Credit Sesame: Unlock Your Financial Freedom Today

Understanding your credit score can be a game changer for your financial health. Credit Sesame offers a free service that keeps you updated on your credit score daily.

Managing your credit can feel overwhelming, but it doesn’t have to be. With Credit Sesame, you get daily updates on your credit score and a summary of your credit report. This service provides personalized actions to help you improve your score. You can also view credit offers tailored to your profile. The best part? It’s free and easy to use. By staying informed, you can take control of your financial future. Start improving your credit today with Credit Sesame. Visit Credit Sesame now to learn more.

Introduction To Credit Sesame

Credit Sesame is a free service that keeps users updated on their credit score and credit report summary. By offering personalized actions and relevant credit offers, it helps users understand and improve their credit scores.

What Is Credit Sesame?

Credit Sesame provides users with daily updates on their credit score. It also gives a credit report summary, helping users stay informed about their credit health.

Main Features:

- Daily Credit Score Updates: Users can check their credit score daily.

- Sesame Grade: Provides a clear letter grade based on the five major factors impacting credit scores.

- Personalized Actions: Offers tailored actions to help users improve their credit scores and reach their financial goals faster.

- Credit Offers: Displays the best offers with a high chance of approval based on the user’s credit profile.

- Credit Builder: Allows users to build credit through everyday purchases using a prepaid debit card.

Purpose And Mission

Credit Sesame aims to make credit monitoring easy and accessible for everyone. Its mission is to help users improve their financial health by providing tools to monitor and improve their credit scores.

Benefits:

- Free Service: Access to credit scores and reports without needing a credit card.

- Easy Monitoring: Immediate access to credit scores and factors affecting them.

- Personalized Guidance: Helps users take specific actions to improve credit.

- High Approval Offers: Reduces uncertainty in the application process by showing offers with high approval chances.

- Credit Building: Enables users to build credit without a credit check or security deposit.

Key Features Of Credit Sesame

Credit Sesame offers a suite of tools designed to help users manage and improve their credit. Below, we explore the key features that make Credit Sesame a valuable resource for anyone looking to keep tabs on their financial health.

Free Credit Score Monitoring

Credit Sesame provides daily credit score updates at no cost. Users can track their score and understand the factors influencing it. This feature ensures that users are always informed about their credit health.

Credit Report Card

The Credit Report Card gives users a clear view of their credit profile. It includes a Sesame Grade, which is a letter grade based on the five key factors affecting credit scores. This tool helps users quickly identify areas for improvement.

