Credit Monitoring Alerts: Stay Ahead of Identity Theft

Credit monitoring alerts are essential for maintaining a healthy credit profile. They notify you of significant changes in your credit report, helping you stay proactive.

In today’s digital age, monitoring your credit is vital. Credit monitoring alerts from services like Credit Sesame ensure you are informed of any changes in your credit score or report. These alerts can help you detect fraud early, manage your credit more effectively, and make informed financial decisions. Credit Sesame offers a free service that provides daily credit score checks, personalized actions to improve your credit, and secure data protection. With a better understanding of your credit health, you can take steps to improve it and leverage better opportunities for credit offers. Interested in learning more? Check out Credit Sesame here.

Introduction To Credit Monitoring Alerts

Managing credit is crucial in today’s financial world. Credit monitoring alerts play a vital role in helping individuals stay informed about their credit health. Let’s explore what these alerts are and why they matter.

What Are Credit Monitoring Alerts?

Credit monitoring alerts notify you of changes to your credit report. They keep you updated on new activities and potential issues. These alerts can include:

- New account openings

- Hard inquiries

- Changes in account balances

- New public records

Credit Sesame provides daily credit score checks and personalized credit actions. This helps users understand and improve their credit health.

Purpose And Importance In Modern Financial Management

Credit monitoring alerts serve several key purposes:

- Identity Theft Prevention: Alerts help detect fraudulent activities early.

- Credit Score Management: Stay aware of factors affecting your credit score.

- Financial Planning: Better understand your credit health for informed decisions.

Credit Sesame offers a free service to check your credit score daily. Users benefit from personalized actions to enhance their credit score. The Sesame Grade provides a clear letter grade, making it easier to understand credit health.

| Feature | Benefit |

|---|---|

| Daily Credit Score Check | Monitor changes in your credit score daily |

| Sesame Grade | Clear letter grade based on credit factors |

| Personalized Actions | Tailored actions to improve your credit |

| Credit Offers | Receive high approval rate offers |

| Credit Builder | Build credit with everyday purchases |

Credit Sesame also ensures secure data handling with 256-bit encryption. They commit to not selling personal information to third parties. This provides users with peace of mind regarding their data security.

Key Features Of Credit Monitoring Alerts

Credit monitoring alerts are essential for maintaining a healthy credit profile. These alerts provide real-time updates and comprehensive monitoring of your credit report. They offer various features to help detect and prevent identity theft. Here are the key features that make credit monitoring alerts indispensable for anyone serious about their financial health.

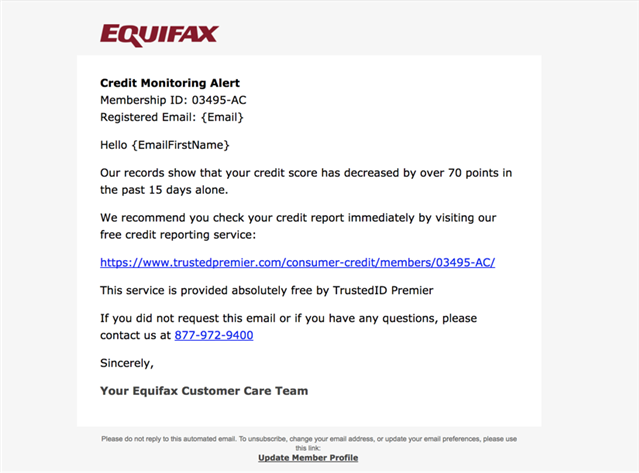

Real-time Notifications

Real-time notifications are crucial for staying informed about changes in your credit report. With Credit Sesame, you receive instant alerts whenever there is a significant change. This could include new credit inquiries, changes in account balances, or updates to your personal information. These notifications help you respond quickly to any potential issues, preventing possible damage to your credit score.

Comprehensive Credit Report Monitoring

Comprehensive credit report monitoring ensures that all aspects of your credit report are checked regularly. Credit Sesame provides daily checks of your credit score and report summary. This continuous monitoring helps you stay aware of your credit health and identify any discrepancies early. You can also receive personalized actions and offers based on your credit profile, helping you make informed decisions.

Identity Theft Detection And Prevention

Identity theft detection and prevention are vital features of credit monitoring alerts. Credit Sesame offers robust security measures, including 256-bit encryption to protect your data. The service alerts you to any suspicious activity, helping you take immediate action to prevent identity theft. By keeping your personal information secure, you can have peace of mind knowing your identity is protected.

Customizable Alert Settings

Customizable alert settings allow you to tailor the notifications to your needs. With Credit Sesame, you can set alerts for specific changes in your credit report. This customization ensures you receive relevant updates without being overwhelmed by unnecessary notifications. You can focus on the changes that matter most to you, enhancing your ability to manage your credit effectively.

| Feature | Description |

|---|---|

| Real-Time Notifications | Immediate alerts for significant changes in your credit report. |

| Comprehensive Credit Report Monitoring | Daily checks of your credit score and report summary. |

| Identity Theft Detection and Prevention | Alerts for suspicious activity with robust security measures. |

| Customizable Alert Settings | Tailor notifications to your specific needs. |

Using credit monitoring alerts is a proactive approach to managing your credit. With features like real-time notifications, comprehensive monitoring, identity theft detection, and customizable settings, you can stay on top of your credit health with ease.

Pricing And Affordability

Credit monitoring alerts are essential for managing and improving your credit score. Credit Sesame offers both free and paid services, allowing users to choose an option that fits their budget and needs. Let’s explore the pricing and affordability of these services.

