Best First Credit Cards for Students

The best first credit cards for students include Discover it® Student Cash Back and Journey® Student Rewards from Capital One. These cards offer rewards and help build credit.

Starting college often means managing finances for the first time. A student credit card can be a valuable tool in this journey. These cards typically have lower credit limits, making them manageable for beginners. They often come with rewards, such as cashback on purchases or points for future use.

Some even offer incentives for good grades. Choosing the right card can help students build a strong credit history. This is crucial for future financial endeavors like renting an apartment or buying a car. Responsible use of a student credit card sets the foundation for a healthy financial future.

Top Credit Cards

Choosing the right credit card can be confusing for students. The best first credit cards offer rewards, low fees, and an easy approval process. Below are the top credit cards for students.

Card A

Card A is perfect for students starting their credit journey. It offers a cash-back reward on all purchases. Plus, there is no annual fee.

- 1.5% cash-back on all purchases

- No annual fee

- 0% intro APR for the first 6 months

Students can benefit from the low interest rate after the intro period.

Card B

Card B offers amazing rewards for students who spend on dining and entertainment. The card provides a higher cash-back rate in these categories.

- 3% cash-back on dining and entertainment

- 1% cash-back on all other purchases

- No foreign transaction fees

This card is ideal for students who enjoy eating out and traveling.

Card C

Card C is great for students who need a low-interest card. It offers a long 0% APR period on purchases and balance transfers.

- 0% intro APR for 12 months

- Low ongoing APR after the intro period

- No annual fee

This card helps students who may need extra time to pay off purchases.

| Card | Cash-back | Intro APR | Annual Fee |

|---|---|---|---|

| Card A | 1.5% | 0% for 6 months | None |

| Card B | 3% on dining | N/A | None |

| Card C | N/A | 0% for 12 months | None |

Benefits Of Student Credit Cards

Student credit cards offer many benefits to young adults. They are a great tool for learning financial responsibility. Students can build a solid credit history early. These cards often come with extra perks. Let’s dive into the key benefits of student credit cards.

Build Credit History

Building a credit history is crucial for financial success. Student credit cards help students start their credit journey. A good credit score opens doors to better loans and mortgages. With responsible use, students can see their credit scores rise. Timely payments and low balances are key habits. These habits form a strong credit profile. A good credit history can save money in the future. Lenders trust borrowers with good credit scores.

Cashback Rewards

Many student credit cards offer cashback rewards. These rewards can be on everyday purchases. For example, buying groceries or gas. Some cards offer higher rewards for specific categories. Cashback can be a great way to save money. Students can use these rewards for important expenses. This feature makes student credit cards more appealing. Earning while spending is a win-win situation.

Low Fees

Student credit cards often come with low fees. Many do not have an annual fee. This makes them affordable for students. Some cards also offer lower interest rates. Low fees mean more savings for students. These savings can be used for other needs. Low fees make managing finances easier. Students can focus on their studies without financial stress.

How To Choose

Choosing your first credit card as a student is crucial. It’s important to select a card that meets your needs. Focus on these key factors to make the best choice.

Interest Rates

Interest rates are the percentage you pay on borrowed money. Look for a card with low interest rates to save money. Compare rates from different cards before deciding. Remember, lower rates mean less money paid in interest.

Credit Limit

The credit limit is the maximum amount you can borrow. As a student, you may start with a lower credit limit. This helps you manage spending and build credit. Look for cards that offer credit limit increases over time.

Rewards Program

A rewards program gives you points or cash back for spending. Choose a card with a rewards program that fits your lifestyle. Some cards offer cash back on groceries, gas, or dining. Others may offer points for travel or shopping.

| Card Feature | Details |

|---|---|

| Interest Rates | Look for low rates to save money. |

| Credit Limit | Start with a lower limit, then increase. |

| Rewards Program | Choose a program that fits your spending habits. |

Consider these factors when choosing your first credit card. Make an informed decision to build a strong financial future.