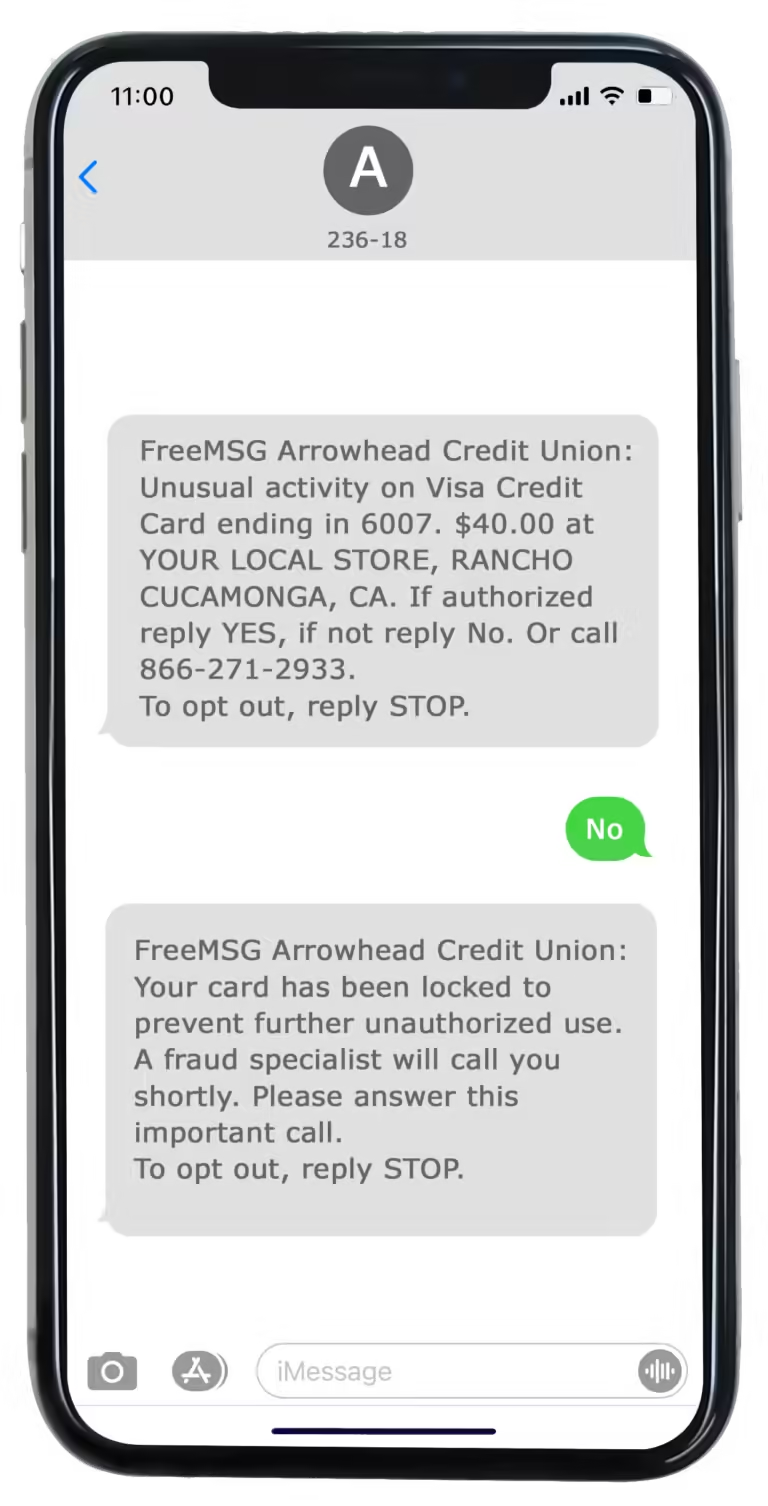

Identity Theft Protection

Credit Sesame offers identity theft protection to safeguard users’ personal information. This feature provides peace of mind by monitoring for suspicious activity and alerting users to potential threats.

Personalized Financial Recommendations

Credit Sesame provides personalized actions and credit offers based on the user’s credit profile. These recommendations help users improve their credit scores and achieve their financial goals faster.

Credit Building Tools

Credit Sesame’s Credit Builder feature allows users to build credit through everyday purchases using a prepaid debit card. There is no credit check or security deposit required, making it an accessible option for many.

| Feature | Description |

|---|---|

| Free Credit Score Monitoring | Daily updates on credit scores. |

| Credit Report Card | Provides a letter grade based on key credit factors. |

| Identity Theft Protection | Monitors for suspicious activity and alerts users. |

| Personalized Financial Recommendations | Offers tailored actions and credit offers. |

| Credit Building Tools | Helps build credit with a prepaid debit card. |

Credit Sesame’s features make it easy to stay on top of your credit and take actionable steps toward improving it. By providing free tools and personalized guidance, Credit Sesame supports users in achieving better financial health.

Pricing And Affordability

Credit Sesame offers a range of pricing options to suit various needs. Understanding these options helps users make an informed decision about which plan best meets their financial goals. Let’s dive into the details.

Free Vs Premium Plans

Credit Sesame provides a robust free service that includes daily credit score updates and a credit report summary. This free plan allows users to monitor their credit and take personalized actions to improve their scores.

For those seeking more advanced features, Credit Sesame also offers premium plans. These plans come with additional benefits such as enhanced credit monitoring and identity theft protection.

- Free Plan: Daily credit score updates, Sesame Grade, personalized actions, and credit offers.

- Premium Plan: Enhanced features for a monthly fee.

Cost Breakdown Of Premium Features

Premium features come with specific costs. Credit Sesame’s premium plans include Sesame Cash, which has various fees associated with it.

| Feature | Cost |

|---|---|

| Monthly Fee | $9.99 (waived with $500 deposit or $1,000 spending) |

| Monthly Inactivity Fee | $3 (waived with account activity) |

| First 30 Days | No fees charged |

| International Cash Withdrawals | Additional fees apply |

| Out-of-Network Cash Withdrawals | Additional fees apply |

| Third-Party Cash Deposits | Additional fees apply |

These fees can be waived under certain conditions, making the premium plan more affordable for active users.

