Top Student Credit Cards With Rewards

Top student credit cards with rewards offer cashback, points, or travel benefits. They help build credit and provide valuable perks.

Choosing the right student credit card can be crucial for financial growth. Many student credit cards come with appealing rewards, such as cashback on purchases, points for travel, or discounts on popular brands. These cards not only help you earn rewards but also build your credit history.

Establishing a good credit score early can open doors to better financial opportunities in the future. It’s important to compare the features and benefits of each card to find the one that fits your spending habits and financial goals. Consider factors like interest rates, annual fees, and the type of rewards offered.

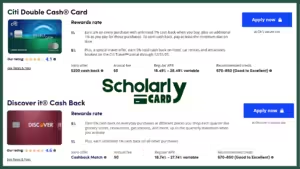

Cashback Rewards

Cashback rewards are a great way for students to save money. Student credit cards with cashback rewards offer many benefits. These rewards can help students manage their finances better.

How Cashback Works

Cashback rewards give you a percentage of your spending back. This means you earn money by using your credit card. For example, a 1% cashback rate gives you $1 back for every $100 spent.

Different cards offer different rates. Some cards give higher rates for specific purchases. For example, you might earn more cashback on groceries or gas. Always check the cashback categories before you apply.

Best Cashback Cards

| Card Name | Cashback Rate | Annual Fee |

|---|---|---|

| Discover it® Student Cash Back | 5% on rotating categories | $0 |

| Chase Freedom® Student Credit Card | 1% on all purchases | $0 |

| Bank of America® Cash Rewards for Students | 3% on chosen category | $0 |

These cards have no annual fee. This is great for students on a budget.

- Discover it® Student Cash Back: Earn 5% on categories that change every three months.

- Chase Freedom® Student Credit Card: Earn 1% on every purchase, with no limits.

- Bank of America® Cash Rewards for Students: Choose your own category for 3% cashback, like gas or online shopping.

Choose a card that fits your spending habits. This way, you maximize your cashback earnings.

Travel Rewards

Travel rewards on student credit cards can open up a world of adventures. Many student credit cards offer points for travel expenses. These points can be redeemed for flights, hotels, and more. This makes travel more affordable and fun for students.

Earning Travel Points

Earning travel points is easy with the right student credit card. Some cards give points for every dollar spent. Others offer bonus points for travel-related purchases.

- Earn points for booking flights and hotels.

- Get extra points for dining at restaurants.

- Earn points for renting cars.

Many cards also offer sign-up bonuses. Spend a certain amount in the first few months to earn bonus points. This can give your points balance a big boost.

Top Travel Cards

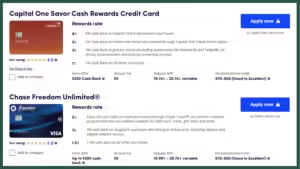

Here are some top student credit cards with travel rewards:

| Card Name | Rewards Rate | Sign-up Bonus |

|---|---|---|

| Discover it® Student Cash Back | 5% on rotating categories | Double first year’s rewards |

| Journey® Student Rewards from Capital One | 1% on all purchases | None |

| Bank of America® Travel Rewards Credit Card for Students | 1.5 points per $1 spent | 25,000 points after $1,000 spent |

These cards offer various ways to earn and redeem travel points. Each card has unique benefits and rewards rates. Choose a card that fits your spending habits and travel plans.

Points-based Rewards

Many student credit cards offer points-based rewards. These rewards can be valuable for students. Let’s explore how they work and which cards offer the best deals.

Understanding Points Systems

Points-based rewards are simple. You earn points for every dollar spent. Later, you can redeem these points for various rewards.

Some cards offer extra points for specific purchases. For example, you might earn more points for buying groceries or gas. It’s essential to understand the points structure of your card.

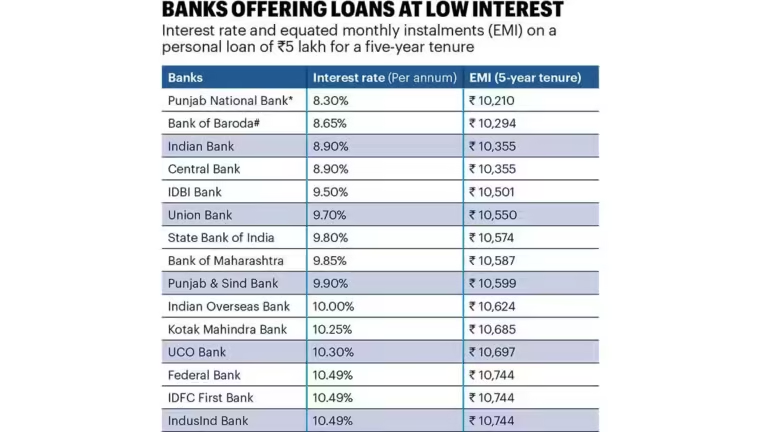

Low Interest Rates

Choosing a student credit card with low interest rates can save you money. Interest rates affect how much you pay in the long run. Let’s dive into why interest rates matter and explore cards with low APR.

