How To Repair Credit Fast: Proven Strategies for Success

Improving your credit score can seem daunting. But, it’s essential for financial health.

Credit repair isn’t just about fixing bad credit; it’s about building a foundation for a better financial future. Whether you’ve faced unexpected expenses, job loss, or simply made some financial mistakes, repairing your credit is possible and can significantly impact your life. In this guide, we’ll explore practical steps to help you repair your credit effectively. You’ll learn how to assess your credit situation, dispute errors, and adopt habits that enhance your credit score. With patience and dedication, you can achieve a healthier credit profile, opening doors to better financial opportunities. Let’s get started on this journey to better credit with some actionable strategies and tips. For a comprehensive tool to assist you, check out Credit Sesame.

Introduction To Credit Repair

Understanding how to repair your credit can seem daunting. But with the right tools and knowledge, you can make significant improvements. Let’s dive into the basics of credit repair and why it is essential for your financial health.

Understanding Credit Scores

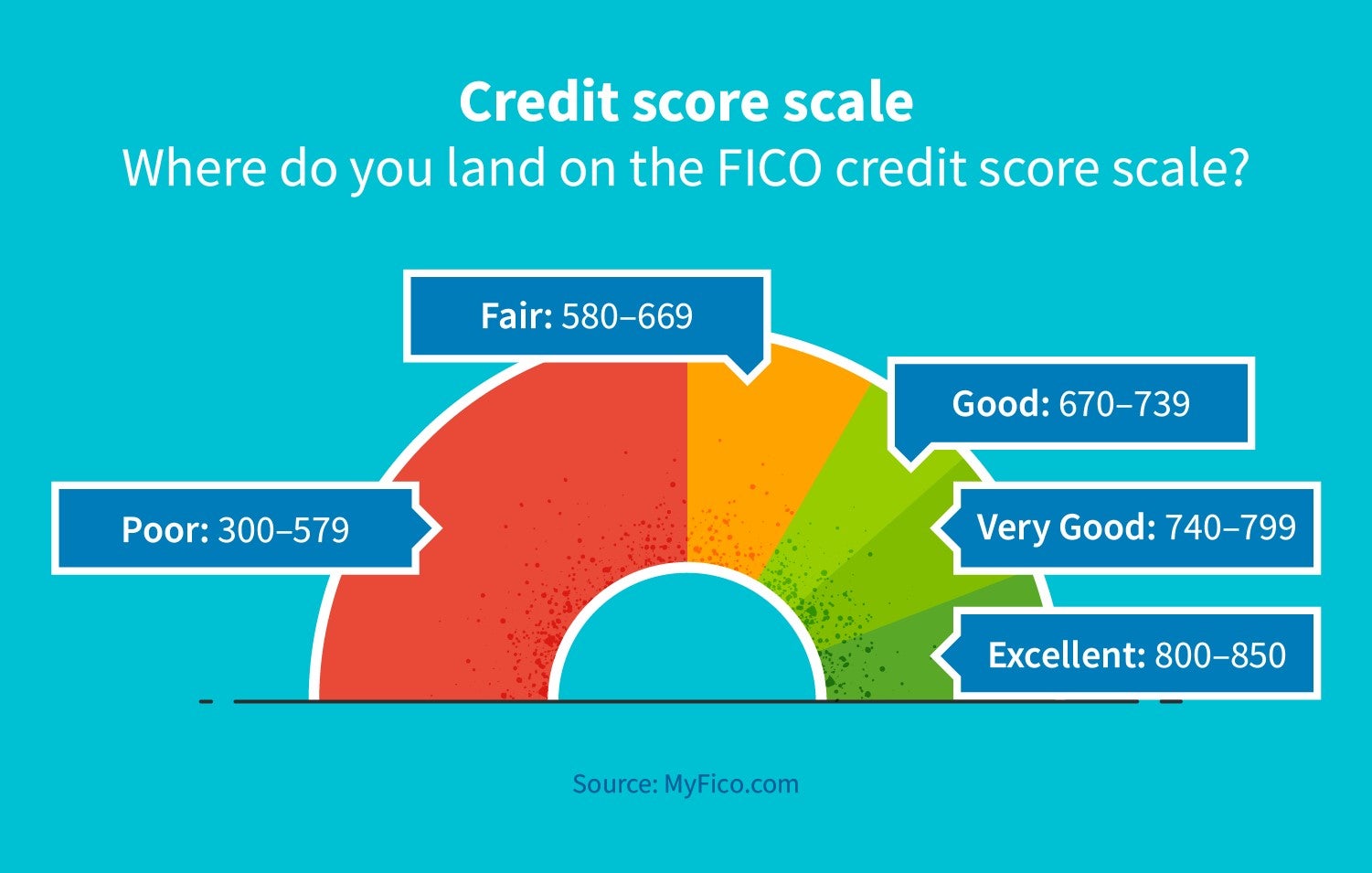

Credit scores are numerical representations of your creditworthiness. They range from 300 to 850 and are based on factors such as payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

Here’s a breakdown of the factors affecting your credit score:

- Payment History: Accounts for 35% of your score. Late payments negatively impact your score.

- Credit Utilization: Represents 30% of your score. It’s the ratio of your credit card balances to your credit limits.

- Length of Credit History: Makes up 15% of your score. A longer credit history can improve your score.

- Types of Credit: Accounts for 10% of your score. A mix of credit types (credit cards, loans) is beneficial.

- Recent Credit Inquiries: Also 10% of your score. Frequent credit inquiries can lower your score.

Why Credit Repair Is Important

Repairing your credit is crucial for several reasons. A good credit score can lead to better loan and credit card offers, lower interest rates, and improved financial opportunities. Poor credit can limit your access to these benefits.

Here are some benefits of having a good credit score:

- Lower Interest Rates: Save money on loans and credit cards.

- Higher Credit Limits: Access more credit when needed.

- Better Loan Approvals: Easier approval for mortgages and auto loans.