Application Process

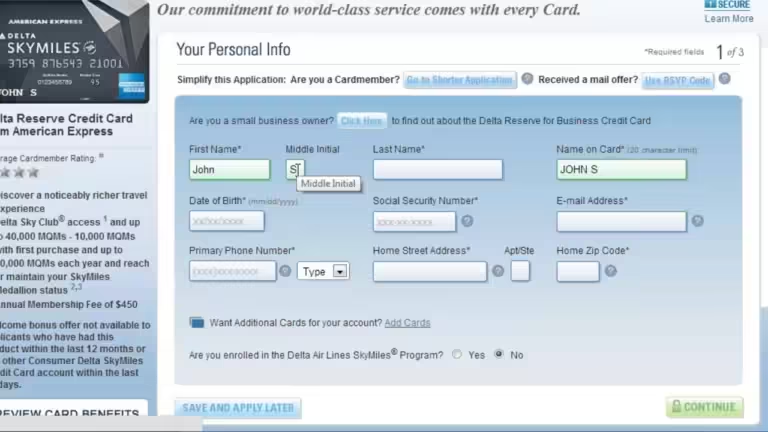

Applying for your first credit card as a student can be exciting. Understanding the application process is crucial. This section will guide you through the Eligibility Criteria and the Required Documents needed for a smooth application.

Eligibility Criteria

Before applying, ensure you meet the basic eligibility criteria. Here are the common requirements:

- Age: You must be at least 18 years old.

- Residency: You need to be a resident of the country.

- Income: Proof of a stable income or a cosigner.

- Student Status: Enrolled in an accredited institution.

Required Documents

Gathering the necessary documents is the next step. Here is a list of what you may need:

- Identification: Government-issued ID like a passport or driver’s license.

- Proof of Address: Utility bill or bank statement.

- Proof of Income: Pay stubs or a letter from your employer.

- Student Verification: Student ID or enrollment letter.

| Document | Description |

|---|---|

| Government-issued ID | Passport, driver’s license, or state ID |

| Proof of Address | Utility bill or bank statement |

| Proof of Income | Pay stubs or employer letter |

| Student Verification | Student ID or enrollment letter |

Having these documents ready will streamline your application process. Make sure to double-check all information before submission.

Managing Your Card

Getting your first credit card as a student is exciting. It gives you freedom and responsibility. Managing your card wisely is crucial. Here are some tips on budgeting and avoiding debt.

Budgeting Tips

Creating a budget helps you manage your spending. Follow these simple steps:

- List your monthly income, including allowance, part-time jobs, and any other sources.

- Make a list of your monthly expenses, including rent, food, and entertainment.

- Compare your income and expenses. Adjust your spending to avoid overspending.

- Use budgeting apps to track your spending. They help you stay on track.

- Set aside money for savings. Aim to save at least 10% of your income.

Avoiding Debt

Debt can be a big problem if not managed properly. Here are some tips to avoid debt:

- Pay your credit card bill on time. Late payments can lead to high fees.

- Pay more than the minimum payment. This reduces your debt faster.

- Keep your credit utilization low. Use only 30% of your credit limit.

- Avoid cash advances. They have high fees and interest rates.

- Monitor your credit card statements. Check for errors and report them immediately.

By following these tips, you can manage your credit card effectively. You will build a strong financial foundation for the future.

Common Mistakes

Choosing the best first credit card can be tricky for students. Many common mistakes can hurt their credit score. Avoiding these mistakes helps build a strong financial future.

Late Payments

Late payments can damage your credit score quickly. It’s important to pay on time. Setting up automatic payments can help. Missing a payment can lead to late fees. Always keep track of your due dates. Paying the minimum amount is better than missing a payment.

Maxing Out Credit

Maxing out your credit card is a big mistake. It can lower your credit score. Try to keep your balance below 30% of your credit limit. This shows lenders that you manage credit well. High balances can lead to higher interest rates. Always spend within your means.

Frequently Asked Questions

What Are The Best First Credit Cards For Students?

The best first credit cards for students include Discover it® Student Cash Back and Capital One SavorOne Student. These cards offer rewards, no annual fees, and help build credit.

How Can Students Qualify For A Credit Card?

Students can qualify for a credit card by proving their income or having a co-signer. Some student credit cards require enrollment in a college or university.

Why Should Students Get A Credit Card?

Students should get a credit card to build their credit history. Good credit can help with future loans, renting apartments, and even job applications.

What Features Should Student Credit Cards Have?

Student credit cards should have no annual fees, cashback rewards, and low interest rates. These features help students manage their finances effectively.

Conclusion

Choosing the best first credit card for students is essential. It helps build credit and manage finances responsibly. Research your options carefully. Consider fees, rewards, and interest rates. A smart choice now can pave the way for a strong financial future.

Start your journey towards financial independence with the right card.