Overall, Credit Sesame offers flexible pricing options. Users can choose between the free service and premium plans based on their needs.

Pros And Cons Of Credit Sesame

Credit Sesame is a popular platform for credit monitoring and improvement. It offers many features that can help users manage their credit effectively. Below, we explore the pros and cons of using Credit Sesame.

Advantages Of Using Credit Sesame

Credit Sesame provides several benefits that make it a valuable tool for users aiming to improve their credit scores.

- Free Service: Users can access their credit scores and reports without any cost, no credit card required.

- Daily Credit Score Updates: Users receive daily updates on their credit scores, allowing for real-time monitoring.

- Sesame Grade: This feature gives a clear letter grade based on the five major factors affecting credit scores, helping users understand their credit health better.

- Personalized Actions: Credit Sesame offers tailored actions to help users improve their credit scores and achieve their financial goals faster.

- Credit Offers: The platform displays the best credit offers with a high chance of approval, reducing uncertainty in the application process.

- Credit Builder: Users can build credit through everyday purchases using a prepaid debit card, without a credit check or security deposit.

- Easy Monitoring: Immediate access to credit scores and the factors impacting them makes monitoring straightforward.

Limitations And Potential Drawbacks

While Credit Sesame has many advantages, there are some limitations and potential drawbacks to consider.

- Sesame Cash Fees: The service has a $9.99 monthly fee, which can be waived with a $500 deposit or $1,000 spending. There is also a $3 monthly inactivity fee, waived with account activity. Additional fees apply for international and out-of-network cash withdrawals and third-party cash deposits.

- Limited Free Services: Although the basic credit score and report monitoring are free, other advanced features may require a subscription or additional fees.

- Security Measures: While Credit Sesame uses 256-bit encryption to protect data, users should always be cautious about sharing personal information online.

- Privacy Concerns: Credit Sesame ensures privacy by not selling personal information to third parties, but users should review the Terms of Use and Privacy Policy for complete assurance.

Ideal Users And Scenarios

Credit Sesame is a comprehensive tool for managing and improving credit. But who can benefit the most from using this service? Let’s explore the ideal users and scenarios where Credit Sesame shines the brightest.

Who Can Benefit The Most?

- First-Time Credit Users: Those new to credit can easily monitor and understand their credit score.

- Individuals with Poor Credit: Personalized actions help improve low credit scores.

- Frequent Credit Card Users: High approval offers and credit monitoring aid in better financial decisions.

- Students: Students can start building credit without needing a security deposit.

- Anyone Seeking Financial Improvement: The free service offers tailored advice to reach financial goals faster.

Real-life Scenarios Where Credit Sesame Shines

| Scenario | How Credit Sesame Helps |

|---|---|

| Building Credit | Use the Credit Builder feature to build credit with everyday purchases. |

| Monitoring Credit | Receive daily updates on credit scores and report summaries for easy tracking. |

| Improving Poor Credit | Follow personalized actions to improve credit scores and achieve financial goals. |

| Finding Credit Offers | View credit offers with a high chance of approval based on your profile. |

| Financial Planning | Utilize Sesame Grade to understand the factors impacting your credit score. |

Frequently Asked Questions

What Is Credit Sesame?

Credit Sesame is a free financial service platform. It helps users manage their credit scores and finances.

How Does Credit Sesame Work?

Credit Sesame provides free credit score monitoring. It offers personalized financial recommendations and tools.

Is Credit Sesame Really Free?

Yes, Credit Sesame offers a free membership. It includes credit score monitoring and financial advice.

Can Credit Sesame Affect My Credit Score?

No, Credit Sesame does not affect your credit score. It performs a soft inquiry, which doesn’t impact your score.

Conclusion

Credit Sesame offers a simple way to monitor and improve your credit score. With daily updates and personalized guidance, managing your credit has never been easier. The service is free and helps you understand your credit profile. Find credit offers that fit your needs and have a high chance of approval. Credit Sesame also provides tools to build your credit with everyday purchases. Start taking control of your credit today with Credit Sesame. For more details, visit Credit Sesame.