- Improved Job Prospects: Some employers check credit scores during hiring.

- Reduced Insurance Premiums: Pay less for insurance policies.

How Credit Sesame Can Help

Credit Sesame is a free credit monitoring service that helps you manage and improve your credit score. With daily credit score monitoring and personalized actions, you can take steps to repair your credit effectively.

Here are some main features of Credit Sesame:

- Daily Credit Score Monitoring: Check your credit score daily and see what impacts it.

- Sesame Grade: A clear letter grade based on the five major factors affecting your credit score.

- Personalized Actions: Recommendations to improve your credit score.

- Credit Offers: Find the best credit offers with high approval chances based on your profile.

- Credit Builder Tool: Build credit using everyday purchases with a prepaid debit card system.

For more details, you can visit Credit Sesame and explore the various tools and features offered.

Assessing Your Current Credit Situation

Understanding your credit situation is the first step to improving your credit score. By assessing your current credit status, you can identify areas that need attention and take appropriate actions. This section will guide you through obtaining your credit report, and identifying errors and negative items that may be affecting your score.

Obtaining Your Credit Report

To begin, you need to obtain your credit report. You can get a free credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Additionally, you can use platforms like Credit Sesame to monitor your credit score daily.

- Visit the Annual Credit Report website.

- Request a copy of your report from each bureau.

- Alternatively, sign up for Credit Sesame for daily updates.

Identifying Errors And Negative Items

Once you have your credit report, review it carefully. Look for any errors or negative items that could be impacting your score. Common errors include:

- Incorrect personal information.

- Accounts that don’t belong to you.

- Incorrect account statuses.

- Duplicate accounts.

If you find any errors, dispute them with the credit bureau. You can do this online or by mail. Provide any supporting documentation to help your case. Correcting these errors can significantly improve your credit score.

Negative items, such as late payments or collections, also impact your score. Create a plan to address these items. For example, pay off any outstanding debts and make sure to pay your bills on time moving forward.

