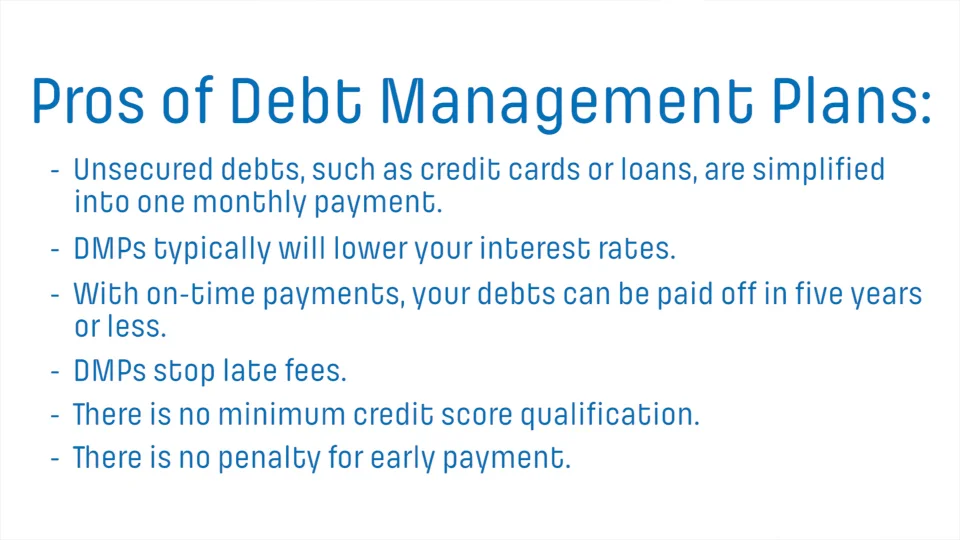

Pros And Cons Of Debt Management Tools

Debt management tools can be incredibly useful for those looking to take control of their finances. Understanding the pros and cons is essential to making an informed decision. Below, we’ll explore the advantages and potential drawbacks of using these tools.

Advantages Of Using Debt Management Tools

- Organization: Debt management tools help keep all your financial information in one place, making it easier to track your progress.

- Personalized Advice: Tools like Credit Sesame offer tailored suggestions to improve your credit score.

- Time-Saving: Quickly see your credit score and receive personalized recommendations without spending hours on research.

- Free Access: Many tools, including Credit Sesame, provide basic services for free, making them accessible to everyone.

- Confidence in Applications: Apply for credit with greater confidence by seeing offers tailored to your profile.

- Secure: Most tools use advanced encryption to protect your data, ensuring your personal information is safe.

Potential Drawbacks To Consider

- Fees: While basic services might be free, some tools have additional fees for premium features, like the $9.99 monthly fee for Credit Sesame’s Sesame Cash.

- Data Privacy: Although data is usually protected, it’s important to read the privacy policy to understand how your information is used.

- Over-Reliance: Relying too heavily on these tools can make users complacent, neglecting to actively manage their finances.

- Limited Features: Free versions might offer limited features, requiring a paid subscription for more comprehensive tools.

Using debt management tools can be a great way to monitor and improve your credit. Credit Sesame, for example, provides daily updates and personalized advice, making it easier to stay on top of your finances.

For more information, visit Credit Sesame and explore their range of features.

Recommendations For Ideal Users

Not everyone needs debt management tools, but they can be a game-changer for many. Understanding who benefits the most and recognizing essential scenarios can help you decide if these tools are right for you.

Who Can Benefit The Most From Debt Management Tools?

Individuals with Multiple Debts: If you have various credit cards, loans, and other debts, managing them can be overwhelming. Debt management tools like Credit Sesame can help you track and organize all your debts in one place.

People with Low Credit Scores: Those struggling with low credit scores can gain significant advantages. Credit Sesame provides daily credit score updates and personalized actions to improve your score.

Budget-Conscious Users: If you are looking for a cost-effective solution, Credit Sesame offers a free basic service with no credit card required. This makes it accessible for everyone.

Scenarios Where Debt Management Tools Are Essential

Preparing for Major Purchases: Planning to buy a home or a car? Knowing your credit score and understanding how to improve it can save you thousands in interest.

Recovering from Financial Setbacks: If you’ve faced job loss, medical expenses, or other financial crises, debt management tools can help you get back on track. Credit Sesame’s Sesame Grade offers a clear picture of your credit health and suggests ways to improve it.

Consolidating Debt: Considering debt consolidation? Use Credit Sesame to evaluate your credit situation and find the best credit offers with a high chance of approval.

Building Credit for the First Time: New to credit? Credit Sesame’s Credit Builder helps you build credit using everyday purchases, making it easier to establish a good credit history.

| Scenario | Benefit of Using Credit Sesame |

|---|---|

| Managing Multiple Debts | Track and organize all debts in one place |

| Improving Low Credit Scores | Daily updates and personalized actions |

| Preparing for Major Purchases | Understand and improve credit score |

| Recovering from Financial Setbacks | Clear picture of credit health |

| Consolidating Debt | Evaluate and find the best offers |

| Building Credit | Use everyday purchases to build credit |

Frequently Asked Questions

What Is Debt Management?

Debt management is a strategy to manage and repay debts. It involves budgeting, financial planning, and possibly negotiating with creditors. The goal is to reduce debt and improve financial health.

How Can I Manage My Debts Effectively?

To manage debts effectively, create a budget, track expenses, and prioritize payments. Consider debt consolidation or seeking help from a credit counselor. Stay disciplined and avoid new debts.

What Are Debt Management Resources?

Debt management resources include credit counseling agencies, budgeting tools, debt consolidation services, and educational materials. These resources help individuals understand and manage their financial obligations.

Can Debt Management Improve My Credit Score?

Yes, effective debt management can improve your credit score. Timely payments and reduced debt balances positively impact your credit rating. Consistent financial responsibility is key.

Conclusion

Managing debt effectively is crucial for financial health. Explore resources to understand your options. Use tools like Credit Sesame for daily credit score updates. Personalized actions help improve your credit score. Stay proactive and make informed decisions. With the right resources, you can achieve financial stability.