Capital One Student Credit Card Review

The Capital One Student Credit Card offers rewards and no annual fee. It helps students build credit responsibly.

This credit card is ideal for students starting their financial journey. It features a rewards program, allowing cardholders to earn cashback on purchases. The absence of an annual fee makes it a cost-effective choice. Students can benefit from tools and resources provided by Capital One to learn about credit management.

The card also includes fraud coverage and easy account management via a mobile app. Responsible use of this card can lead to an improved credit score, opening doors to better financial opportunities in the future. Overall, it’s a solid option for students aiming to build credit and earn rewards simultaneously.

Card Features

The Capital One Student Credit Card comes packed with a variety of features designed to help students build credit while enjoying valuable perks. Below, we explore the most essential features of this credit card.

Rewards Program

The Capital One Student Credit Card offers a rewards program that allows students to earn cash back on their purchases. The rewards are simple and straightforward:

- 1% cash back on all purchases

- 5% cash back on select categories

The cash back rewards can be redeemed in various ways, including:

- Statement credits

- Gift cards

- Checks

- Charitable donations

These rewards do not expire as long as the account remains open.

Interest Rates And Fees

The interest rates and fees for the Capital One Student Credit Card are designed to be manageable for students:

| Type | Rate/Fee |

|---|---|

| Annual Percentage Rate (APR) | Variable APR of 19.99% – 26.99% |

| Annual Fee | $0 |

| Late Payment Fee | Up to $40 |

The card also offers a grace period of 25 days on purchases, giving students time to pay their bill without incurring interest.

These features make the Capital One Student Credit Card an excellent choice for students aiming to build credit while enjoying rewards.

Application Process

The application process for the Capital One Student Credit Card is straightforward. This guide will help you understand each step to get started.

Eligibility Requirements

Before you apply, ensure you meet these eligibility requirements:

- You must be at least 18 years old.

- Have a U.S. Social Security Number or Individual Taxpayer Identification Number.

- Be a college student with proof of enrollment.

- Have a valid U.S. address.

- Show proof of income to pay your credit card bills.

Step-by-step Application Guide

Follow this step-by-step guide to complete your application:

- Visit the Capital One website.

- Navigate to the Student Credit Card section.

- Click the “Apply Now” button.

- Fill in your personal information:

- Name

- Address

- Social Security Number

- Date of Birth

- Provide your financial information:

- Income

- Employment status

- Submit proof of your student status:

- Student ID

- Enrollment verification

- Review the terms and conditions.

- Submit your application.

After submission, you will receive a confirmation email. You can expect to hear back within a few days.

Benefits

The Capital One Student Credit Card offers many benefits for students. This card helps students build credit while gaining rewards. Explore the key benefits below.

Cash Back Opportunities

With the Capital One Student Credit Card, students enjoy cash back rewards. Earn 1% cash back on every purchase. Also, get 1.25% cash back when you pay on time. These rewards can help students save money.

Students can redeem cash back in many ways. Choose from statement credits, checks, or gift cards. Enjoy the flexibility of using rewards as needed.