Utilize Credit Sesame’s Personalized Actions feature to get recommendations on how to improve your credit score based on your specific situation.

| Action | Details |

|---|---|

| Dispute Errors | Contact credit bureaus with supporting documents to correct errors. |

| Address Negative Items | Pay off debts and ensure timely payments in the future. |

| Use Credit Sesame | Monitor your score daily and follow personalized recommendations. |

By carefully assessing your current credit situation, you can take control and improve your financial health. Use tools like Credit Sesame to stay informed and proactive in your credit journey.

Disputing Errors On Your Credit Report

Errors on your credit report can harm your credit score. It’s crucial to check your report regularly and dispute any inaccuracies. Correcting these errors can improve your credit score and financial health.

How To File A Dispute

To file a dispute, follow these steps:

- Obtain Your Credit Report: Request your credit report from the three major credit bureaus: Experian, TransUnion, and Equifax. You can get a free report annually from each bureau at Annual Credit Report.

- Identify Errors: Review your credit report carefully. Look for inaccuracies like incorrect personal information, accounts you don’t recognize, or wrong account statuses.

- Gather Documentation: Collect documents that support your claim. This can include bank statements, payment records, or any other relevant evidence.

- Contact the Credit Bureau: Write a dispute letter to the credit bureau. Include your personal information, details about the error, and copies of supporting documents. You can also dispute online through the credit bureau’s website.

What To Expect During The Dispute Process

After filing a dispute, here’s what to expect:

- Investigation: The credit bureau will investigate your claim. They will contact the data furnisher (e.g., bank, lender) to verify the information.

- Response Time: The investigation typically takes 30 days. The credit bureau must respond within this period.

- Outcome Notification: You will receive the results of the investigation. If the error is confirmed, the credit bureau will correct your report.

- Updated Credit Report: After the correction, you will receive an updated credit report. Review it to ensure the error has been fixed.

Using tools like Credit Sesame can simplify this process. Credit Sesame offers free credit monitoring, daily credit scores, and personalized actions. These features help you stay informed and take steps to improve your credit score.

Paying Down Debt

Paying down debt is one of the most effective ways to repair your credit. By reducing your debt, you can improve your credit utilization ratio, which is a key factor in your credit score. Let’s explore some strategies to help you manage and reduce your debt effectively.

Prioritizing High-interest Debt

When you have multiple debts, it is crucial to prioritize paying off high-interest debt first. High-interest debt, such as credit card balances, can quickly accumulate and become overwhelming. Focus on these debts to save money on interest and reduce your overall debt faster.

Here’s how you can prioritize high-interest debt:

- List all your debts with their interest rates.

- Identify the debts with the highest interest rates.

- Allocate extra payments to these high-interest debts while maintaining minimum payments on others.

Debt Snowball Vs. Debt Avalanche Method

Two popular methods for paying down debt are the Debt Snowball and Debt Avalanche methods. Both have their advantages, and choosing the right one depends on your financial situation and personal preferences.

Debt Snowball Method

The Debt Snowball method focuses on paying off your smallest debts first. This method can provide a psychological boost as you see debts being eliminated quickly.

- List your debts from smallest to largest.

- Make minimum payments on all debts except the smallest.

- Allocate extra funds to the smallest debt until it is paid off.

- Repeat the process with the next smallest debt.

Debt Avalanche Method

The Debt Avalanche method prioritizes debts with the highest interest rates. This approach can save you more money on interest over time.

- List your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Allocate extra funds to the debt with the highest interest rate until it is paid off.

- Repeat the process with the next highest interest rate debt.

Both methods are effective, but the Debt Avalanche method is often more financially beneficial. Choose the one that keeps you motivated and helps you stay on track with your debt repayment goals.

Building Positive Credit History

Creating a strong credit history is essential for improving your credit score. By using the right strategies, you can demonstrate responsible credit behavior. This can help you qualify for better credit offers and lower interest rates.