Why Interest Rates Matter

Interest rates determine the cost of borrowing money. A lower rate means you pay less in interest. This is important for students who might carry a balance. High interest rates can lead to debt quickly. Low interest rates keep your costs manageable.

Cards With Low Apr

Some student credit cards offer low APR to help manage costs. Here are a few options:

| Card Name | APR Range | Rewards |

|---|---|---|

| Discover it® Student Cash Back | 12.99% – 21.99% | 5% cash back on rotating categories |

| Journey® Student Rewards from Capital One | 26.99% variable | 1% cash back on all purchases |

| Bank of America® Cash Rewards for Students | 13.99% – 23.99% | 3% cash back on chosen category |

- Discover it® Student Cash Back: Offers 5% cash back on rotating categories. It has a low APR range of 12.99% – 21.99%.

- Journey® Student Rewards from Capital One: Provides 1% cash back on all purchases. It has a variable APR of 26.99%.

- Bank of America® Cash Rewards for Students: Gives 3% cash back on a chosen category. Its APR ranges from 13.99% to 23.99%.

No Annual Fees

Many students seek credit cards with rewards but worry about fees. No annual fees make these cards perfect for students.

Benefits Of No Annual Fees

No annual fees mean students save money. Every dollar saved counts.

- Cost-effective: Students don’t pay extra for the card.

- More savings: Rewards without annual fees boost savings.

- Easy to manage: No annual fees make budgeting easier.

Students can focus on using rewards without worrying about fees. This helps them build credit and save money.

Best No-fee Cards

| Card Name | Key Benefits |

|---|---|

| Discover it® Student Cash Back |

|

| Chase Freedom® Student Credit Card |

|

| Bank of America® Travel Rewards for Students |

|

These cards offer rewards and no annual fees. Students can choose a card that fits their needs.

Building Credit

Building credit is crucial for students. Good credit history opens doors to loans, apartments, and jobs. Starting early helps in establishing a strong financial future.

Importance Of Credit History

Your credit history shows how well you manage borrowed money. Lenders use it to decide if you are reliable. A good credit history means you are more likely to get loans with lower interest rates.

Students often have limited credit history. Using a student credit card responsibly can build your credit. Pay on time and keep balances low. These actions help you achieve a good credit score.

Cards For Building Credit

Many credit cards are designed to help students build credit. Below are some of the best options:

| Card Name | Rewards | Annual Fee |

|---|---|---|

| Discover it® Student Cash Back | 5% cash back on rotating categories | $0 |

| Chase Freedom® Student | 1% cash back on all purchases | $0 |

| Capital One® Journey Student | 1% cash back, 1.25% for on-time payments | $0 |

These cards offer rewards and no annual fee. They also report to credit bureaus, helping you build credit.

- Discover it® Student Cash Back: 5% cash back on rotating categories.

- Chase Freedom® Student: 1% cash back on all purchases.

- Capital One® Journey Student: 1% cash back, 1.25% for on-time payments.

Choose a card that fits your spending habits. Use it wisely to build a solid credit history.

Additional Benefits

Student credit cards often offer more than just rewards. They come with extra perks and benefits that can be very useful. These benefits make managing finances easier and more rewarding for students.

Extra Perks And Offers

Many student credit cards provide extra perks and offers. These can include:

- Cashback on everyday purchases like groceries and gas

- Discounts on travel, dining, and entertainment

- Access to exclusive events and promotions

- Free credit score monitoring

- Extended warranties on purchases

Some cards also offer special deals for students. These might include discounts on textbooks, software, and electronics. Always check what extra perks come with your card.

Choosing The Right Card

Choosing the right student credit card is important. Here are some tips:

- Look at the rewards program. See what type of rewards you can earn.

- Check the interest rates. Lower rates are better if you carry a balance.

- Review the fees. Some cards have annual fees or late payment fees.

- Read the fine print. Make sure you understand all terms and conditions.

Frequently Asked Questions

What Are The Best Student Credit Cards?

The best student credit cards offer rewards and low fees. Look for cards with cashback, points, or travel rewards.

Do Student Credit Cards Have Annual Fees?

Many student credit cards have no annual fees. This makes them a cost-effective choice for students.

Can Students Earn Rewards With Credit Cards?

Yes, many student credit cards offer rewards. These can include cashback, points, and travel perks.

How Do Student Credit Card Rewards Work?

Student credit card rewards accumulate through spending. You earn points, cashback, or miles based on purchases.

Conclusion

Choosing the right student credit card can be a game-changer. Rewards like cashback and travel points offer great benefits. Always compare options and read the fine print. The right card can help build your credit while offering valuable rewards. Make an informed decision to maximize your financial benefits.