Credit Building Tools

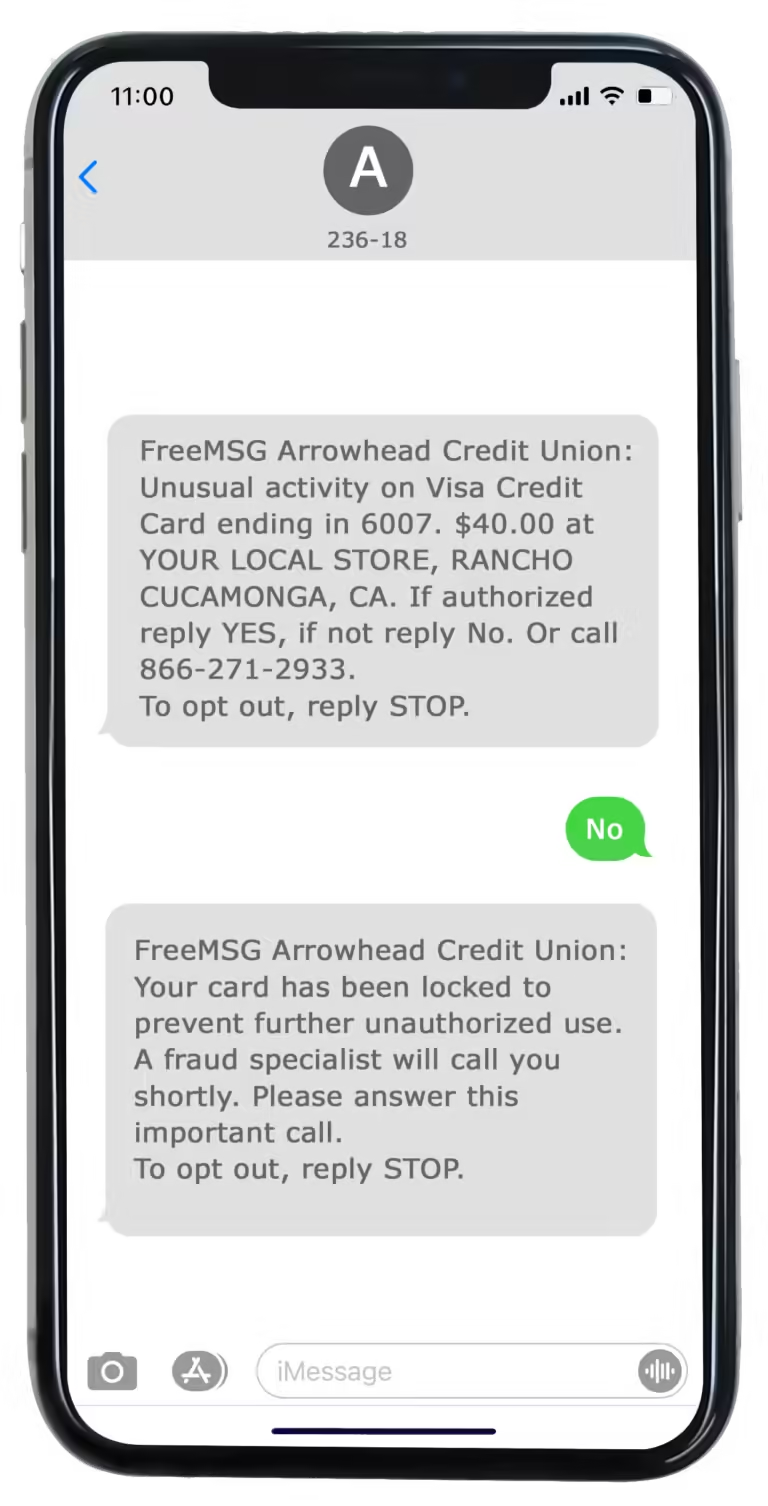

This card helps students build credit responsibly. Capital One offers credit monitoring tools. Use these tools to track your credit score. Get alerts about changes to your credit report.

Students can set up automatic payments to avoid late fees. This feature ensures on-time payments. On-time payments are crucial for building a good credit history.

Additionally, Capital One provides access to the CreditWise app. This app offers tips for improving credit scores. It also helps monitor credit activity. These tools make building credit easier for students.

Drawbacks

The Capital One Student Credit Card offers many benefits, but it has some drawbacks. Understanding these drawbacks can help you make an informed decision.

Potential Fees

One of the main drawbacks is the potential fees. While the card has no annual fee, late payment fees and cash advance fees can add up.

| Fee Type | Amount |

|---|---|

| Late Payment Fee | Up to $40 |

| Cash Advance Fee | 3% of the amount |

These fees can be a burden for students on a tight budget.

Limited Credit Limit

Another drawback is the limited credit limit. Students often start with a lower limit, which can be restrictive.

- Initial credit limits are often low.

- This can limit your purchasing power.

- It may take time to qualify for a higher limit.

This limited credit limit can make it hard to manage larger expenses.

Comparisons

Comparing the Capital One Student Credit Card with other options is crucial. It helps students make informed decisions. Let’s explore how it stacks up against other cards.

Versus Other Student Cards

The Capital One Student Credit Card offers unique benefits. Here’s a comparison with other popular student cards:

| Features | Capital One Student Card | Discover it® Student Cash Back | Chase Freedom® Student |

|---|---|---|---|

| Annual Fee | None | None | None |

| Rewards Rate | 1.5% on all purchases | 5% on rotating categories, 1% on others | 1% on all purchases |

| Sign-Up Bonus | None | Cashback match for first year | $50 after first purchase |

| Credit Limit | $300 – $500 | Based on creditworthiness | Based on creditworthiness |

The Capital One Student Card has no annual fee. It offers 1.5% cash back on all purchases. Other cards may offer higher rewards on specific categories.

Versus Secured Credit Cards

Secured credit cards require a deposit. The Capital One Student Card does not. Here are the key differences:

- Deposit Requirement: Secured cards need a refundable deposit. The student card does not.

- Credit Limit: Secured cards’ limits depend on the deposit. The student card offers a $300 – $500 limit.

- Rewards: Many secured cards offer no rewards. The student card provides 1.5% cash back on all purchases.

- Annual Fee: Some secured cards have an annual fee. The student card does not.

The Capital One Student Card is great for students who want rewards. It is also good for those who don’t want to pay a deposit.

Tips For Using Responsibly

Using a Capital One Student Credit Card wisely is crucial for building a strong credit history. Here are some practical tips that can help you manage your card responsibly and avoid common pitfalls.

Budgeting Tips

Having a budget can help you manage your spending. Follow these simple steps to create an effective budget:

- Track your expenses: Write down everything you spend.

- Set limits: Decide how much you can spend in each category.

- Stick to your budget: Try to stay within your set limits.

By sticking to a budget, you can avoid overspending and make sure you can pay your balance in full each month.

Avoiding Debt

Debt can be overwhelming, but you can avoid it with these strategies:

- Pay your balance in full: Aim to pay your full balance each month.

- Set up alerts: Use alerts to remind you of due dates.

- Limit your credit use: Use only a small portion of your credit limit.

These actions can keep your debt under control and improve your credit score.

Frequently Asked Questions

What Are The Benefits Of The Capital One Student Credit Card?

The Capital One Student Credit Card offers rewards on every purchase, no annual fee, and access to a higher credit line after making your first five monthly payments on time.

Does The Capital One Student Credit Card Have An Annual Fee?

No, the Capital One Student Credit Card does not have an annual fee, making it a cost-effective option for students.

How Can I Apply For A Capital One Student Credit Card?

You can apply for a Capital One Student Credit Card online through the Capital One website. The application process is straightforward and quick.

What Credit Score Is Needed For A Capital One Student Credit Card?

A fair credit score, typically around 580-669, is generally needed to qualify for the Capital One Student Credit Card.

Conclusion

Choosing the Capital One Student Credit Card can be a smart move for building credit. It offers valuable rewards and no annual fee. Students can benefit from its user-friendly features. Start your financial journey on the right foot with this card.

Remember to use it responsibly to maximize benefits.