Secured Credit Cards

One effective way to build positive credit history is by using secured credit cards. These cards require a cash deposit, which becomes your credit limit. This minimizes the risk for lenders, making them more accessible for those with bad or no credit.

- How It Works: You deposit a certain amount as collateral.

- Credit Limit: The deposit sets your credit limit.

- Usage: Use the card responsibly by making small purchases.

- Payments: Pay your balance on time to improve your score.

Using secured credit cards responsibly can help you transition to unsecured credit cards over time. They are a proven tool for building positive credit history.

Authorized User Accounts

Another strategy to build positive credit history is by becoming an authorized user on someone else’s credit card account. This allows you to benefit from their good credit behavior.

- Permission: The primary cardholder must add you as an authorized user.

- Credit History: You inherit their positive credit history.

- No Liability: You are not responsible for the debt.

- Credit Score Impact: Your score benefits from their timely payments.

This method can be particularly useful if you have a family member or close friend with excellent credit. Ensure the primary cardholder continues to use their credit responsibly.

Building a positive credit history takes time and disciplined effort. Tools like Credit Sesame can assist in monitoring your credit score and providing personalized actions to reach your financial goals.

Managing Credit Utilization

Managing credit utilization is vital for repairing your credit score. It involves keeping your credit card balances low and increasing your credit limits. Both strategies help maintain a healthy credit utilization ratio, which is a key factor in your credit score.

Keeping Balances Low

One effective way to manage credit utilization is by keeping your balances low. Aim to use no more than 30% of your available credit. This means if you have a credit limit of $1,000, try to keep your balance under $300.

- Pay off your balances regularly.

- Consider making multiple payments each month.

- Track your spending to avoid overspending.

Using tools like Credit Sesame can help you monitor your balances daily. They provide personalized actions to help you keep your balances in check. This service is free and does not require a credit card to sign up.

Increasing Credit Limits

Another strategy is increasing your credit limits. This can improve your credit utilization ratio without changing your spending habits. Contact your credit card issuer to request a higher limit. If you have a good payment history, your request is more likely to be approved.

- Check your credit score before requesting an increase.

- Prepare to explain why you need a higher limit.

- Be ready to show proof of income or employment.

Using the Credit Sesame platform, you can find credit offers that match your profile. These offers often come with higher limits and better terms. This can further help in maintaining a healthy credit utilization ratio.

| Strategy | Action | Tool |

|---|---|---|

| Keeping Balances Low | Pay off balances regularly | Credit Sesame Monitoring |

| Increasing Credit Limits | Request higher limit from issuer | Credit Offers on Credit Sesame |

By following these strategies and leveraging tools like Credit Sesame, you can better manage your credit utilization. This is a significant step towards repairing and improving your credit score.

Establishing A Budget And Financial Plan

Repairing your credit starts with establishing a solid budget and financial plan. Knowing where your money goes each month helps you make informed decisions. This process involves tracking income, expenses, and setting financial goals. These steps will guide you towards better financial health.

Tracking Income And Expenses

Begin by tracking all sources of income. This includes your salary, bonuses, freelance work, and any other earnings. Create a list or use a budgeting app to record each source and amount.

| Source of Income | Monthly Amount |

|---|---|

| Job Salary | $3000 |

| Freelance Work | $500 |

| Bonuses | $200 |

Next, track your expenses. List everything you spend money on, from rent and groceries to entertainment and dining out. Categorize these expenses to see where you can cut back.

- Rent: $1200

- Groceries: $300

- Utilities: $150

- Dining Out: $100

- Entertainment: $50

Setting Financial Goals

Once you understand your income and expenses, set clear financial goals. These goals will keep you focused and motivated. They can range from short-term goals like paying off a credit card to long-term goals like saving for a home.

- Short-term goals: Pay off $500 credit card debt in 3 months.

- Mid-term goals: Save $2000 for an emergency fund in 6 months.

- Long-term goals: Save $20,000 for a down payment on a house in 5 years.