Free Vs. Paid Services

Credit Sesame provides a variety of free services to help users stay on top of their credit health. These include:

- Daily Credit Score Check: Monitor your credit score changes daily.

- Credit Report Summary: Get a snapshot of your credit report.

- Personalized Actions: Receive tailored advice to improve your credit score.

- Credit Offers: Access offers based on your credit profile.

For users looking for more comprehensive features, Credit Sesame offers a paid service known as Sesame Cash. The fees for Sesame Cash are as follows:

| Service | Fee |

|---|---|

| Monthly Fee | $9.99 (waived if deposit/spend thresholds are met) |

| Monthly Inactivity Fee | $3 (waived with account activity) |

| First 30 Days | All fees waived |

Cost-benefit Analysis

Evaluating the cost-benefit of Credit Sesame’s free vs. paid services can help determine the best fit for your needs.

- Free Services: Ideal for basic credit monitoring and personalized advice. No cost, providing essential tools for credit management.

- Paid Services: Sesame Cash offers advanced features such as a prepaid debit card and virtual secured credit card. These features can help build credit through everyday purchases, making it worth the monthly fee for some users.

Overall, the free services are beneficial for most users. Paid services provide additional value for those looking to build credit actively.

Value For Different User Needs

Different users have different needs when it comes to credit monitoring:

- Basic Users: Those who want to keep an eye on their credit score and report without spending money will find the free services sufficient.

- Active Builders: Users aiming to build or repair their credit may find value in the paid features of Sesame Cash, like the prepaid debit card and virtual secured credit card.

Credit Sesame’s diverse offerings ensure that both basic users and active builders can find a plan that suits their requirements.

Pros And Cons Of Credit Monitoring Alerts

Credit monitoring alerts help you stay on top of your credit health. They provide timely notifications about changes in your credit report. But are these alerts always beneficial? Let’s explore the advantages and potential drawbacks.

Advantages Based On Real-world Usage

- Early Detection of Fraud: Receive alerts for suspicious activities, helping you catch identity theft early.

- Improved Credit Management: Daily updates on your credit score and report summary with services like Credit Sesame.

- Personalized Advice: Get tailored actions to improve your credit score.

- Credit Building Opportunities: Use tools like Sesame Grade to understand and improve your credit health.

- Financial Security: Protect your data with 256-bit encryption, ensuring your information stays safe.

Potential Drawbacks And Limitations

- Too Many Alerts: Frequent notifications can become overwhelming and lead to alert fatigue.

- Limited Free Features: Some advanced features may require a paid subscription.

- False Alarms: Alerts for minor changes might cause unnecessary worry.

- Data Accuracy: Reliance on credit bureaus’ data, which may not always be up to date.

- Privacy Concerns: Even with encryption, sharing personal data always carries some risk.

Credit monitoring alerts offer many benefits but come with some limitations. Understanding these pros and cons can help you make better decisions about using such services.

Specific Recommendations For Ideal Users

Credit monitoring alerts provide essential information to help safeguard your financial health. These alerts can notify you about significant changes in your credit report, helping you take timely action to protect your credit score. Below are some specific recommendations for those who can benefit the most from using credit monitoring alerts.

Who Should Use Credit Monitoring Alerts?

Credit monitoring alerts are highly beneficial for various user groups. Here is a detailed look:

- Individuals with High Credit Activity: If you frequently apply for credit cards, loans, or other financial products, monitoring alerts help you track changes and detect any errors swiftly.

- Identity Theft Victims: If you have previously been a victim of identity theft, credit monitoring can alert you to suspicious activities, allowing you to take quick action.

- People Improving Their Credit: Those working on improving their credit scores can benefit from monitoring to see how their actions impact their credit in real-time.

- Young Adults: If you are starting to build your credit, monitoring alerts can guide you and help you avoid common pitfalls.

Scenarios Where Credit Monitoring Alerts Are Most Beneficial

Here are some scenarios where credit monitoring alerts prove invaluable:

| Scenario | Benefit |

|---|---|

| Applying for a Mortgage | Ensures your credit report is accurate before a major financial commitment. |

| Sudden Drop in Credit Score | Alerts you to investigate and address the cause promptly. |

| New Credit Inquiries | Notifies you of any unauthorized applications made in your name. |

| Changes in Account Balances | Helps you monitor for unusual activity or errors in your accounts. |

| Opening New Credit Accounts | Confirms that new accounts are those you initiated. |

Utilizing services like Credit Sesame, which offers free credit monitoring and personalized actions, can significantly aid in these scenarios. The tool provides a daily credit score check, personalized credit actions, and secure data protection, making it an ideal choice for many users.

Frequently Asked Questions

What Are Credit Monitoring Alerts?

Credit monitoring alerts notify you of changes to your credit report. They help protect against identity theft.

How Do Credit Monitoring Alerts Work?

Credit monitoring alerts track your credit report for changes. They notify you via email or SMS.

Why Are Credit Monitoring Alerts Important?

Credit monitoring alerts help you detect fraudulent activity early. They protect your credit score and personal information.

Can Credit Monitoring Alerts Prevent Identity Theft?

Credit monitoring alerts can’t prevent identity theft. However, they can help you detect it quickly and take action.

Conclusion

Staying on top of your credit is crucial. Credit monitoring alerts can help you stay informed. They notify you of changes and protect against identity theft. Using a service like Credit Sesame can simplify this process. Regular updates and personalized actions help you improve your credit health. Maintaining good credit opens up financial opportunities. Start monitoring today to secure a better financial future.