Use tools like Credit Sesame to monitor your progress. Credit Sesame offers daily credit score monitoring, personalized actions, and credit offers tailored to your profile. This can help you achieve your financial goals more efficiently.

By tracking your income and expenses and setting financial goals, you can take control of your finances. This is a crucial step towards repairing your credit and achieving financial stability.

Seeking Professional Help

Repairing your credit can be a daunting task. Sometimes, seeking professional help can make the process easier. Here are two effective ways to get professional assistance: credit counseling services and hiring a credit repair company.

Credit Counseling Services

Credit counseling services offer guidance and support to help you manage your debts. They provide personalized advice to improve your credit score. These services often include:

- Debt Management Plans: Structured plans to pay off your debts systematically.

- Financial Education: Workshops and resources to understand credit and personal finance.

- Budgeting Assistance: Help to create and maintain a realistic budget.

Organizations like Credit Sesame provide tools to monitor and improve your credit. Using their daily credit score monitoring, you can keep track of your progress. Their personalized actions guide you on the best steps to take for improvement.

Hiring A Credit Repair Company

If you need more intensive help, consider hiring a credit repair company. These companies work to remove negative items from your credit report. They negotiate with creditors and credit bureaus on your behalf. Hiring a credit repair company typically involves:

- Credit Report Analysis: Reviewing your credit report for errors and discrepancies.

- Dispute Filing: Submitting disputes to remove incorrect or outdated information.

- Negotiation: Working with creditors to settle debts and improve your credit standing.

Credit repair companies often charge for their services. It’s essential to understand their fee structure before committing. Credit Sesame, for example, offers a comprehensive credit management platform. While their basic services are free, additional features like the Sesame Cash Fees might apply based on usage.

Choosing between credit counseling and a credit repair company depends on your specific needs. Both options provide professional assistance to help you achieve better credit health.

Monitoring Your Progress

Repairing your credit is an ongoing process. It requires patience and persistence. To ensure you are on the right track, regularly monitor your progress. This helps you identify areas that need improvement and celebrate small victories along the way.

Regularly Checking Credit Reports

Regular checks of your credit report are essential. They help you spot errors and fraudulent activities. You can request a free copy of your credit report from each of the three major credit bureaus annually. Look for discrepancies in:

- Personal Information

- Account Status

- Credit Inquiries

Correcting these errors can significantly boost your credit score. Credit Sesame offers a comprehensive summary of your credit report. It’s free and easy to use. With daily updates, you stay informed about any changes.

Using Credit Monitoring Tools

Credit monitoring tools provide real-time updates on your credit activity. They alert you to suspicious actions and significant changes. Credit Sesame’s credit monitoring service is a great example. It offers:

| Feature | Details |

|---|---|

| Daily Credit Score Monitoring | Check your score daily and see what impacts it. |

| Sesame Grade | A clear letter grade based on key credit factors. |

| Personalized Actions | Get recommendations to improve your score. |

These tools help you stay proactive in managing your credit. They ensure you are always aware of your credit health. Sign up for free and explore the tools offered by Credit Sesame. Remember, consistent monitoring is key to repairing and maintaining good credit.

Frequently Asked Questions

How To Start Repairing My Credit?

To start repairing your credit, check your credit report for errors. Then, pay off outstanding debts and make timely payments.

How Long Does Credit Repair Take?

Credit repair can take a few months to a few years. It depends on your credit situation and financial habits.

Can Paying Off Debt Improve Credit Score?

Yes, paying off debt can improve your credit score. It reduces your credit utilization ratio and shows responsible financial behavior.

Are Credit Repair Companies Effective?

Credit repair companies can help, but you can do most repairs yourself. Be cautious of scams and high fees.

Conclusion

Repairing credit takes time and dedication, but the results are worth it. Consistent effort in monitoring and managing your credit can lead to financial freedom. Utilize tools like Credit Sesame to track your progress and get personalized advice. Stay patient, follow the steps, and watch your credit improve. Remember, improving your credit opens up many financial opportunities. Start today and take control of your financial future.